Munis Posted Negative Returns Last Week

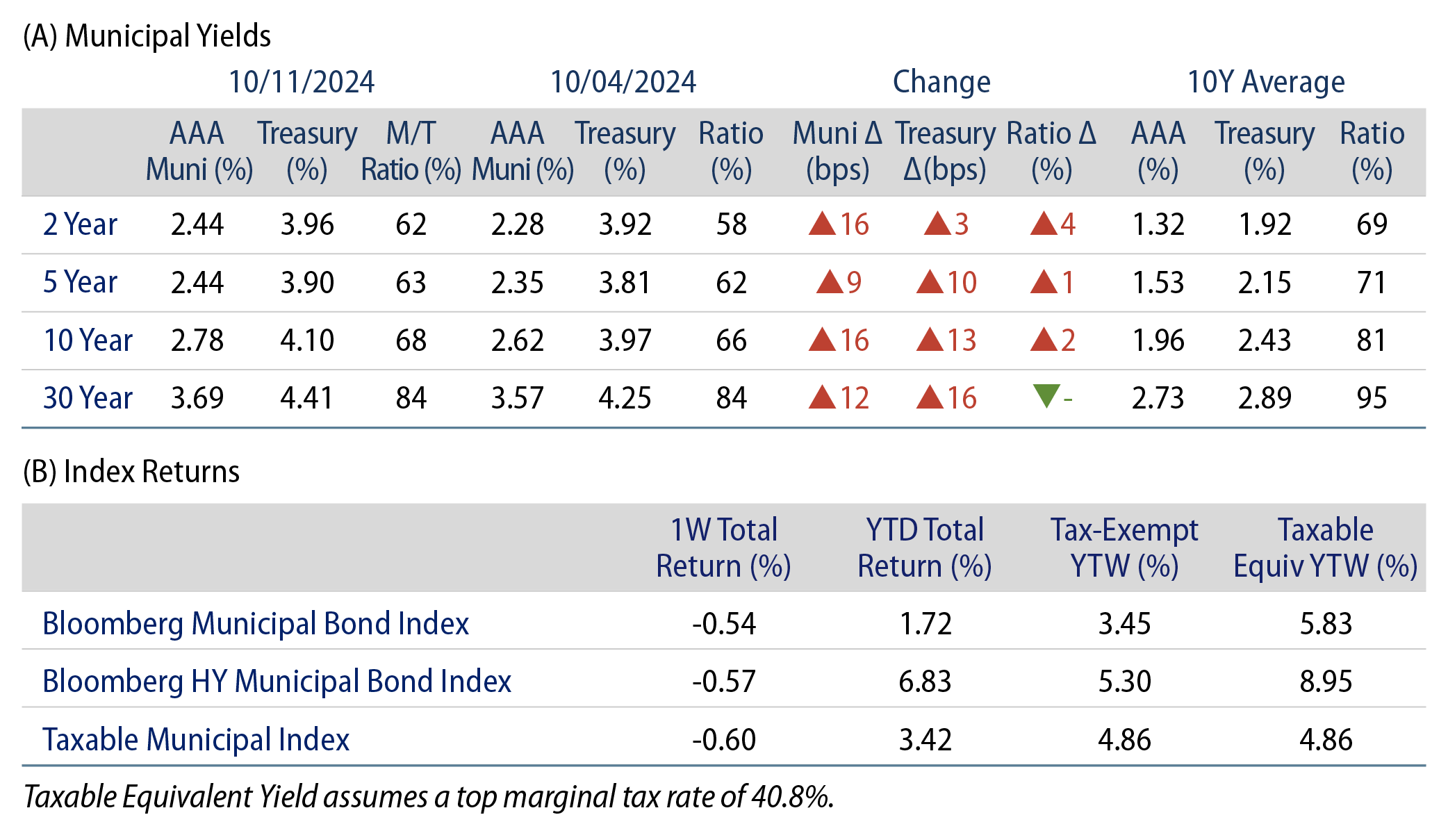

Municipals posted negative returns last week along with other fixed-income sectors amid higher yield conditions. Fixed-income yields generally moved higher across the curve, with Treasuries moving up to 16 basis points (bps) higher across the curve. Meanwhile, high-grade muni yields moved higher in sympathy with Treasuries and technicals remained challenged by elevated supply levels. The Bloomberg Municipal Index returned -0.54% during the week, the High Yield Muni Index returned -0.57% and the Taxable Muni Index returned -0.60%. This week we highlight potential individual income tax policy implications of the upcoming election.

