Municipals Posted Negative Returns Last Week

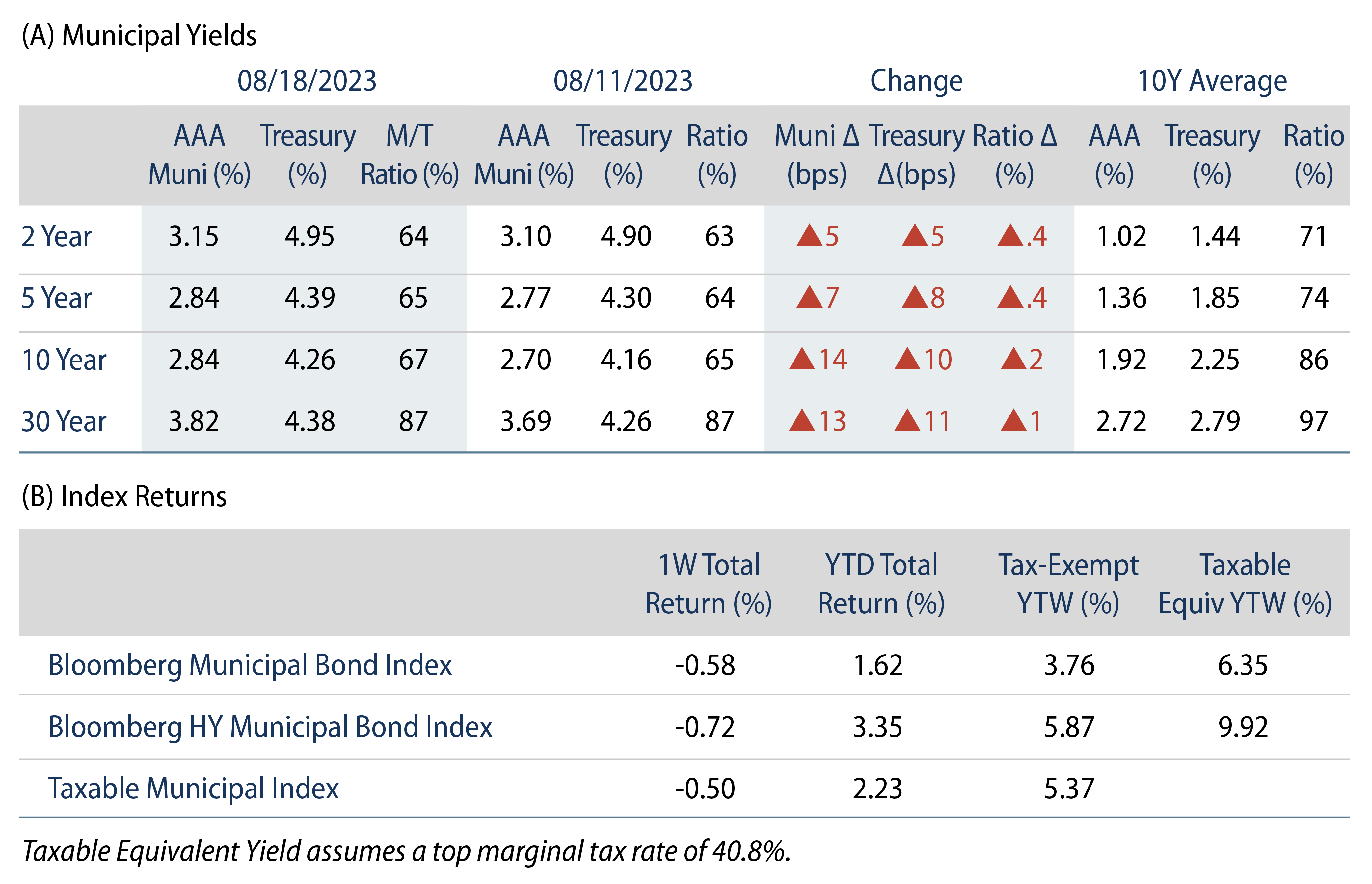

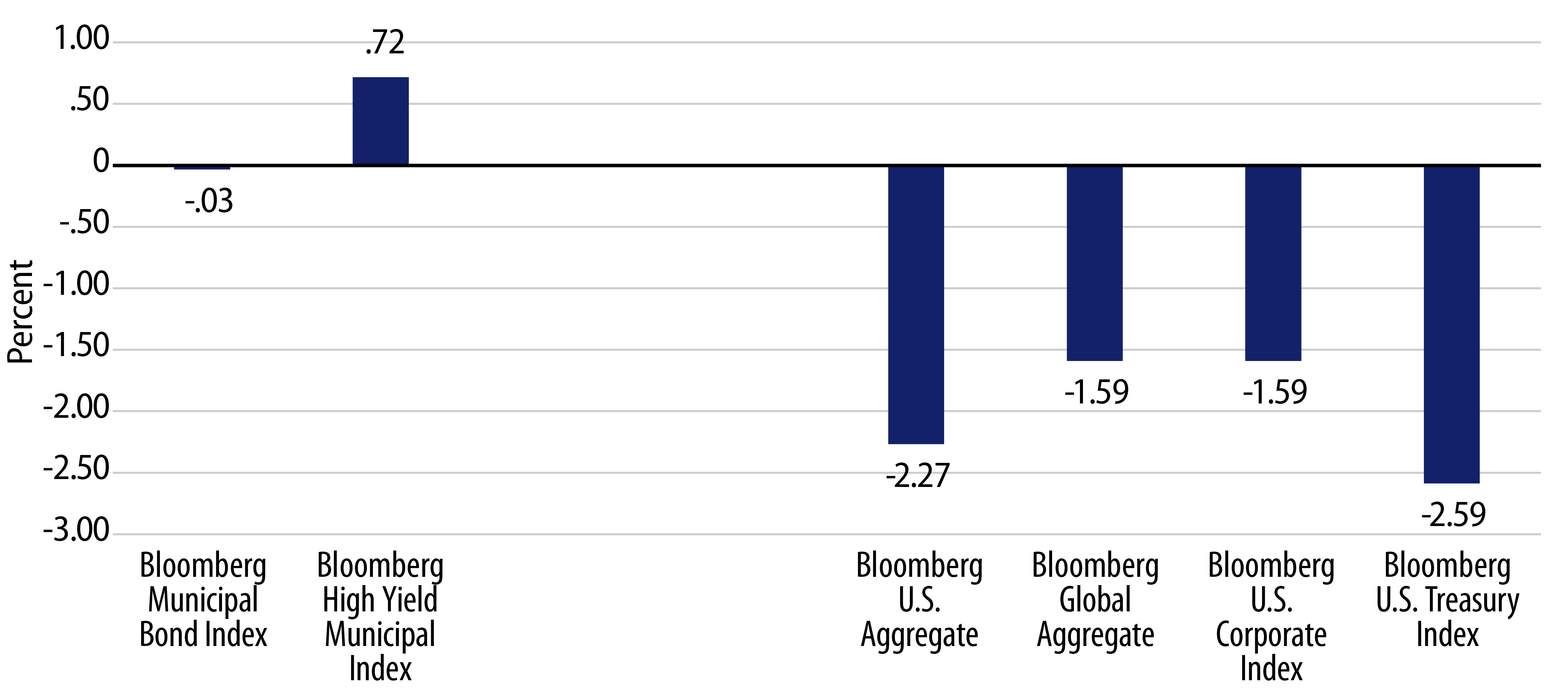

Municipals generally underperformed Treasuries last week, catching up to the overall rate weakness and reversing the outperformance of the prior two weeks. Meanwhile, high-grade muni yields moved higher with Treasuries across the curve. Market technicals were neutral amid modest fund outflows and lower supply conditions. The Bloomberg Municipal Index returned -0.58% during the week, the High Yield Muni Index returned -0.72% and the Taxable Muni Index returned -0.50%. This week we evaluate negative net supply trends that took place over the summer and helped insulate the municipal market from the rate volatility that affected other fixed-income asset classes.

Technicals Were Neutral with Modest Fund Outflows Offset by Lower Supply

Fund Flows: During the week ending August 16, weekly reporting municipal mutual funds recorded $264 million of net outflows, according to Lipper. Long-term funds recorded $53 million of inflows, high-yield funds recorded $82 million of outflows and intermediate funds recorded $19 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to $7.4 billion.

Supply: The muni market recorded $8 billion of new-issue volume last week, down 17% from the prior week. YTD issuance of $227 billion is down 7% year-over year (YoY), with tax-exempt issuance down 1% YoY and taxable issuance down 41% YoY. This week’s calendar is expected to remain near $8 billion. Large transactions include $1.2 billion State of Michigan State Trunk Line Fund and $1 billion New York City Transitional Finance Authority transactions.

