Municipals Posted Positive Returns Last Week

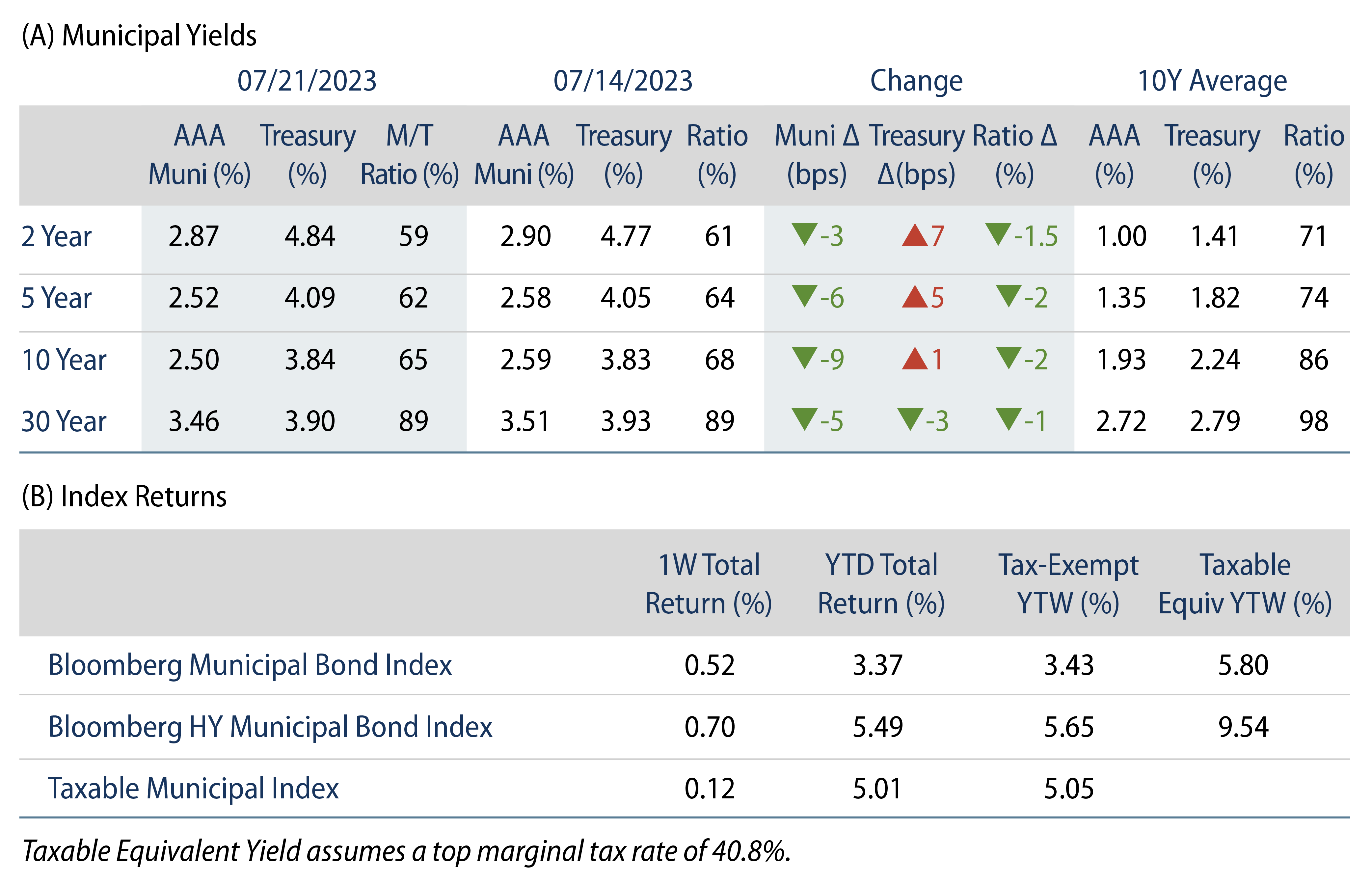

Municipals posted positive returns last week as high-grade municipal yields moved lower across the curve. Munis outperformed Treasuries, which moved higher in short and intermediate maturities. Technicals improved as municipal mutual funds recorded inflows. The Bloomberg Municipal Index returned 0.52% during the week, the High Yield Muni Index returned 0.70% and the Taxable Muni Index returned 0.12%. This week we highlight the New York Metropolitan Transportation Authority’s (MTA) recently released budget and fare increases.

Muni Technicals Improve with Fund Inflows

Fund Flows: During the week ending July 19, weekly reporting municipal mutual funds recorded $1.0 billion of net inflows, according to Lipper. Long-term funds recorded $1.0 billion of inflows, high-yield funds recorded $408 million of inflows and intermediate funds recorded $122 million of inflows. This week’s inflows bring year-to-date (YTD) net outflows to $7.3 billion.

