Municipals Posted Negative Returns, Turning YTD Returns Negative

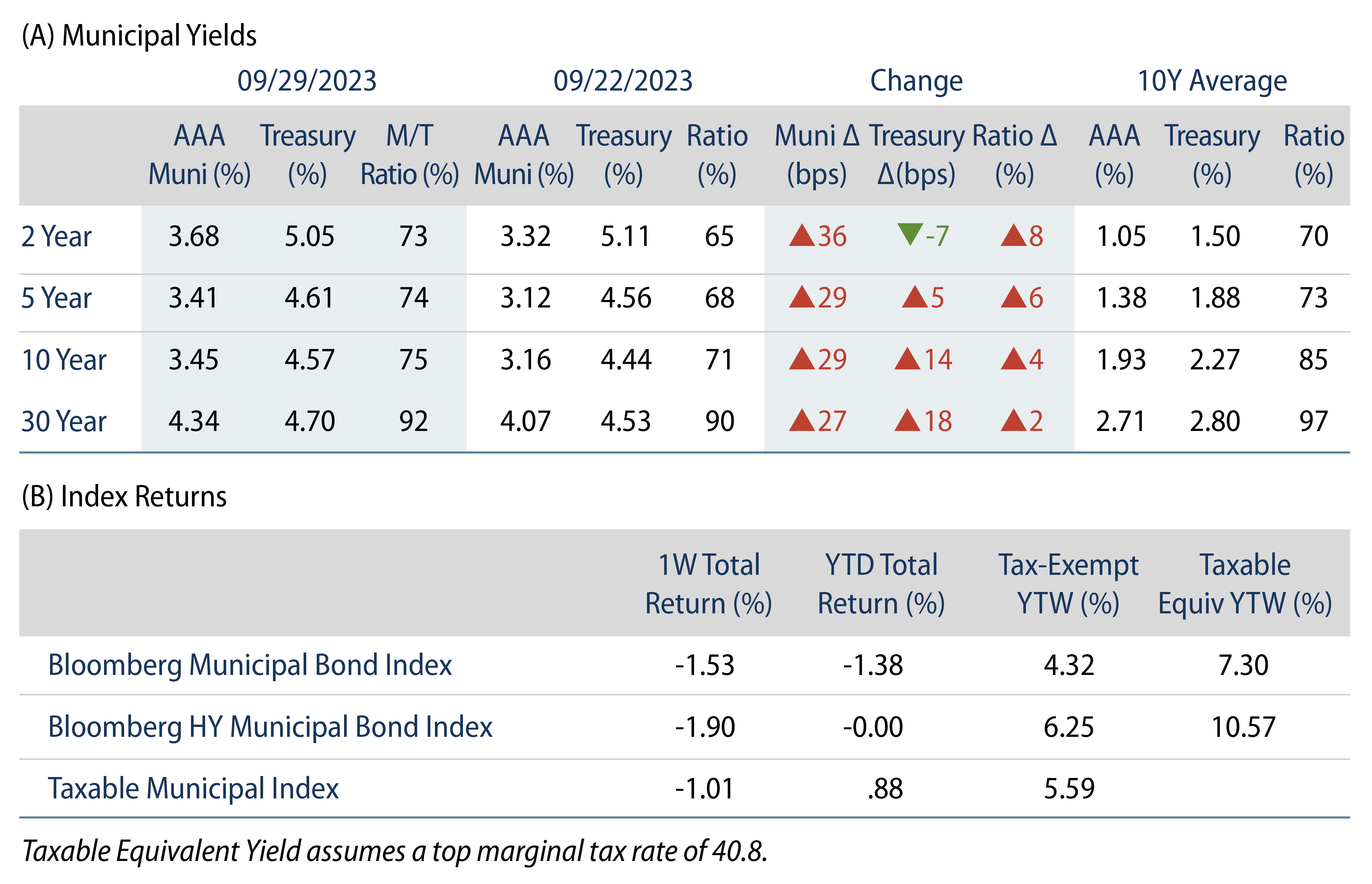

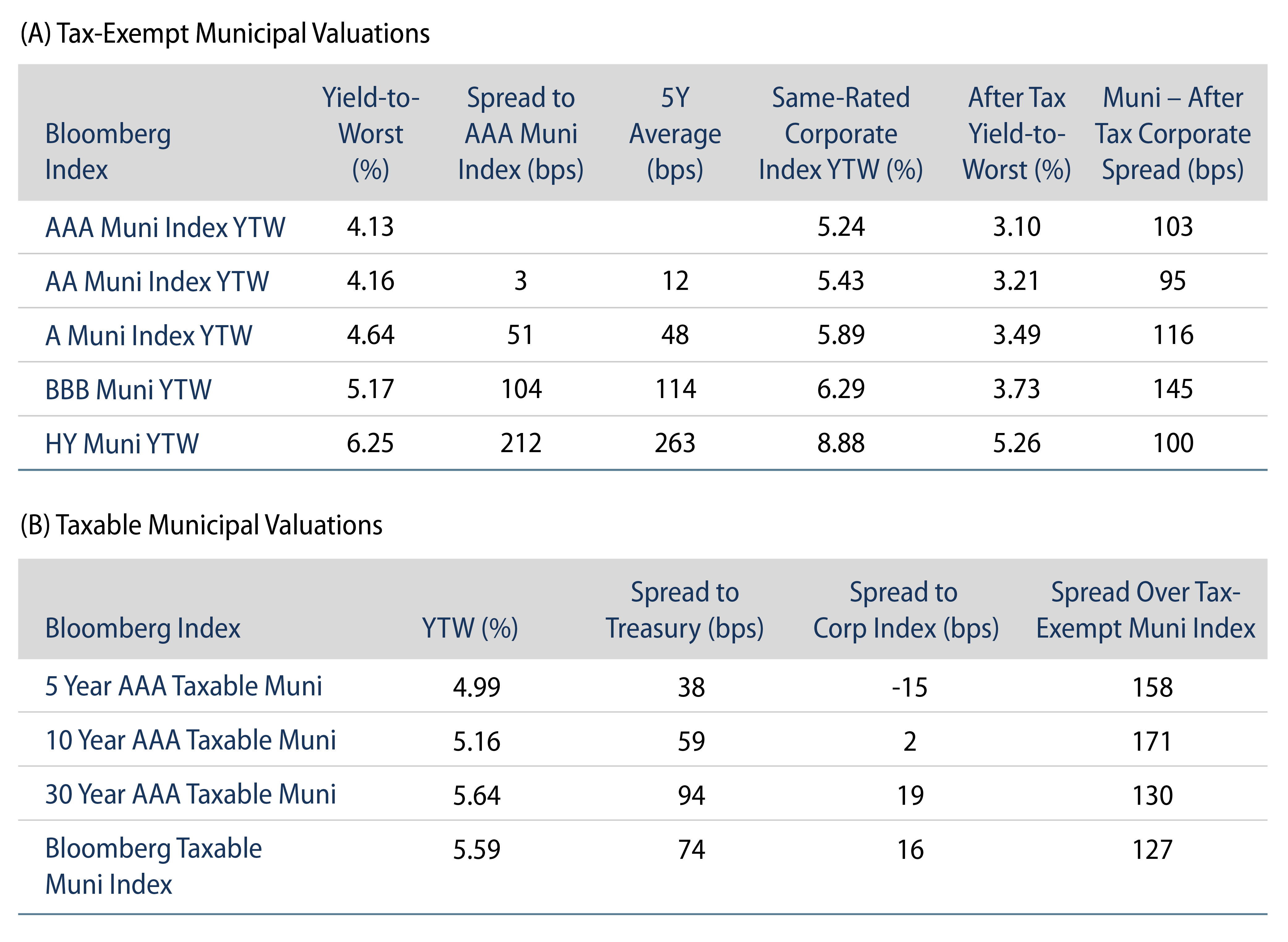

Munis posted negative returns and sold off during the week, turning year-to-date (YTD) returns negative. Municipals underperformed Treasuries on weak technicals and hawkish Fed rhetoric, with technicals remaining weak amid fund outflows and higher supply. The Bloomberg Municipal Index returned -1.53% during the week, the High Yield Muni Index returned -1.90% and the Taxable Muni Index returned -1.01%. This week we highlight recent elevated supply, and relative value within the gas pre-pay sector.

Technicals Remained Weak Amid Fund Outflows and Heightened Supply Conditions

Fund Flows: During the week ending September 27, weekly reporting municipal mutual funds recorded $1.2 billion of net outflows, according to Lipper. Long-term funds recorded $459 million of outflows, high-yield funds recorded $365 million of outflows and intermediate funds recorded $262 million of outflows. This week’s outflows bring YTD net outflows to $12 billion.

