Investment-Grade Munis Posted Positive Returns Last Week

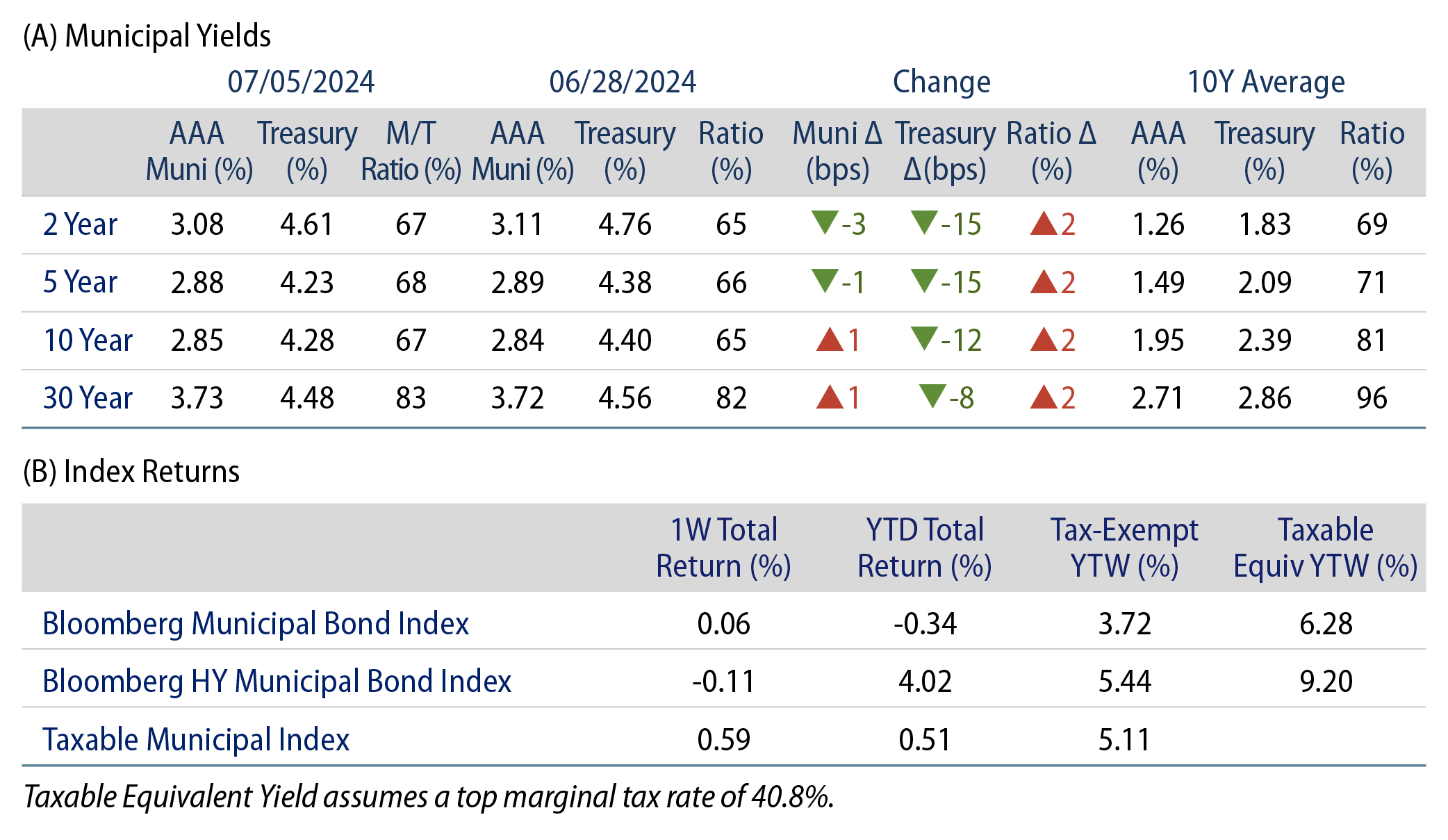

Investment-grade munis posted positive returns during the week as the high-grade muni yield curve steepened modestly, with yields moving lower in shorter maturities. Munis underperformed Treasuries which rallied on weak service data and downward payroll revisions. Meanwhile, technicals improved during the holiday-shortened week. The Bloomberg Municipal Index returned 0.06% during the week, the High Yield Muni Index returned -0.11% and the Taxable Muni Index returned 0.59%. This week we provide a mid-year market update for muni investors.

Technicals Strengthened Amid Low Holiday Supply, Elevated Mid-Year Coupons and Principal Redemptions

Fund Flows (up $343 million): During the week ending July 3, weekly reporting municipal mutual funds recorded $343 million of net inflows, according to Lipper. Long-term funds recorded $356 million of inflows, high-yield funds recorded $215 million of inflows and intermediate funds recorded $125 million of inflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $12 billion. In addition to inflows, the market benefited from elevated mid-year coupon and principal payments.

