Macros, Markets and Munis

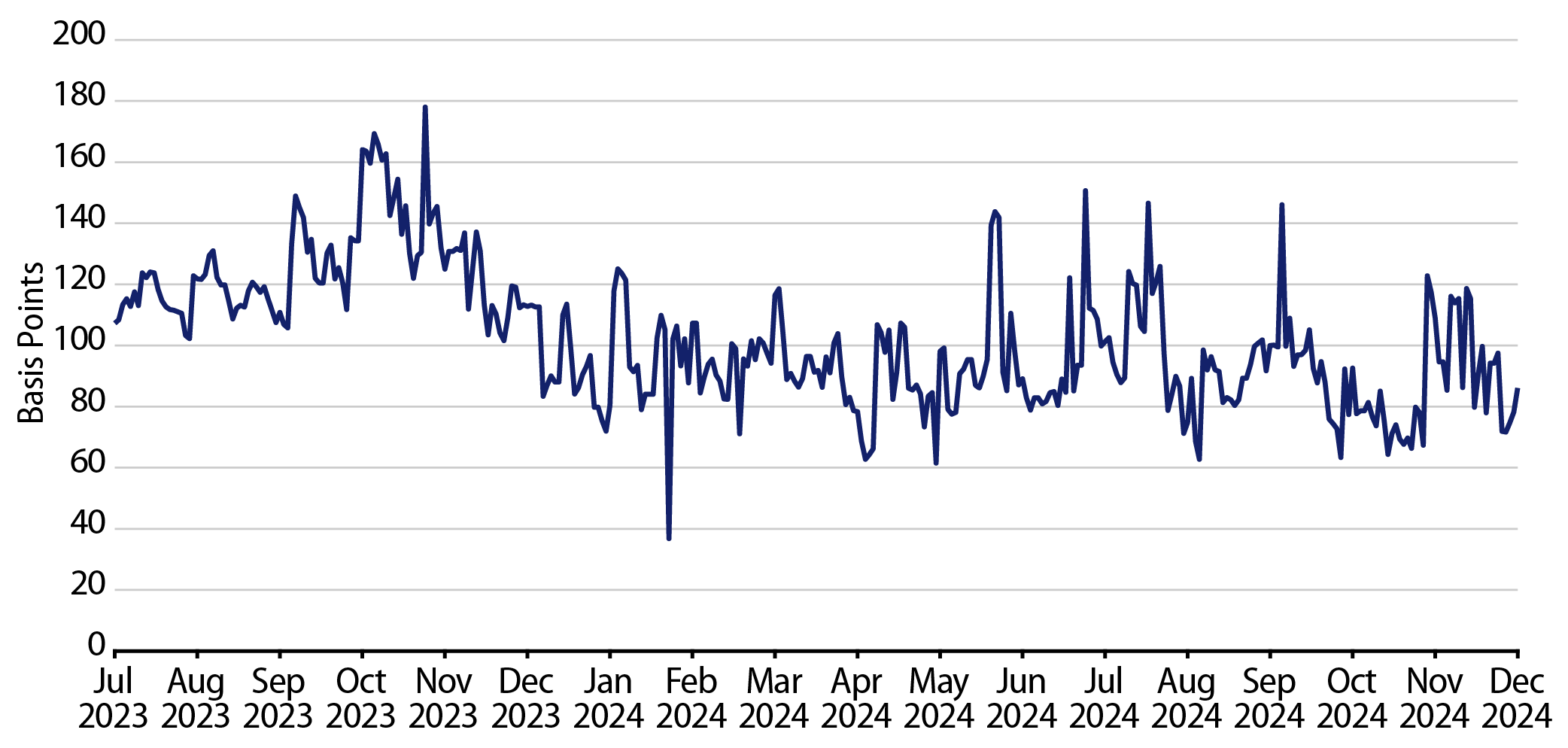

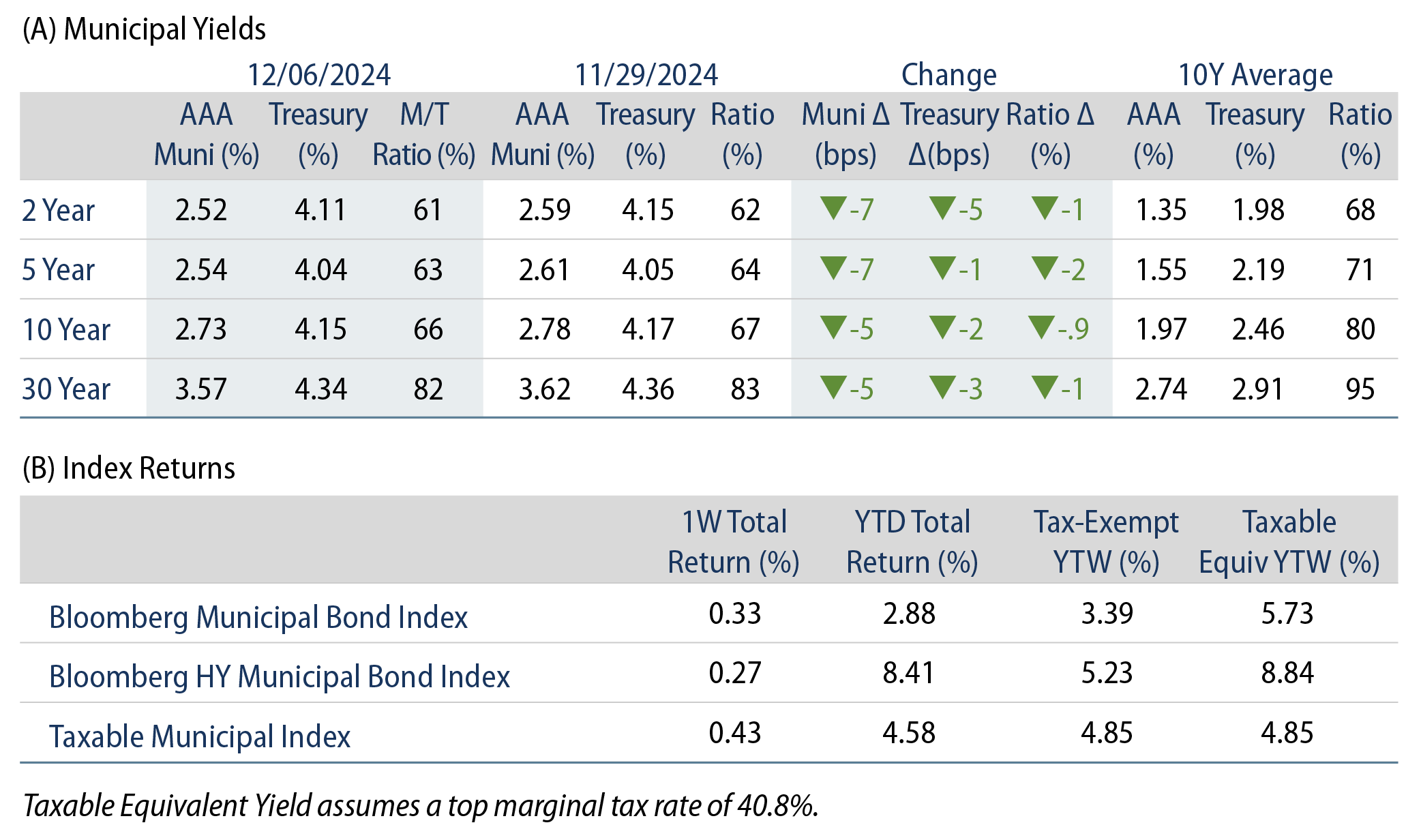

Munis posted positive returns last week as fixed-income yields trailed lower on relatively dovish Federal Reserve (Fed) rhetoric signaling expectations of a December rate cut. This was reinforced by softening payroll data, which remained below the three-month trailing average and led the unemployment rate higher to 4.2%. Munis trailed Treasuries lower, but generally outperformed on strong demand conditions as mutual funds recorded heavy inflows. Meanwhile, elevated muni supply returned following the Thanksgiving holiday. This week we highlight higher gas prepay issuance trends that have supported the record muni supply seen so far this year.

Mutual Funds Garnered Robust Inflows as Supply Returned

Fund Flows (up $1.2 billion): During the week ending December 4, weekly reporting municipal mutual funds recorded $1.2 billion of net inflows, according to Lipper. Long-term funds recorded $919 million of inflows, intermediate funds recorded $106 million of inflows and high-yield funds recorded $534 million of inflows. This week’s inflows marked the 23rd consecutive week of inflows and led estimated year-to-date (YTD) net inflows higher to $42 billion.