Supply: The muni market recorded $11 billion of new-issue volume last week, up 29% from the prior week. YTD issuance of $194 billion is down 13% year-over year (YoY), with tax-exempt issuance down 7% YoY and taxable issuance down 44% YoY. This week’s calendar is expected to decline to $7 billion. Large transactions include $692 million state of Washington General Obligation and $621 million Black Belt Energy transactions.

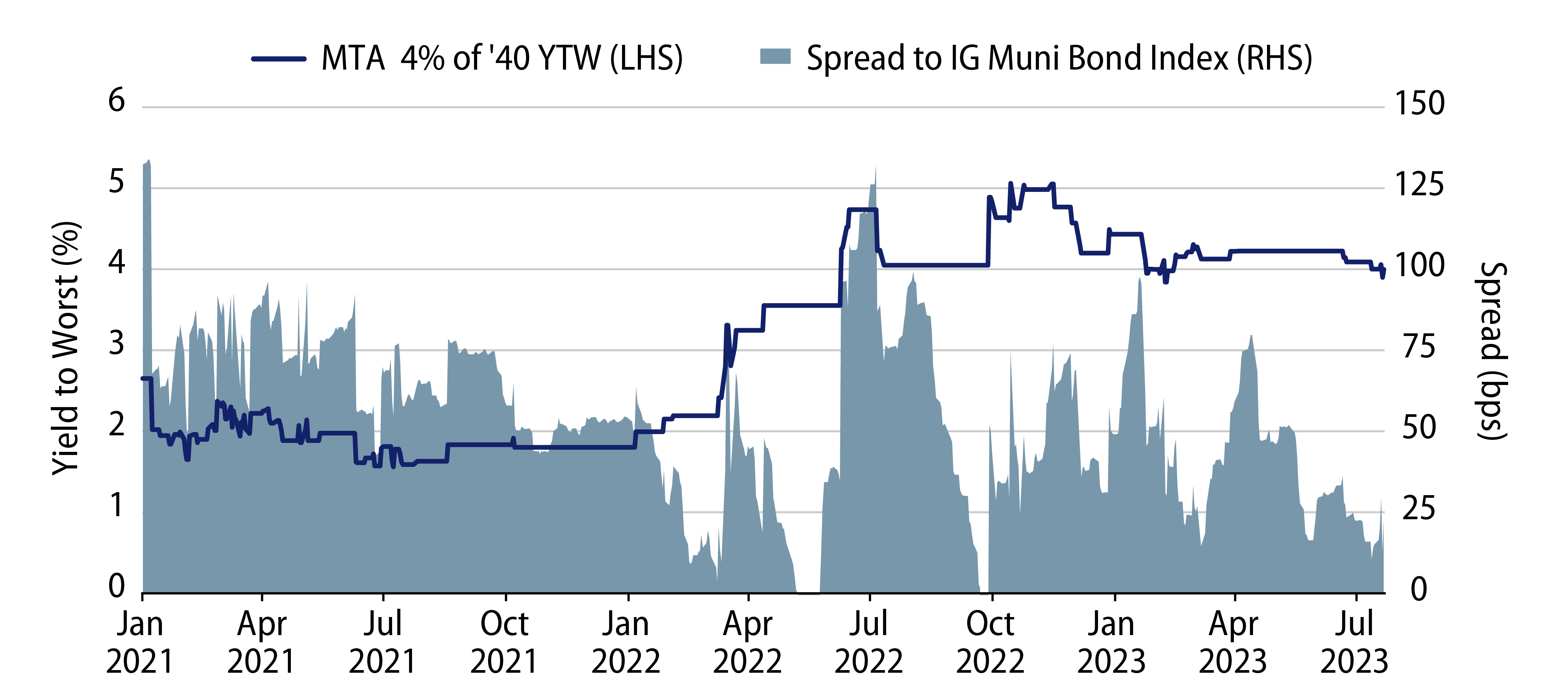

This Week in Munis: MTA Raises Fares, Highlights Budget Surplus

The New York MTA has been in focus throughout the pandemic and the subsequent recovery, considering the Authority’s elevated debt loads and presence at the center of the conversation around ridership concerns associated with work-from-home and return-to-office trends. Last week, the MTA released five-year budget projections, reflecting the impact of recent additional revenue streams. Following operating deficits of approximately $2 billion to $3 billion since 2020, offset only by pandemic-related federal aid, the MTA is projecting balanced budgets for the next five years.