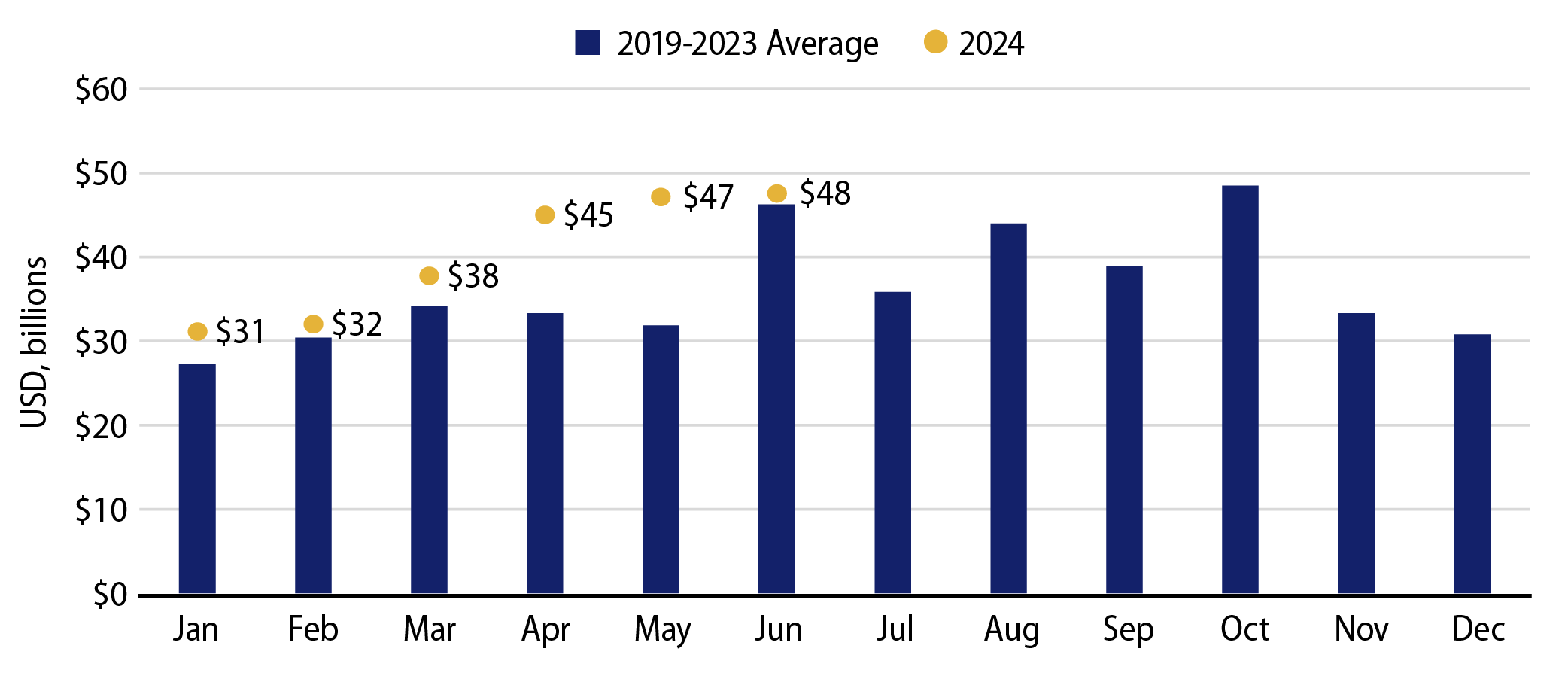

Supply (YTD supply of $240 billion, up 38% YoY): The muni market recorded a scant $653 million of new-issue volume last week, down 95% from the prior week due to the holiday-shortened week. YTD issuance of $240 billion is 38% higher than last year’s level, with tax-exempt issuance 42% higher and taxable issuance 4% higher year-over-year (YoY). This week’s calendar is expected to pick up back to an elevated $13 billion. The largest deals include $1.3 billion Dormitory Authority of the State of New York sales tax and $500 million Houston, Texas general obligation transactions.

This Week in Munis: Mid-Year Update

Performance

The muni market posted negative returns in the first half of the year as the market contended with ongoing rate volatility and robust new-issue supply levels following strong outperformance in 4Q23. The investment-grade Bloomberg Municipal Bond Index returned -0.40% in the first half of the year. Shorter-duration securities generally outperformed as rates moved higher following strong economic data, and lower-quality municipals outperformed as market fundamentals remained resilient.

Supply/Demand

Municipal supply spiked in the first half of the year. Total new-issue supply reached $241 billion, up 38% from 2023 levels, driven by elevated tax-exempt refunding activity. Tax-exempt municipal issuance of $220 billion was up 43% YoY. The taxable supply of $21 billion was in line with last year’s level, but comprised a below-average 9% of total issuance.

Municipal mutual funds returned to positive levels after recording $15 billion of net inflows in the first half of the year following two consecutive years of fund outflows, according to ICI. While positive, demand for municipal funds remains limited relative to the magnitude of over $120 billion of outflows observed in 2022 and 2023.

