Municipals Posted Negative Returns Last Week

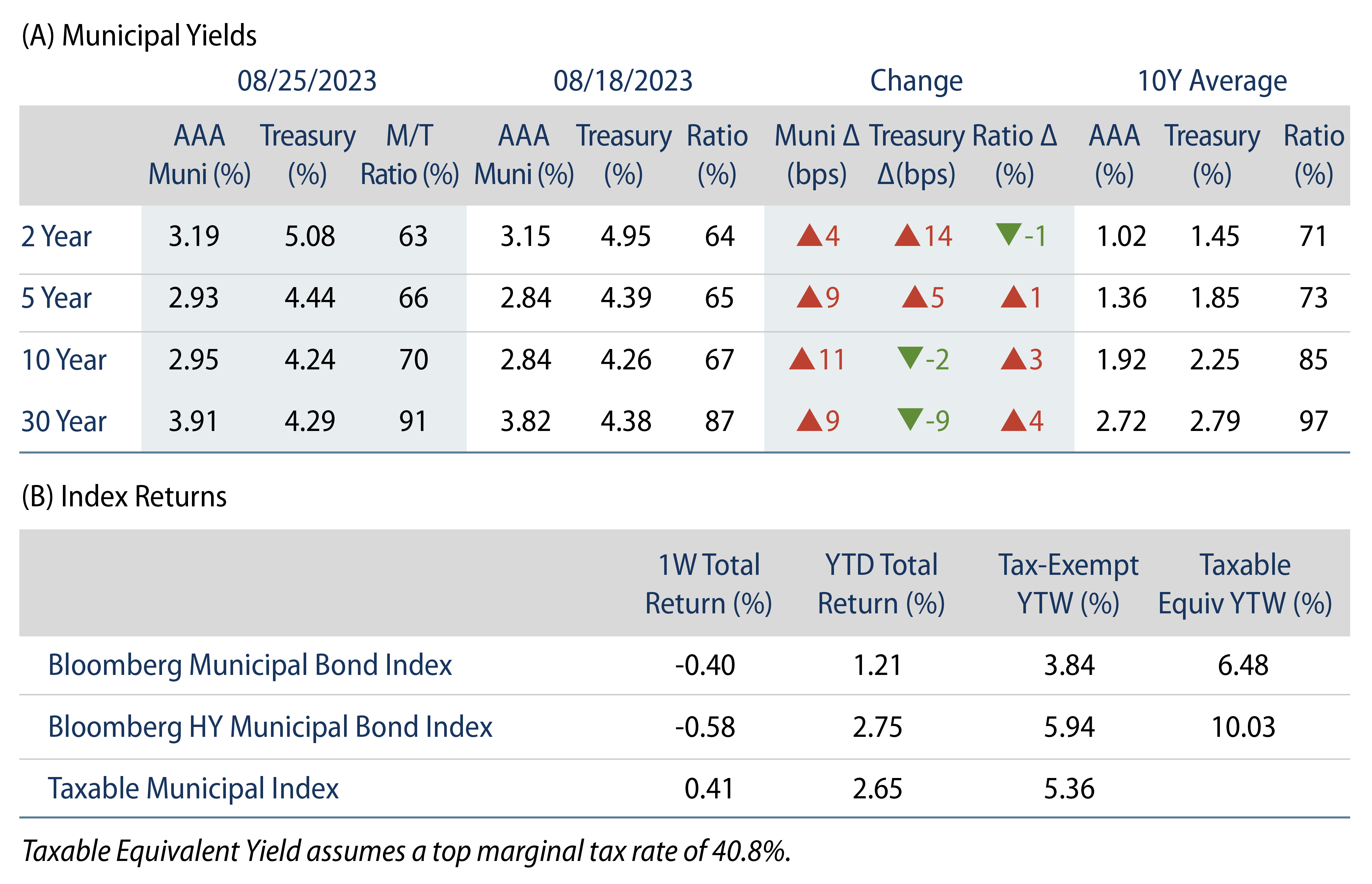

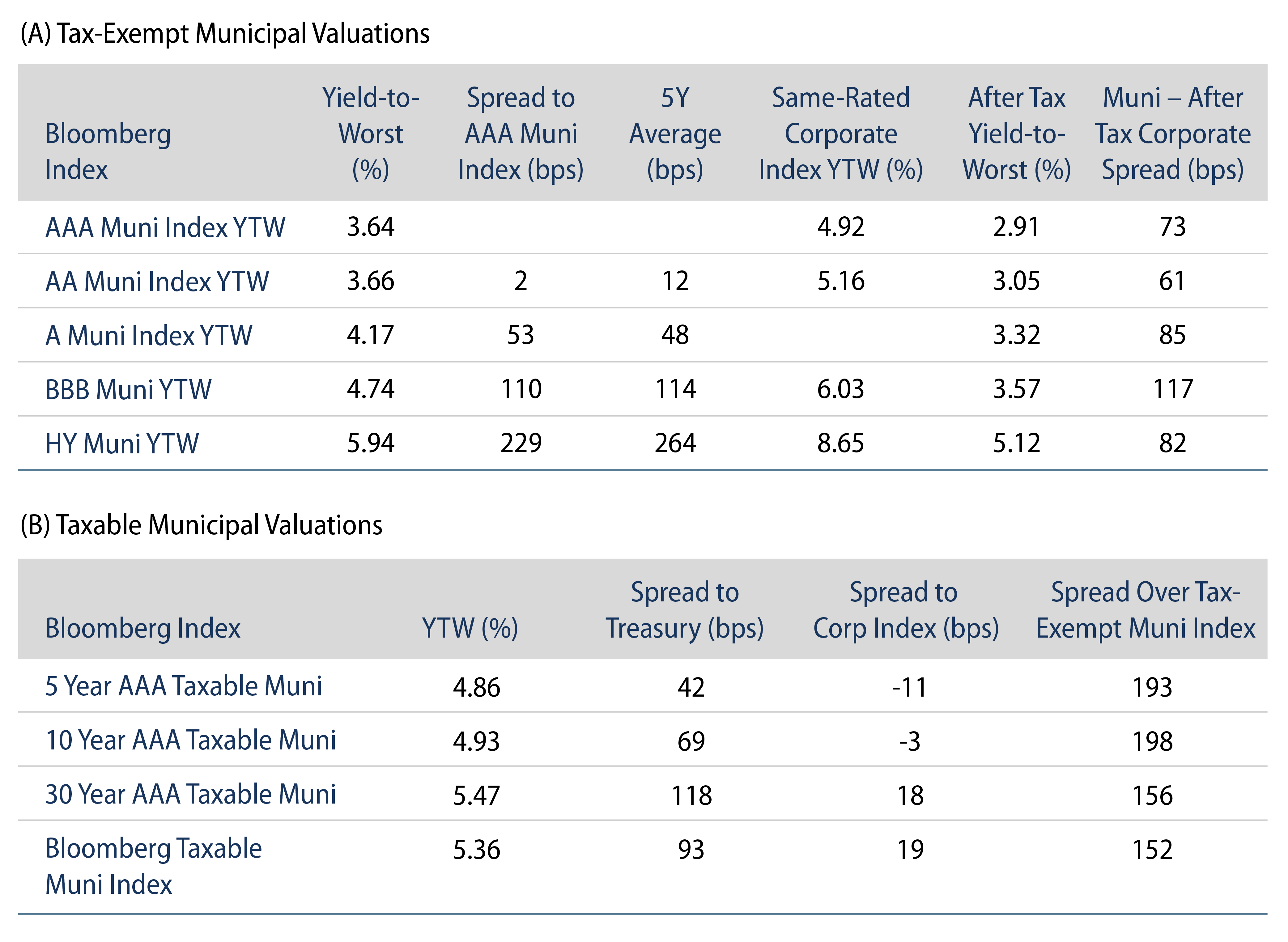

Weaker technicals were driven by fund outflows and higher supply conditions. High-grade municipal yields moved higher with US Treasuries (USTs) across the curve. Munis generally underperformed USTs, continuing to reverse outperformance seen over the summer as technicals weakened. The Bloomberg Municipal Index returned -0.40% during the week, the High Yield Muni Index returned -0.58%, and the Taxable Muni Index returned 0.41%. Ahead of the Labor Day holiday this week, we highlight the state of muni payrolls.

Municipal Mutual Funds Extended Outflows Last Week

Fund Flows: During the week ending August 23, weekly reporting municipal mutual funds recorded $534 million of net outflows, according to Lipper. Long-term funds recorded $298 million of outflows, high-yield funds recorded $28 million of inflows, and intermediate funds recorded $72 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to $8.0 billion.

