Macros, Markets and Munis

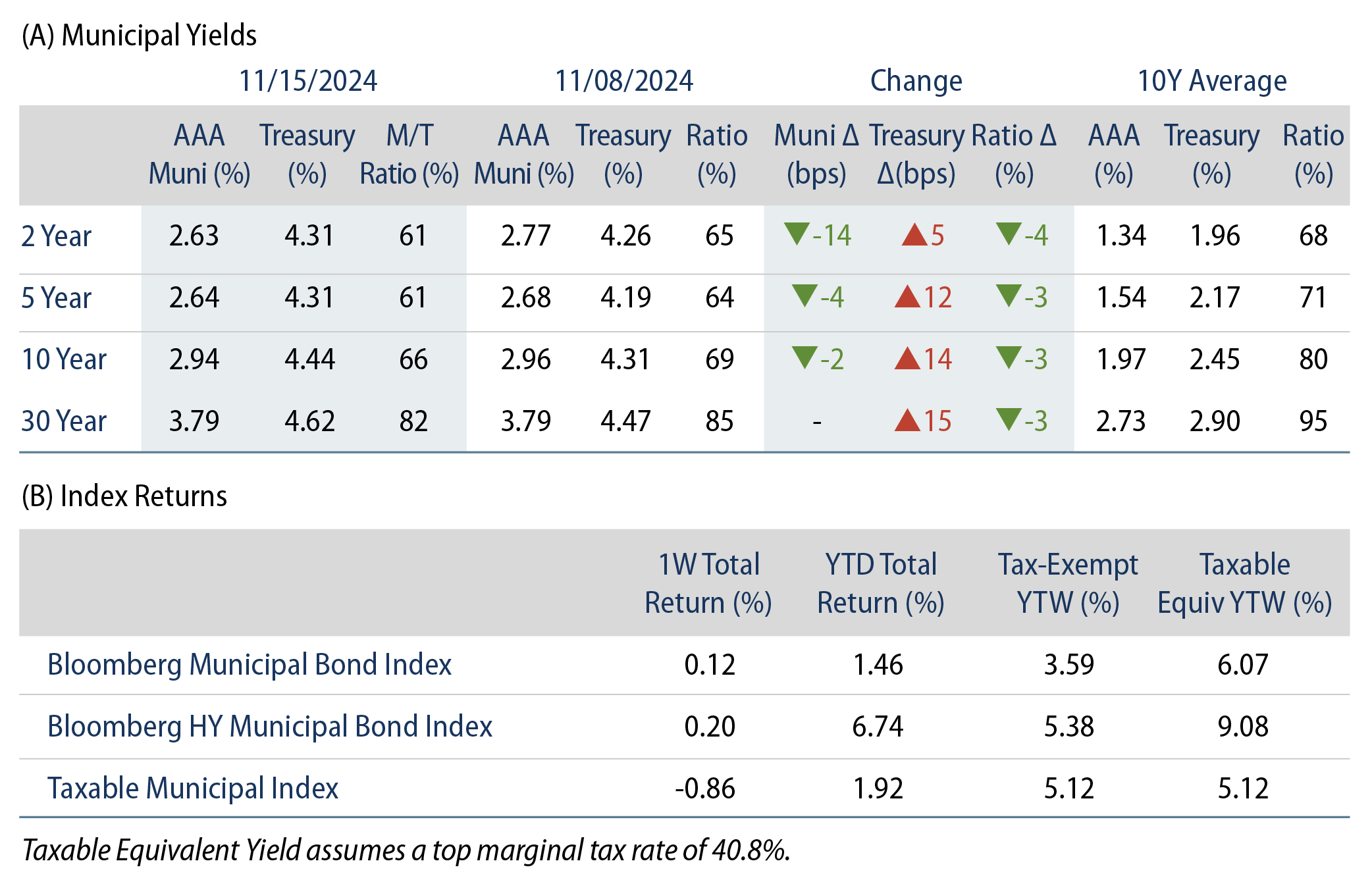

Munis posted positive returns and outperformed Treasuries last week. Fixed-income yields moved higher with the release of favorable economic data as markets considered potential implications of a Republican Congress majority. Treasury yields moved 5 basis points (bps) to 15 bps higher across the curve, while muni yields moved lower on favorable technical factors, considering limited supply conditions and continued inflows. The Bloomberg Municipal Index returned 0.12% during the week, the High Yield Muni Index returned 0.20% and the Taxable Muni Index returned -0.86%. This week we review market moves as muni supply recovered from election outcomes and digested potential changes to federal and state tax policy.