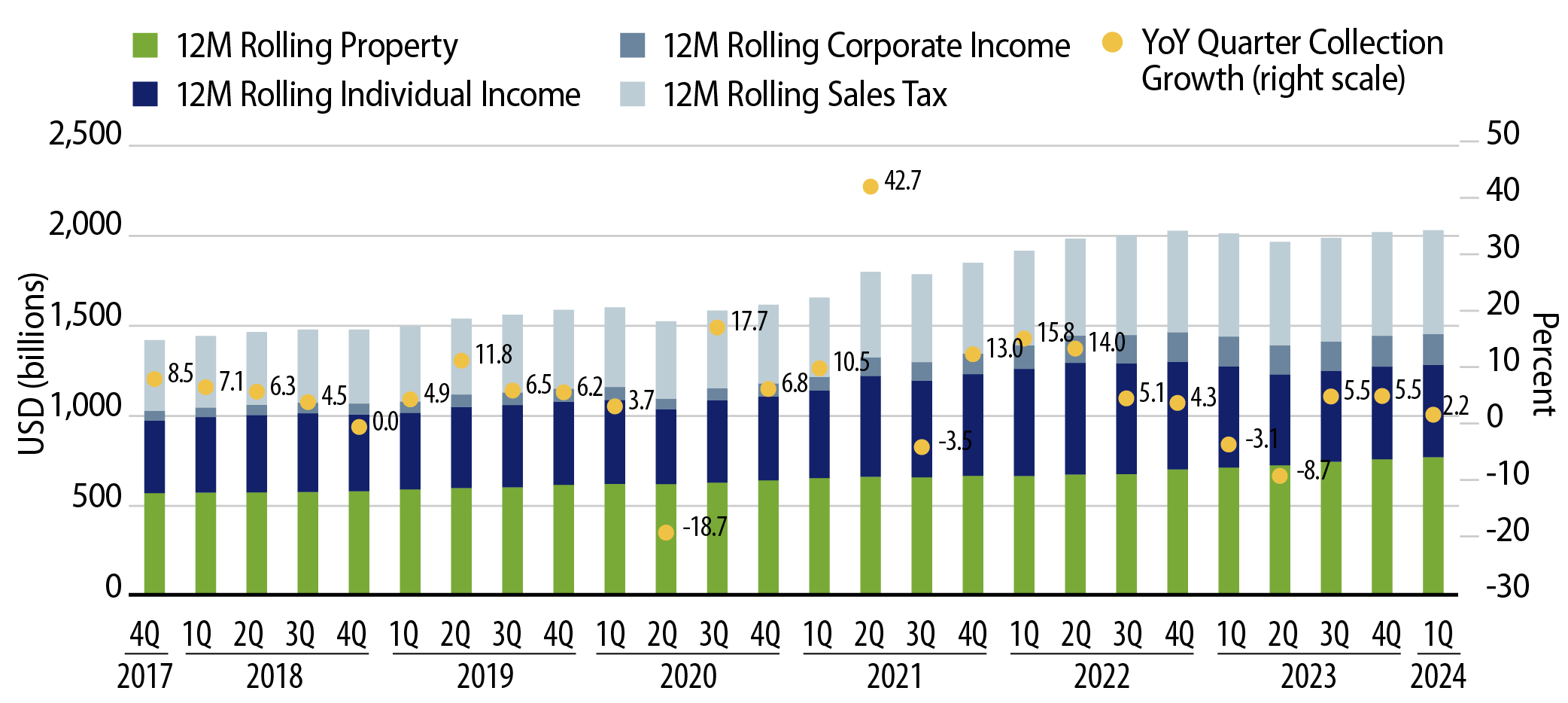

Fundamentals

First-quarter 2024 state and local government tax collections grew 2.2% from first-quarter 2023 levels to $487 billion. Among the major state revenue sources, individual income taxes declined 0.7% YoY, while corporate income and sales tax collections increased 1.5% and 0.3% YoY, respectively. Property tax collections, the primary source of revenue for local governments, increased 6.0% YoY to $195 billion. Continued tax collection growth highlights the resiliency of municipal credit, despite signs of slower economic growth.

Rating agencies continue to take notice of improved credit fundamentals, with upgrades outpacing downgrades by a factor of over 3-to-1 in the first half of the year. According to Bloomberg data, first-time payment defaults declined 43% YoY to $711 million, isolated to the high-yield municipal segment and led by the continuing care and retirement community sector.

