Municipals Posted Negative Returns During the Week

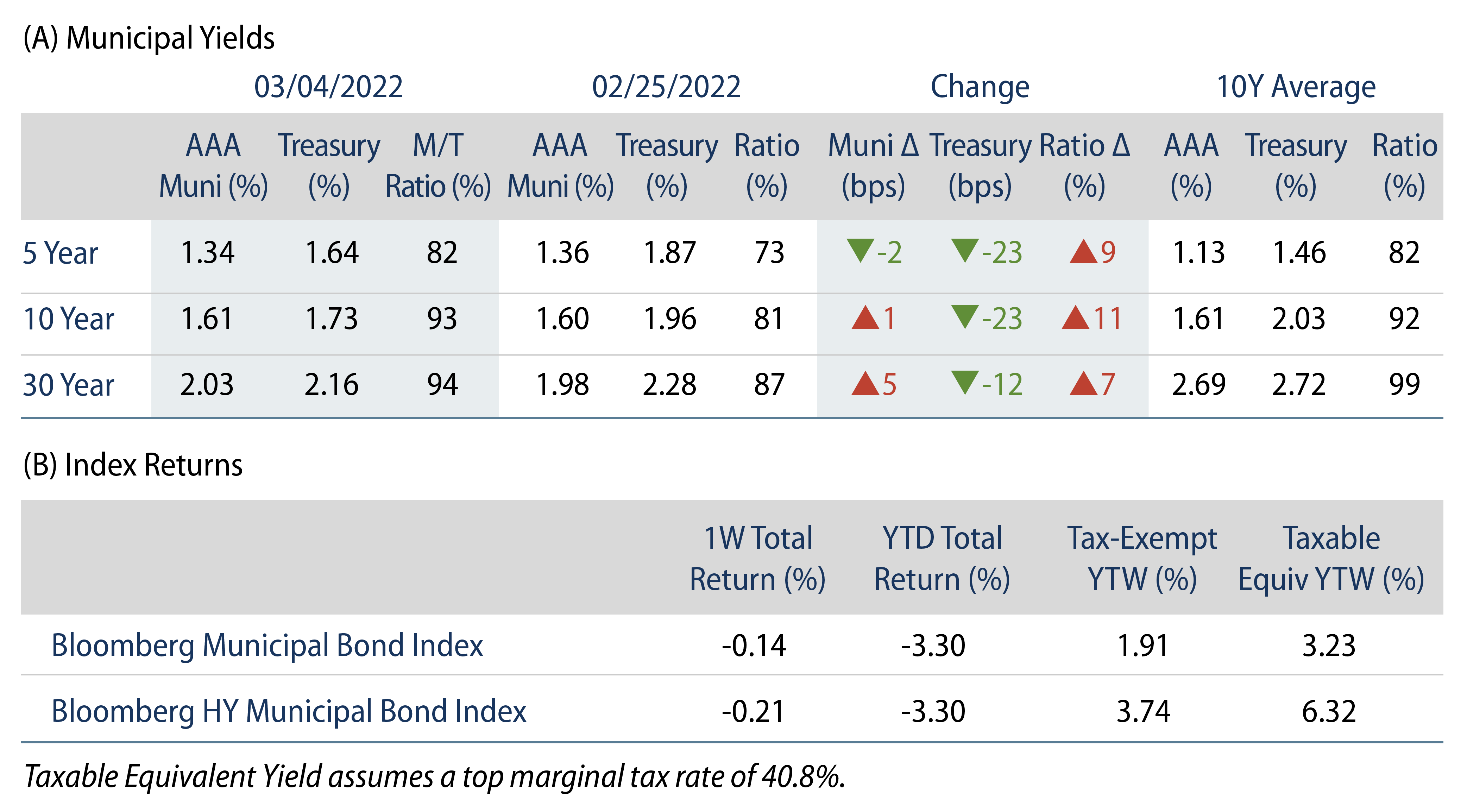

Municipals recorded negative returns during the week, as high-grade municipal yields moved 2 bps lower in short maturities and 1-5 bps higher in intermediate to long maturities. The Bloomberg Municipal Index returned -0.14%, while the HY Muni Index returned -0.21%. Municipals underperformed the Treasury rally, resulting in higher Municipal/Treasury ratios. Supply and Technicals continued to weaken amid persistent mutual fund outflows along with a building new-issue calendar. This week we highlight the muni market’s reaction thus far to the Russia/Ukraine conflict.

