Municipals Moved Higher in Sympathy with Treasuries

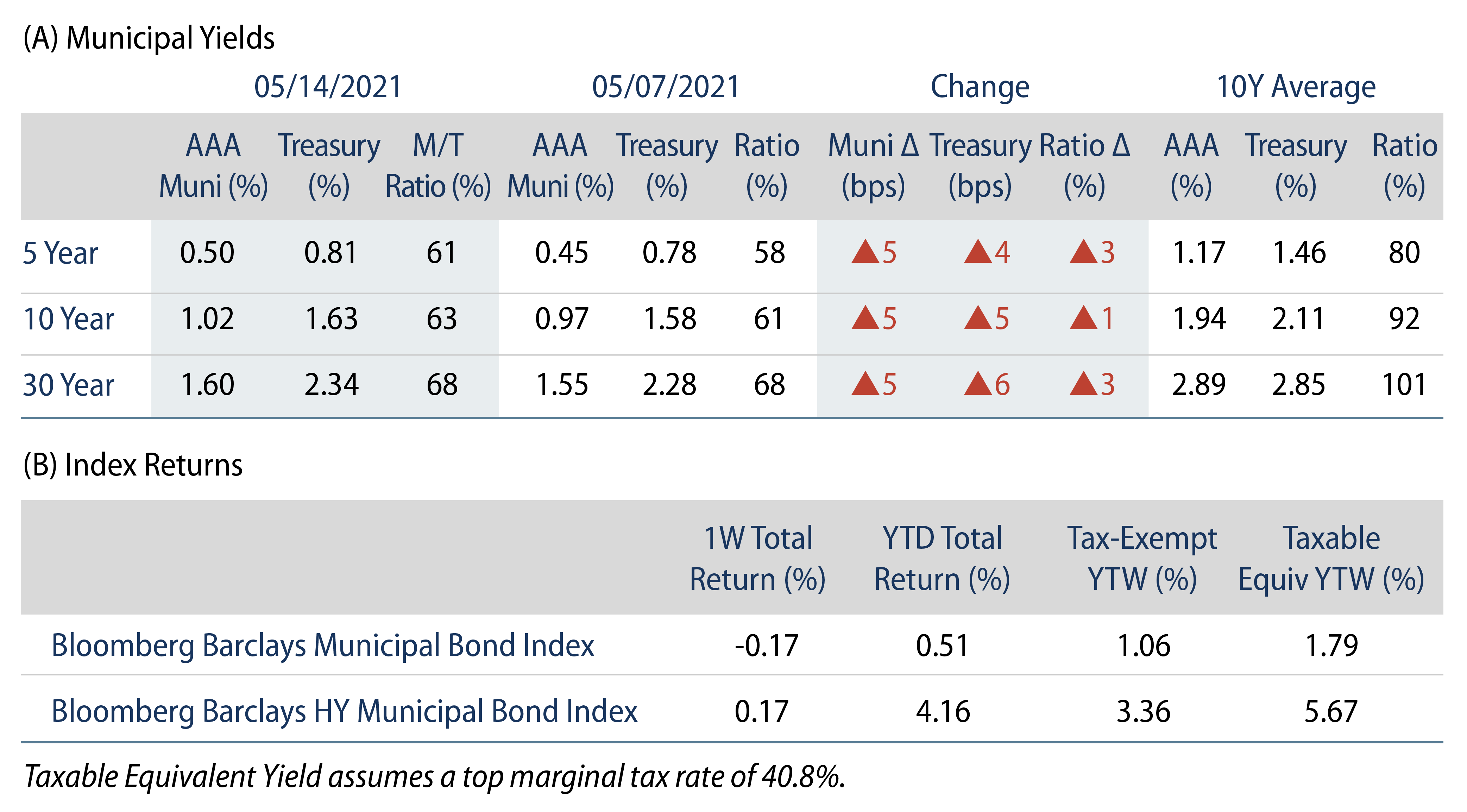

US municipal yields moved higher with Treasury yields during the week. AAA municipal yields moved 5 bps higher during the week. Munis modestly underperformed Treasuries, as Muni/Treasury ratios ticked modestly higher, ranging from 61% to 68%. Market technicals remain strong, driven by persistent fund flows. The Bloomberg Barclays Municipal Index returned -0.17% while the HY Muni Index returned 0.17%. This week, as municipal valuations remain near record rich levels, we explore structural opportunities associated with embedded optionality.

Market Technicals Remain Strong, Supported by Positive Fund Flows

Fund Flows: During the week ending May 12, municipal mutual funds recorded $750 million of net inflows, according to Lipper. Long-term funds recorded $960 million of inflows, high-yield funds recorded $487 million of inflows and intermediate funds recorded $171 million of inflows. Net inflows year to date (YTD) reached $45.9 billion and muni funds have now recorded net inflows in 51 of the past 52 weeks.