Supply: The muni market recorded $9 billion of new issue volume last week, up 20% from last week. YTD issuance of $236 billion was down 8% year-over-year (YoY), with tax-exempt issuance down 1% YoY and taxable issuance down 45% YoY. This week’s calendar is expected to drop to $4 billion ahead of the holiday weekend. Large transactions include $665 million Main Street Natural Gas and $259 million City of Jacksonville (appropriation) transactions.

This Week in Munis: State & Local Payrolls Improve YTD, Lag Post-Pandemic Recovery

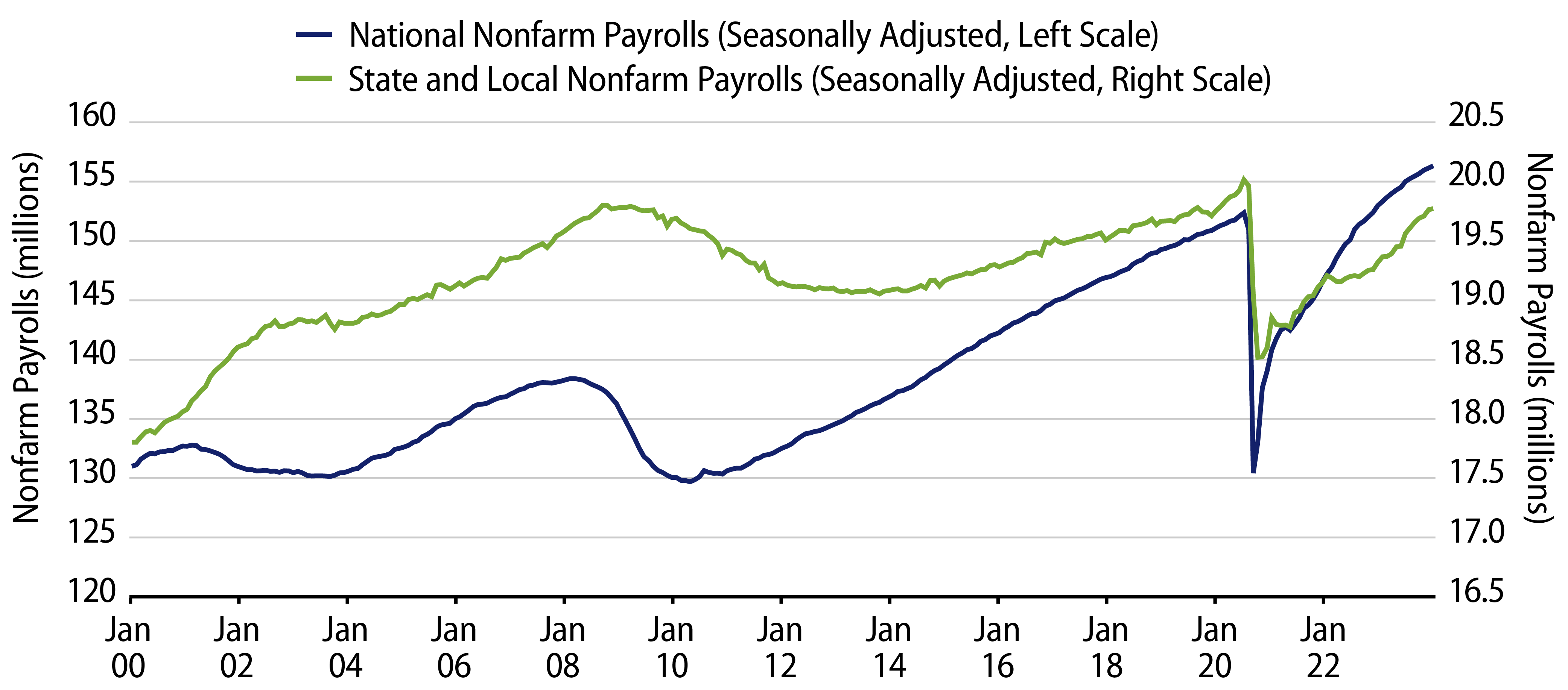

Last week the U.S. Bureau of Labor Statistics announced a -306,000 downward revision to annual payrolls through March. Despite this downward revision, national nonfarm payrolls remain 2.6% higher than the pre-pandemic peak. While national nonfarm payrolls remain well above pre-pandemic highs, state and local payrolls continue to lag pre-pandemic levels by 1.3%. This gap has closed modestly this year, as state and local payrolls have been improving (1.6%) at a greater rate than national payrolls (1.2%)

Within public sector payrolls, state and local employment remain 1.5% and 1.1% below pre-pandemic highs, respectively. While local jobs have steadily improved from the depths of the pandemic to 14.5 million, state payrolls have been more volatile and started to pick up in earnest this year, increasing 2.9% YTD compared to 1.2% growth observed from the local level.