Supply (YTD supply of $481 billion, up 40% YoY): The muni market recorded $16 billion of new-issue supply, marking the highest level of issuance this year. YTD issuance of $481 billion is 40% higher than last year’s level, with tax-exempt issuance 43% higher and taxable issuance 11% higher year-over-year. This week’s calendar is expected to step down but remain elevated at $10 billion. The largest deals include $2.2 billion Dormitory Authority of the State of New York and $600 million Chicago Transit Authority transactions.

This Week in Munis: Gas Prepay Supply

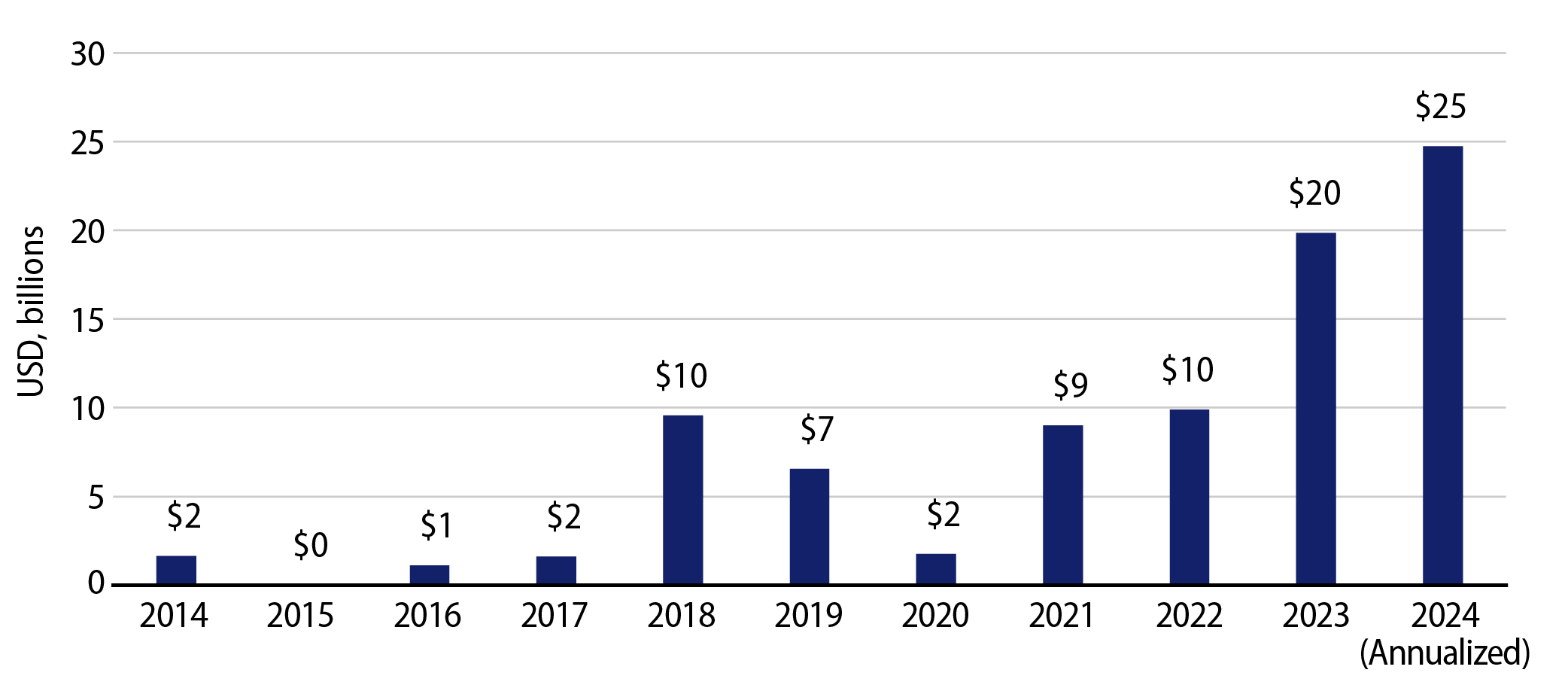

In recent weeks, we highlighted the elevated 2024 supply conditions that have contributed to relatively attractive income opportunities in the municipal market. When evaluating the sources of the higher sector-level supply, the expansion of the gas prepay sector continues to grow and has contributed to the record issuance in 2024.

Gas prepay security structures allow muni investors an opportunity to invest in corporate-backed credit, typically of a financial institution, within the traditional tax-exempt market. Gas prepay bonds are typically issued by a municipal district and secure future deliveries of gas from a gas supplier, typically a commodity trading arm of an investment bank. The underlying credit of the gas prepay structure reflects the credit quality of the financial institution participating in the structure.