Supply: The muni market recorded $7.0 billion of new-issue volume during the week, down 31% from the prior week. Total issuance YTD of $159 billion is up 22% from last year's levels. This week's new-issue calendar is expected to increase to $8.2 billion. The largest deals include $1.2 billion state of Connecticut General Obligation and $600 million Charlotte-Mecklenberg Hospital transactions.

This Week in Munis: "Putting" Structure to Work in the Short End of the Curve

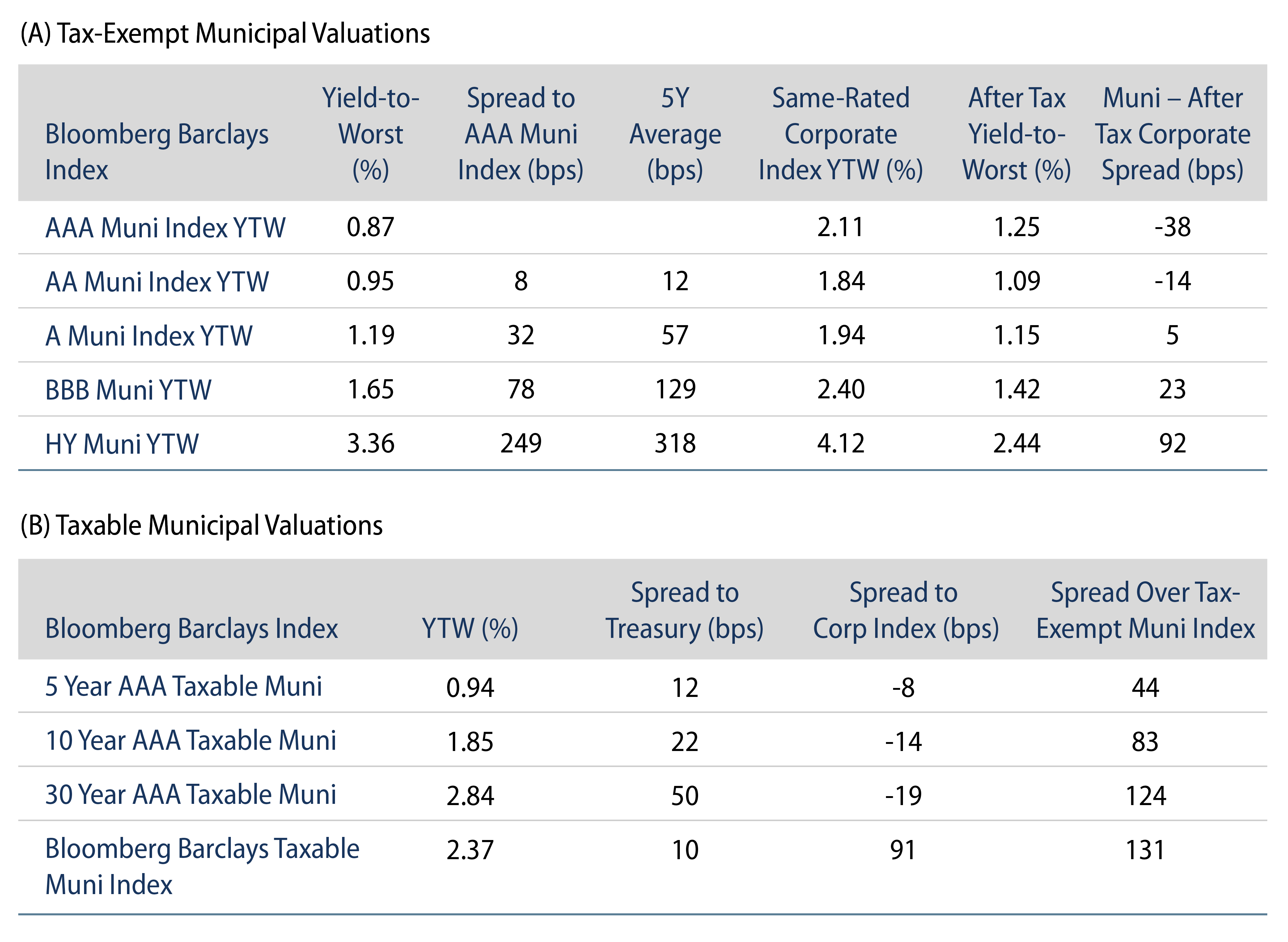

Accommodative monetary policy and persistent demand for tax-exempt income have challenged municipal investors with record low yields, particularly at the short end of the muni curve. As traditional fixed-rate securities appear increasingly rich, relatively higher income opportunities can be exploited from municipal securities that incorporate structural complexities such as a "put" feature, embedded optionality that allows the bondholder to force an issuer to repurchase the underlying bond at specified dates prior to maturity.