Valuations

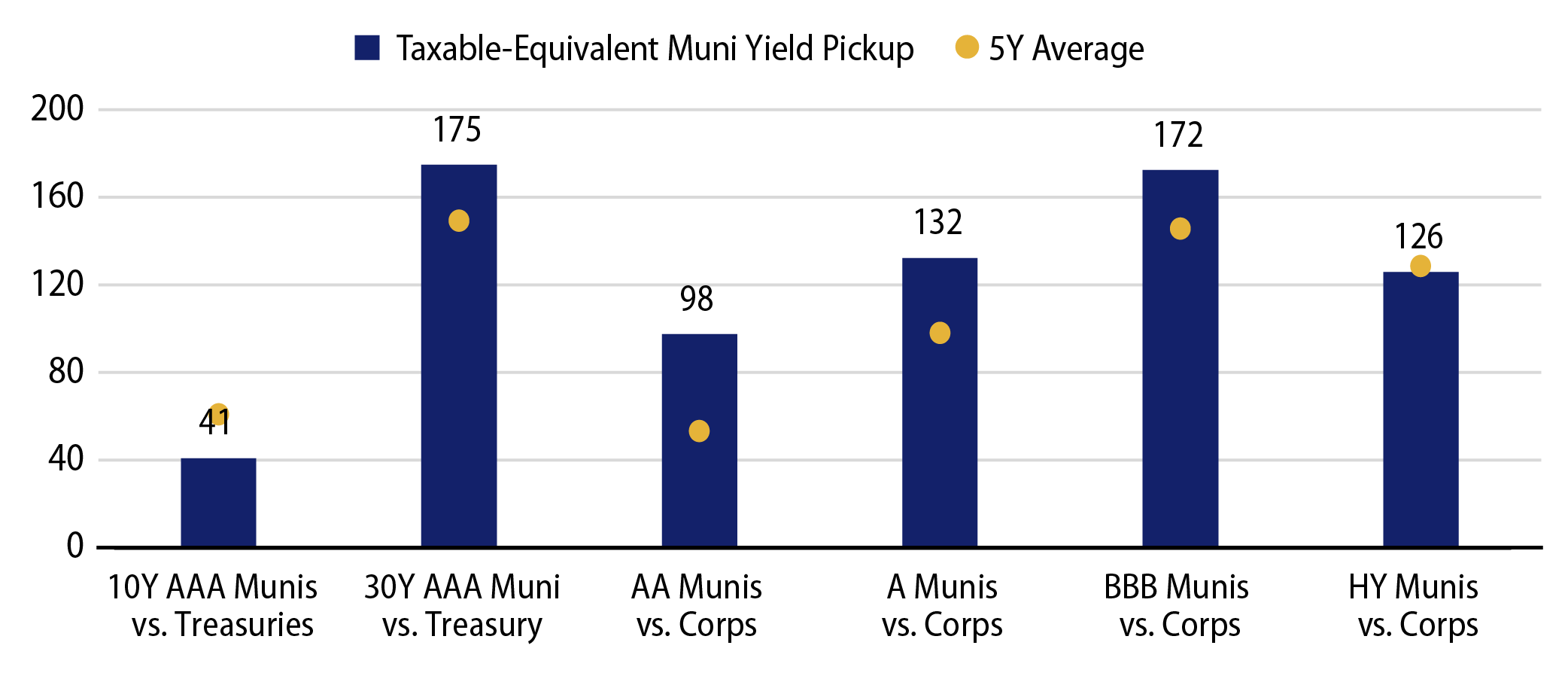

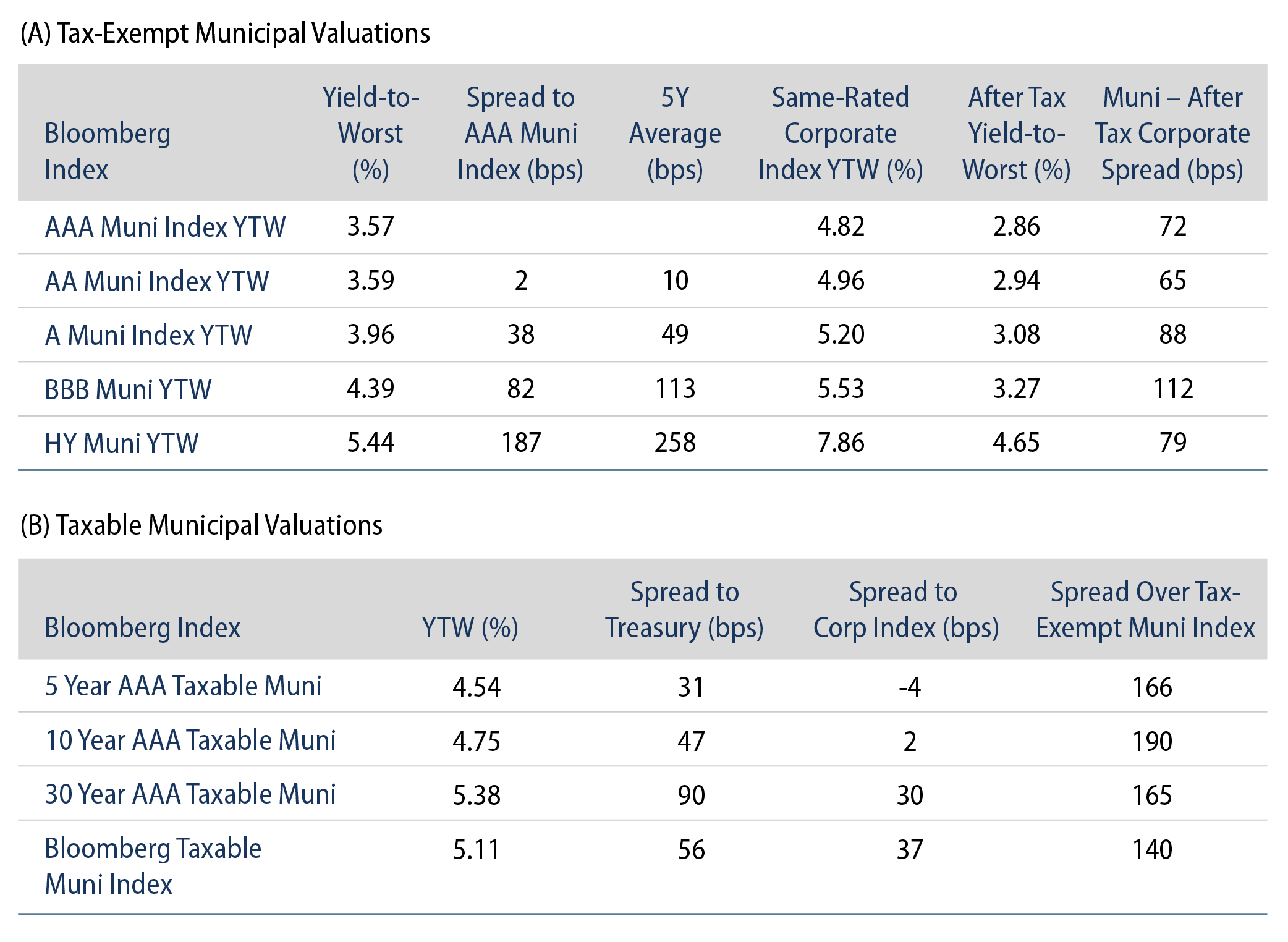

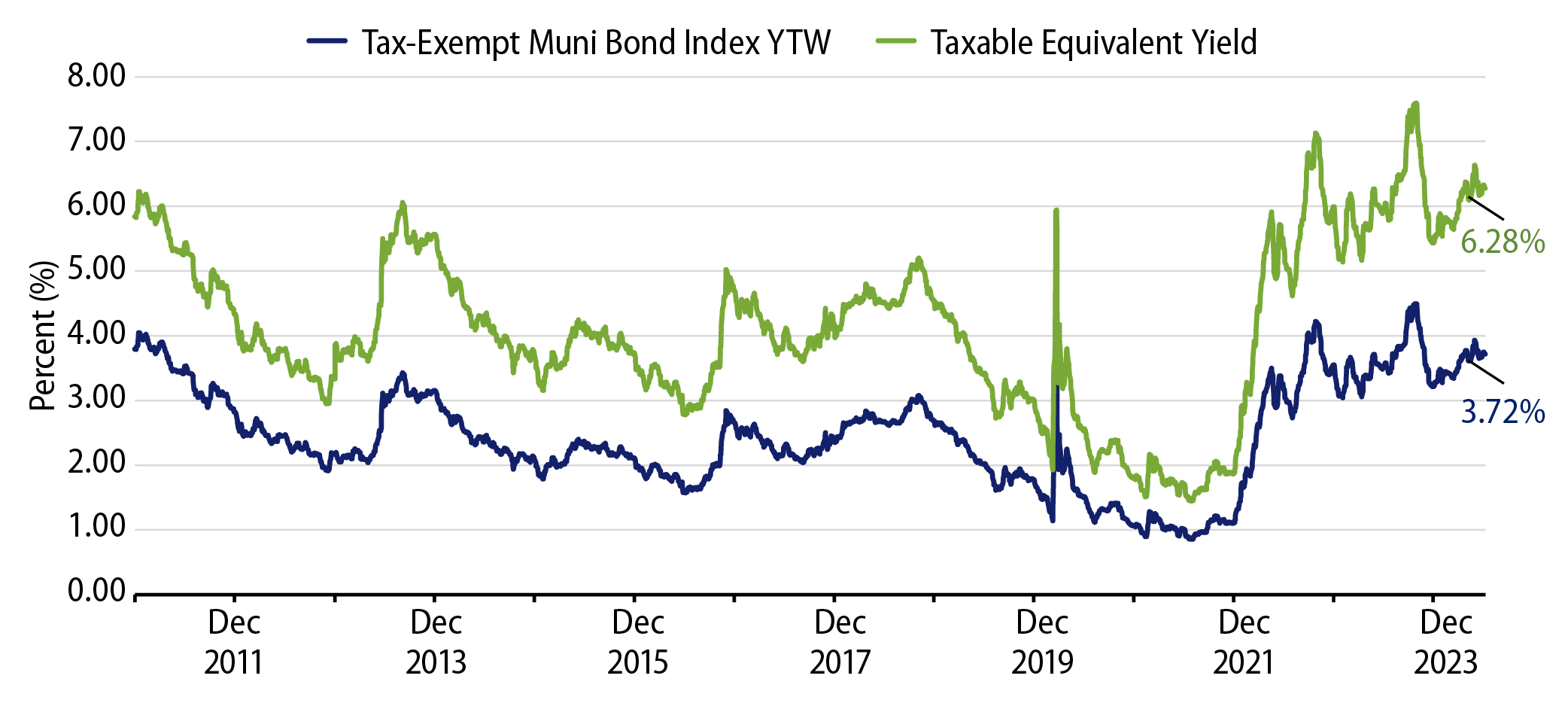

Negative performance YTD has resulted in higher tax-exempt municipal income opportunities and improved relative value of the municipal asset class. So far this year, the average Bloomberg Municipal Bond Index yield to worst (YTW) increased by 50 basis points (bps) to 3.72%, improving the taxable equivalent yield for a top taxpayer to 6.28% (from 5.44%).

