Munis Posted Positive Returns Last Week

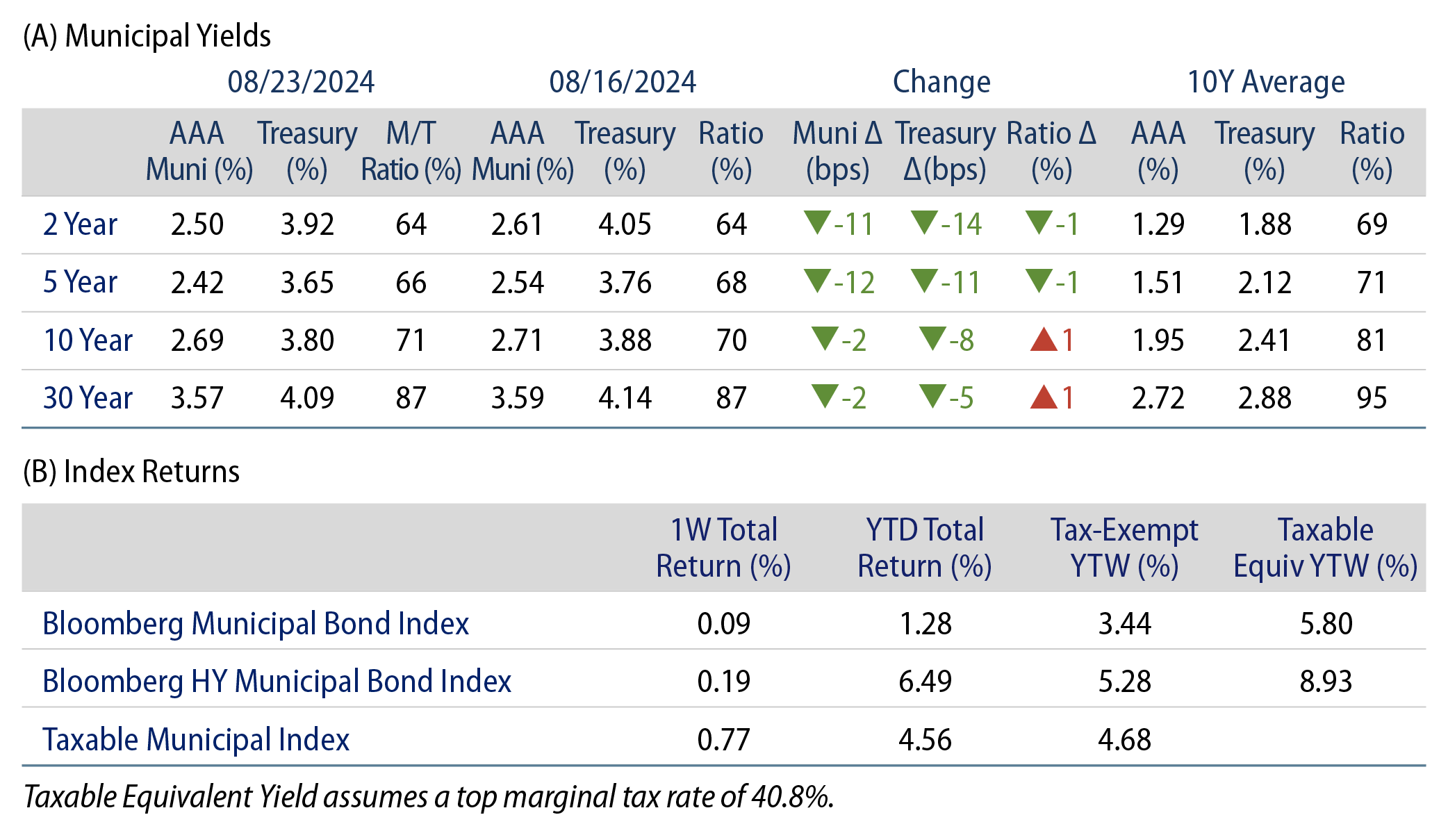

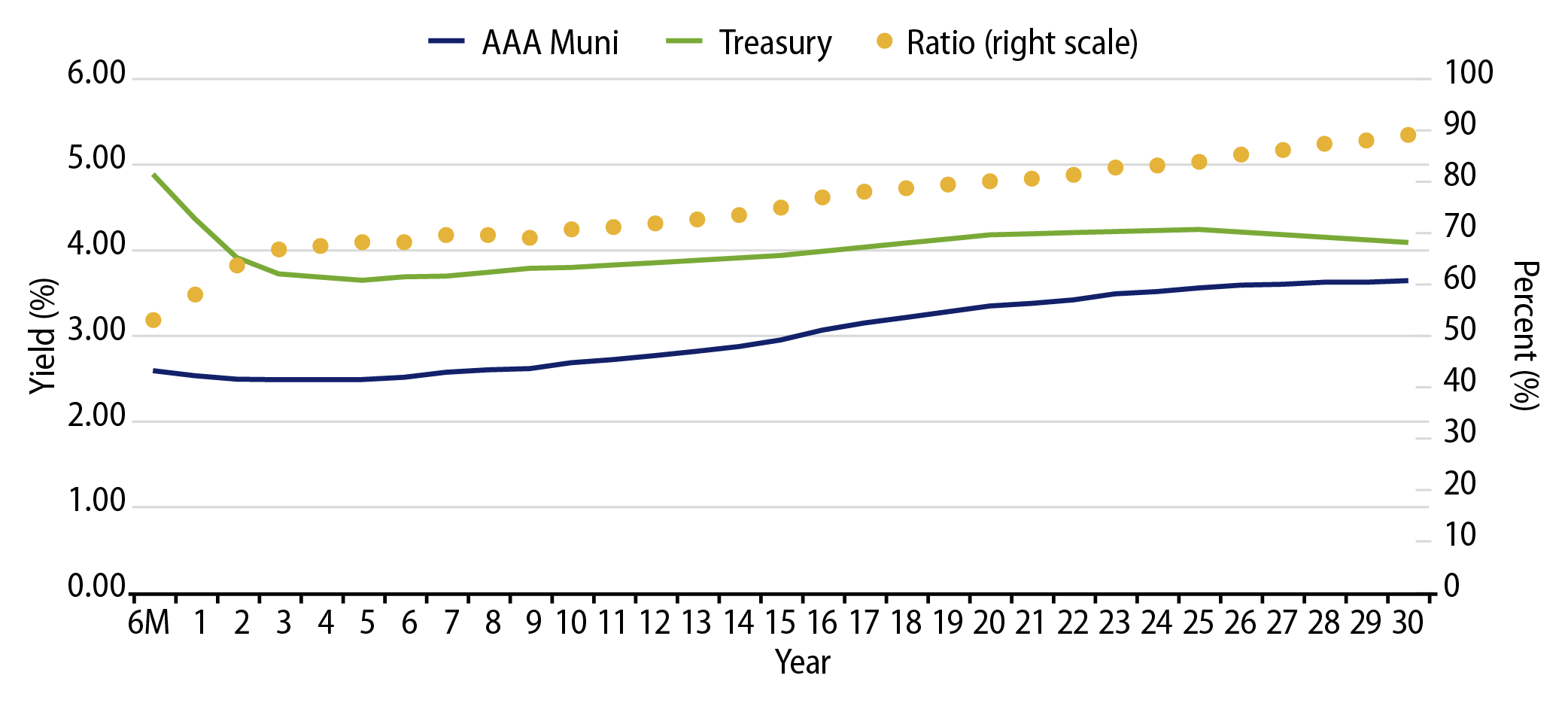

Municipals posted positive returns last week as yields generally moved lower with Treasuries amid dovish Federal Reserve (Fed) commentary, capped by Fed Chair Jerome Powell noting that ''the time has come for policy shift.'' Meanwhile, the high-grade muni yield curve steepened, moving lower in shorter maturities and higher in long maturities, and supply and demand remained elevated. The Bloomberg Municipal Index returned 0.09% during the week, the High Yield Muni Index returned 0.19% and the Taxable Muni Index returned 0.77%. This week we touch on Vice President Kamala Harris' new tax plan.

Supply and Demand Moved Higher

Fund Flows (up $501 million): During the week ending August 21, weekly reporting municipal mutual funds recorded $501 million of net inflows, according to Lipper. Long-term funds recorded $410 million of inflows, high-yield funds recorded $355 million of inflows and intermediate funds recorded $14 million of outflows. This week’s inflows represent the eighth consecutive week of inflows and lead estimated year-to-date (YTD) net inflows higher to $19 billion.

