Municipals Posted Negative Returns Last Week

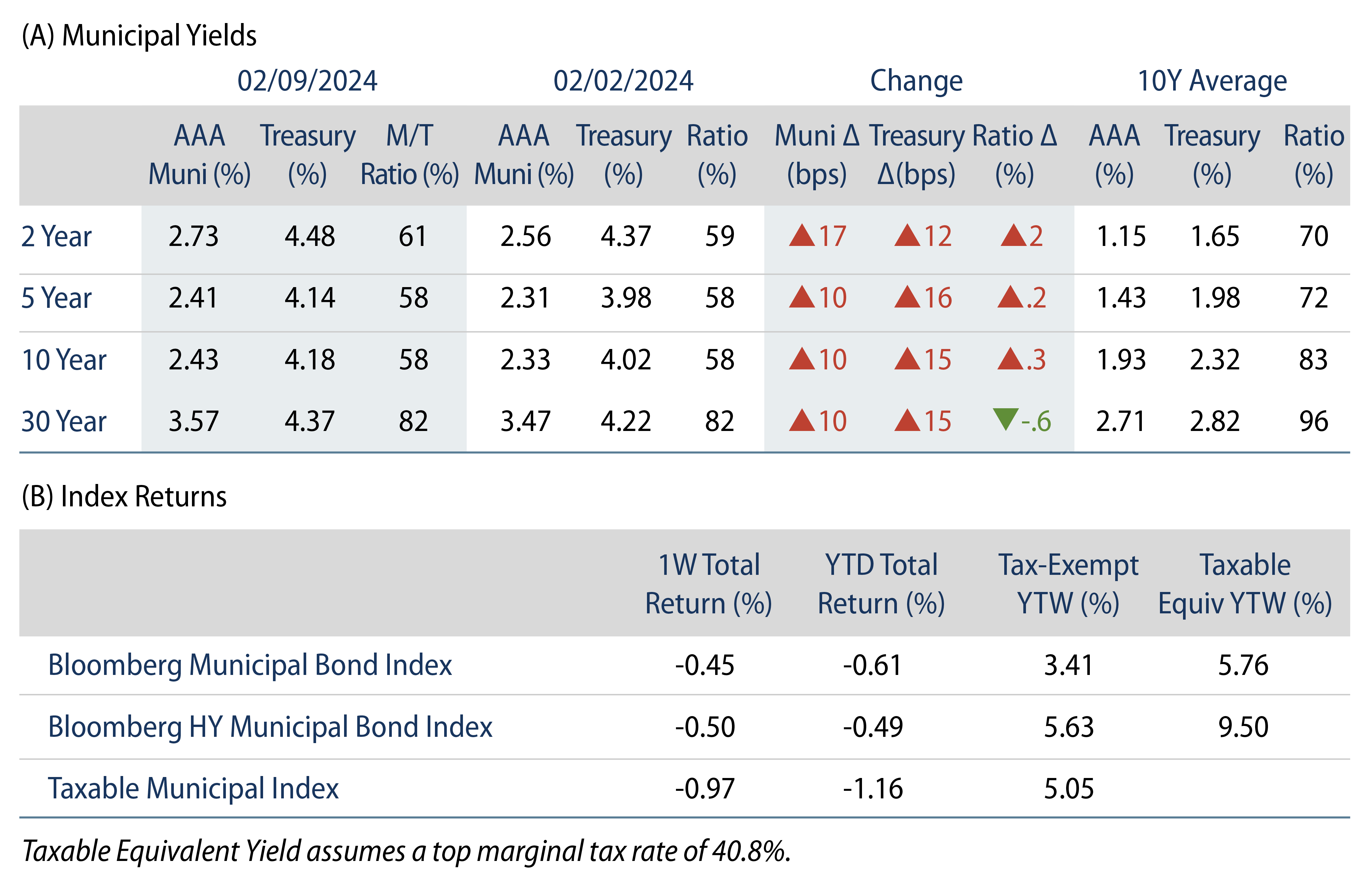

Munis posted negative returns but outperformed Treasuries during a volatile week that saw regional banking challenges and the Fed keeping rates unchanged, but noting that additional progress on inflation is required before easing policy. High-grade muni yields moved 10-17 basis points (bps) higher across the curve. Meanwhile, market technicals waned with fund outflows and higher supply conditions. The Bloomberg Municipal Index returned -0.45% during the week, the High Yield Muni Index returned -0.50% and the Taxable Muni Index returned -0.97%. This week we highlight diverging valuations between top-quality munis and credit-oriented counterparts.

Muni Technicals Waned on Fund Outflows, Higher Supply Conditions

Fund Flows: During the week ending February 7, weekly reporting municipal mutual funds recorded $121 million of net outflows, according to Lipper. Long-term funds recorded $61 million of outflows, high-yield funds recorded $347 million of inflows and intermediate funds recorded $44 million of inflows. Short-term funds posted outflows of $83 million. This week’s outflows led estimated year-to-date (YTD) net inflows lower to $2 billion.