Muni Inflows and Elevated Supply Persist

Fund Flows (up $419 million): During the week ending October 9, weekly reporting municipal mutual funds recorded $419 million of net inflows, according to Lipper. Long-term funds recorded $295 million of inflows, intermediate funds recorded $98 million of inflows and high-yield funds recorded $308 million of inflows. This week’s inflows lead estimated year-to-date (YTD) net inflows higher to $30 billion.

Supply (YTD supply of $398 billion, up 45% YoY): The muni market recorded $11 billion of new-issue volume last week, down 13% from the prior week. YTD issuance of $398 billion is 45% higher than last year’s level, with tax-exempt issuance 48% higher and taxable issuance 14% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $15 billion, despite the holiday shortened week. The largest deals include $1.5 billion New Jersey Transportation Trust and $1.6 billion City of Chicago general obligation transactions.

This Week in Munis: Election in Focus—Individual Income Taxes

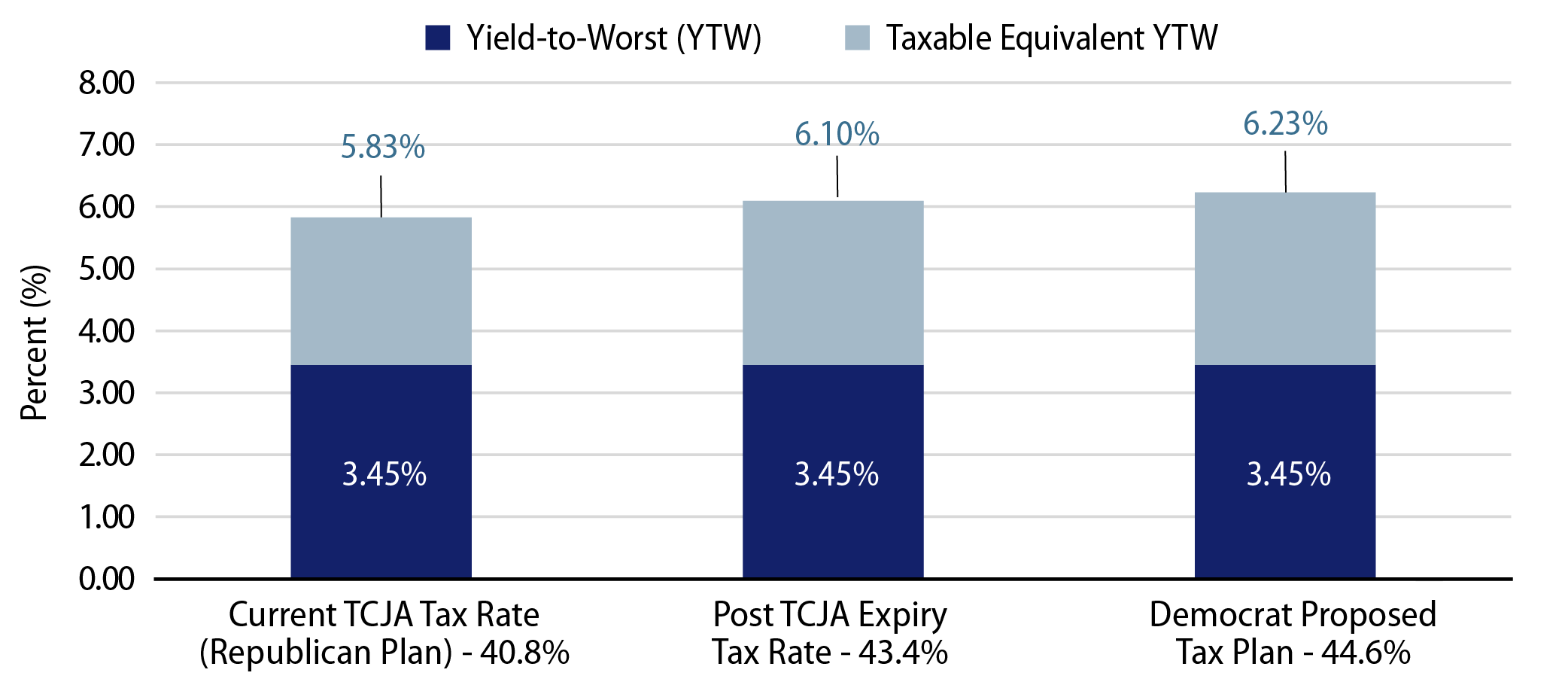

Tax policy is typically a key issue in presidential elections, but the upcoming election is especially significant as many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire in 2025. For individuals, the TCJA reduced the highest federal marginal tax rate to 37.0% (from 39.6%), introduced wider brackets that limited tax burdens, raised the standard deduction and blunted the impact of the Alternative Minimum Tax (AMT). These measures were partially funded by limiting state and local tax deductions to $10,000, which increased the overall tax burden for high-net-worth individuals in states with high tax rates where individuals face potentially larger deductions.

Without Congressional action, when the TCJA sunsets in late 2025, most individuals would face higher tax burdens considering the reversion to the 39.6% top tax rate, narrower tax brackets and expansion of the AMT. Moreover, a reduction of the standard deduction and lower child tax credits would compound individual tax liabilities, but this could be offset by a return of state and local tax deductions in high-tax states.

As highlighted in Western Asset’s 2024 election outlook, whether Trump or Harris wins the election, each party would likely promote tax policy changes so that most Americans are not saddled with higher tax burdens. We expect a Harris administration to seek tax hikes on the wealthy, which would increase the highest marginal tax rates beyond the tax increases associated with the TCJA expiration. Meanwhile, we anticipate Trump would, at the very least, extend the current TCJA tax regime, if not pursue further cuts.

Considering the potential for split government or thin margins in Congress, along with the likelihood of increased federal deficits under either administration’s policies, passing any major tax reform could be difficult. As such, we ascribe a higher probability that tax rates trend higher, which would bode well for the value of the municipal tax-exemption and demand for tax-exempt municipal securities.