Municipal Outflows Continue Ahead of Building New Issue Supply

Fund Flows: During the week ending March 2, weekly reporting municipal mutual fund outflows accelerated to $2.8 billion, according to Lipper. Long-term funds recorded $2.2 billion of outflows, high-yield funds recorded $818 million of outflows and intermediate funds recorded $465 million of outflows. Municipal fund outflows year to date (YTD) extended to $12.6 billion.

Supply: The muni market recorded $7.4 billion of new-issue volume, down 21% from the prior week. Total YTD issuance of $65 billion is 8% higher from last year’s levels, with tax-exempt issuance trending 34% higher year-over-year (YoY) and taxable issuance trending 49% lower YoY. This week’s new-issue calendar is expected to jump to $10 billion. Largest deals include $2.2 billion State of California and $2.1 billion University of Michigan transactions.

This Week in Munis: Ukraine/Russia Impact on Munis

The municipal market has underperformed most other high quality fixed-income sectors and even equities since Russia invaded Ukraine and market volatility ensued. From February 24 to March 4, the Bloomberg Municipal Index returned -0.23% and the High Yield Muni Index retuned -0.31%. The high-grade municipal yield curve steepened, moving 1 basis point (bp) higher in 5-years and 9 bps higher in 30-years.

Municipals are generally insulated from the Russia/Ukraine conflict from a fundamental perspective, and we attribute most of the recent underperformance to elevated Treasury rate volatility. As highlighted last week, Munis and Fed Rate Hikes, we typically find that over long-term periods of rising rates, municipals tend to outperform high-quality fixed-income sectors. However, elevated periods of US Treasury rate volatility, such as the Taper Tantrum in 2013, can contribute to negative demand cycles and drive underperformance over a shorter horizon.

From a fundamentals standpoint, while we anticipate limited direct impact from escalating geopolitical tensions, we are monitoring potential second-order effects that could arise, particularly across trade, oil, and cybersecurity:

Oil: The conflict has exacerbated recent inflation-driven pressures observed in the oil market. An extension of these pressures that keep oil prices elevated could benefit local economies with high concentration to the energy sector particularly for issuers in Texas, Colorado, and Pennsylvania. However from a sector perspective, electric utilities, transportation, and tourism sectors trying to recover from pandemic-driven drawdowns would likely be adversely impacted from prolonged elevated oil prices.

Trade: Certain local economies in the United States have outsized exposure to global trade. We do not believe Russian sanctions alone would materially impact trade activity within these regions, but further escalation that involves other key trading partners such as China could negatively impact issuers with higher reliance on trade.

Cybersecurity: Cybersecurity has been a growing vulnerability for issuers within the municipal market in recent years. An Emisoft report highlights that over 2,300 local governments, schools, and healthcare organizations were impacted by ransomware attacks in 2021, with estimated total damages of $624 million. As global tensions intensify, state and local governments could become increasingly vulnerable to cyber attacks. While cybersecurity risks have increased, awareness has improved in recent years following headline attacks in Baltimore County and Atlanta, and municipalities have been dedicating an increased portion of their budgets to cybersecurity. In addition, within the Infrastructure Investment and Jobs Act passed last year, state and local governments can now access up to $1 billion in federal grants to address cybersecurity threats, which we anticipate will be particularly supportive of smaller issuers without robust IT resources.

Western Asset continues to monitor the volatility associated with geopolitical tensions, but we expect these potential second-order impacts to be fairly limited. During this environment where overall municipal fundamentals are in-tact to improving, recent volatility has contributed to an improved after-tax relative value proposition of the asset class, and has provided additional opportunities for an active manager to navigate value within the market.