Supply: The muni market recorded $10 billion of new-issue volume last week, down 78% from the prior week. YTD issuance of $44 billion is 76% higher from last year’s level, with tax-exempt issuance 84% higher and taxable issuance 5% lower year-over year. This week’s calendar is expected decline to $6 billion. Largest deals include $682 billion Kentucky Public Energy Authority and $400 million Prosper TX Independent School District transactions.

This Week in Munis: Diverging Valuations

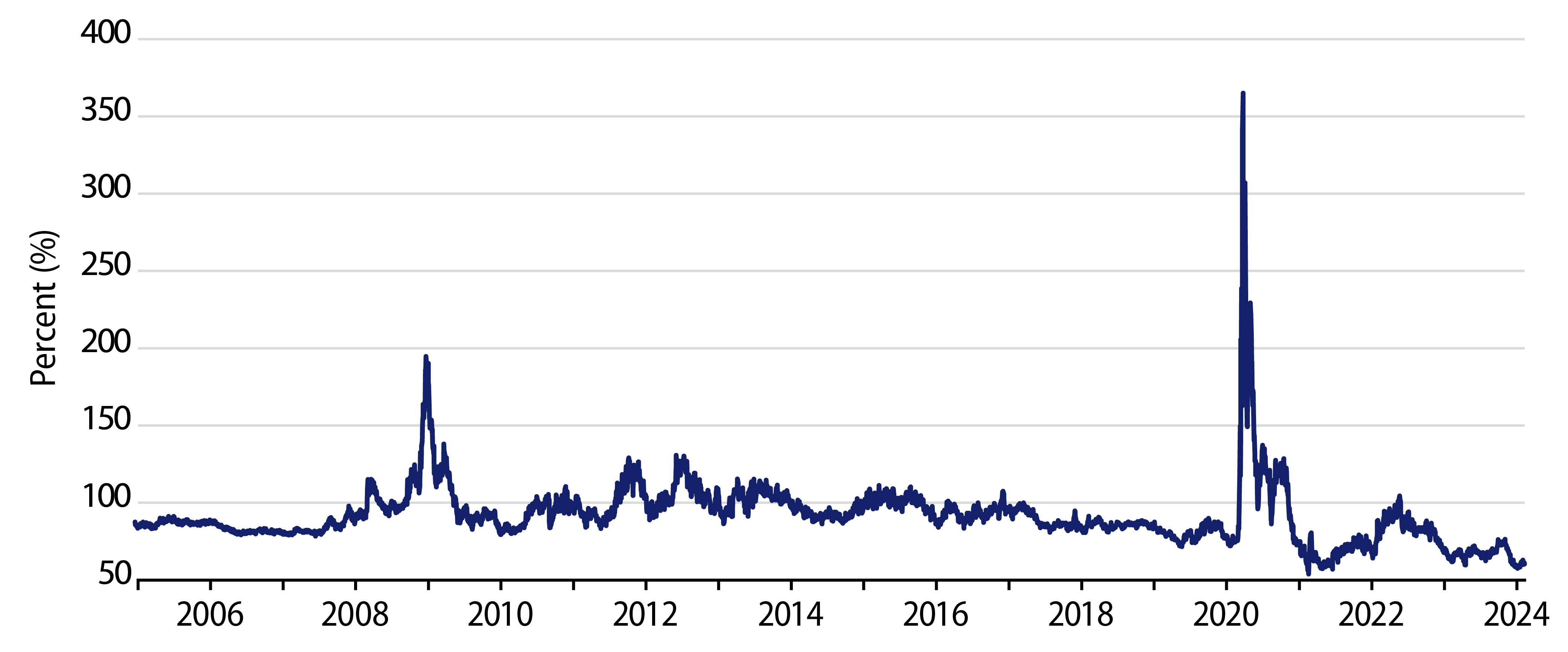

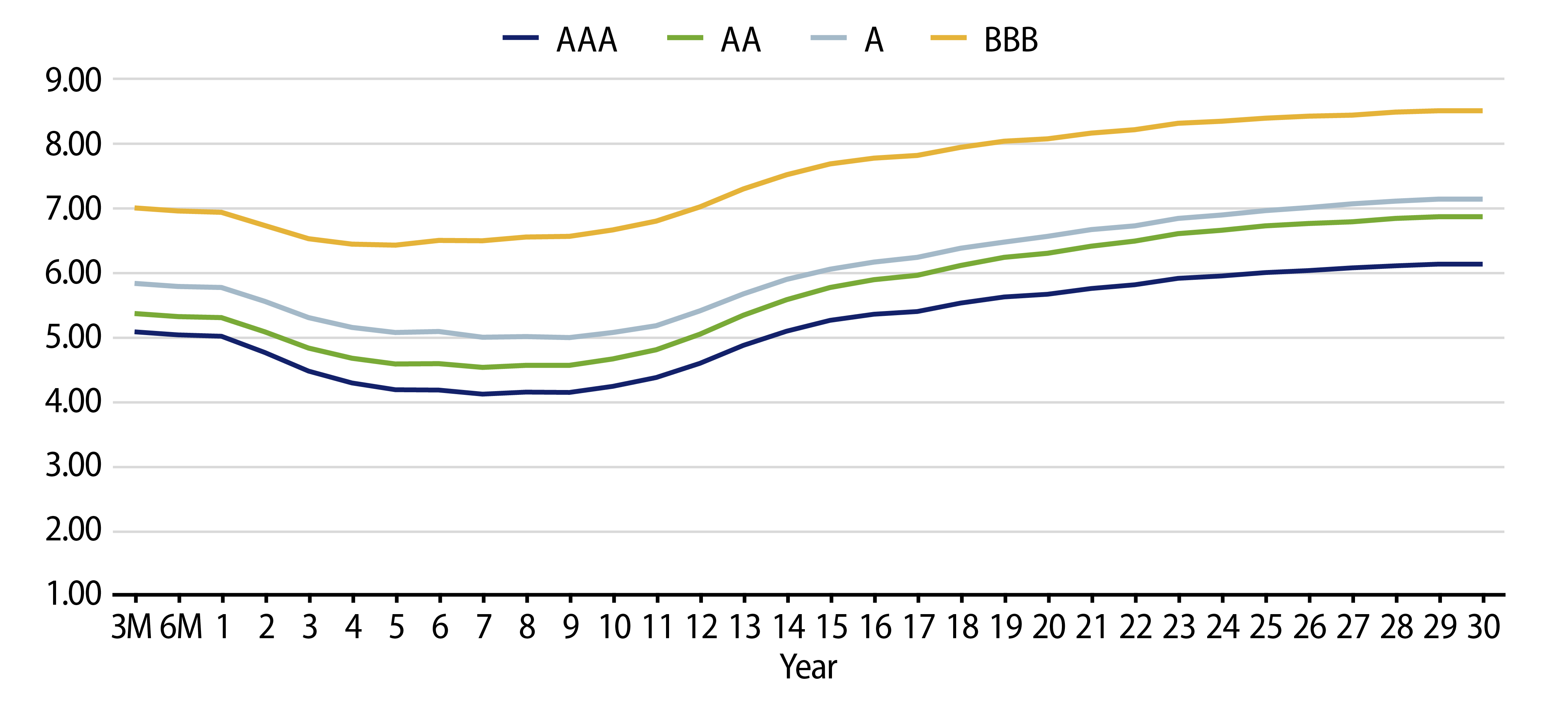

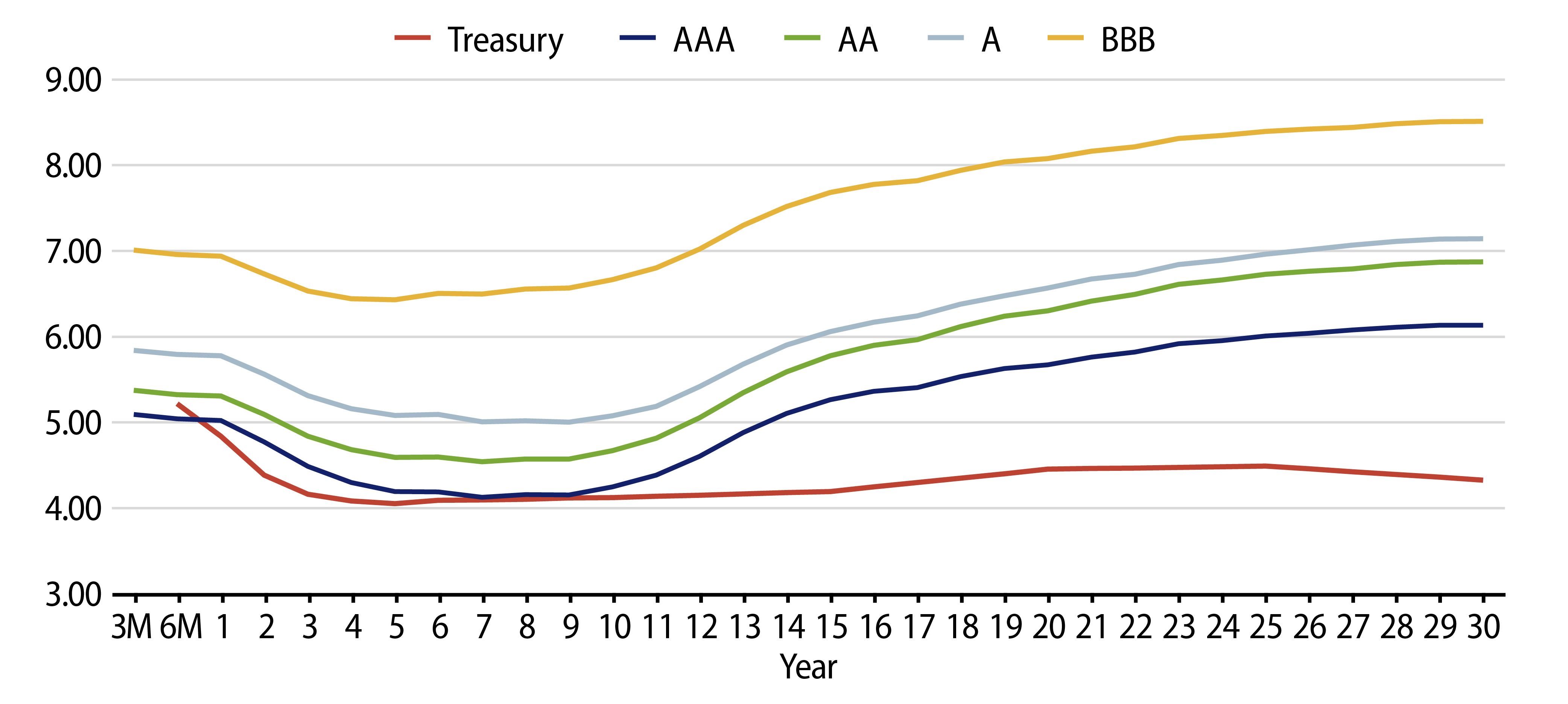

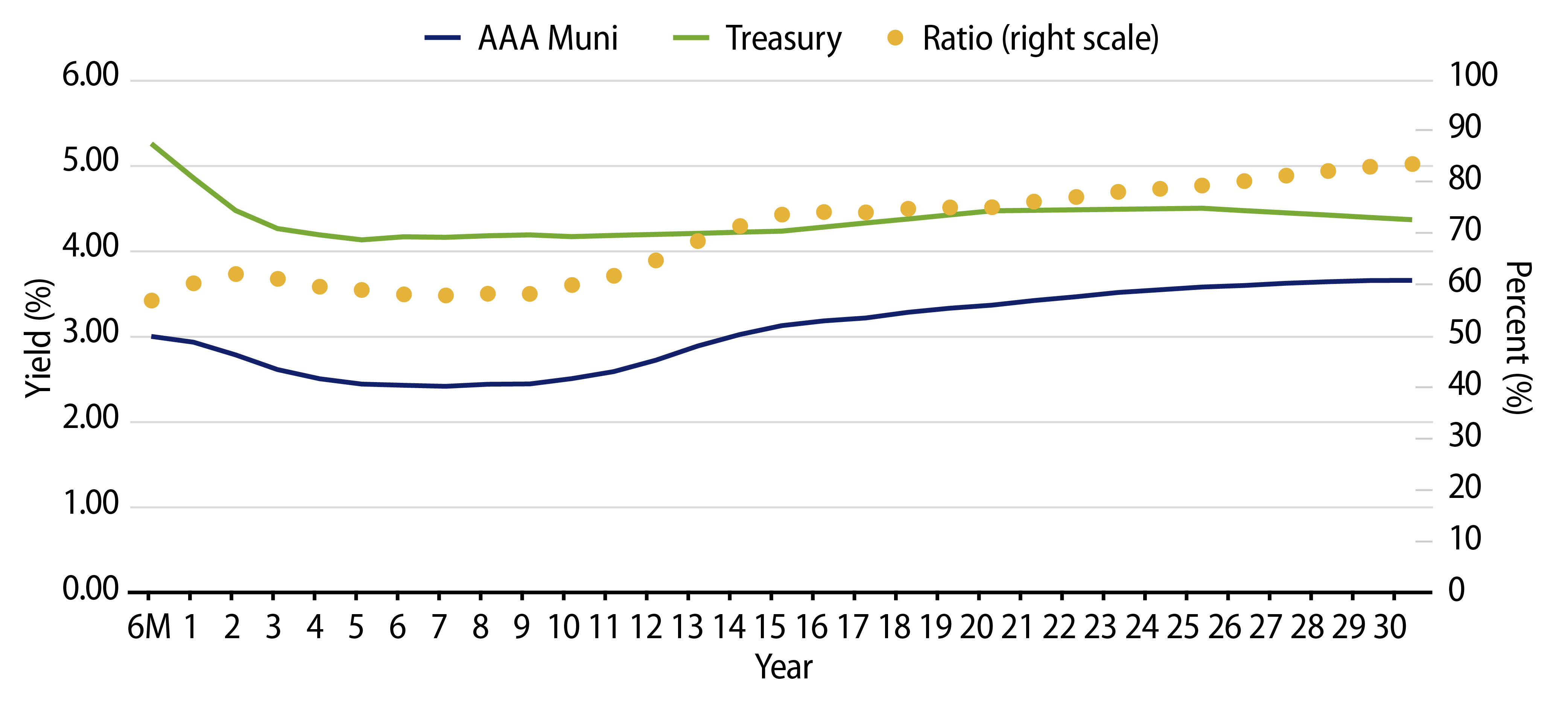

AAA Municipal-to-Treasury ratios are perhaps the most widely used metric to determine if the municipal asset class offers relative value to other taxable fixed-income assets. As the 10-year AAA Muni/Treasury ratio has fallen to near record low levels this year, market participants might be considering holding off allocating to municipals at potentially “relatively rich” valuations.