Muni Supply Levels Remained Elevated as Fund Inflows Continued

Fund Flows (up $305 million): During the week ending November 13, weekly reporting municipal mutual funds recorded $305 million of net inflows, according to Lipper. Long-term funds recorded $164 million of inflows, intermediate funds recorded $154 million of inflows, and high-yield funds recorded $150 million of inflows. This week’s inflows represent the 20th consecutive week of inflows and led estimated year-to-date (YTD) net inflows higher to $38 billion.

Supply (YTD supply of $451 billion, up 41% YoY): The muni market recorded $8 billion of new-issue volume last week, picking back up to more elevated levels following the prior quiet election week. YTD issuance of $451 billion is 41% higher than last year’s level, with tax-exempt issuance 44% higher and taxable issuance 8% higher year-over year (YoY). This week’s calendar is expected to increase to $10 billion. The largest deals include $1 billion Houston Airport (United Terminal) and $520 million Maricopa County Industrial Development Authority transactions.

This Week in Munis: Election Outcomes

The muni market looked ahead to policy implications associated with a red sweep as the Republicans secured victory across the executive branch and Congress. As highlighted in Western Asset’s Election Outlook, we anticipate potential changes to both federal and state tax policy to significantly influence municipal market valuations. Here we review potential federal and state tax policy change implications and corresponding impacts to the muni market.

Federal Tax Policy

Individual Taxes: A key focus for the Trump administration is extending the 2017 Tax Cuts and Jobs Act (TCJA) individual income tax provisions. These are slated to expire in 2025 and would lead to higher tax rates for individuals. Considering the Republican majority in Congress, we anticipate a high likelihood that TCJA provisions will be extended to maintain the existing tax regime. Initiatives to keep tax rates in their current state are not without cost, as the Congressional Budget Office estimates that maintaining the current individual tax provisions will cost $4.6 trillion over the next decade, thereby limiting the probability of further tax reductions. As a result, the value of the municipal tax exemption will likely not be materially impacted from its current state, and we do not expect material municipal selling pressures associated with individual tax policy changes.

Corporate Taxes: A Trump victory virtually ensures that the corporate tax rate will remain at its permanent level of 21%. Trump had floated a potential measure to bring this rate down even further, pending Congressional support. However, further rate cuts could be challenging given the scope of current deficits, especially when considering the costs of extending the individual tax provisions (which appears to be a priority for the administration). We expect that the current 21% corporate income tax regime will lead to ongoing reductions of bank and insurance company holdings of tax-exempt muni debt.

State Tax Policy

Income Tax Changes: There were limited state income tax change proposals on the ballot this cycle, but Illinois voters approved amendment to the state constitution to create a 3% surtax for top earners in the state. The Illinois constitution currently maintains a flat income tax rate of 4.95%, and the proposed surtax would increase the state’s top marginal tax rate to 7.95%. While the ballot question served as a temperature check and not official legislation to raise taxes, the outcome represents a degree of support for higher taxes on the wealthy to generate more revenue for the state, and potentially draw additional demand for municipals.