In the 10 years from 2013 to 2022, annual gas prepay supply averaged $4.6 billion. As rates moved higher in 2022 into 2023, the tax-exemption became more valuable for issuers and 2023 gas prepay supply increased over four times from the prior 10-year average to $20 billion. In 2024, issuance from the sector is on pace to rise 25% from the prior record year levels to $25 billion. One of the contributing factors to higher supply levels is the expansion of the issuer base from traditional investment banking entities to insurance entities.

The expansion of the gas prepay sector offers municipal investors access to a more diversified pool of issuers beyond traditional government issuers, and potential incremental income opportunities from the less familiar market segment. Given elevated supply conditions combined with a more complex credit profile compared to that of a traditional tax-exempt government issuer, gas prepays can often offer value versus both the traditional tax-exempt market and similarly structured taxable securities after considering tax implications. Western Asset believes active managers with integrated corporate credit resources can navigate these broader credit dynamics to deliver value to investors.

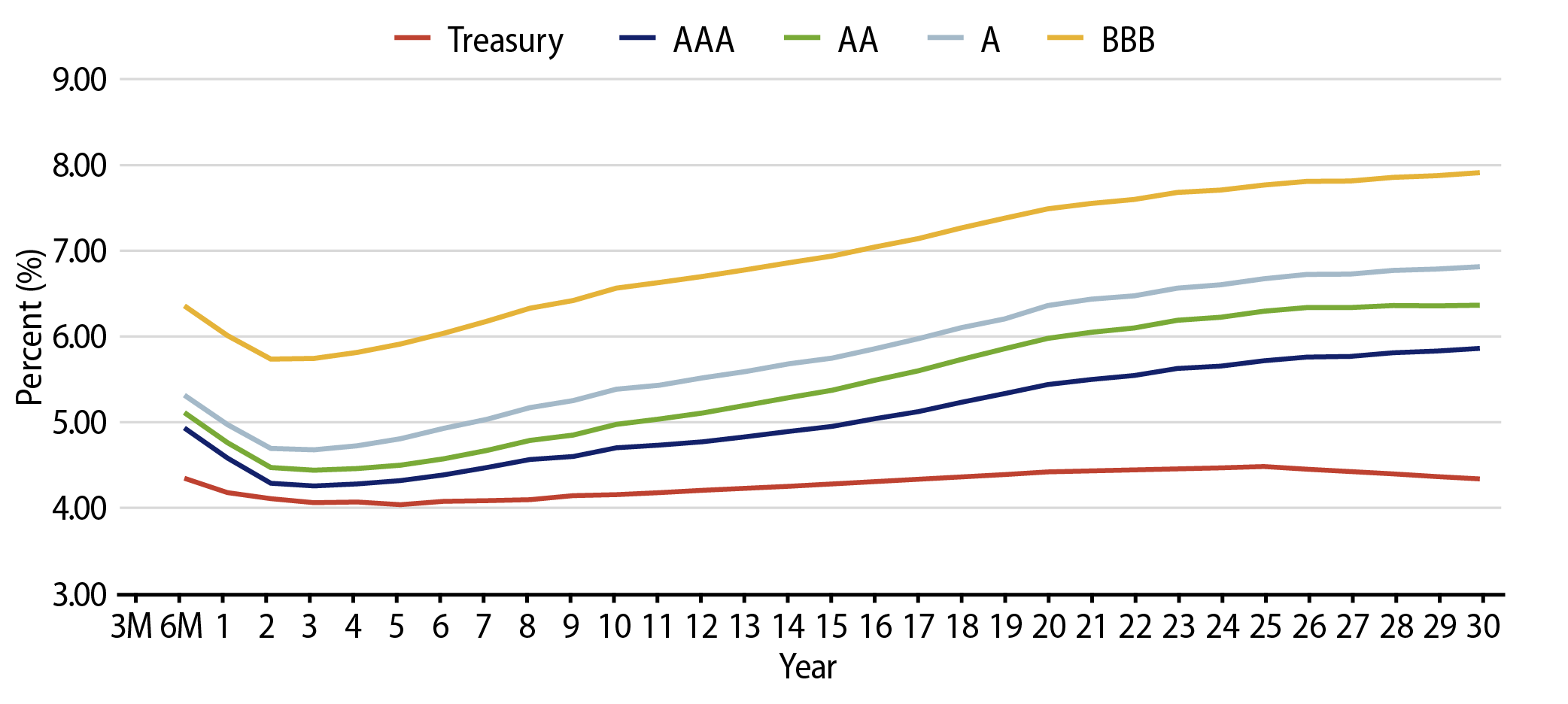

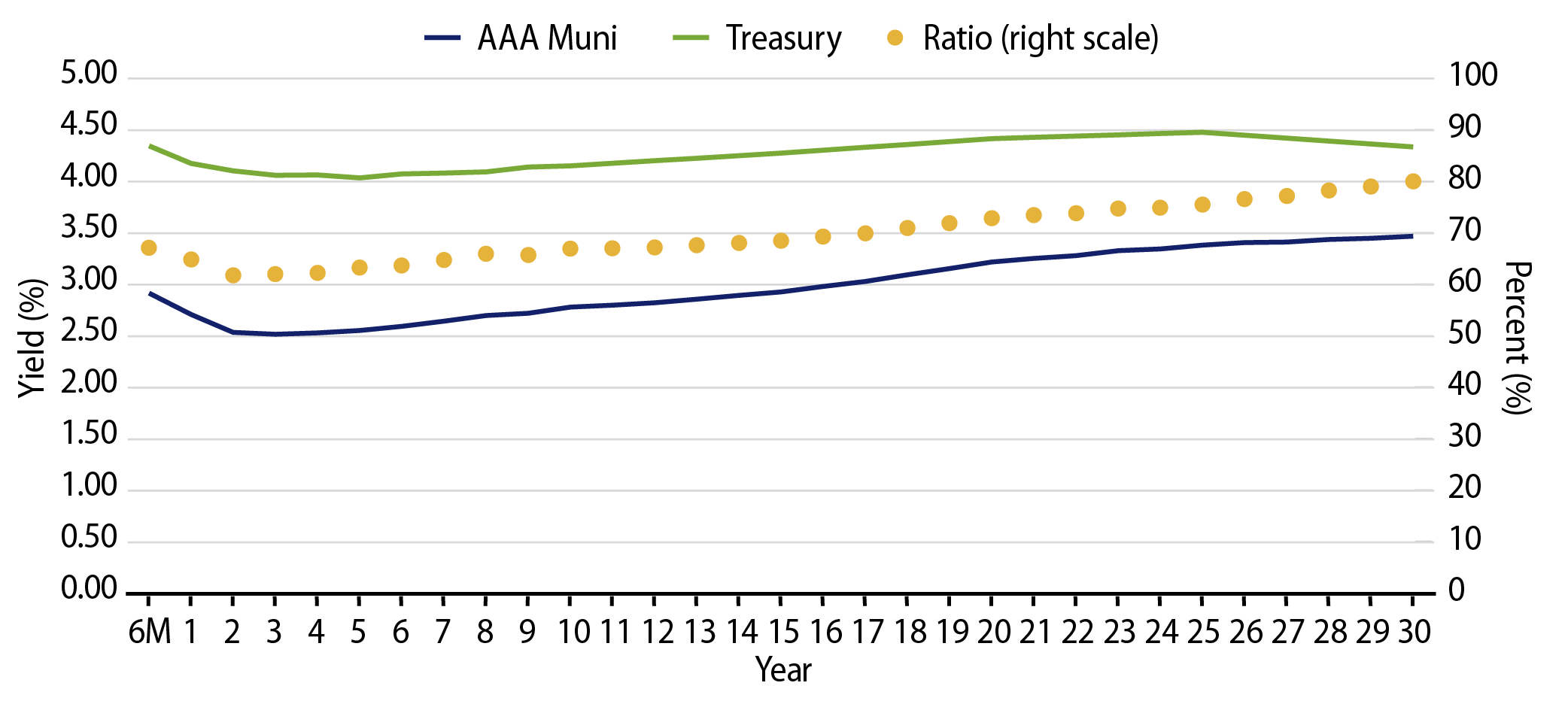

Municipal Credit Curves and Relative Value