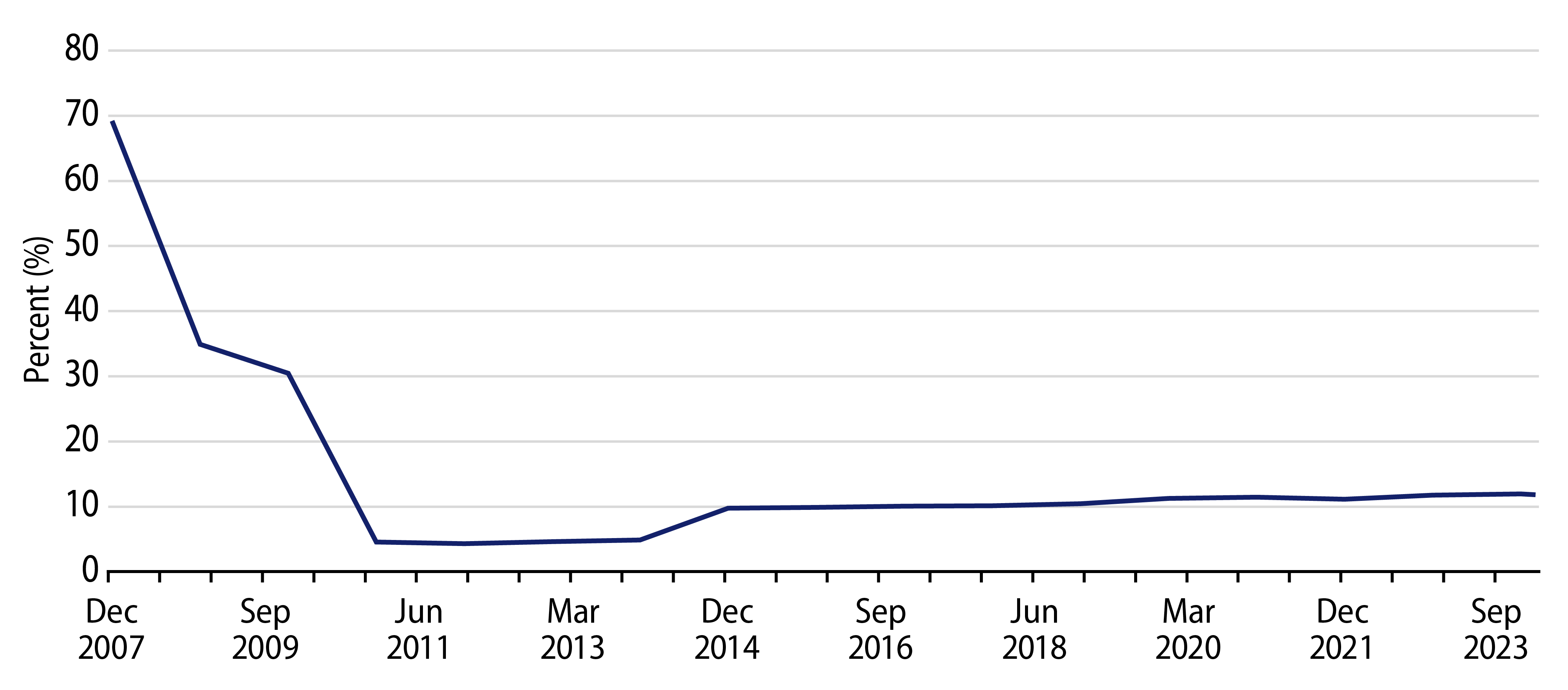

Prior to the global financial crisis (GFC), the 10-Year Muni/Treasury ratio may have been a more relevant metric for the municipal asset class, but today AAA munis comprise a small portion of the overall muni market. In 2007, 70% of munis in the index held a AAA rating on a stand-alone basis, or by virtue of insurance. Following the downgrade of bond insurers after the GFC and subsequent transformation of the muni market to a credit market, AAA munis comprise only 12% of the Bloomberg Municipal Bond Index and even fewer mature within the 10-year maturity tenor.