Supply: The muni market recorded $8 billion of new-issue volume last week, up 72% from the prior week. YTD issuance of $267 billion is down 7% year-over-year (YoY), with tax-exempt issuance in line with prior year levels and taxable issuance down 46% YoY. This week’s calendar is expected to increase to $9 billion. Large transactions include $1 billion San Diego County Regional Airport Authority and $950 million New York City General Obligation transactions.

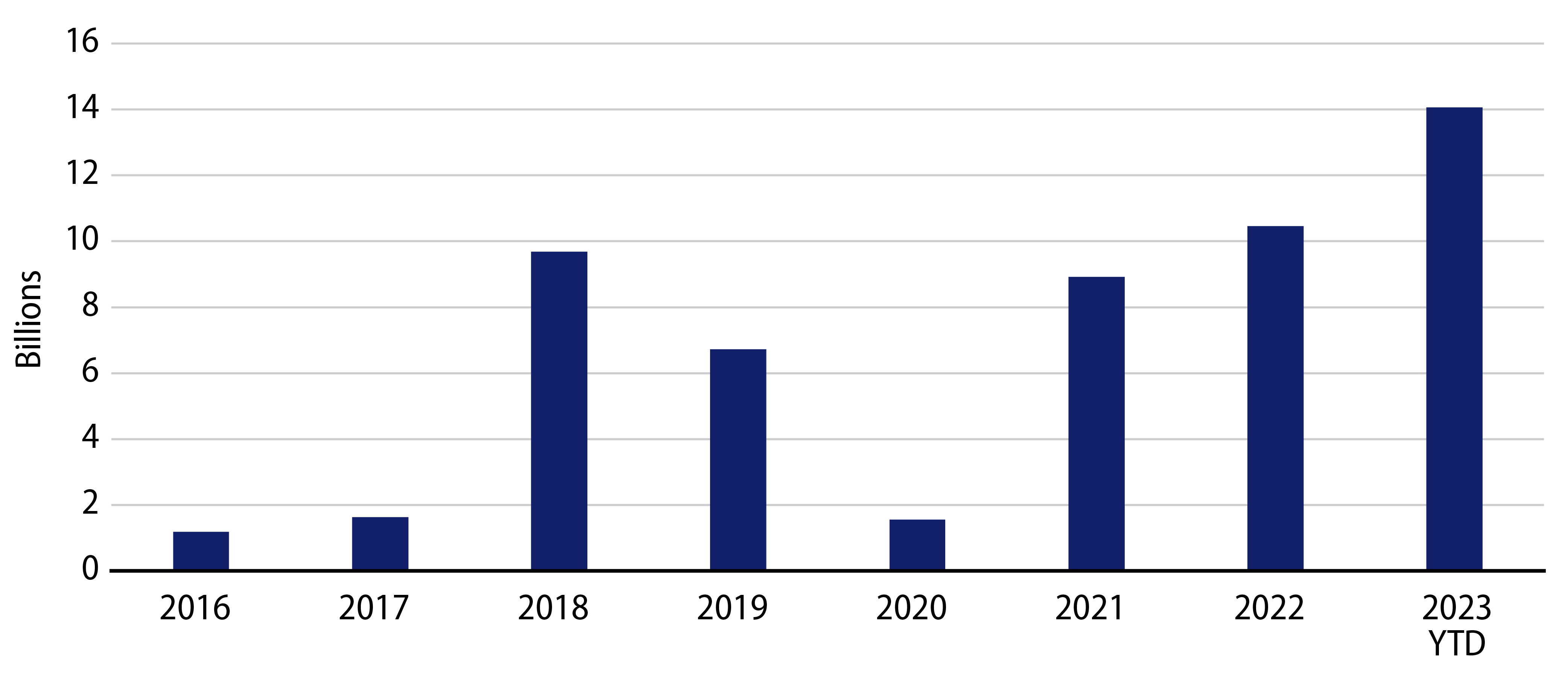

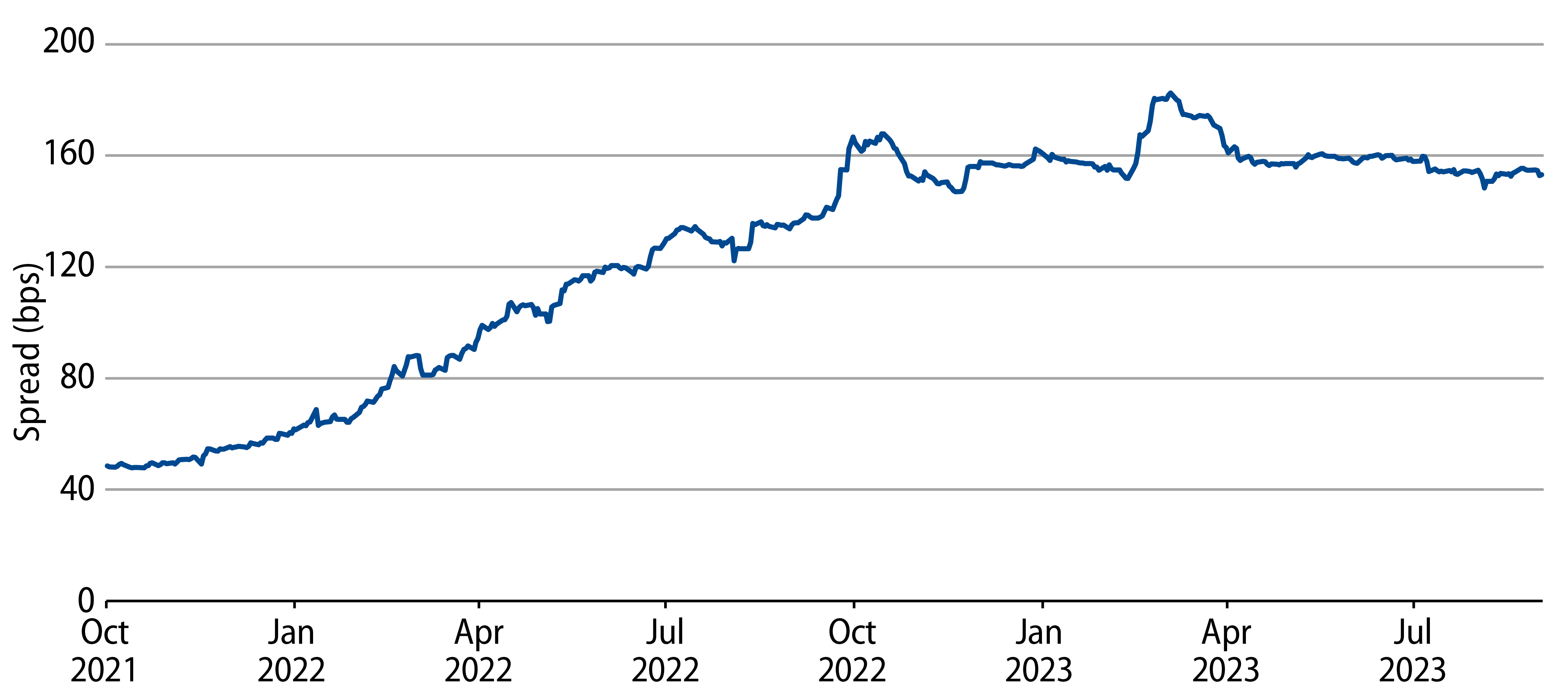

This Week in Munis: Gas Pre-Pay Supply Rises

Gas pre-pay security structures allow muni investors an opportunity to invest in corporate-backed credit, typically of a financial institution, within a traditional tax-exempt municipal security structure. Gas pre-pay bonds are issued by a municipal district and secure future deliveries of gas from a gas supplier, typically a commodity trading arm of an investment bank. The underlying credit of the gas-pre-pay structure reflects the credit quality of the investment bank participating in the transaction. Despite declining total municipal supply YTD, gas pre-pay issuance reached a record high of $14 billion through the first three quarters of the year, up 40% from last year’s level.

The increased supply levels have contributed to higher yields and wider spreads versus top-quality munis, as the average yield and option-adjusted spread (OAS) of the gas pre-pay securities within the muni bond index increased from 1.16% (OAS of 56 bps) at the end of 2021 to 5.07% (OAS of 153 bps) as of September 28, 2023.