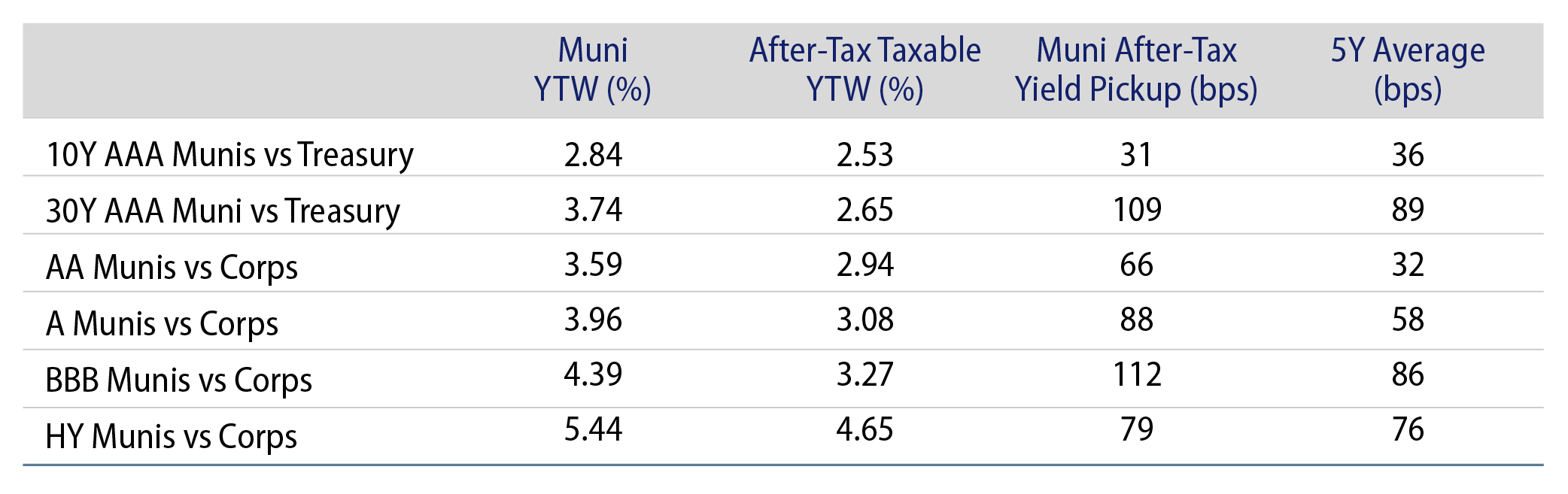

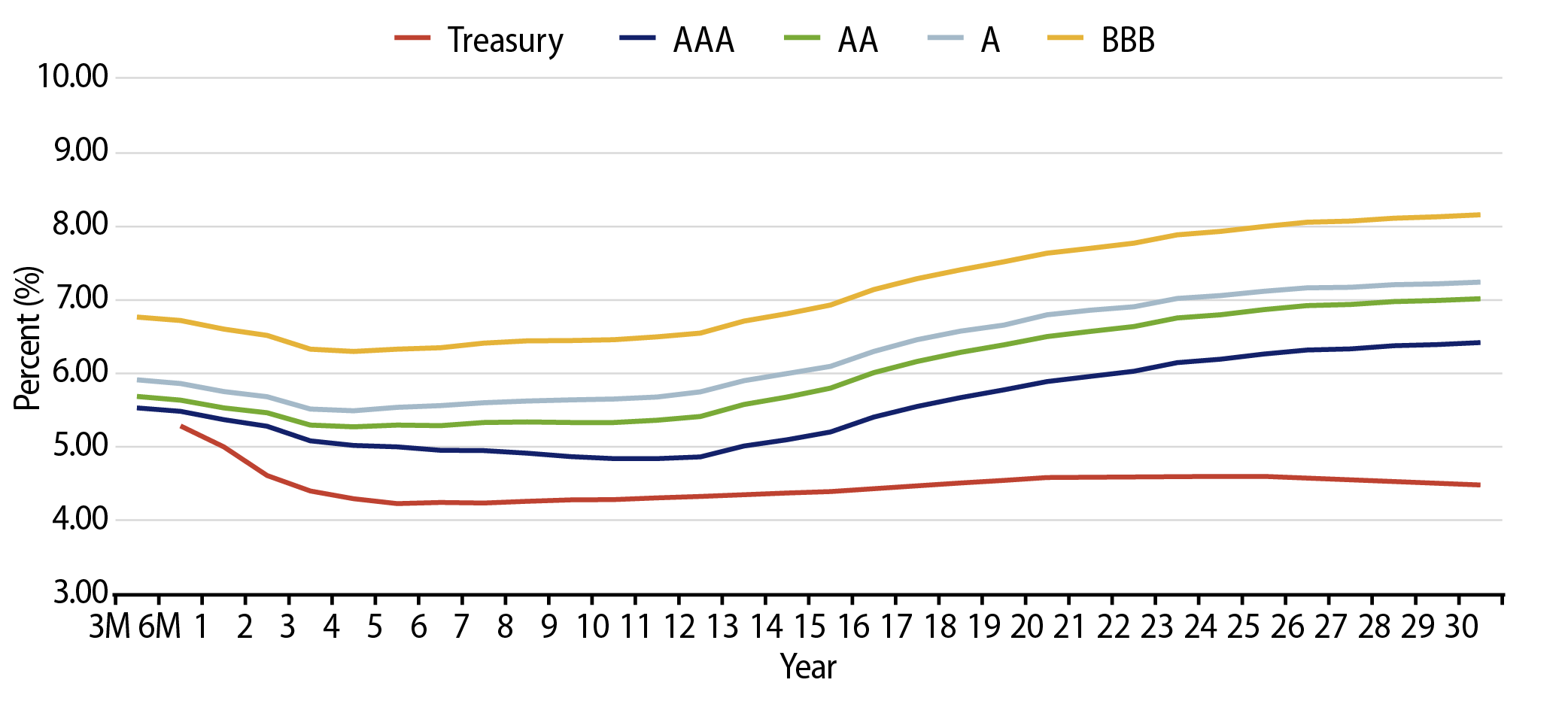

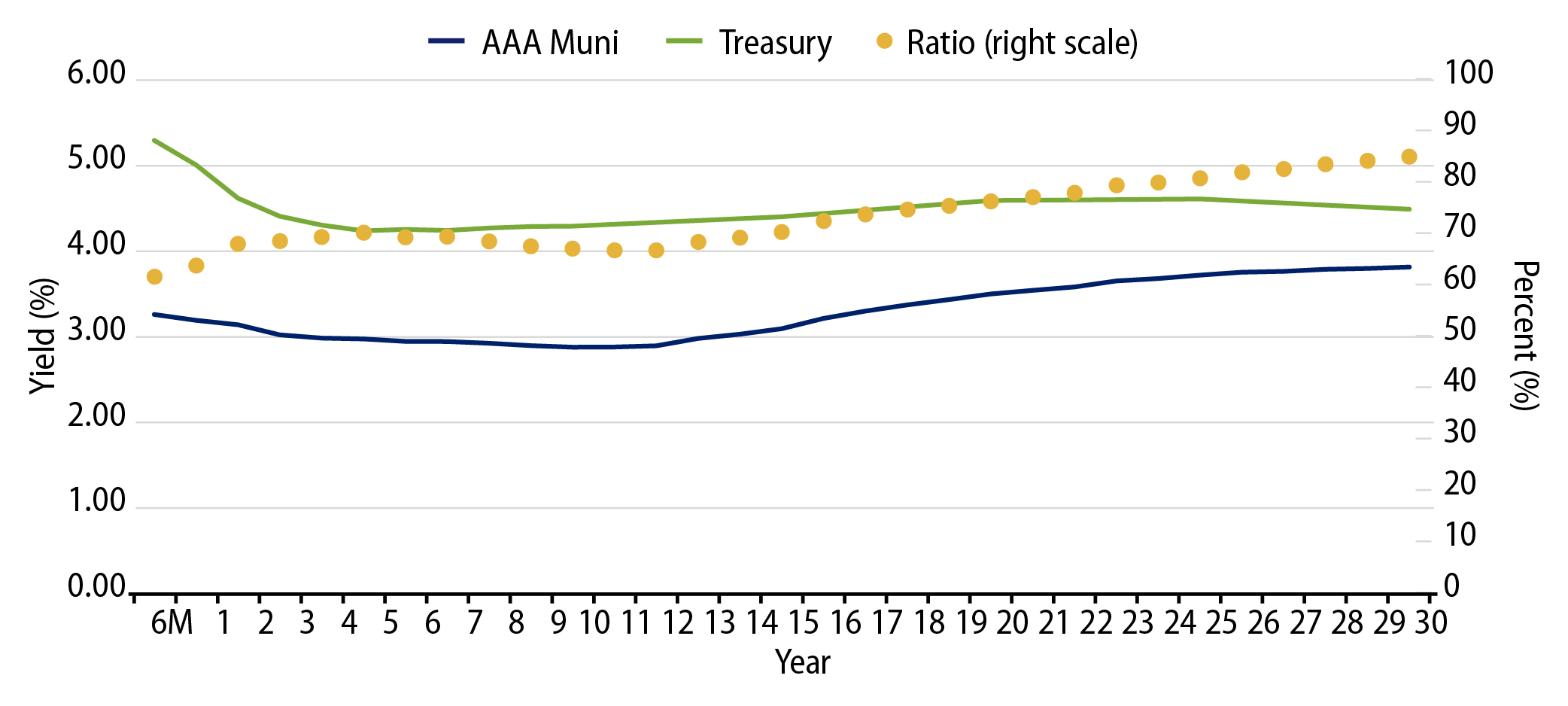

Compared to taxable alternatives, municipals offer a compelling relative value proposition. Longer-duration and lower investment-grade municipal credit offer more than 100 bps of