Supply (YTD supply of $319 billion, up 41% YoY): The muni market recorded $12 billion of new-issue volume last week, up 12% from the prior week. YTD issuance of $319 billion is 41% higher than last year’s level, with tax-exempt issuance 44% higher and taxable issuance 8% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $11 billion. The largest deals include $2.5 billion California State General Obligation and $1 billion Chicago O'Hare Airport transactions.

This Week in Munis: Democrats' Tax Plan

Changes to tax policy will likely be a consequential outcome of this year’s presidential election, as most of the tax cuts associated with the Trump-era Tax Cuts and Jobs Act (TCJA) are slated to expire in 2025. Last week, Vice President Kamala Harris indicated support for $5 trillion of tax increases for both individuals and corporations over the next decade, providing insight into potential outcomes should Democrats secure victory in November.

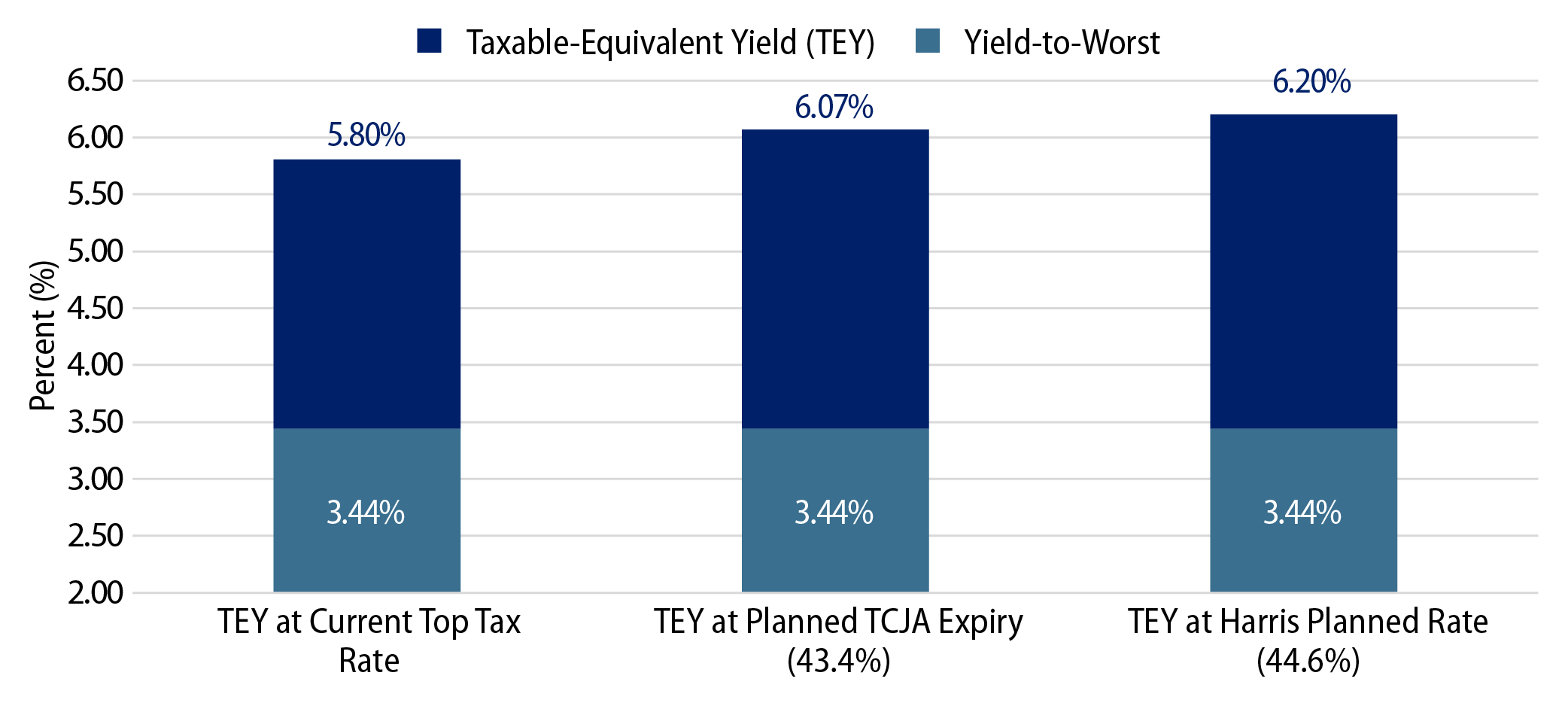