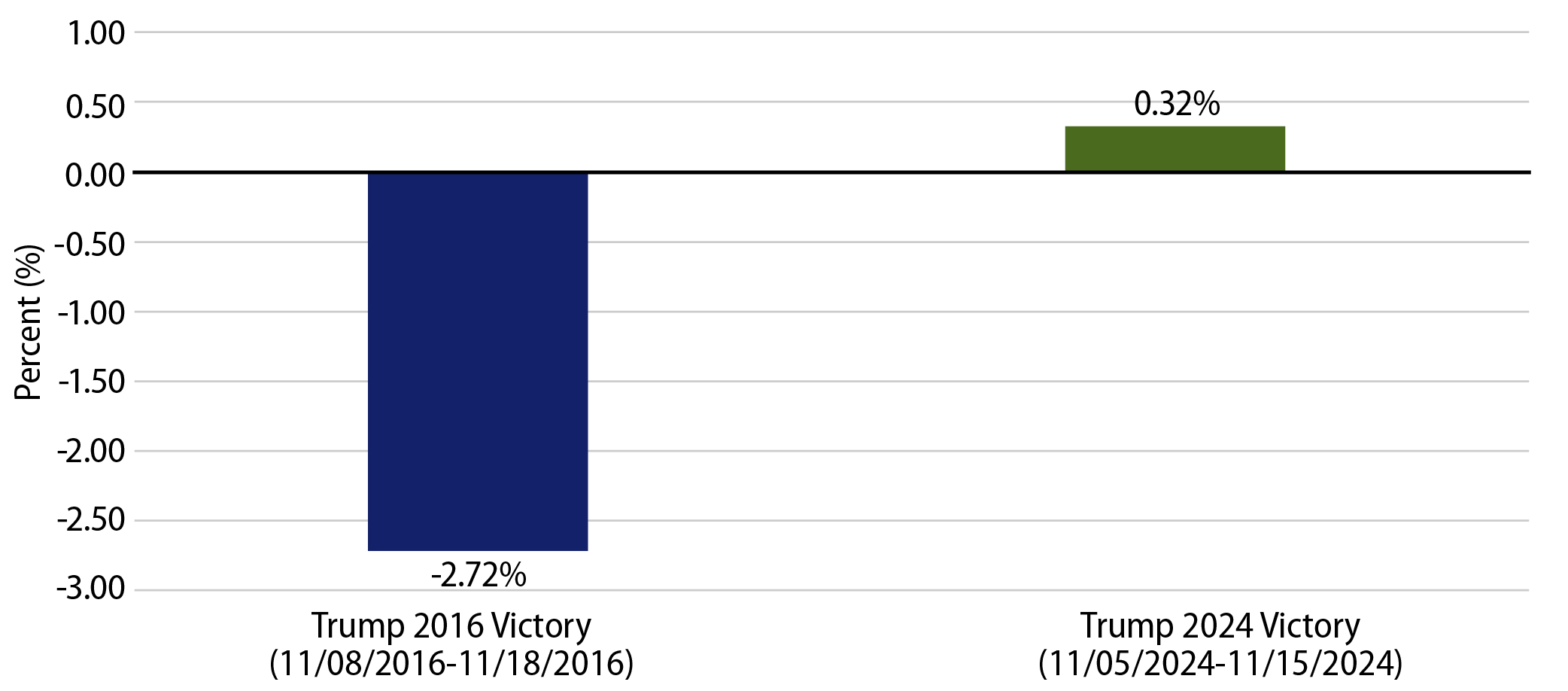

While the potential for tax increases is likely on hold following this election cycle, elevated deficits and debt levels will likely provide limited ability to materially cut taxes from their current levels. Moreover, a greater willingness for states to increase top tax rates could lead investors to look to the municipal asset class to manage higher overall tax liabilities. It appears that markets have come to terms with these realities. In the ten days following Trump’s 2016 victory, the muni market declined by -2.72% due in part to fear that the muni tax exemption would be worth less in a lower tax rate regime. In the ten days following this year’s election, the muni market posted a positive return of 0.32%.

