Municipals Posted Positive Returns During the Week

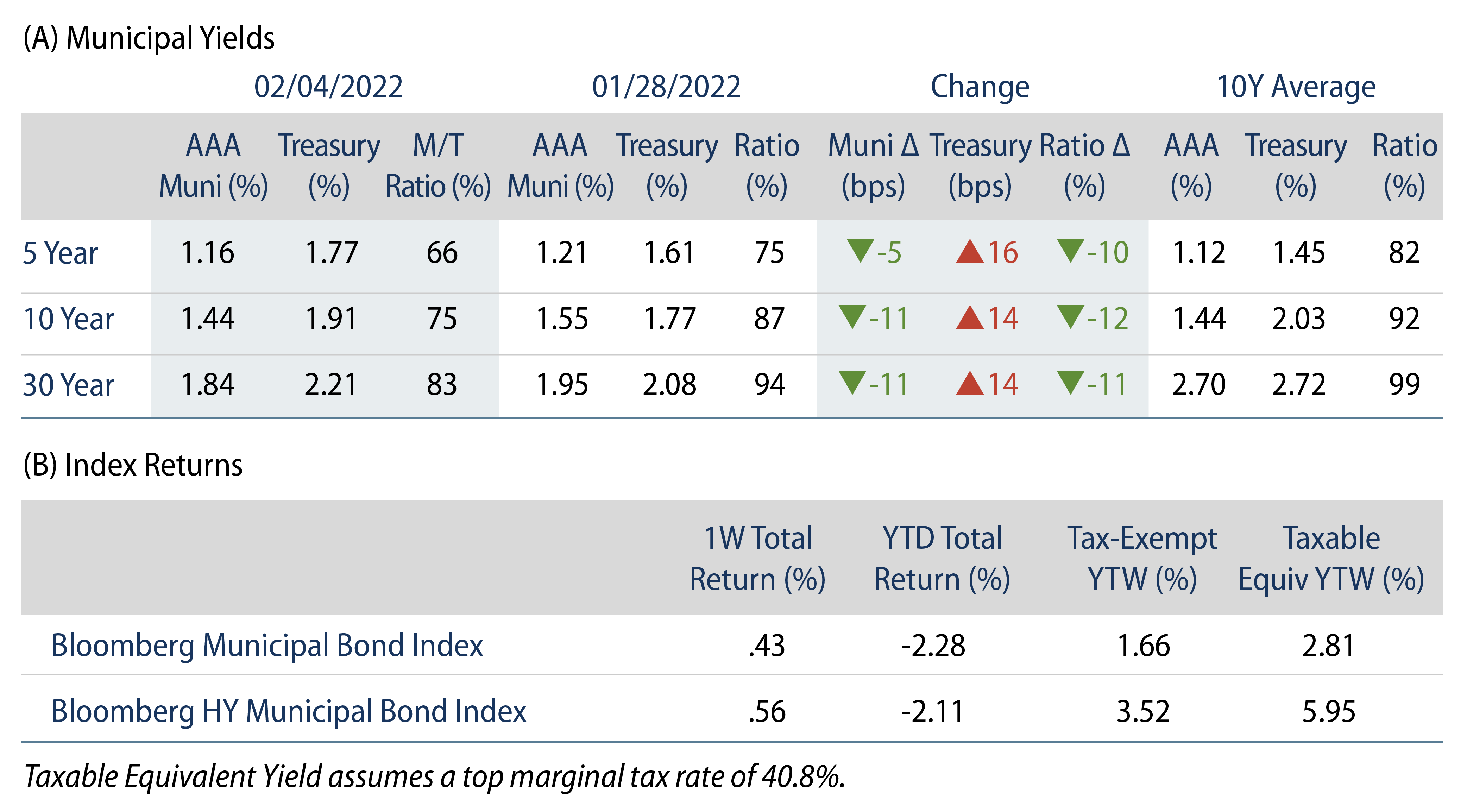

US municipals posted positive returns during the week and outperformed Treasuries as Municipal/Treasury ratios moved lower. High grade municipal yields moved 5-11 bps lower across the curve. Technicals remained soft as municipal outflows continued. The Bloomberg Municipal Index returned 0.43%, while the HY Muni Index returned 0.56%. This week we highlight the Illinois Governor’s initial budget address that took place last week.

Municipal Demand Wanes

Fund Flows: During the week ending February 2, municipal mutual funds recorded $2.9 billion of net outflows, according to Lipper. Long-term funds recorded $2.0 billion of outflows, high-yield funds recorded $1.5 billion of outflows and intermediate funds recorded $294 million of outflows. Municipal fund outflows year to date (YTD) have extended to $4.8 billion.

Supply: The muni market recorded $10 billion of new-issue volume, up 39% from the prior week. Total YTD issuance of $37 billion is 41% higher than last year’s levels, with tax-exempt issuance trending 70% higher year-over-year (YoY) and taxable issuance trending 32% lower YoY. This week’s new-issue calendar is expected to decline to $6 billion. Largest deals include $744 million State of Washington General Obligation and $511 million Port of Portland Airport transactions.

