Municipals Posted Negative Returns During the Week

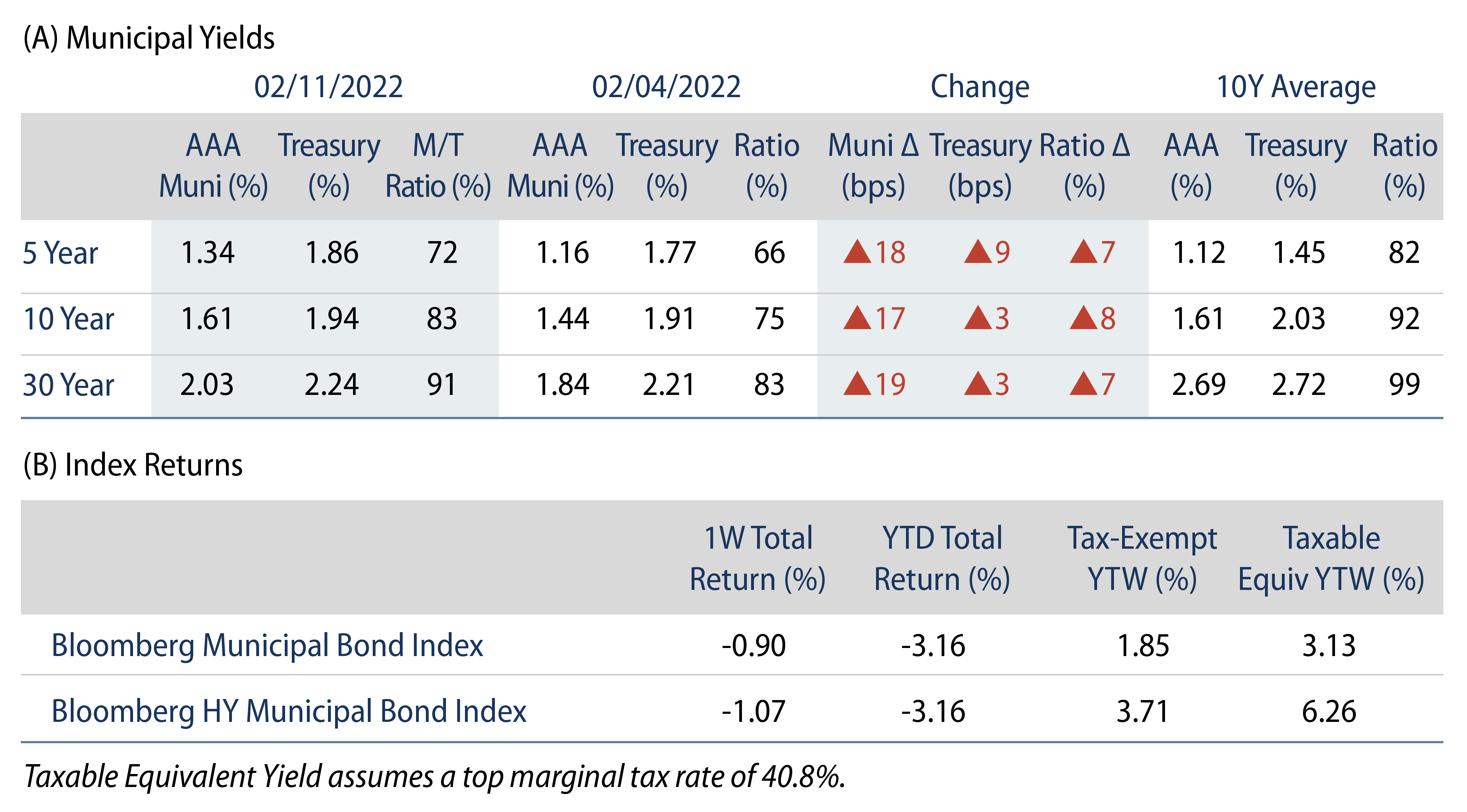

US municipals posted negative returns during the week and generally underperformed Treasuries in intermediate and long maturities. High grade municipal yields moved 17-19 bps higher across the curve. Technicals softened as 2022 municipal mutual fund outflows extended. The Bloomberg Municipal Index returned -0.90%, while the HY Muni Index returned -1.07%. This week we evaluate recently released higher education enrollment data and its impact on the sector.

Technicals Soften as 2022 Fund Outflows Extended

Fund Flows: During the week ending February 9, weekly reporting municipal mutual funds recorded $216 million of net inflows, according to Lipper. Long-term funds recorded $223 million of inflows, high-yield funds recorded $66 million of outflows and intermediate funds recorded $86 million of outflows. Municipal fund outflows year to date (YTD) have extended to $5.9 billion, as monthly-reporting funds recorded elevated outflows this week.

Supply: The muni market recorded $9 billion of new-issue volume, down 8% from the prior week. Total YTD issuance of $44 billion is 30% higher from last year’s levels, with tax-exempt issuance trending 64% higher year-over-year (YoY) and taxable issuance trending 30% lower YoY. This week’s new-issue calendar is expected to decline to $4.4 billion. Largest deals include $641 million National Finance Authority and $300 million Mount Nittany Medical Center transactions.

This Week in Munis—Higher Ed Enrollment Declines

Higher education sector concerns were front of mind throughout the pandemic, as secular industry trends around growing tuition costs and potential shifts to remote learning brought the traditional higher education value proposition into question. The National Student Clearinghouse Research Center recently released data on the Fall 2021 semester which provides perspective around the pandemic’s impact, as well as an early look at post-pandemic enrollment trends across the sector.

Following a 2.5% decline in 2020, higher education enrollment fell 2.7% in the fall of 2021. Within the total YoY enrollment decline, undergraduate enrollment fell 3.1% while graduate enrollment dipped just 0.4%. The largest YoY enrollment percentage decline occurred at private four-year institutions, with an 11.1% drop, whereas four-year public institution enrollment declined 3.8%. Total enrollment losses during the COVID-19 pandemic represent a total two-year decline of 5.1%, or 938,000 students, since the fall of 2019.

A particular concern is the significant drop in international students, who tend to pay higher tuition and support university profitability. US colleges are facing a number of hurdles in international recruitment, including the relatively high education costs, increasing competition for international students from other countries, geopolitical tensions between the US and China, and pandemic-driven concerns. During the 2020-2021 academic year, total international enrollment declined an estimated 15%, according to an Open Doors survey.

The downward trend in enrollment is a cause for concern for the nation’s colleges and universities. However, these student shortfalls will affect each institution differently based on a variety of factors ranging from relative prestige, tuition and fee levels, revenue mix, endowment levels and perceived long-term value of the degree offered. Western Asset believes that large state institutions and prestigious four-year private universities and colleges with significant research activities and diversified revenue sources will continue to attract demand and maintain a sustainable market position. Meanwhile, we are more cautious on smaller private liberal arts colleges, which we expect will be pressured by a higher reliance on relatively expensive student tuition and related fees, leaving limited flexibility to increase tuition to offset enrollment declines should they persist.