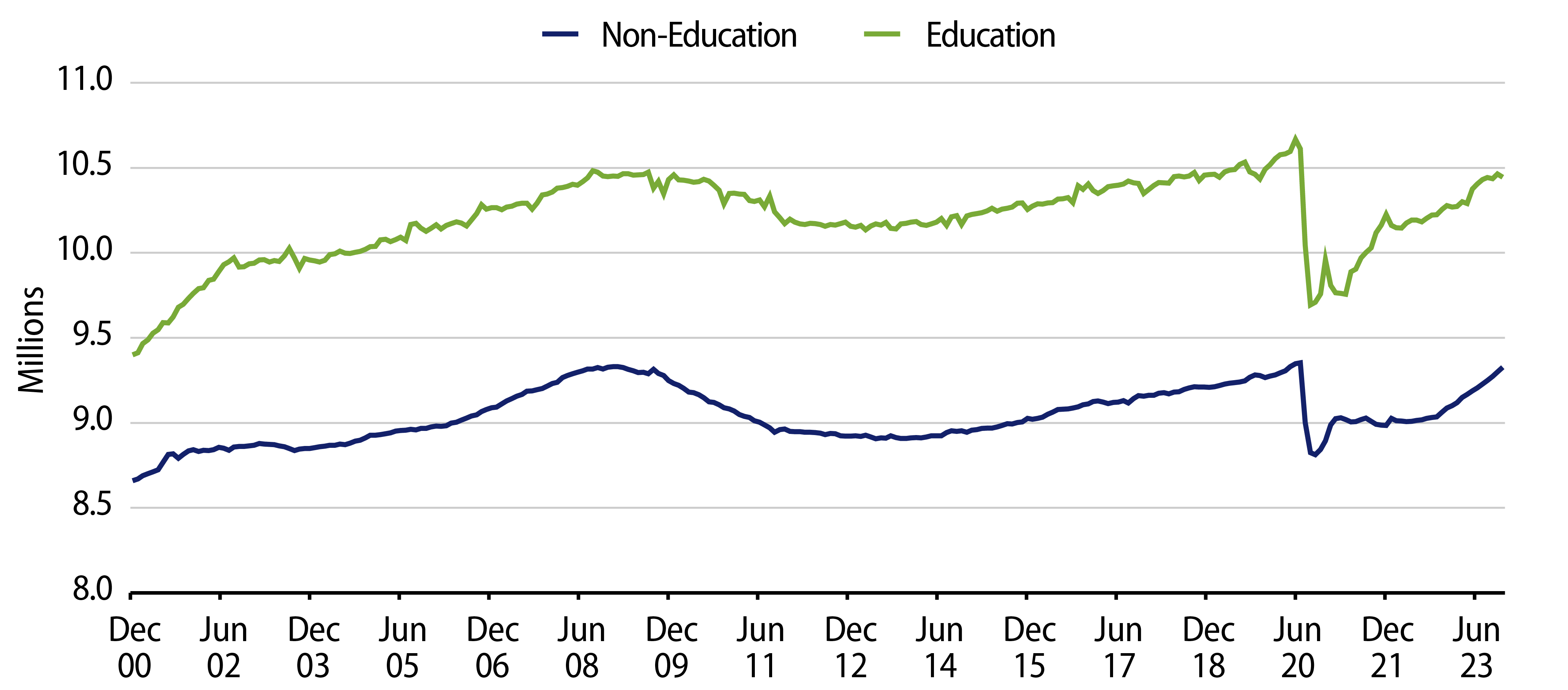

Evaluating state and local payrolls by employment type, non-education employment has nearly fully recovered from pandemic drawdowns to 9.3 million jobs, falling just 25,000 short (-0.3%) of pre-pandemic highs in July 2023. Meanwhile, the larger education payroll category reached 10.4 million in July, still 1.6% below pre-pandemic levels.

Western Asset attributes the lag in public sector payroll growth to overall labor supply challenges, as well as municipalities planning for potential revenue volatility. The demonstrated ability for state and local governments to operate at lower headcount levels while revenues peak is positive for municipal credit fundamentals, as the economy shows signs of cooling.