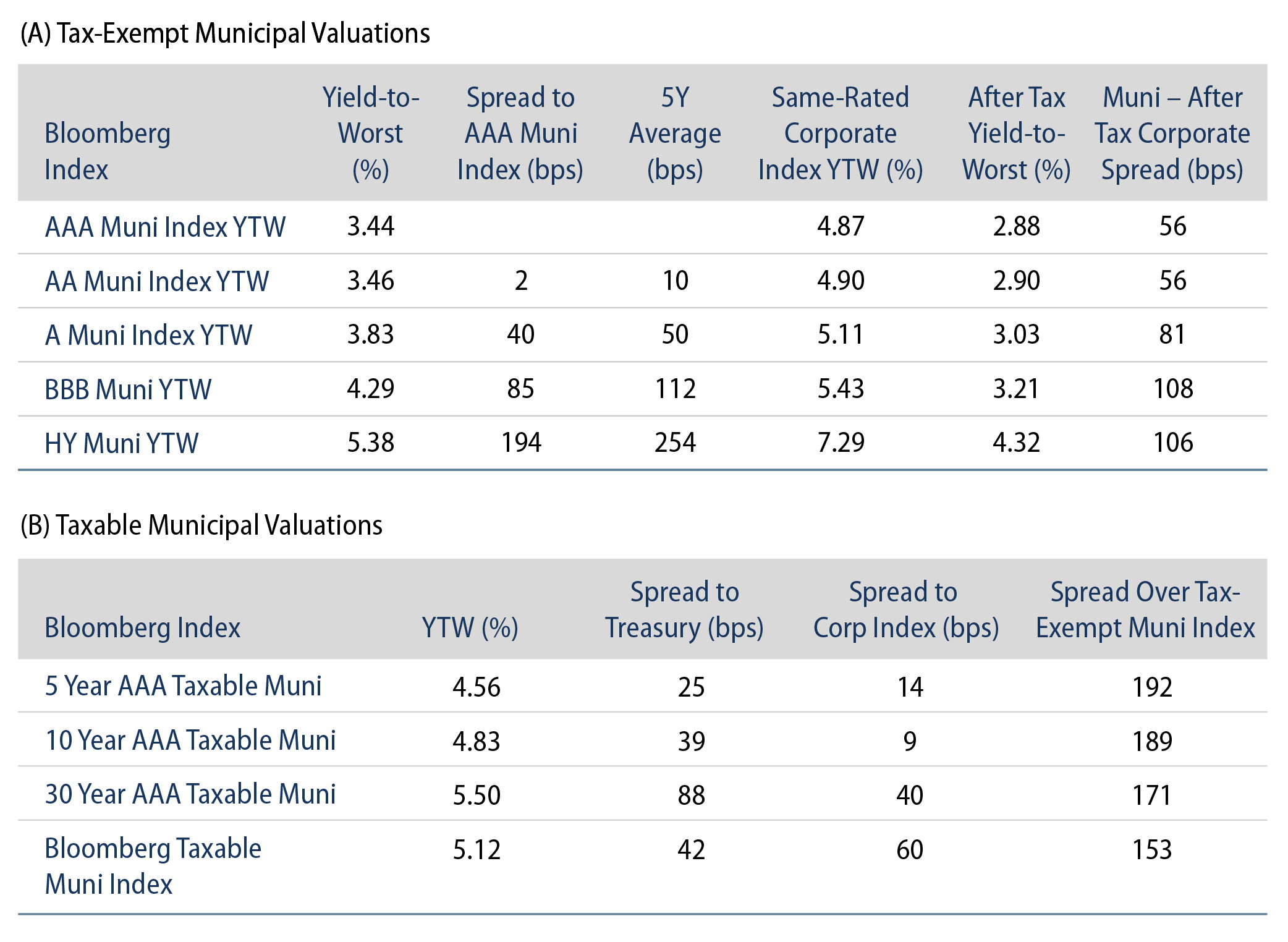

Municipal Credit Curves and Relative Value