Municipal Credit Curves and Relative Value

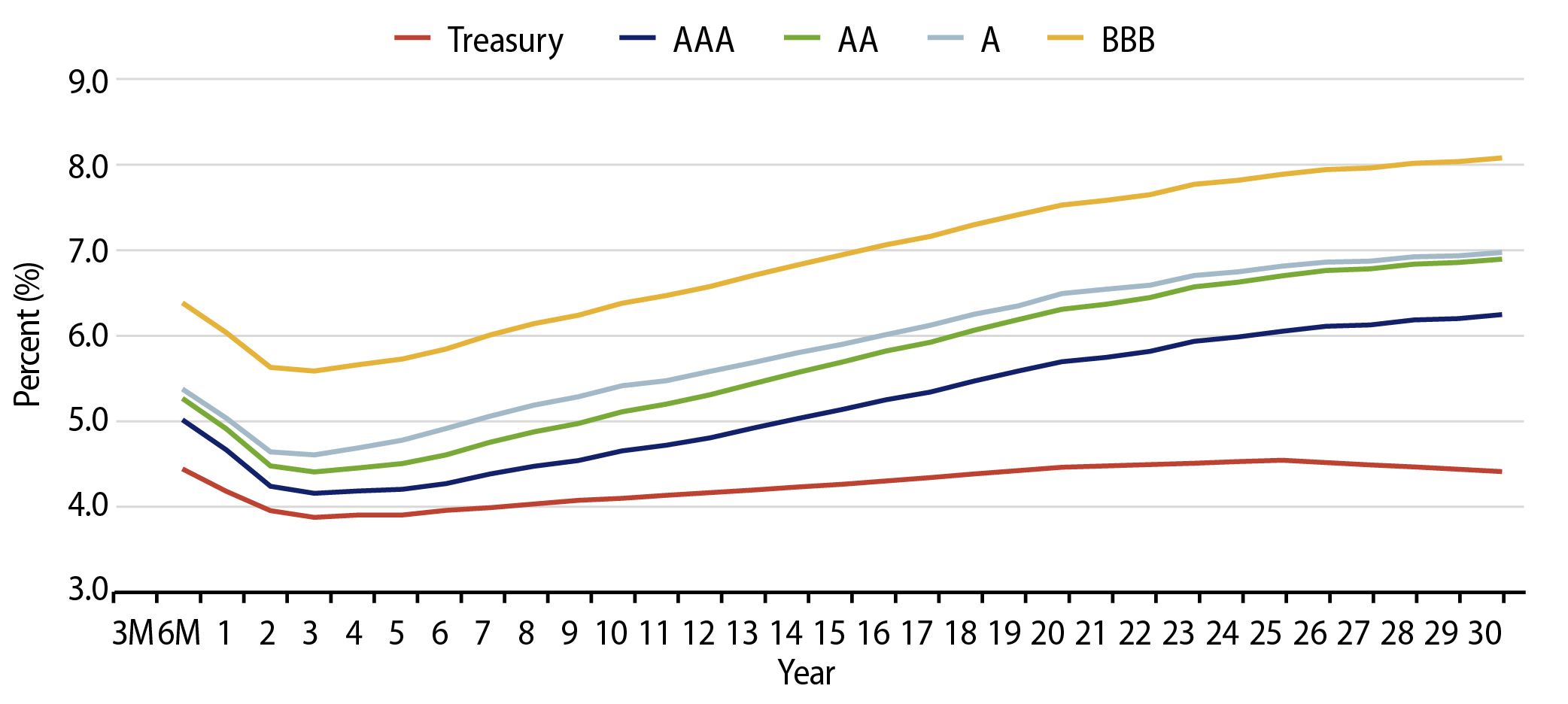

