Municipals Posted Negative Returns During the Week

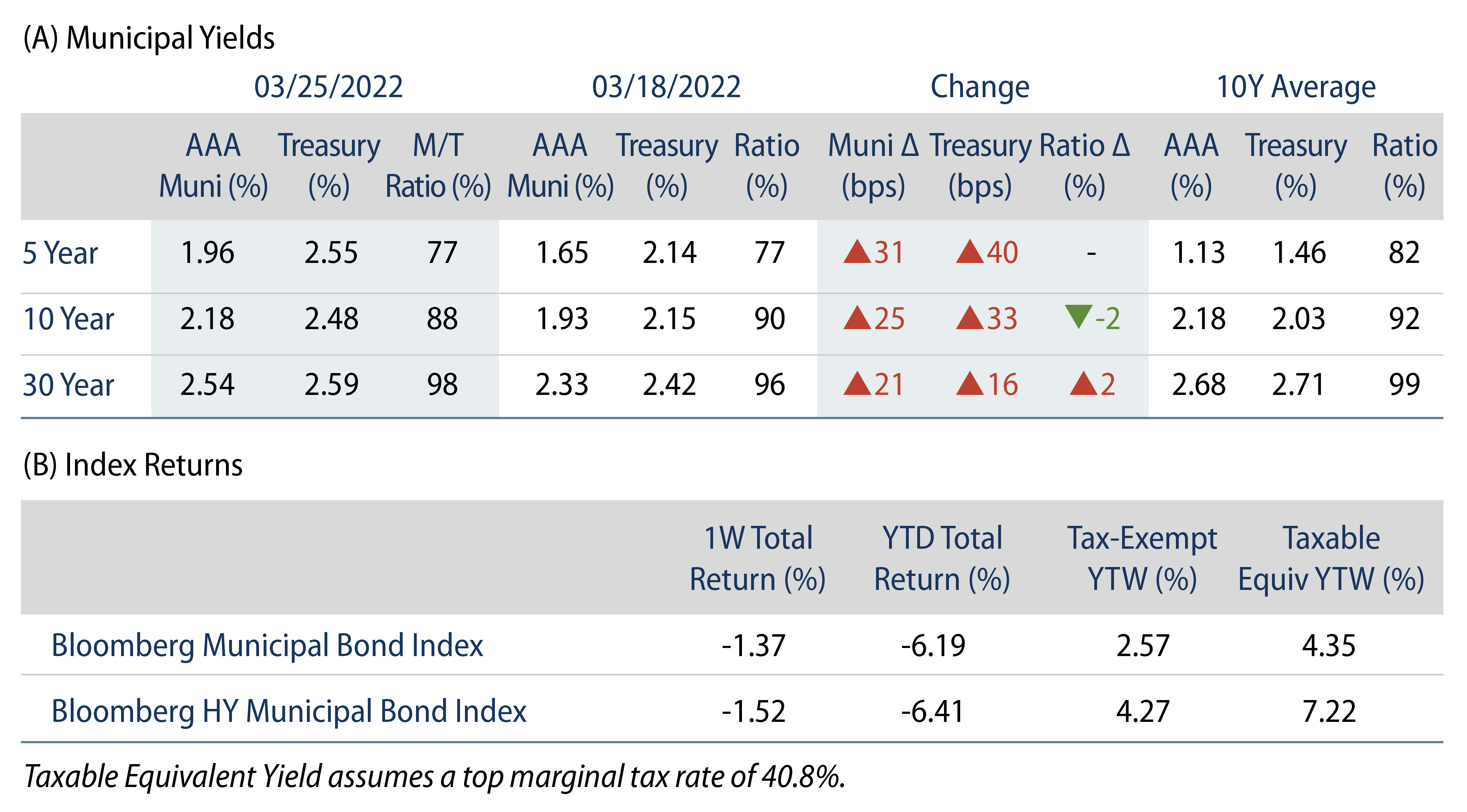

US municipals experienced another volatile week and posted negative returns as high-grade municipal yields moved 21-31 bps higher across the curve. Munis outperformed Treasuries in short and intermediate maturities but underperformed in the long end of the curve. Market technicals remained weak amid continued fund outflows and building new-issue supply. The Bloomberg Municipal Index returned -1.37%, while the HY Muni Index returned -1.52%. This week we highlight proposed gas tax holidays and the potential impact on state budgets.