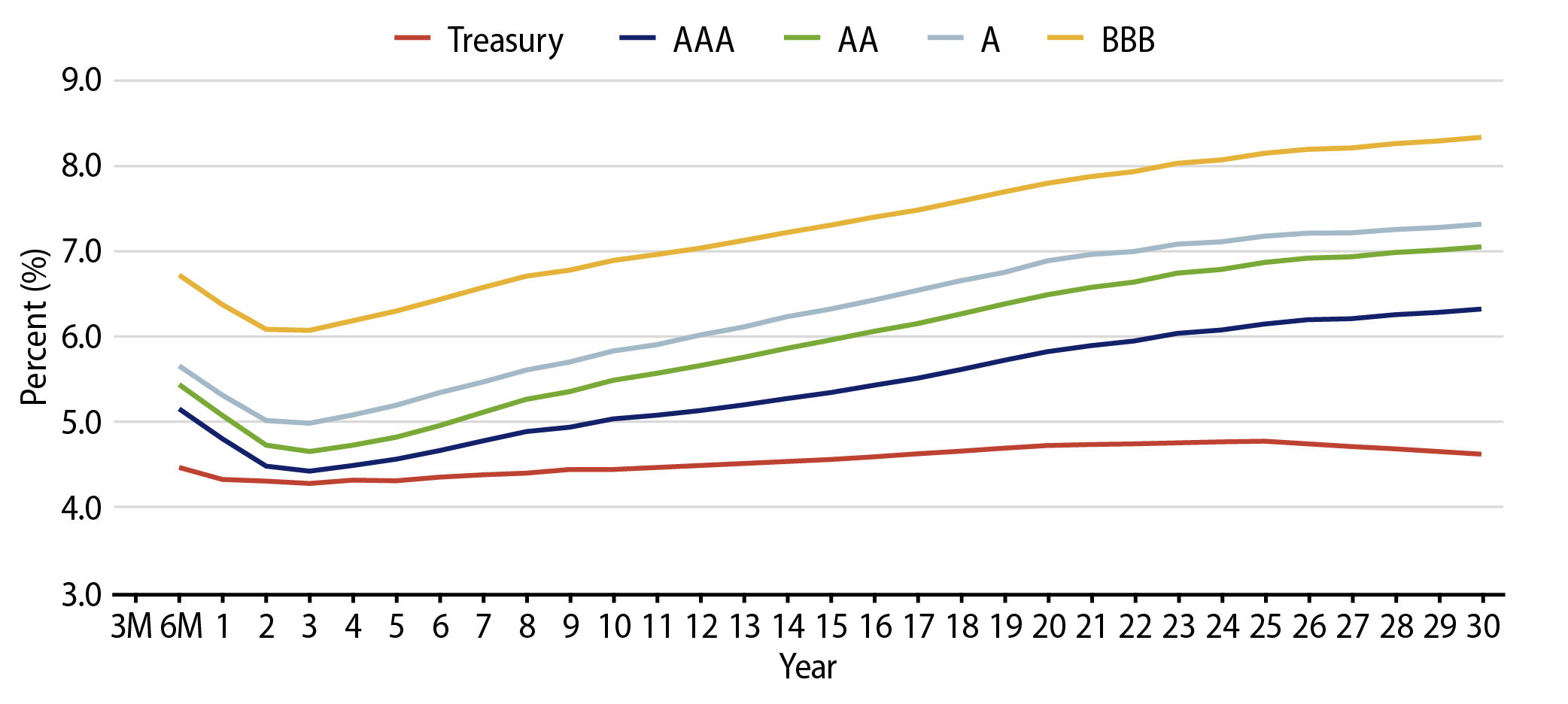

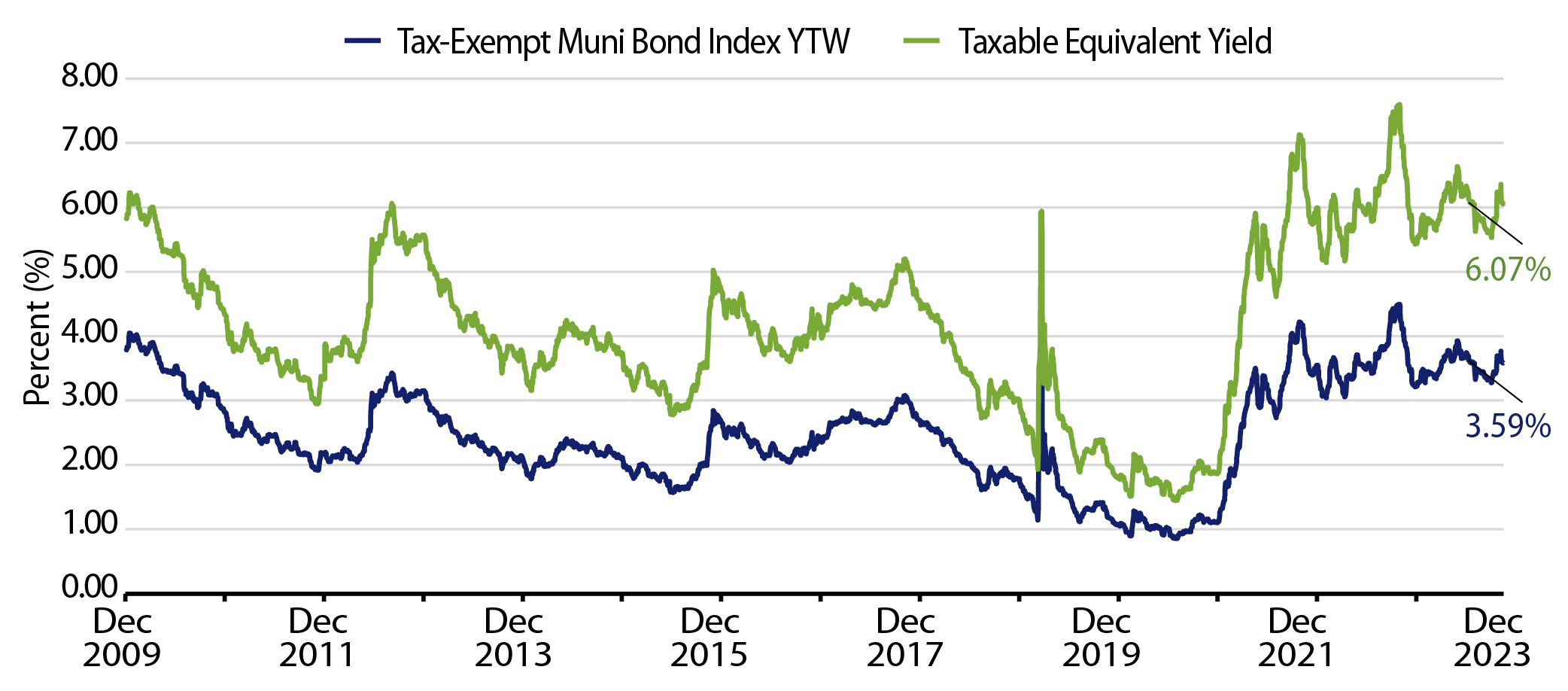

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