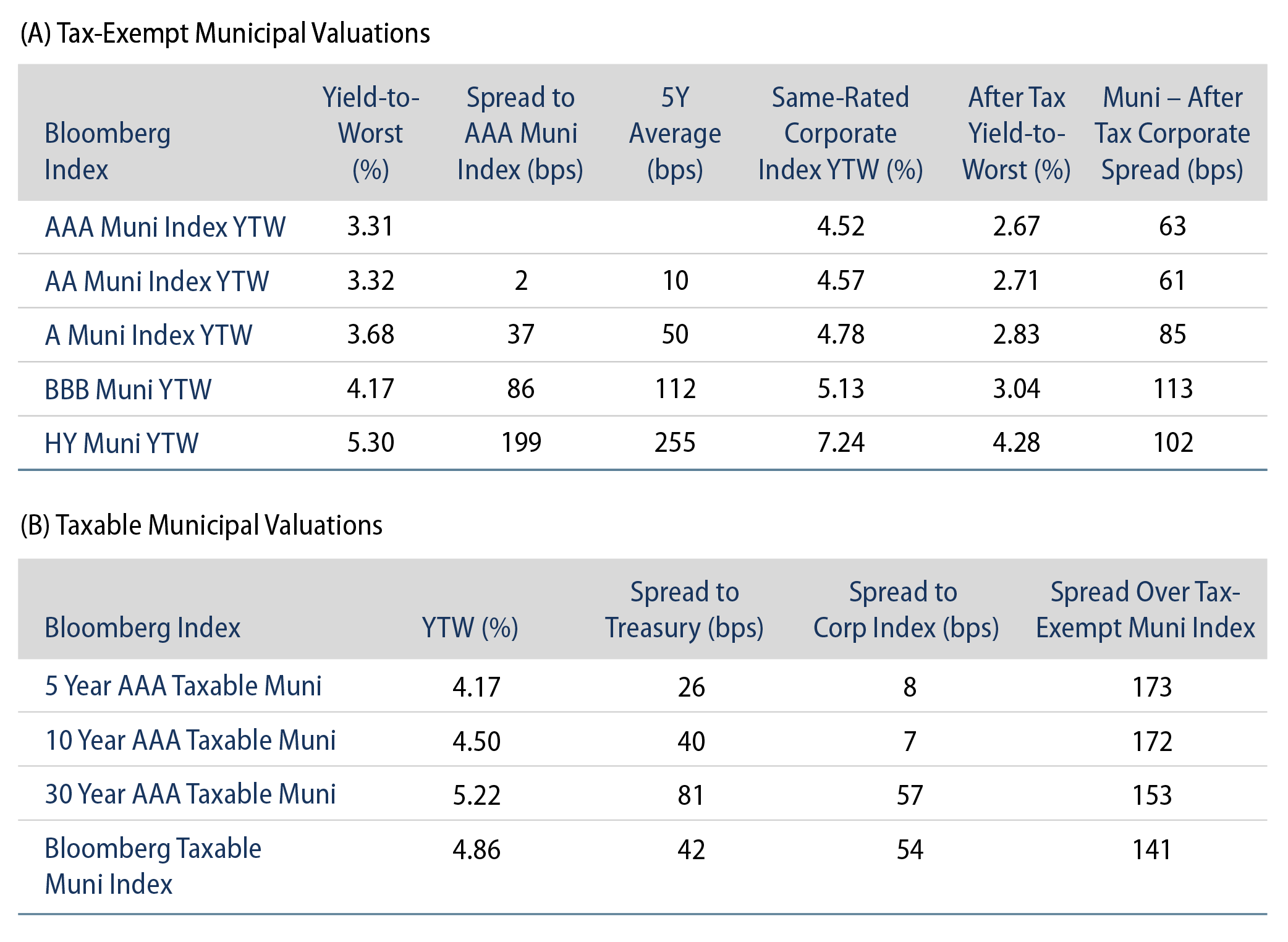

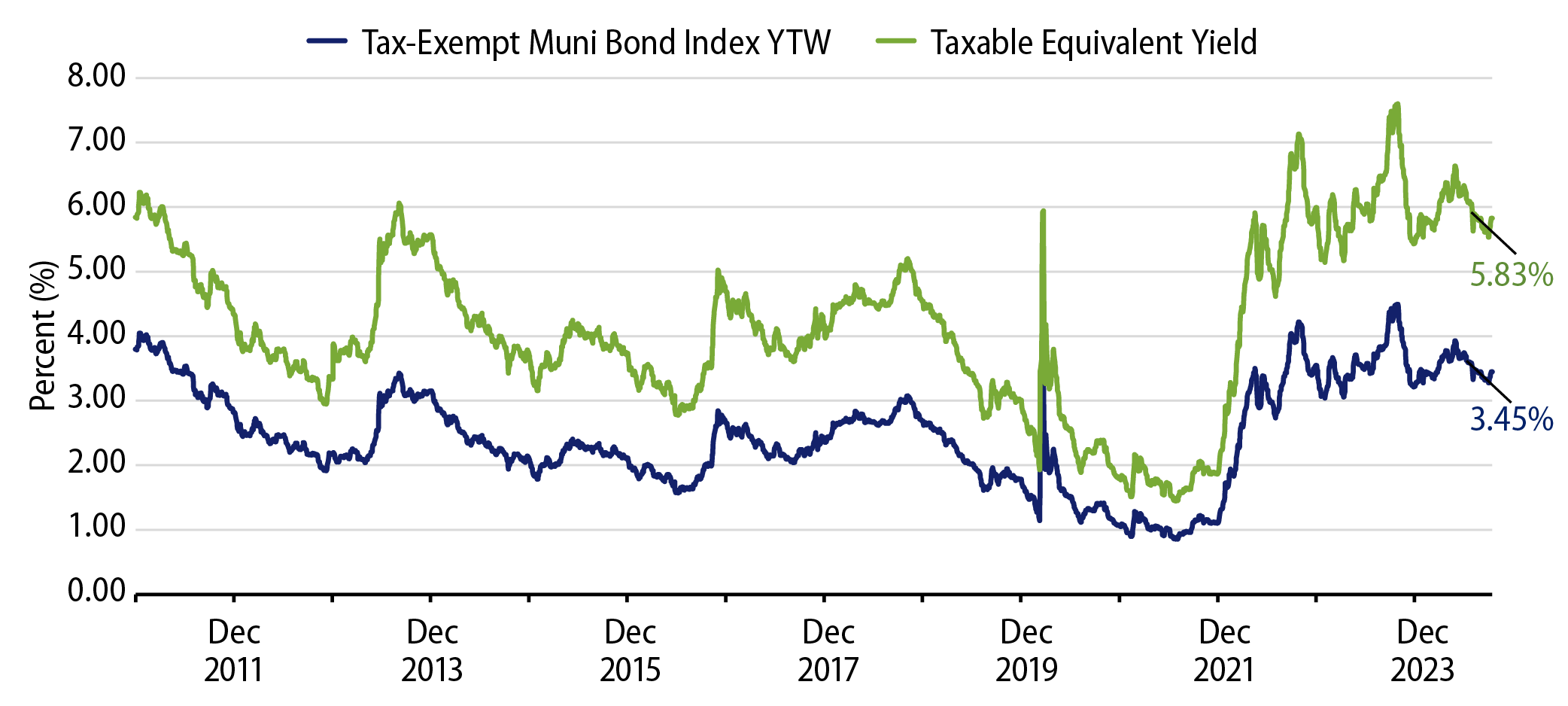

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

