Municipals Posted Positive Returns Last Week

Municipals posted positive returns last week as muni yields moved lower in short durations and stayed flat along the rest of the curve. Munis outperformed Treasuries, avoiding much of the volatility in Treasury yields throughout the week. Meanwhile, technicals were mixed with positive fund inflows but increased supply. The Bloomberg Municipal Index returned 0.10% during the week, the High Yield Muni Index returned 0.21% and the Taxable Muni Index returned -0.09%. This week we highlight divergent demand trends within the municipal market.

Technicals Were Mixed with Positive Flows but Greater Supply

Fund Flows: During the week ending June 7, weekly reporting municipal mutual funds recorded $460 million of inflows, according to Lipper. Long-term funds recorded $899 million of inflows, high-yield funds recorded $380 million of inflows and intermediate funds recorded $10 million of outflows. This week’s inflows bring year-to-date (YTD) net outflows to $8.5 billion.

Supply: The muni market recorded $11 billion of new-issue volume last week, up 46% from the prior week. YTD issuance of $149 billion remains down 14% year-over year (YoY), with tax-exempt issuance down 7% YoY and taxable issuance down 50% YoY. This week’s new-issue calendar is expected to amount to $3 billion.

This Week in Munis: Diverging Demand

The vast majority of municipal demand has traditionally resided in individual retail accounts, given the benefits that the municipal tax exemption provides to individuals subject to higher individual income tax rates. As credit and liquidity challenges emerged in the municipal marketplace following the GFC, there has been a growing concentration of open-end, closed-end and exchange traded mutual funds that has grown over the past decade. As a result, municipal market participants often point to municipal fund flows as a gauge of market sentiment, and a key driver of performance and relative valuations.

Following the record $150 billion of net outflows from municipal mutual funds that contributed to historic negative performance in 2022, higher rates and more attractive relative valuations were expected to draw a rebound in municipal mutual fund demand this year. Exploring data from various fund data providers, we see demand returning in certain areas of the market, but not the sharp recovery many were expecting as the Federal Reserve signaled its pause. Headline estimates through the end of May suggest municipal mutual funds garnered $3.6 billion of net inflows through May 31, a far cry from the $150 billion of fund assets that left the asset class in 2022.

Across the maturity spectrum, short duration municipal mutual funds have led category outflows, recording $10.1 billion of net outflows YTD, as short muni funds have had to compete with taxable money market funds delivering yields above 5%, as well as the potential for investors wanting to step out the curve to lock in longer-term levels of income as the Fed began to signal a slowing of its tightening cycle. In contrast, intermediate and long-term municipal fund categories, which represent nearly 50% of total municipal fund assets, recorded $10.3 billion of YTD net inflows—suggesting that municipal demand is stronger than headline levels might suggest.

From a vehicle perspective, Morningstar reports through the end of May that of the nearly $3.6 billion in municipal fund inflows, open-end funds recorded $2.8 billion of net inflows, while ETFs recorded $783 million of net inflows. Beyond the fund flow figures, the municipal market has also benefited from strong separately managed account (SMA) demand which has remained positive through the 2022 municipal fund outflow cycle, and continues to remain positive YTD, according to Cerulli.

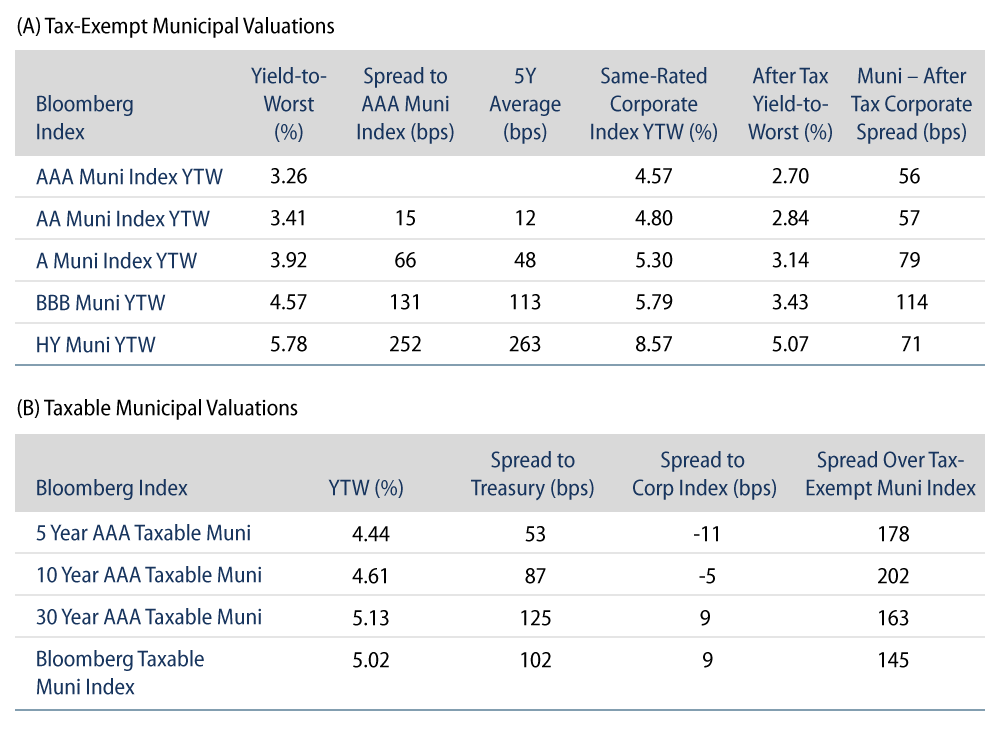

All told, despite modest headline figures, we are seeing demand return to the municipal asset class following weak market conditions in 2022, concentrated in ETF, Long and SMA categories. Concentrated demand dynamics in a fragmented market can provide value opportunities for active managers. We estimate the strong demand observed in ETF and SMA market vehicles has led to a strong bid and relatively rich valuations, in higher-grade and shorter-duration solutions. Western Asset continues to see relative value in longer-duration and lower-quality areas of the market.