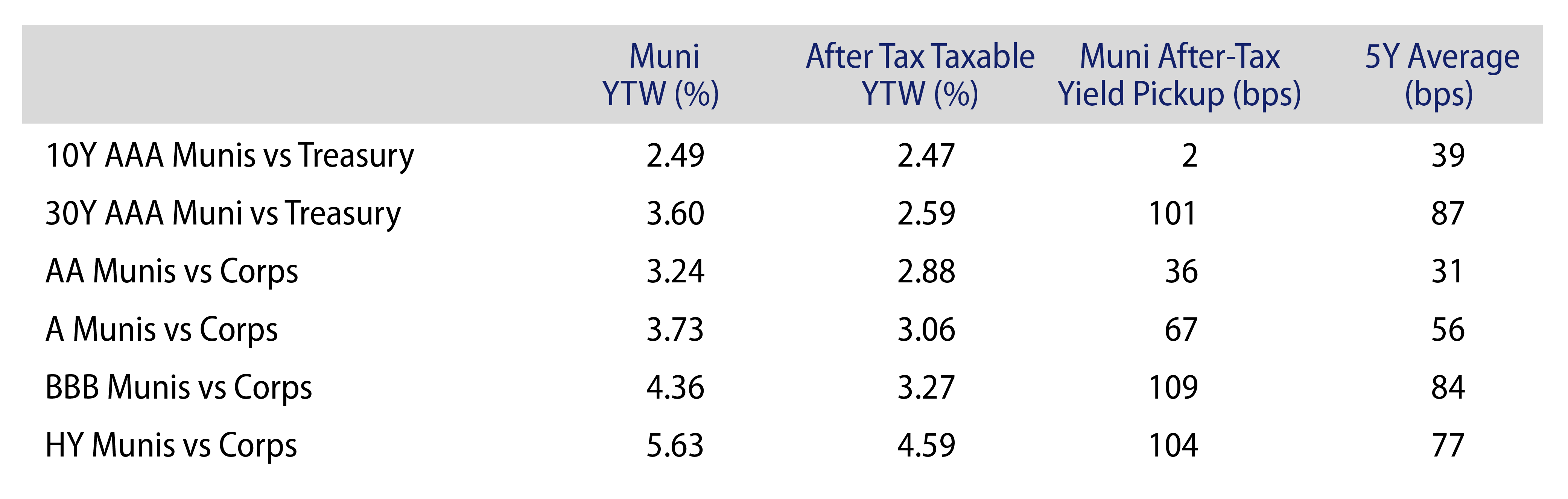

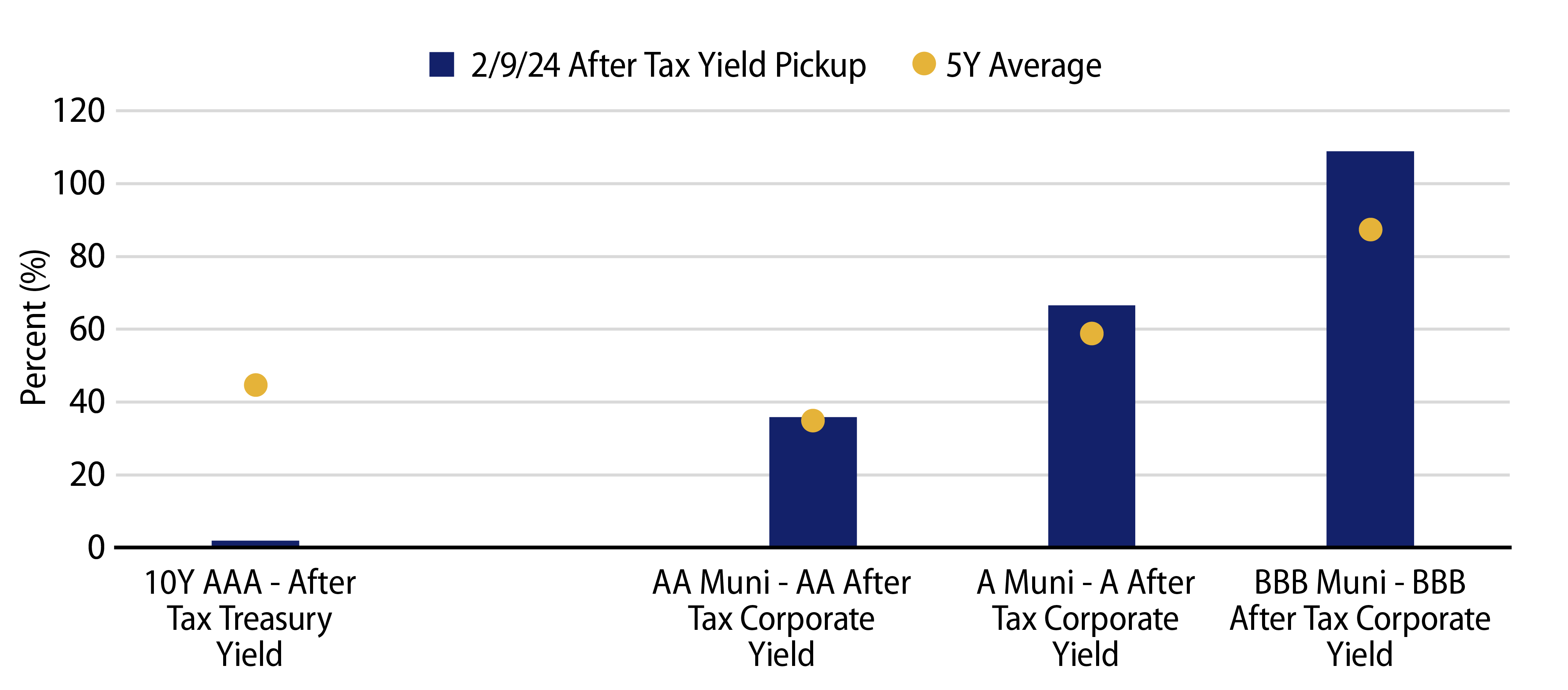

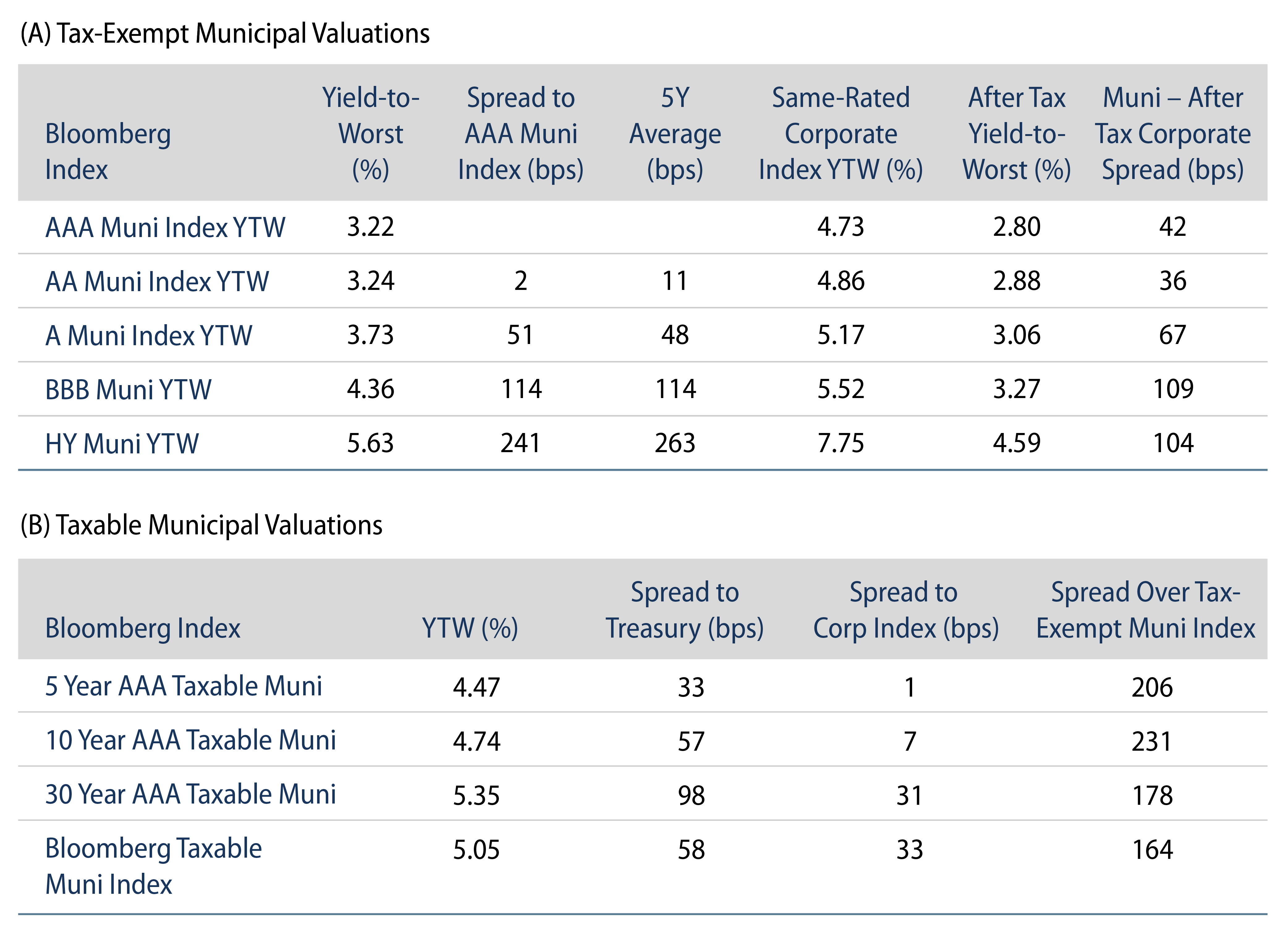

Since the municipal market evolved to a credit market, valuations could be better sought versus comparable corporate bond indices. The AA, A and BBB credit-oriented components of the municipal index together comprise 88% of the Bloomberg Municipal Bond Index. When considering the after-tax yield pickup between like-rated municipal and corporate indices, AA, A and BBB municipals currently offer an after-tax yield pickup that is 36-109 bps higher versus comparably rated corporates, all exceeding five-year averages for top taxpayers.