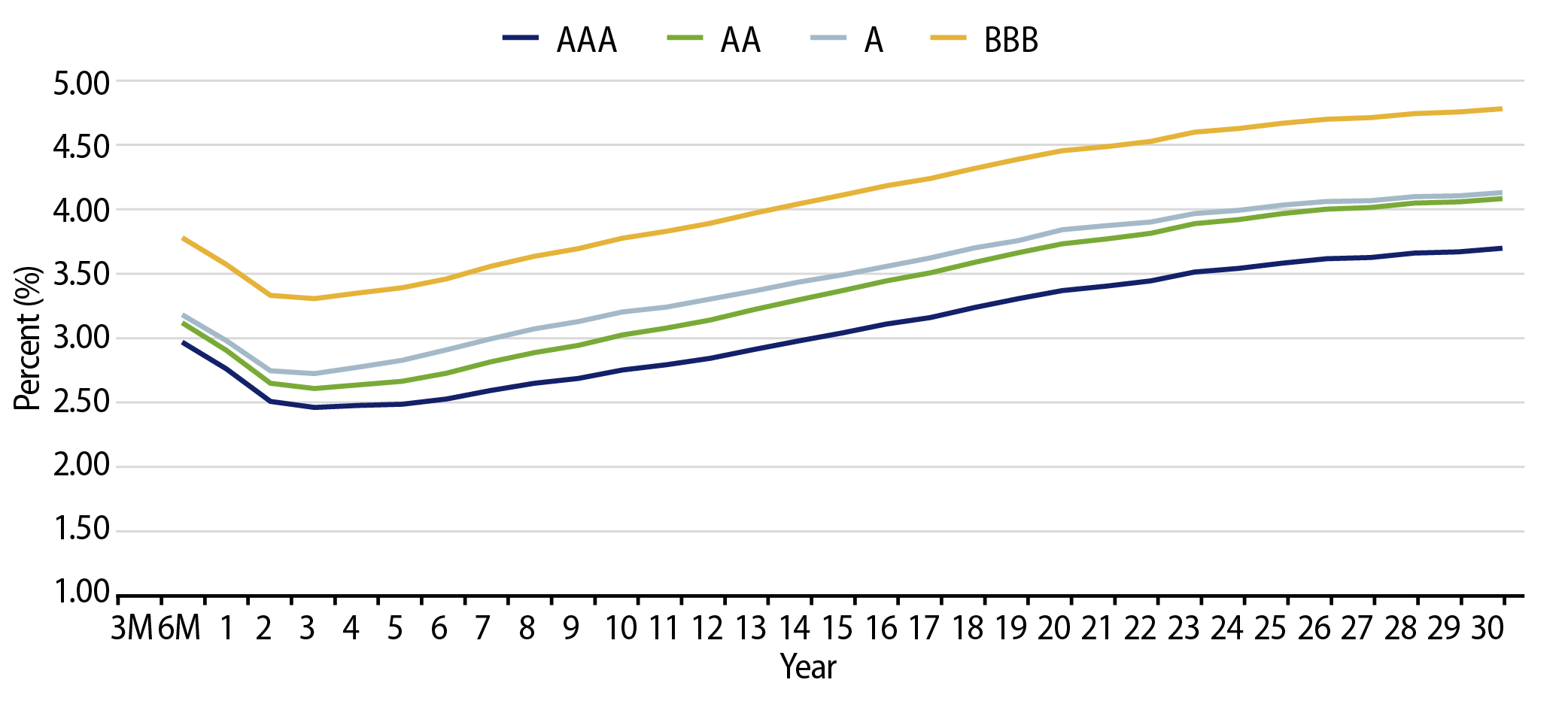

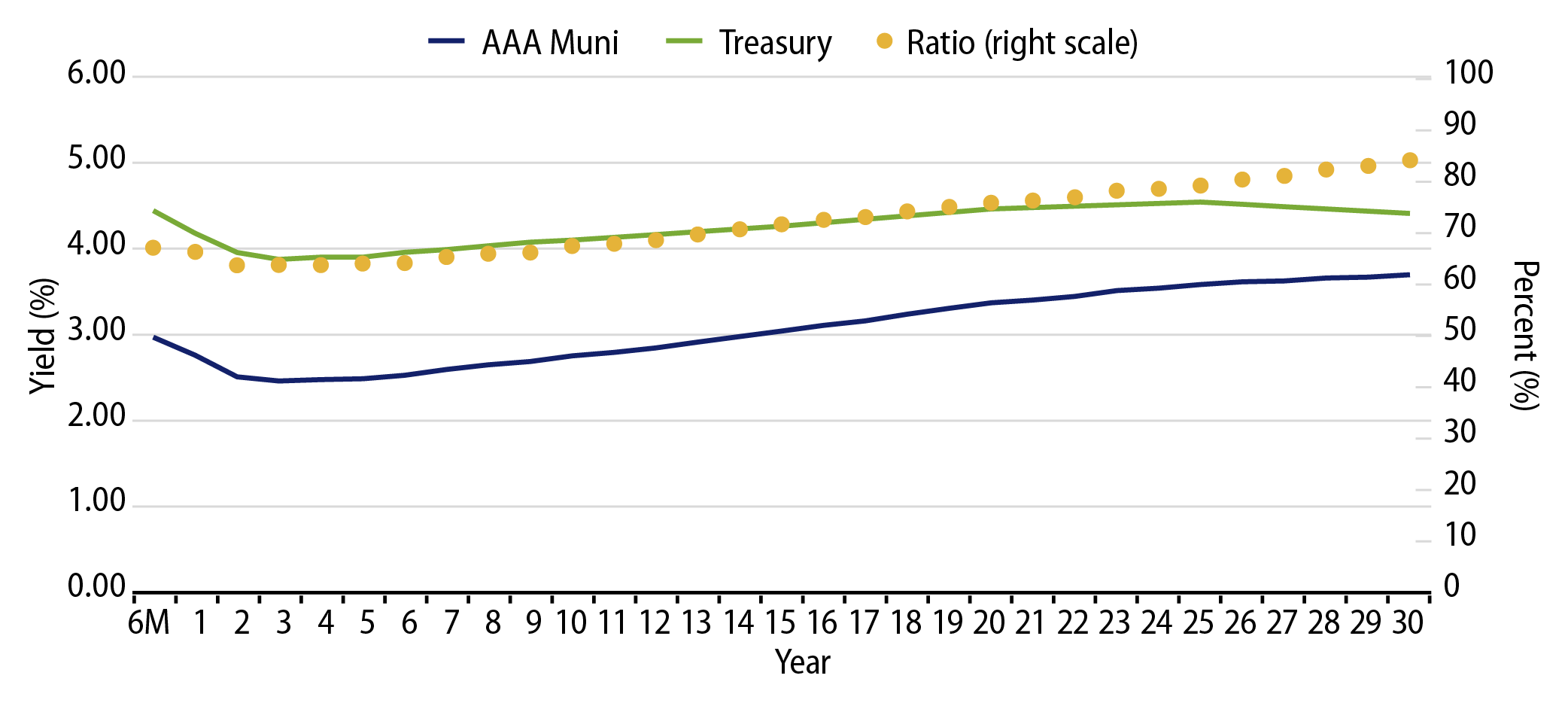