after-tax yield pickup versus like-structured Treasuries and corporate counterparts. Western Asset believes that elevated supply and attractive relative value, in the context of favorable credit fundamentals, offer an attractive entry point for long-term investors who can benefit from long-term tax-exempt income.

Municipal Credit Curves and Relative Value

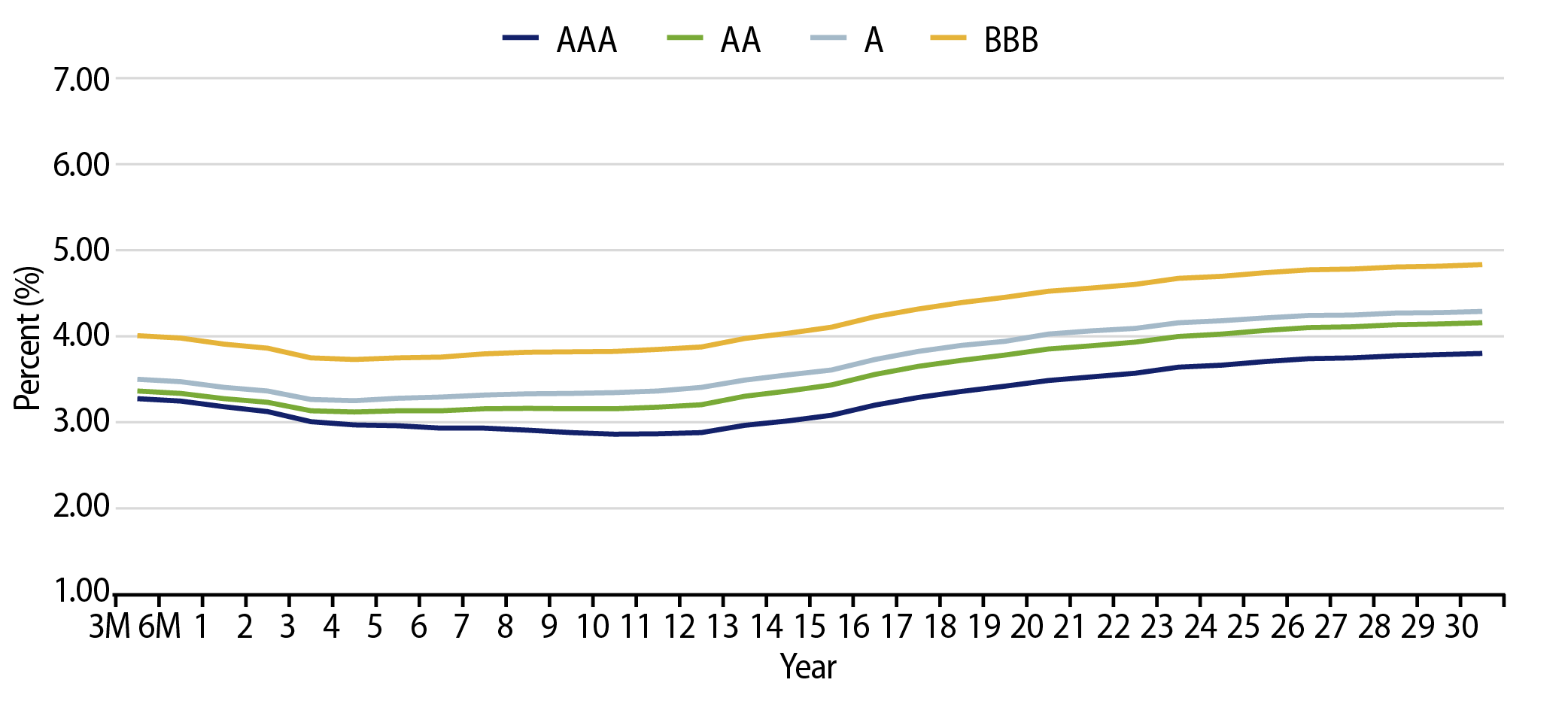

Theme #1: Municipal taxable-equivalent yields are above decade averages.

Theme #2: The muni yield curve has disinverted in recent weeks, but bar-belled value remains.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.