Municipals and the CPI Report

Municipal yields trailed Treasuries lower last week, as the November Consumer Price Index (CPI) report highlighted a continued slowdown in inflation. Municipals generally underperformed the Treasury rally following the softer than anticipated CPI report, as headline inflation fell to 7.1% year-over-year (YoY), down from 7.7% in October, and core inflation fell to 6.0% YoY, down from 6.3% in October. High-grade municipal yields moved 4 bps lower across intermediate and long maturities, while short muni yields moved higher. Municipal mutual funds posted outflows as municipal issuers posted the last significant week of supply of the year. The Bloomberg Municipal Index returned +0.24%, the HY Muni Index returned +0.31% and the Taxable Muni Index returned +0.88%. This week we highlight the significant upward move in the short-term SIFMA (Security Industry/Financial Market Association) borrowing rate.

Market Technicals Weaken as Muni Mutual Funds Post Outflows

Fund Flows: During the week ending December 14, weekly reporting municipal mutual funds recorded $1.2 billion of net outflows, according to Lipper. Long-term funds recorded $524 million of outflows, high-yield funds recorded $128 million of outflows and intermediate funds recorded $525 million of outflows. The week’s flows bring year-to-date (YTD) net outflows to $117 billion.

Supply: The muni market recorded $5.5 billion of new-issue volume last week, down 26% from the prior week. Total YTD issuance of $361 billion is 20% lower than last year’s levels, with tax-exempt issuance trending 8% lower YoY and taxable issuance trending 57% lower YoY. Western Asset does not anticipate significant new-issue volume for the remainder of the year.

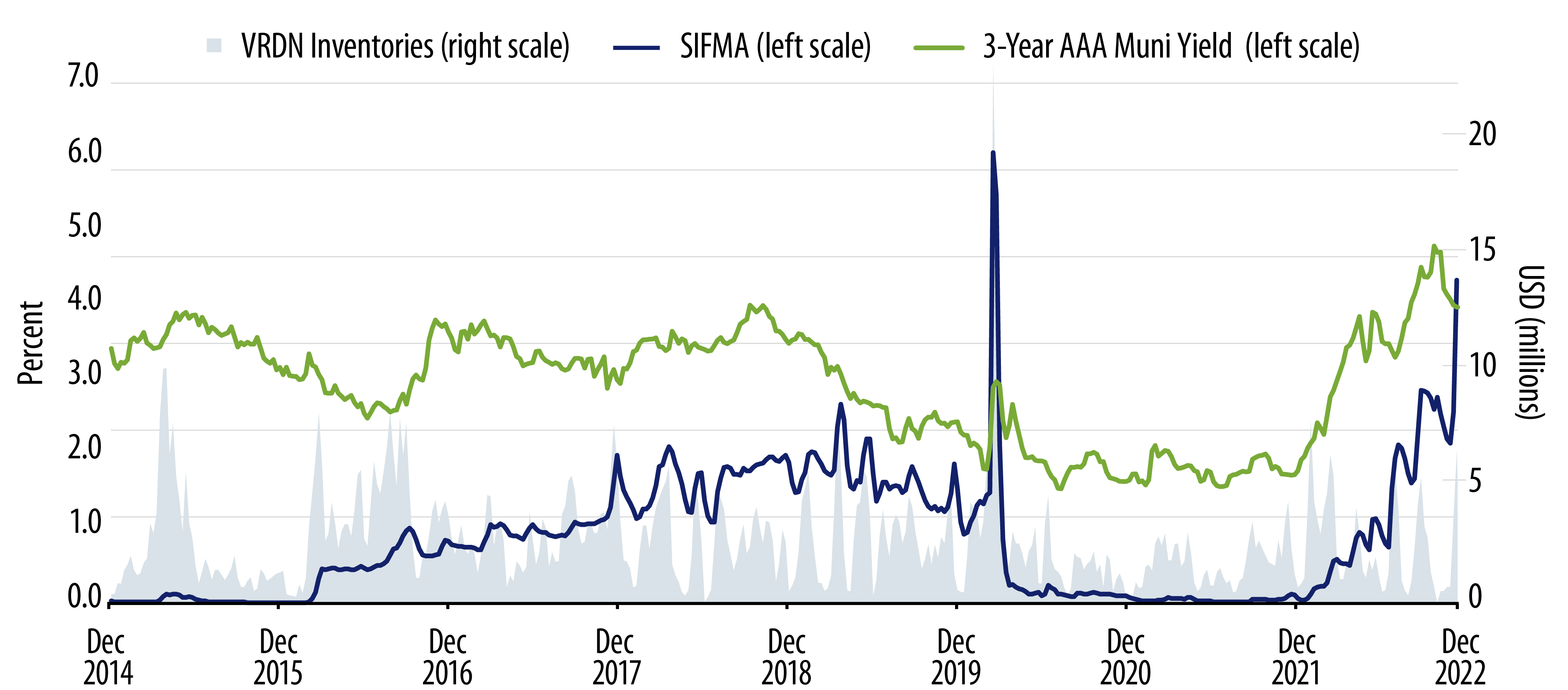

This Week in Munis: SIFMA Spikes

Last week the SIFMA Municipal Swap Index, a measure of the 7-day tax-exempt rate as measured by select Variable Rate Demand Notes (VRDNs) in the marketplace, nearly doubled to 3.73% from 2.21% the prior week, extending the recent value observed at the short end of the muni curve. The SIFMA rate of 3.73% is up from 0.06% at the start of the year, is now higher than the 30-year AAA fixed muni rate, and equivalent to 6.25% on a taxable-equivalent basis.

Western Asset views the significant upward rate move as driven by a confluence of factors:

- First, the short-term muni rate normalized from relatively tight levels. The 7-Day SIFMA Index yield ended the month of November at 1.85%, just 49% of the short-term taxable SOFR rate of 3.80%. The 49% SIFMA/SOFR ratio was much lower than the 5- to 30-year Muni/Treasury ratios that ranged from 69% to 98% at month-end, and implied the vast majority of investors subject to tax rates would be better off in the taxable short-term market. As the Federal Reserve continued to increase the fed funds rate by 50 bps this month, taxable SOFR rates moved in sympathy to 4.32%, and potentially drove short-end tax-exempt demand to the taxable market.

- We also expect that municipal mutual fund complexes that have been holding cash equivalents (including VRDNs) quickly sought to extend duration positioning on the softer-than-anticipated CPI print, not wanting to miss out on relative value opportunities in longer maturities. As these funds put cash to work, VRDNs are typically sent back to dealer balance sheets and remarketed at higher rates. Last week, VRDN inventories reached $6.6 billion, up 2.2x from the prior week ($2.9 billion), and up nearly 9x from November month-end levels ($724 million).

- Last, we expect dealers could want to keep inventory to a minimum going into year-end which could contribute to attractive remarketed VRDN yield levels.

Western Asset expects the elevated SIFMA level could be short-lived considering front-end technicals, which have proven to be resilient in recent years, and we expect will remain strong considering the prospects that inflation and interest rates could stabilize. However, the higher weekly rate certainly rewards existing strategies that have utilized floating-rate VRDNs as part of a liquid allocation, as well as short-term municipal investors that can capture higher income levels in a VRDN allocation. Meanwhile, strategies that rely on higher leverage will likely be burdened by the elevated financing costs that are linked to the SIFMA index rate.