This Week in Munis—Illinois Rising

Last week Governor Pritzker delivered his preliminary budget outline for the 2023 fiscal year. Pritzker focused on the administration’s accomplishments in recent years that included public rating agency rating upgrades and tax savings that will accrue to Illinois residents.

Following an anticipated 2022 fiscal year-end surplus of $1.7 billion, Illinois’ 2023 fiscal budget is structurally balanced without the reliance federal pandemic support. The Governor expects 2023 fiscal-year tax revenues to be consistent with fiscal-year 2022 levels. Notable spending initiatives focus on a paydown of the state’s bill backlog from $4.2 billion to $2.7 billion. Other spending increases include $400 million for K-12 education, $120 million for higher education financial aid, and additional funds for health and human services, in part supported by the continuation of the increased federal Medicaid match. Illinois is also focusing on bolstering its rainy day funds, which were virtually nonexistent heading into the current fiscal year. The state plans to contribute approximately $600 million to its rainy day fund by the end of fiscal-year 2022, then plans to contribute an additional $279 million in fiscal-year 2023.

Governor Pritzker also used the fiscal improvement to offer tax concessions to residents, a removal grocery sales taxes for a year, and a one-time $300 property tax rebate, all measures that should help the Governor during an election year.

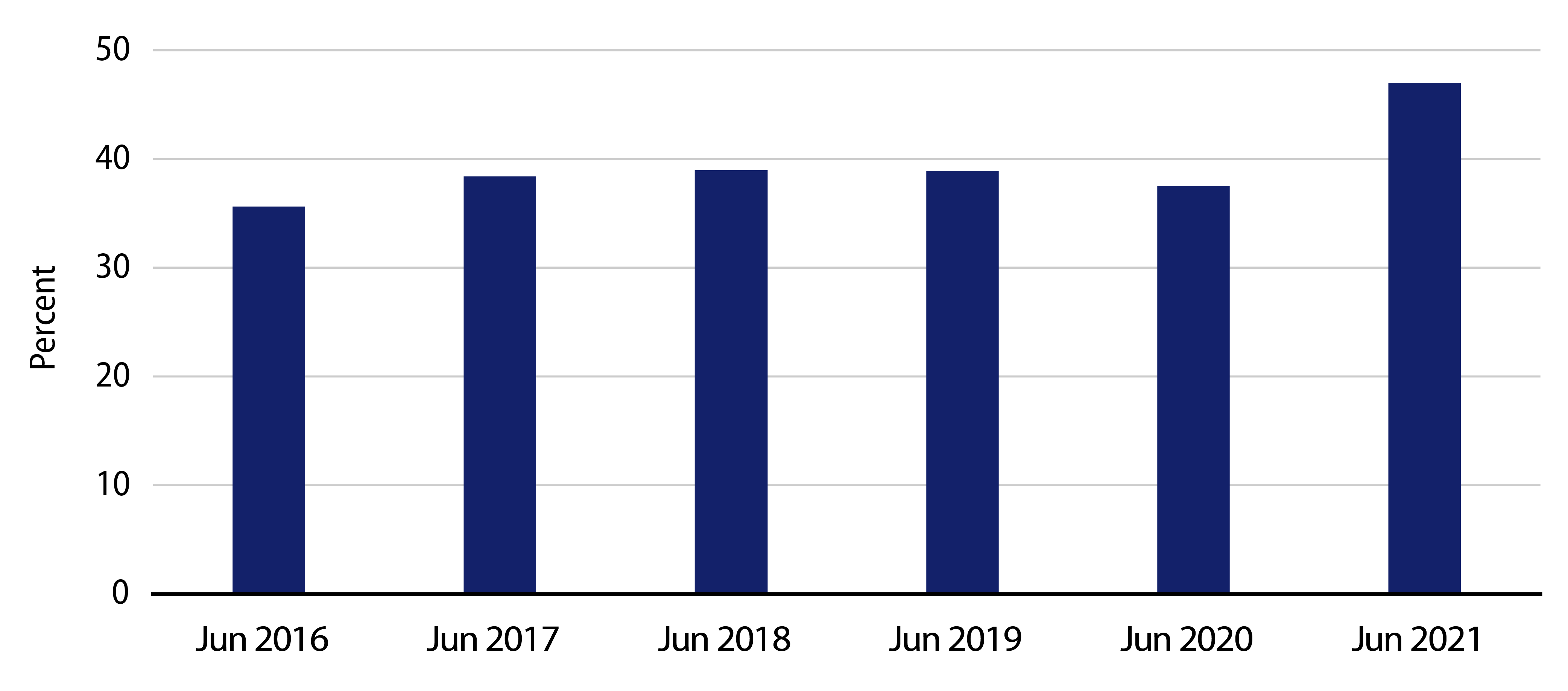

After years of governance challenges, Western Asset believes there have been some very real achievements leading to Illinois’ fiscal stability. Pension funding will remain a primary credit concern for the state and its local governments, but the state has shown willingness to address this issue in recent years which has led to the improvement of its funding ratio from 36% in fiscal-year 2016 to 47% in the current operating budget. Considering additional pension contributions within the upcoming spending plan, along with the continuation of a buy-out program and a reduction of benefits for new employees, we expect this long-term liability to continue to be managed over time and provide the potential for credit improvement.