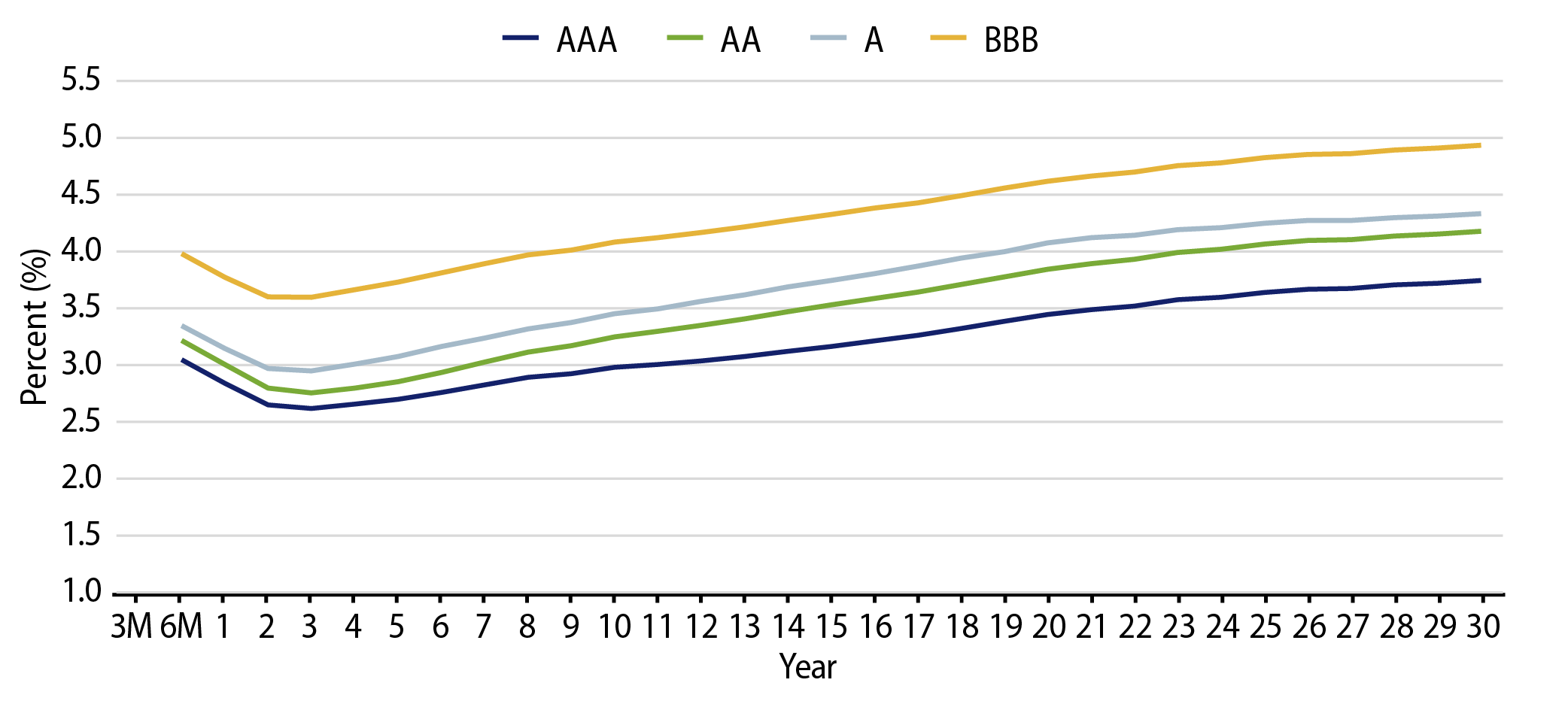

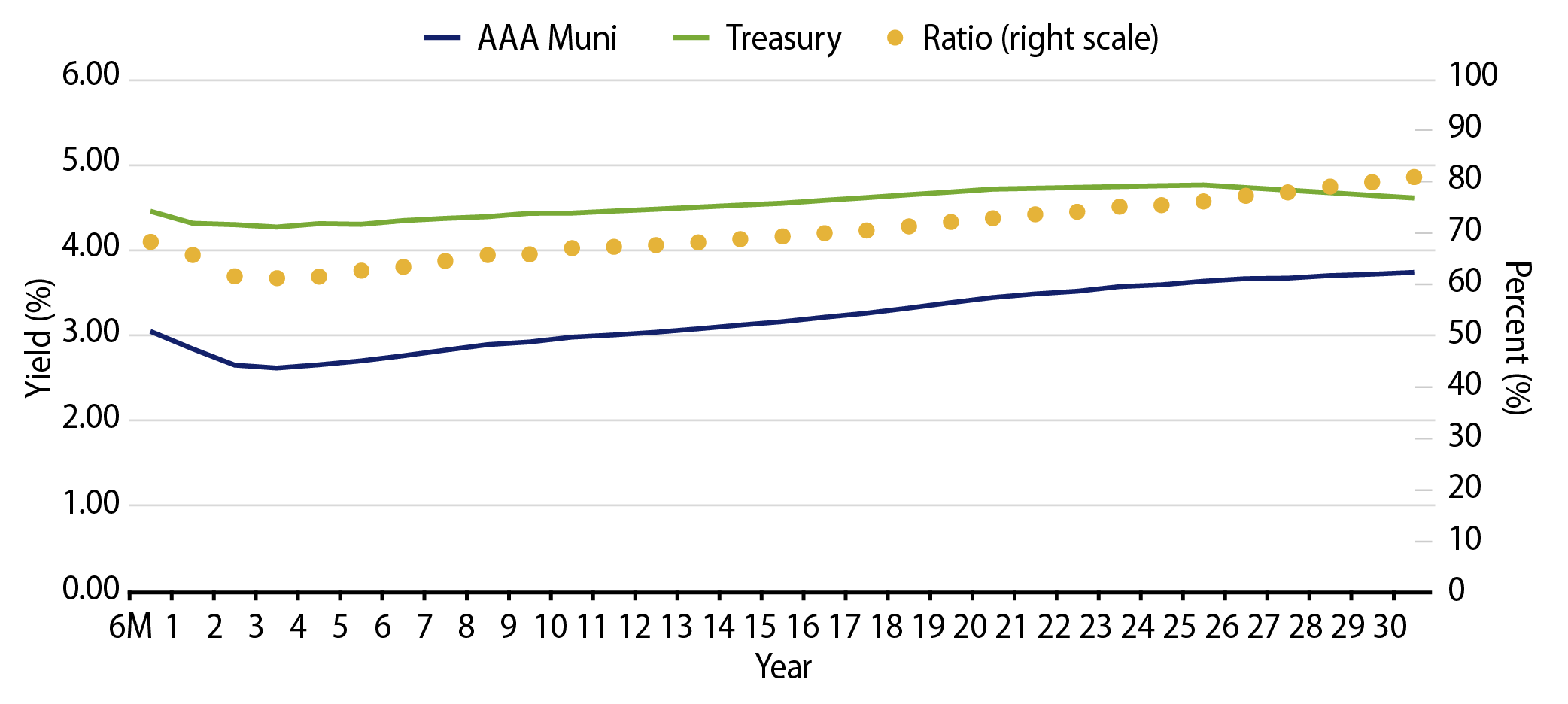