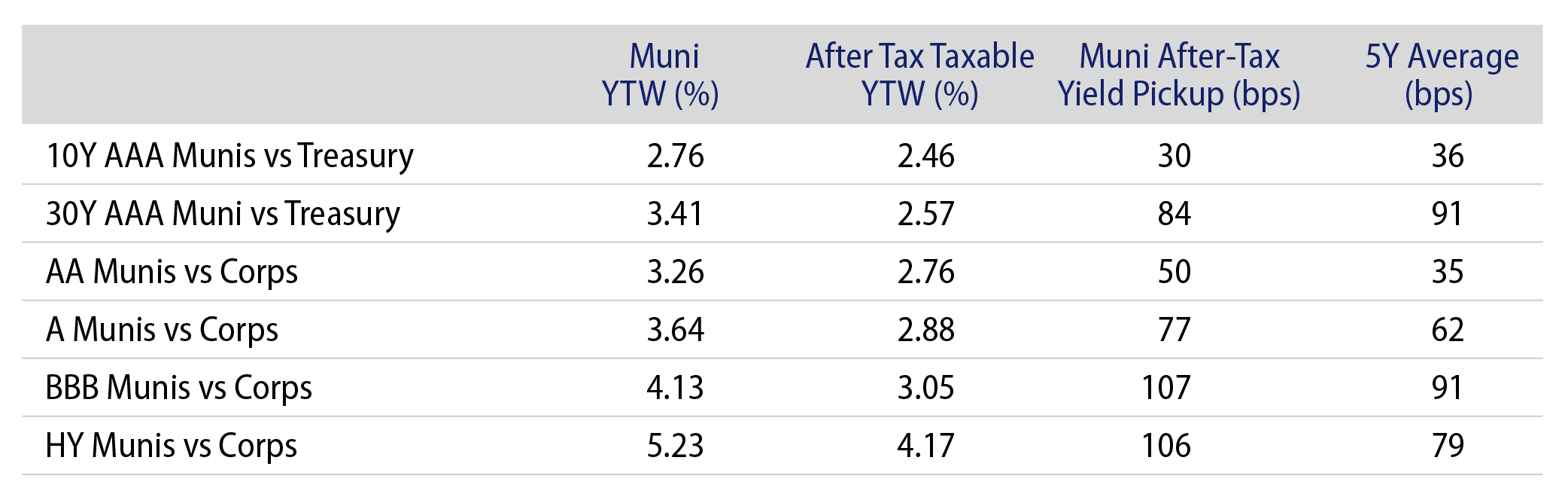

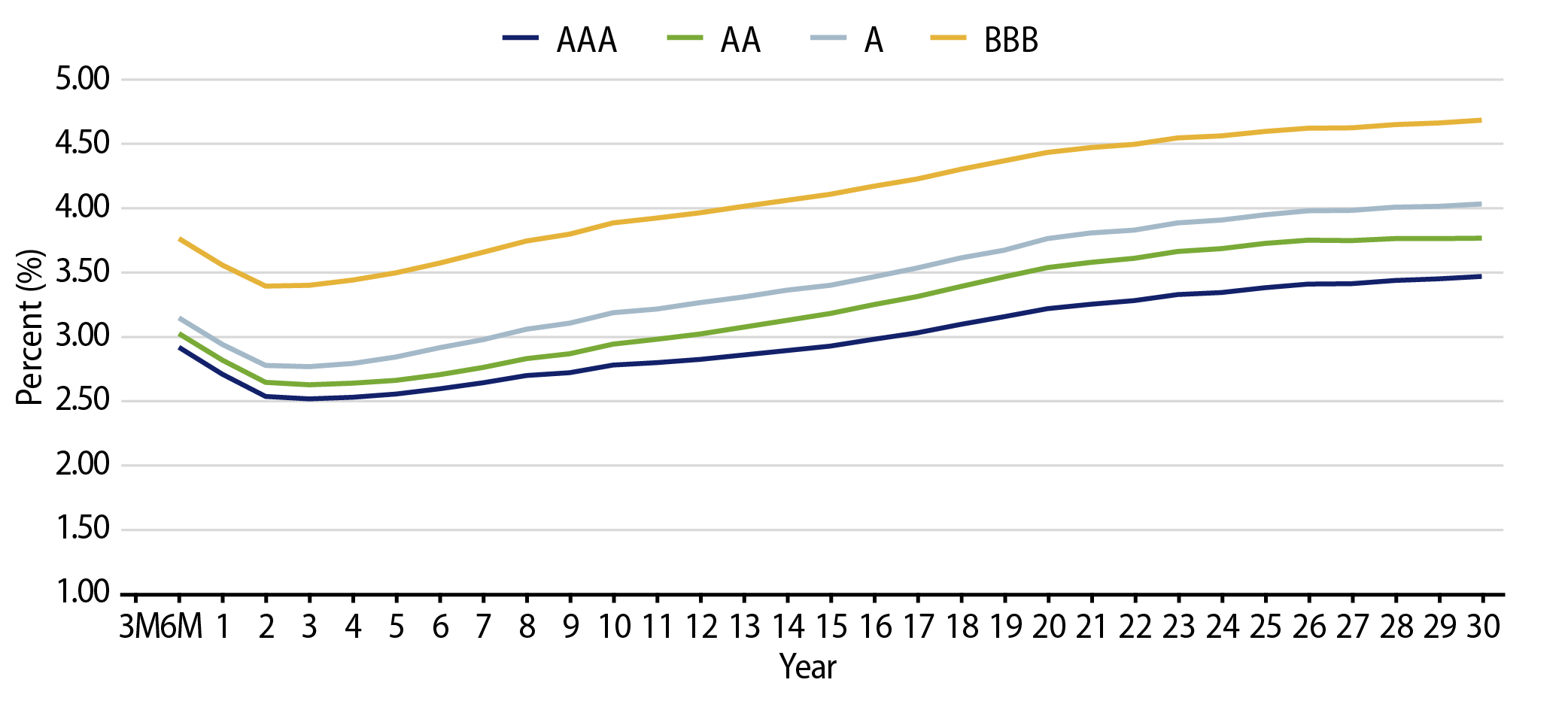

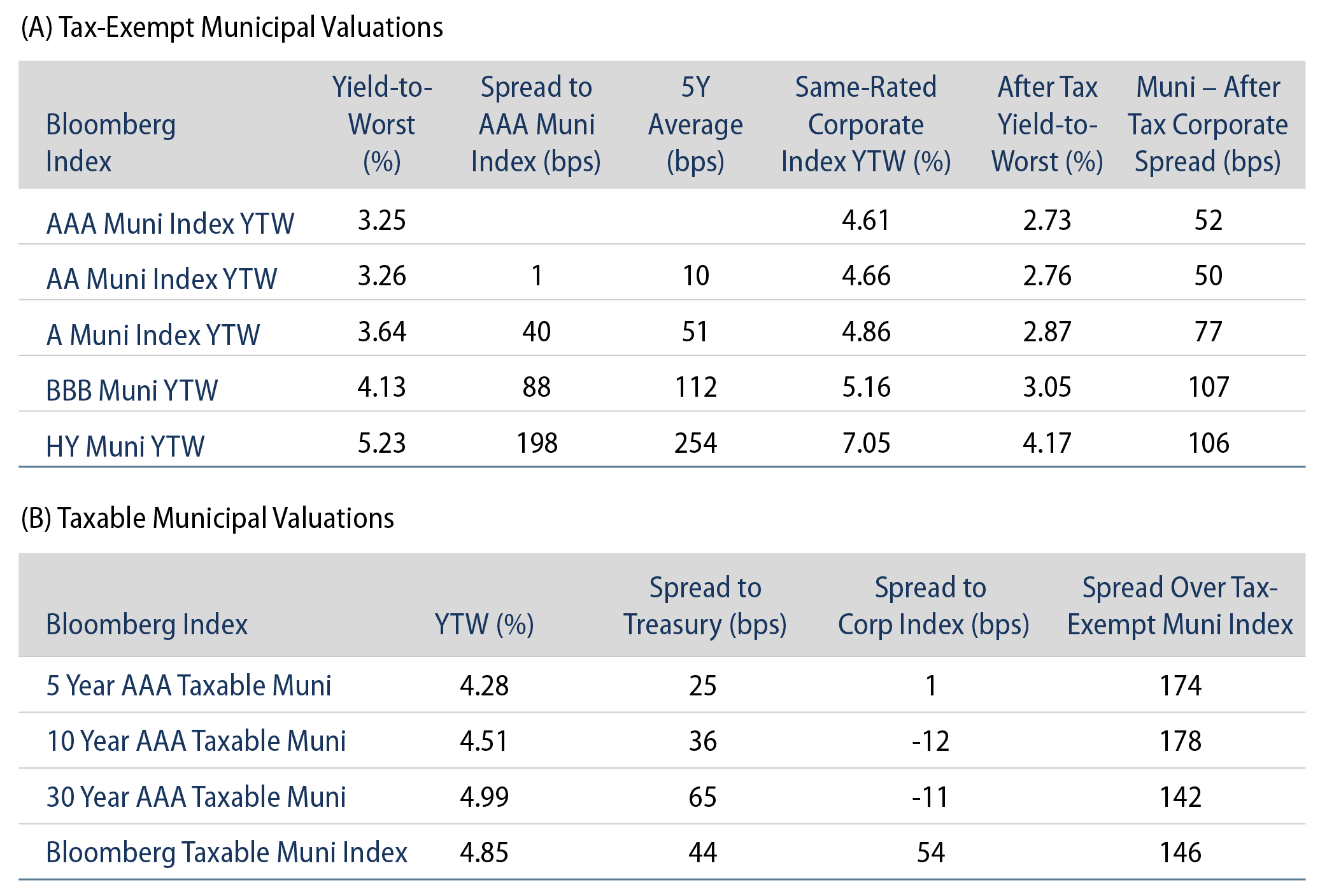

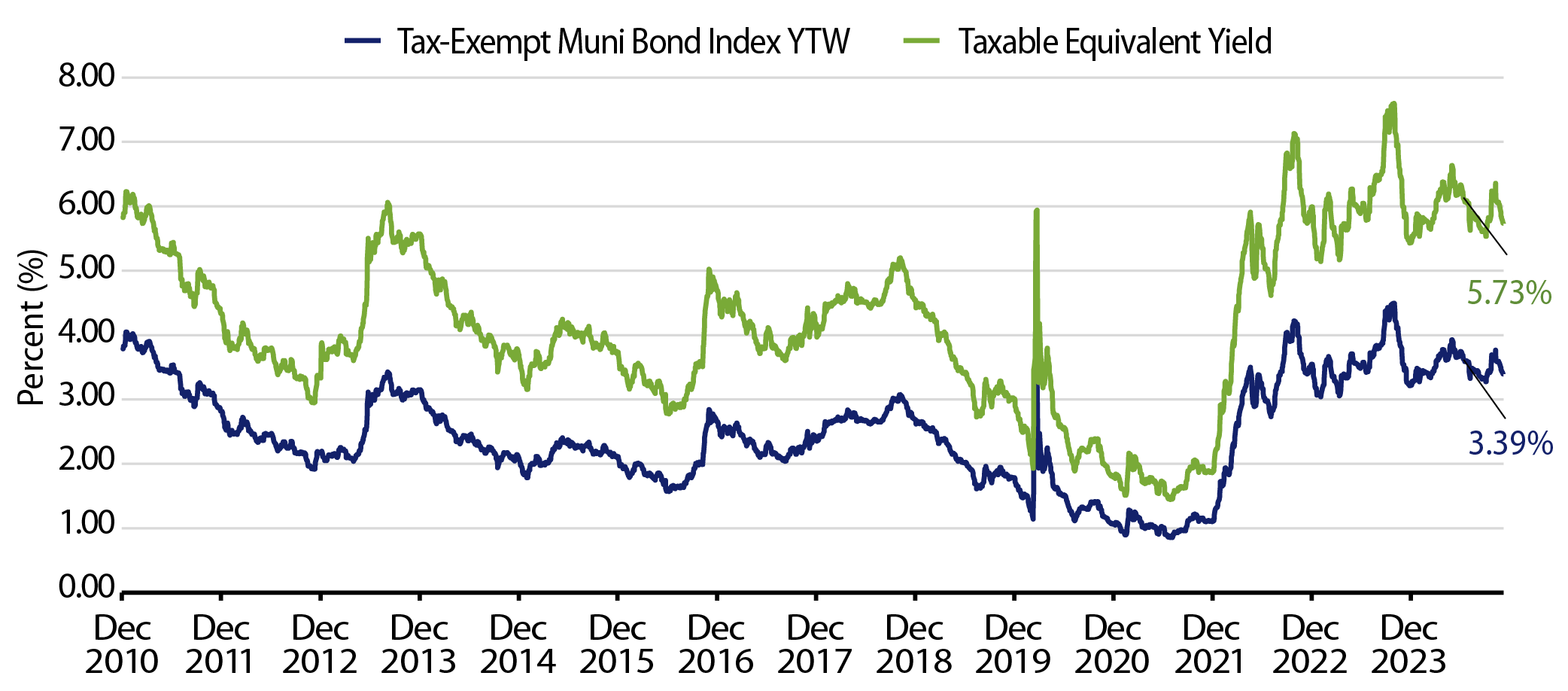

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

Theme #2: A slight inversion in short maturities underscores the potential value in longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.