Issuers often structure securities with an embedded put option to take advantage of the steep municipal yield curve by selling long-term debt that is remarketed in shorter, lower-yield maturity tranches. This can allow the issuer to achieve a relatively lower cost of capital to fund long-term projects versus long-term funding rates.

Western Asset estimates that the relative complexity associated with put structures can offer investors 5 to 25 bps of additional yield versus comparable duration traditional municipal securities. However, assessments of the issuer's credit quality and the bond's underlying extension risk are important considerations in valuing puttable securities. Favorable bondholder protections that mitigate extension risk include a "mandatory put" which requires the issuer to purchase the bond on the remarketing date, where failure to do so would constitute an event of default. Other types of investor safeguards include a provision that would increase the coupon (and issuer borrowing costs) in the event of a failed tender for bonds, or an inclusion of a third party that will guarantee the purchase of the bonds on the tender date.

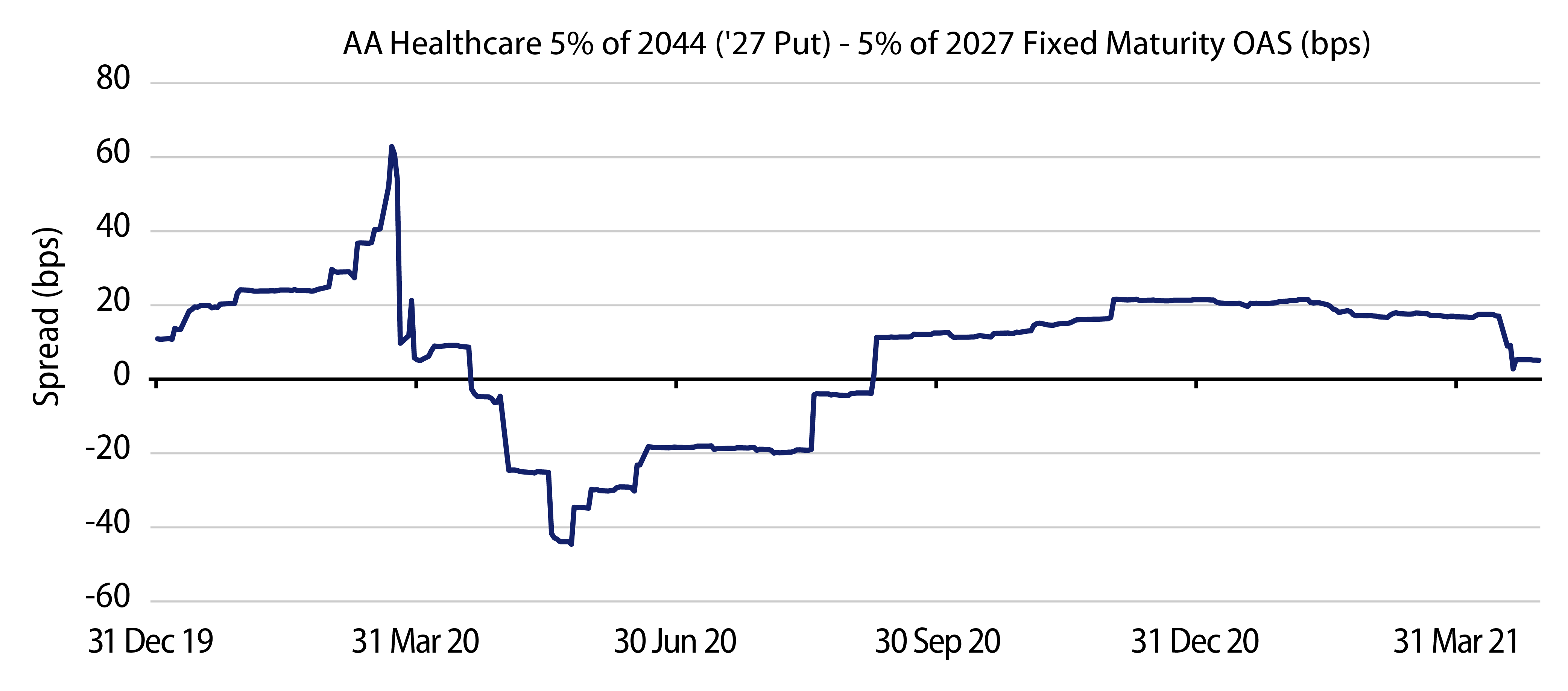

The value of the put structure is illustrated in Exhibit 1, which highlights the spread differential between a 2044 final maturity security with a mandatory put in 2025 versus the same obligor/same coupon security maturing in 2025. YTD, despite its 0.28 year shorter duration, the security with a put feature offered on average 15 bps of incremental yield versus the traditional fixed-maturity municipal, representing a 28% incremental income benefit.