Market Technicals Remain Weak Amid Fund Outflows and Building Supply

Fund Flows: During the week ending March 23, weekly reporting municipal mutual funds recorded $1.5 billion of outflows, according to Lipper. Long-term funds recorded $630 million of outflows, high-yield funds recorded $11 million of inflows and intermediate funds recorded $427 million of outflows. The week’s fund outflows extend the current outflow streak to 11 consecutive weeks, contributing to $19.9 billion of year-to-date (YTD) net outflows.

Supply: The muni market recorded $9.8 billion of new-issue volume, up 62% from the prior week. Total YTD issuance of $93 billion is 2% higher than last year’s levels, with tax-exempt issuance trending 19% higher year-over-year (YoY) and taxable issuance trending 41% lower YoY. This week’s new-issue calendar is expected to decrease to $8 billion. Largest deals include $1 billion California Health Facilities Financing Authority (No Place Like Home) and $1 billion Washington University transactions.

This Week in Munis: Gas Tax Holidays

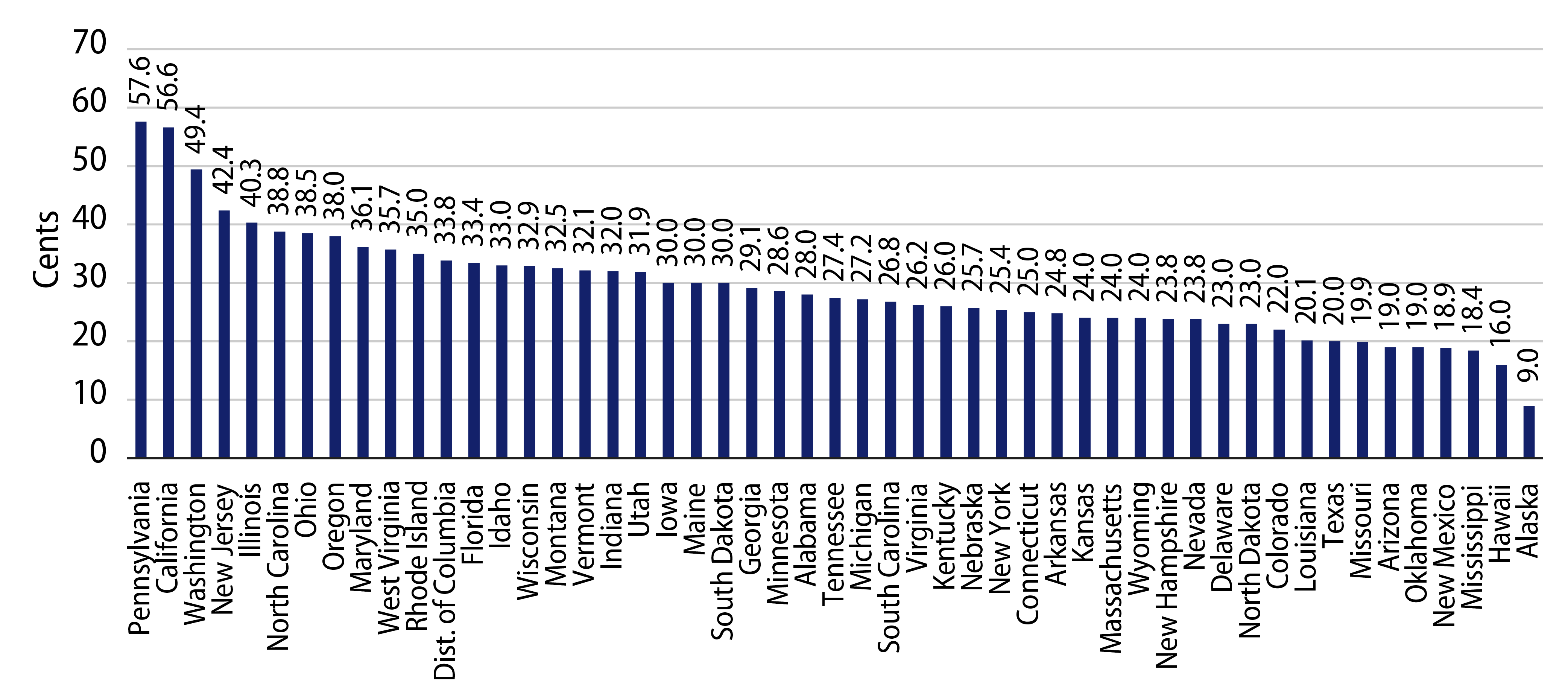

In response to rising gasoline prices, the federal government and many states are considering a gas tax holiday. A senate bill temporarily eliminating the federal state gas tax is currently in committee. Meanwhile, 20 states are reported to be considering various tax breaks. Thus far, Florida, Georgia, Maryland, Connecticut and Michigan lawmakers all voted to temporarily eliminate or reduce gas taxes. State gas tax rates vary, but averaged 29 cents per gallon as of January 2022, and reached as high as 57 cents per gallon (PA, CA). Gas tax relief should provide some measure of respite to residents, particularly in rural areas who have high dependence on gasoline consumption, but could have a modest impact on state revenue collections.