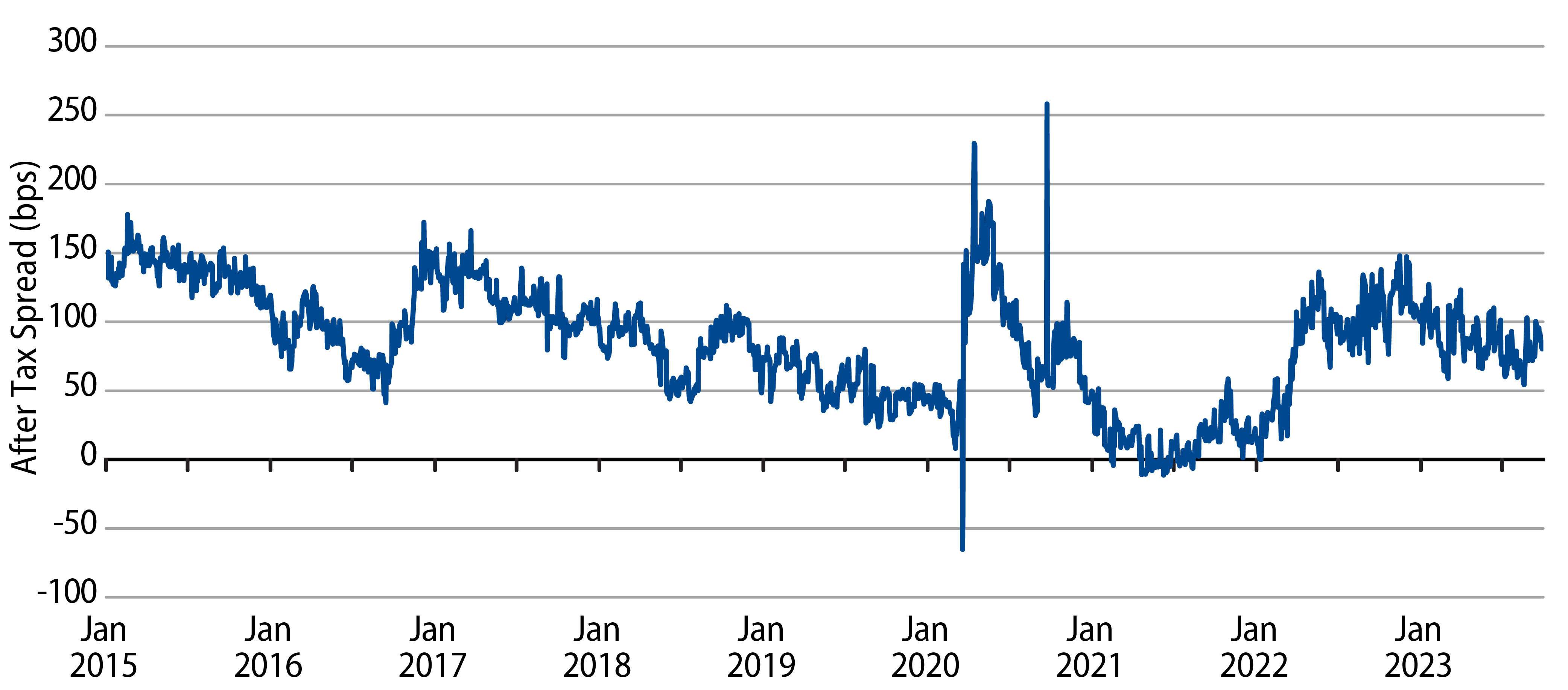

The issuance of same-obligor securities in taxable and tax-exempt markets is another metric of relative value for investors subject to tax rates. Considering the 4.67% tax-exempt yield to worst of a Citigroup gas pre-pay structure (6.5% maturing in 2039), a taxpayer in the top tax bracket could achieve nearly 100 bps of excess after-tax yield pickup in the tax-exempt security versus a similarly structured taxable security.

Western Asset believes the heightened supply technicals within the gas pre-pay sector can contribute to near-term bouts of volatility, but the segment offers investors who are subject to tax rates an attractive tax-exempt carry as well as the ability to achieve higher after-tax returns for certain financial obligors than can be achieved in taxable fixed-income markets. In addition, the value opportunities offered by the segment allow for a global credit manager with integrated credit resources to source the best credit ideas, across taxable and tax-exempt fixed-income markets.