While short- and intermediate-term AAA Municipal/Treasury ratios are undeniably at near record lows, today AAA municipals comprise just a small minority of the municipal market. Western Asset attributes the relatively tighter shorter-term ratios to elevated separately managed account (SMA) demand that maintain guidelines that bias investment into higher quality shorter tenors. Meanwhile, credit-oriented segments that now comprise the majority of the market still offer above-average after-tax yield pick-up versus comparably rated corporates. Whether positioning within a fund or separate account vehicle, Western Asset believes muni investors seeking risk-adjusted value are better served with flexibility to access the broader credit spectrum at current valuations.

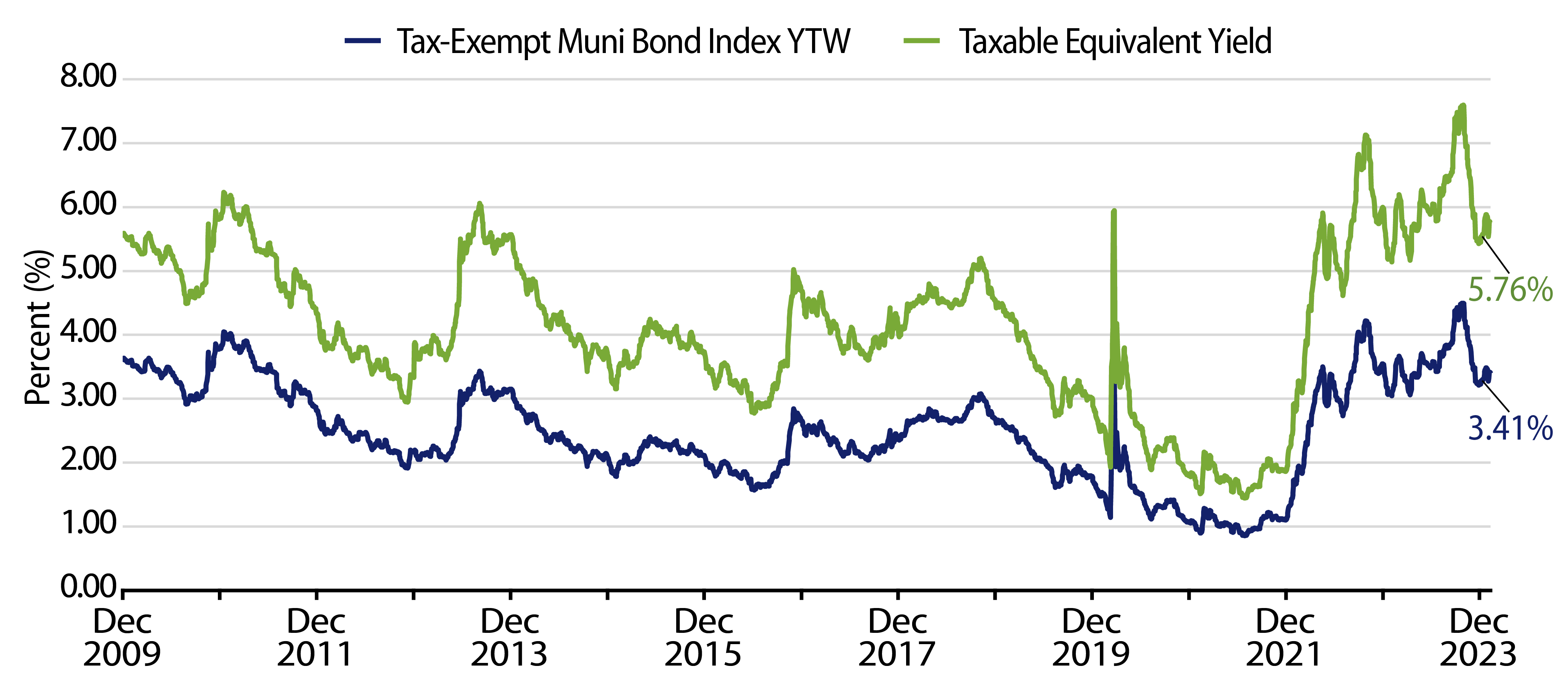

Theme #1: Municipal taxable-equivalent yields are above decade averages.

Theme #2: Recent yield curve steepening has highlighted value in longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.