Theme #2: The muni yield curve has largely disinverted, offering better rolldown opportunity in intermediate maturities.

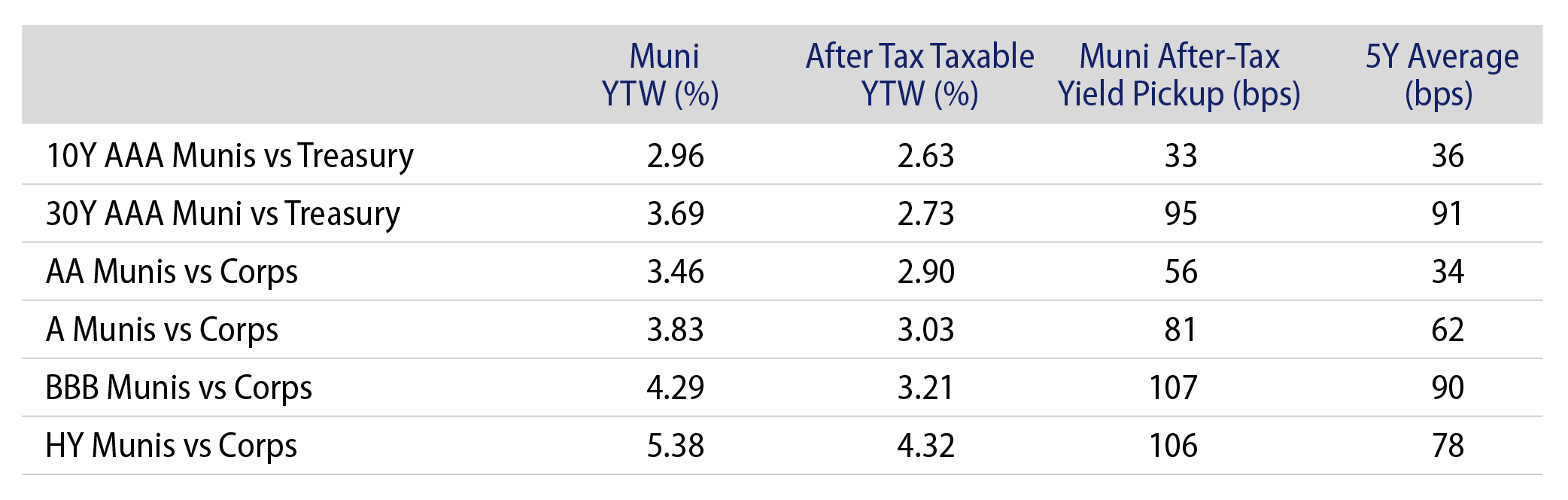

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.