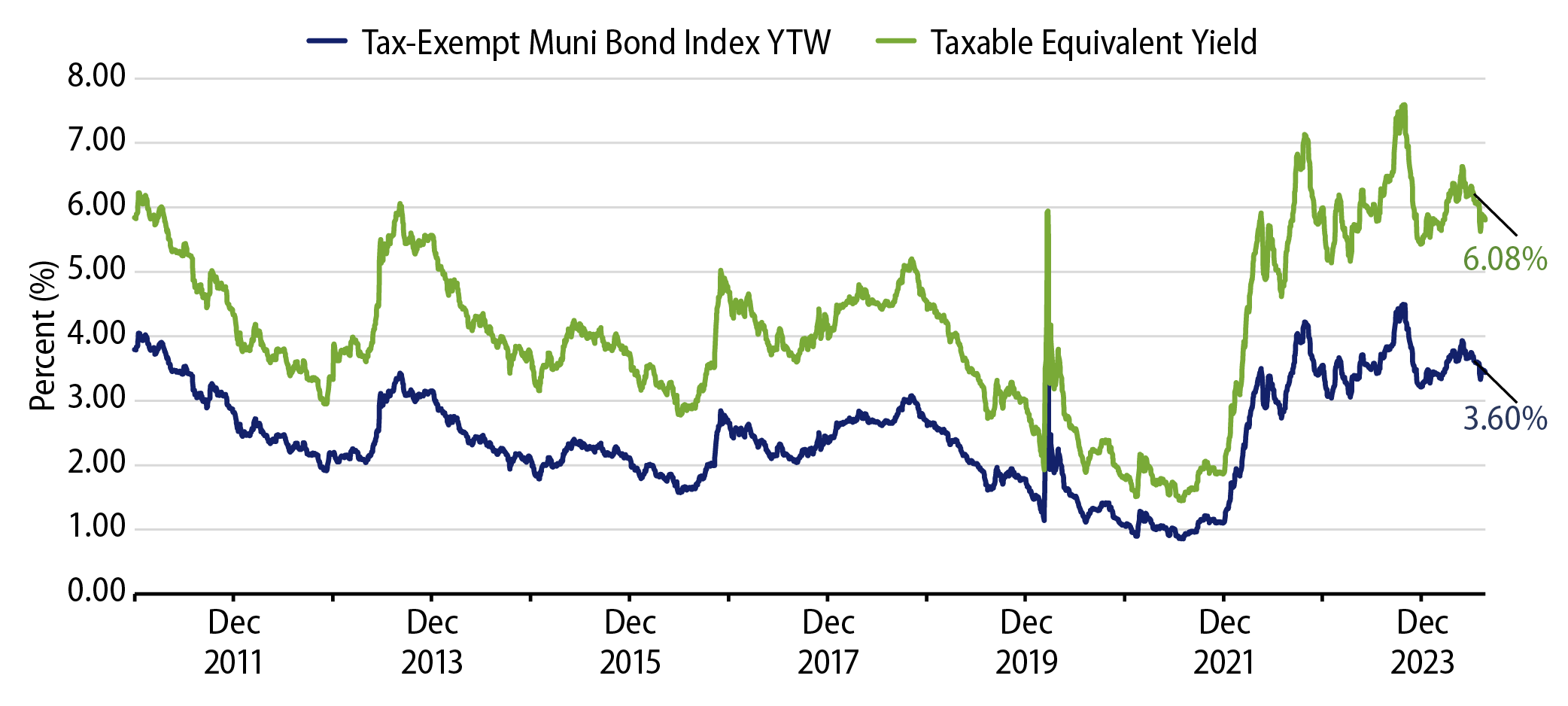

The plan, originally outlined by the Biden administration earlier this year, would seek to increase taxes on high-income individuals by increasing marginal tax rates and widening the scope of how investment gains are treated. Harris’ plan would increase the top marginal income tax rate to the Obama-era rate of 39.6%. She would also increase the Medicare surtax to 5.0% from 3.8%. Together, the top marginal tax rate of 44.6% would surpass both the current top tax rate of 40.8% and the pre-TCJA rate of 43.4%. In addition to higher tax rates, individuals earning over $1 million would see investment earnings taxed at ordinary income tax rates. For those earning over $100 million, Harris’ plan would seek to apply a 25% minimum tax on income and unrealized capital gains. Higher marginal income tax rates and higher potential taxes on other taxable investments should improve the relative appeal for tax-exempt munis.