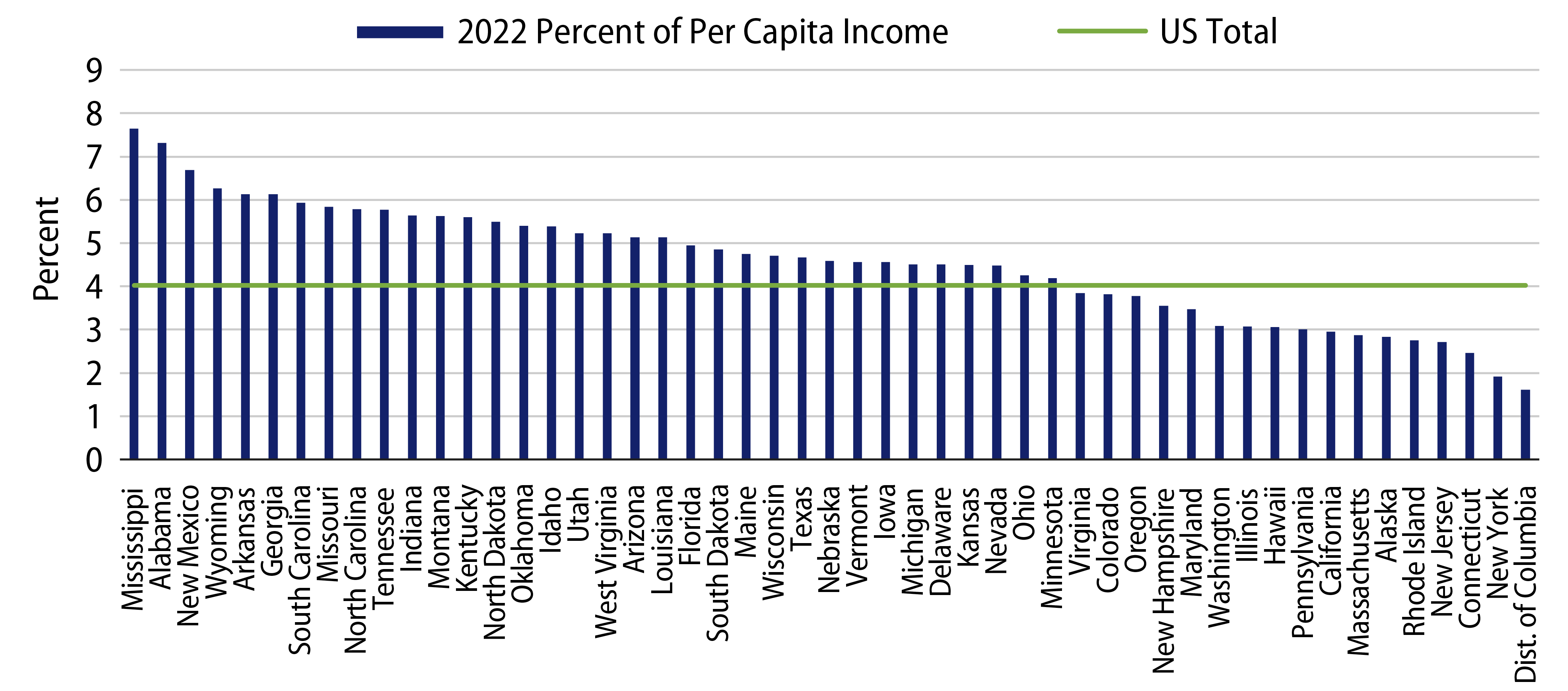

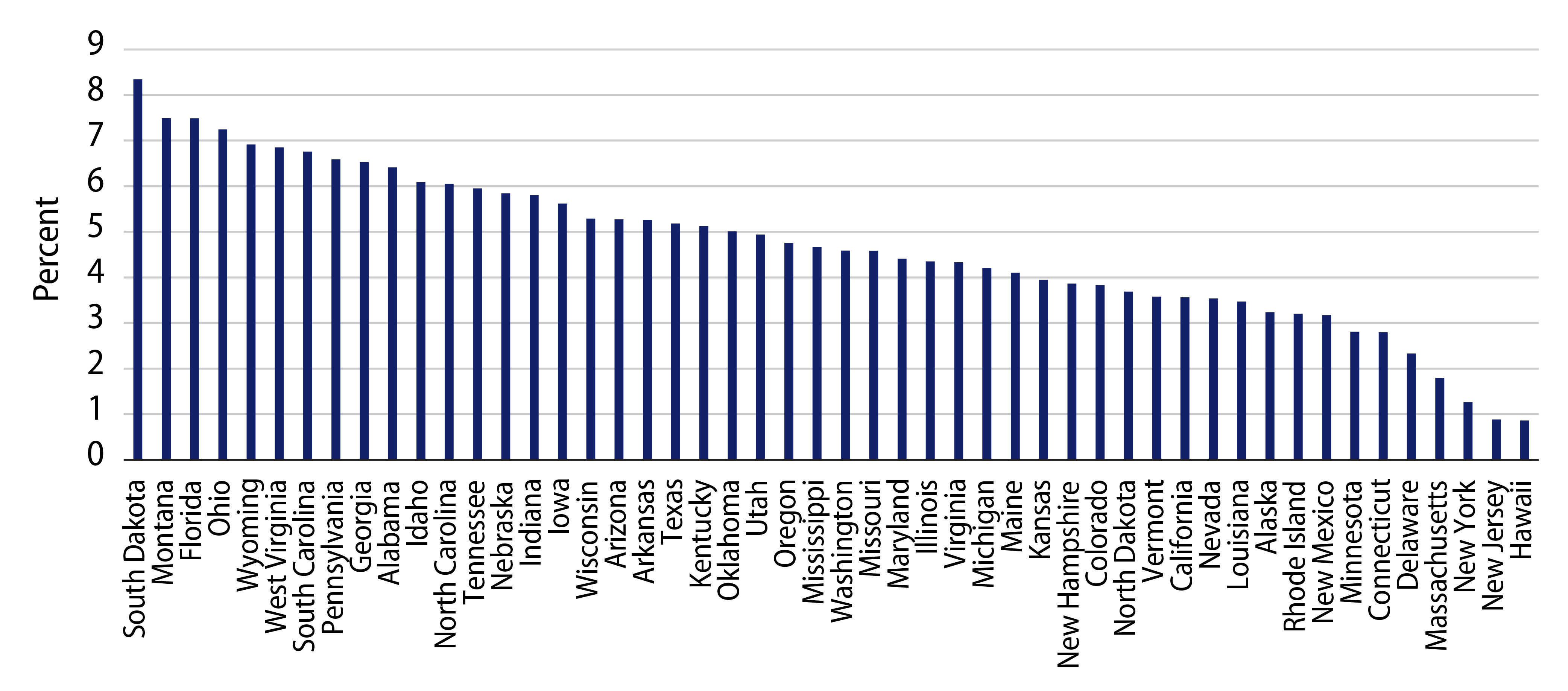

In aggregate, states collected $55 billion of motor fuel taxes in 2021, comprising approximately 4% of total revenue collections, according to Census data. Low income tax states which have higher dependence on sales taxes generally, such as Florida, Montana, and South Dakota, could feel greater budgetary pressure by reducing sales taxes on gasoline purchases. Meanwhile, larger diversified revenue bases observed in Connecticut, New York, and New Jersey have less reliance on this revenue stream. Notably, while California’s gas tax ranks second highest in the nation, the state ranks 13th lowest in gas tax collections as a percentage of total taxes collected.

While we expect modest revenue reductions for states that choose to temporarily reduce gas tax collections, we do not anticipate materially negative credit implications. States are in a position to afford a gas tax holiday, as revenue collections and reserve balances have reached record levels over the past year. Moreover, delivering relief to the local consumer facing a rise in the cost of gasoline from an average of $2.87 per gallon a year ago to $4.30 per gallon can support overall economic activity, and additional sales tax collections away from gasoline. While certain state bond liens are often supported by state tax collections, they are often accompanied by favorable bondholder protections including debt service reserve funds and additional bond tests which limit excess leverage.