This Week in Munis: Riding the Redemption Wave

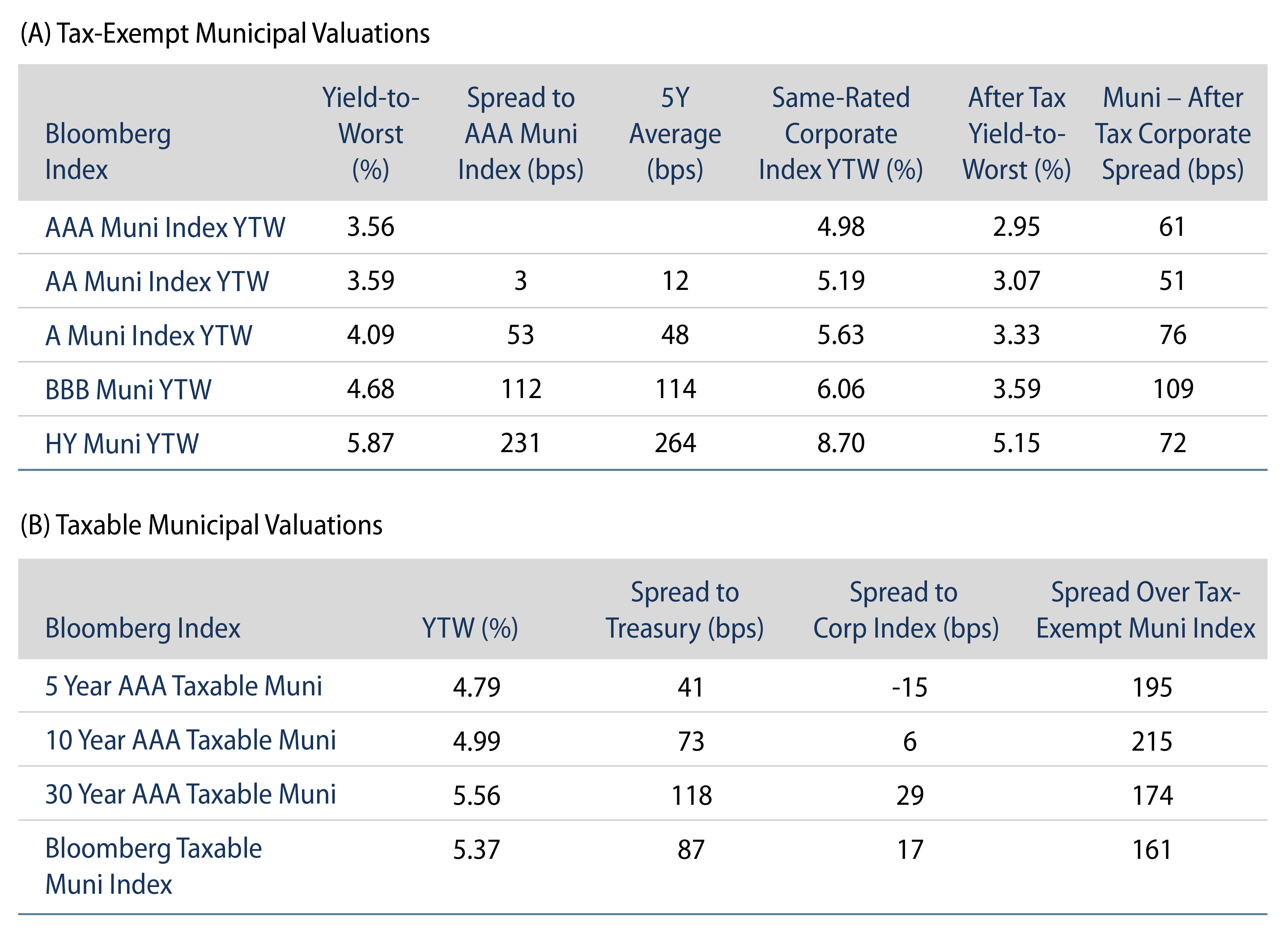

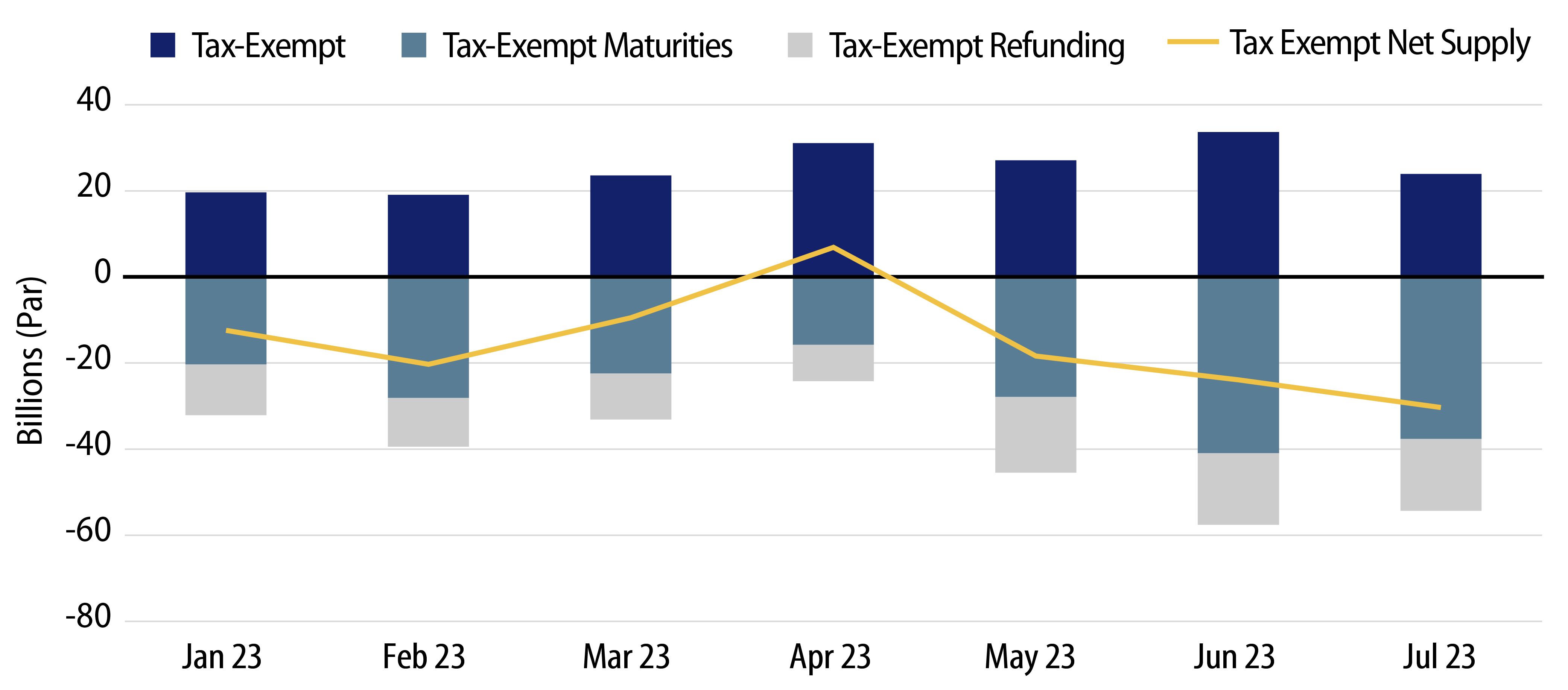

During the summer, the municipal market is often supported by strong seasonal negative net supply dynamics that contribute to muni market performance. So far this summer, we have seen that trend persist amid below average tax-exempt issuance, and above average redemptions from the market.

Net supply is equivalent to new bonds being issued into the market, less those that are redeemed from the market due to bonds maturing or reaching their call dates. In June and July, new tax-exempt issuance reached $58 billion, below the prior five-year average of $65 billion. In addition to lower than average new-issue supply, market redemptions and maturities were an above-average $112 billion, contributing to negative net supply of $54 billion.

The negative net supply trend contributed to a favorable technical backdrop and has helped mitigate the negative returns observed in other fixed-income classes over the summer amid rate volatility. From the beginning of June through August 18, the Bloomberg Municipal Index returned -0.03%, well above the U.S. Aggregate (-2.27%) and U.S. Treasury index returns (-2.59%) over the period.

The negative net supply dynamic highlights how market technicals can help munis serve as a ballast of an overall portfolio allocation during bouts of market volatility. In the remaining weeks of the month, we anticipate market technicals to remain supportive. Tax-exempt new-issue volume tends to be low around the summer holidays, while August scheduled maturities are expected to reach $42 billion, the largest month of the year.