Theme #2: The muni yield curve has largely disinverted, offering better rolldown opportunity in intermediate maturities.

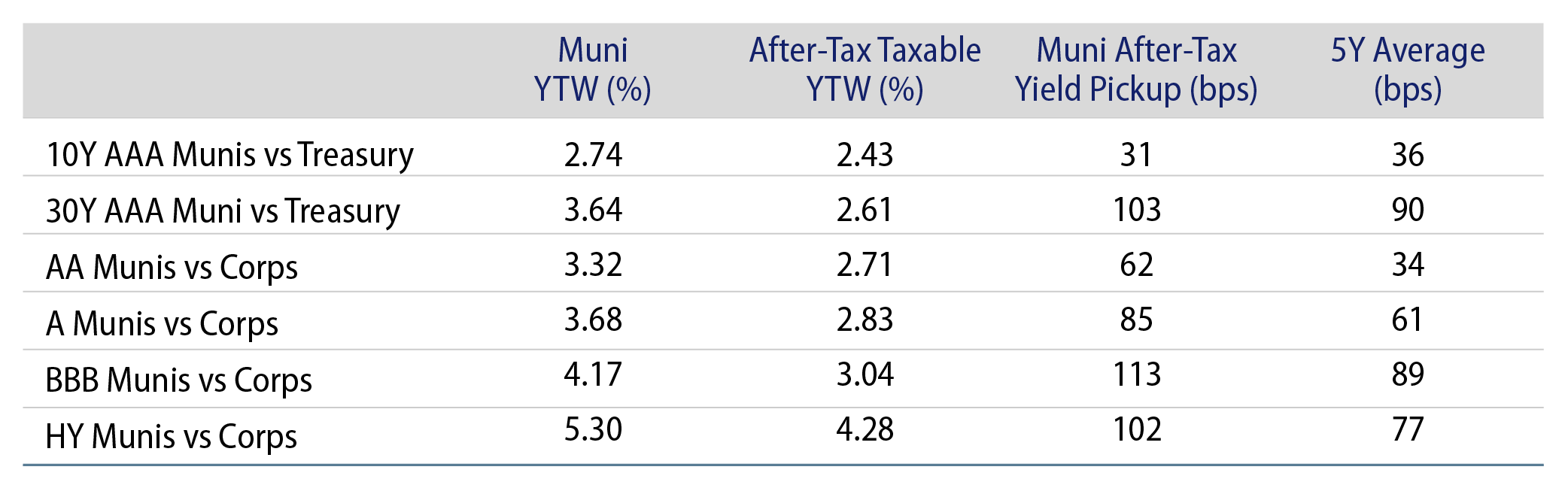

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.