The primary drivers of the prospective balanced budgets include new funding primarily from a $1.1 billion hike in payroll taxes on major companies based in NYC and an increased contribution of $165 million from the city that will pay for a greater share of the para-transit costs. In addition, the MTA announced it will raise rates across its subway, bus and outer-city train lines, which will raise $300 million annually. Transit fares will increase 3% to 5% and tolls will increase 6% to 7%.

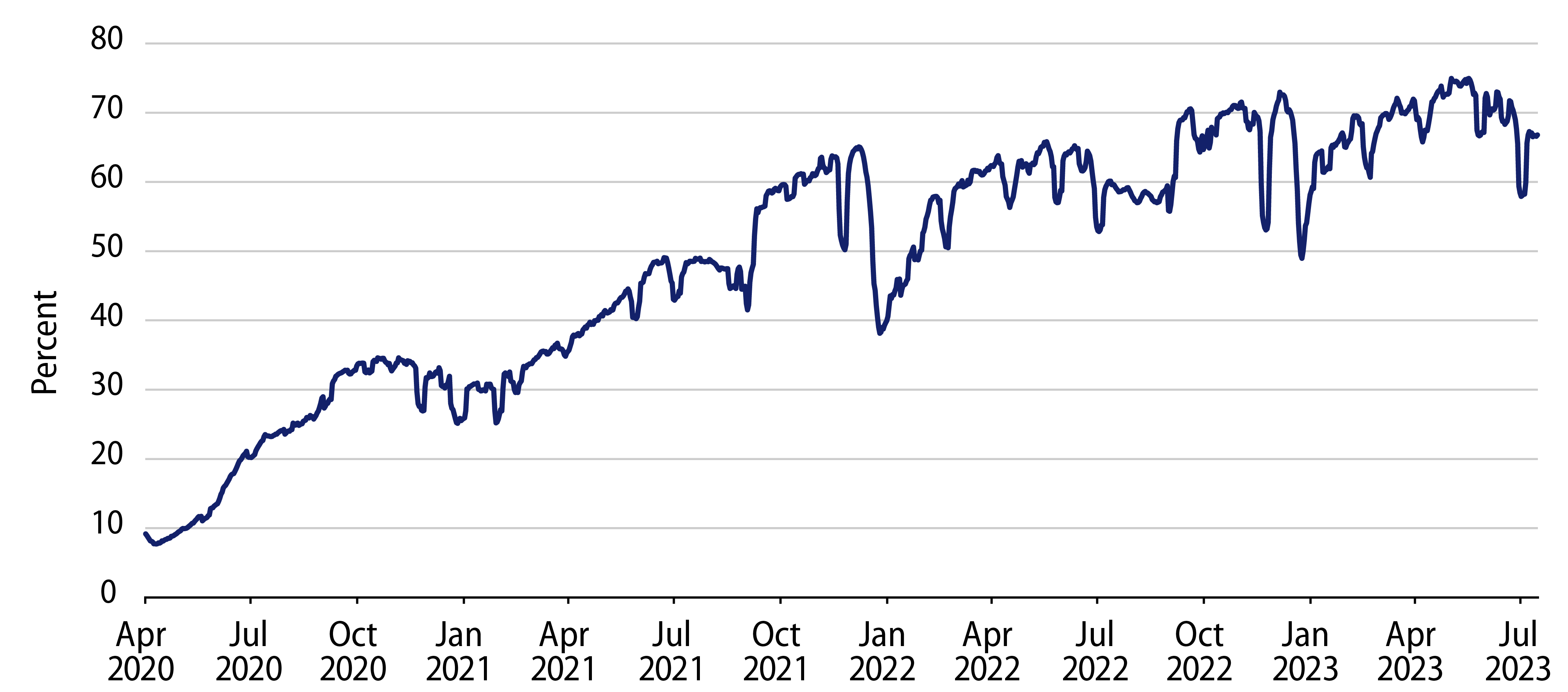

Western Asset views these near-term revenue sources as a credit positive for the MTA and necessary measures to achieve structural balance. However, the Authority remains challenged by ridership levels that remain below pre-pandemic highs (70% of pre-pandemic levels), a high cost structure, high debt load (including an outstanding $3 billion loan from the Federal Reserve Municipal Liquidity Facility), and relatively large capital plan. The Citizen’s Budget Council projects that the MTA will return to deficits in 2029 as federal funding is reduced.

Western Asset anticipates the MTA has the ability to continue to manage through its credit challenges, but considering cost pressures and potential reduced ridership, the Authority will likely need to achieve additional support from state, local and federal governments. While we expect these additional resources would likely be attained, we anticipate the potential for additional credit volatility associated with political headwinds throughout these efforts. While rating agencies appear to be more optimistic with the trajectory of the MTA’s credit profile, we believe current market pricing adequately compensates investors for some of the downside risks.