The Harris plan also includes an increase to the top corporate tax rate to 28% from 21%. The top corporate tax rate was lowered from 35% to 21% as part of the TCJA, and unlike the majority of individual tax provisions, is not slated to expire. Higher corporate tax rates could improve insurance company demand for tax-exempt munis, which waned following the reduction of the corporate tax rate in 2018.

Western Asset expects that even with a Harris victory, it would be difficult to pass most of these initiatives due to likely thin margins in the House and Senate. However, regardless of which candidate wins in November, individual marginal tax rates are scheduled to trend higher when the TCJA expires, absent Congressional action, which should bode well for municipal relative value and overall demand.

Municipal Credit Curves and Relative Value

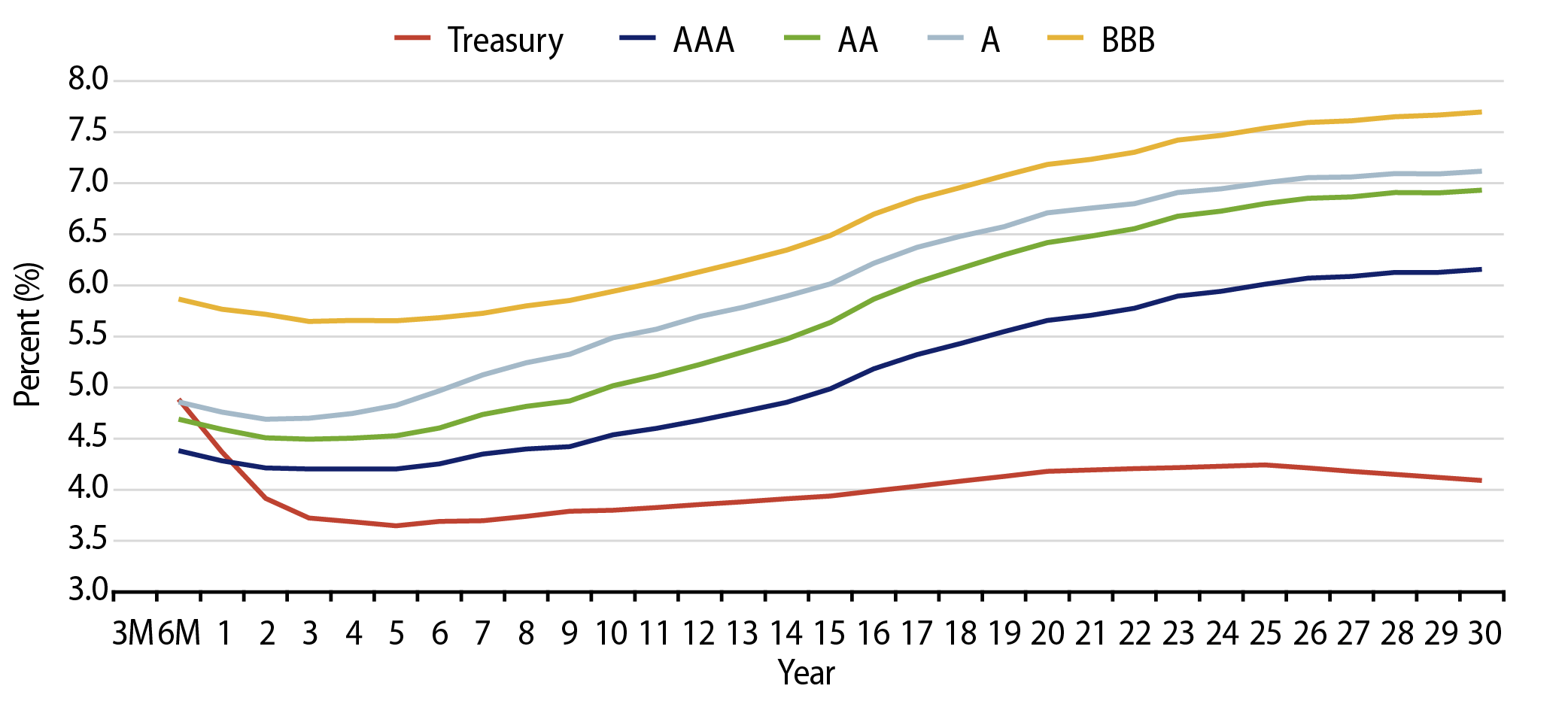

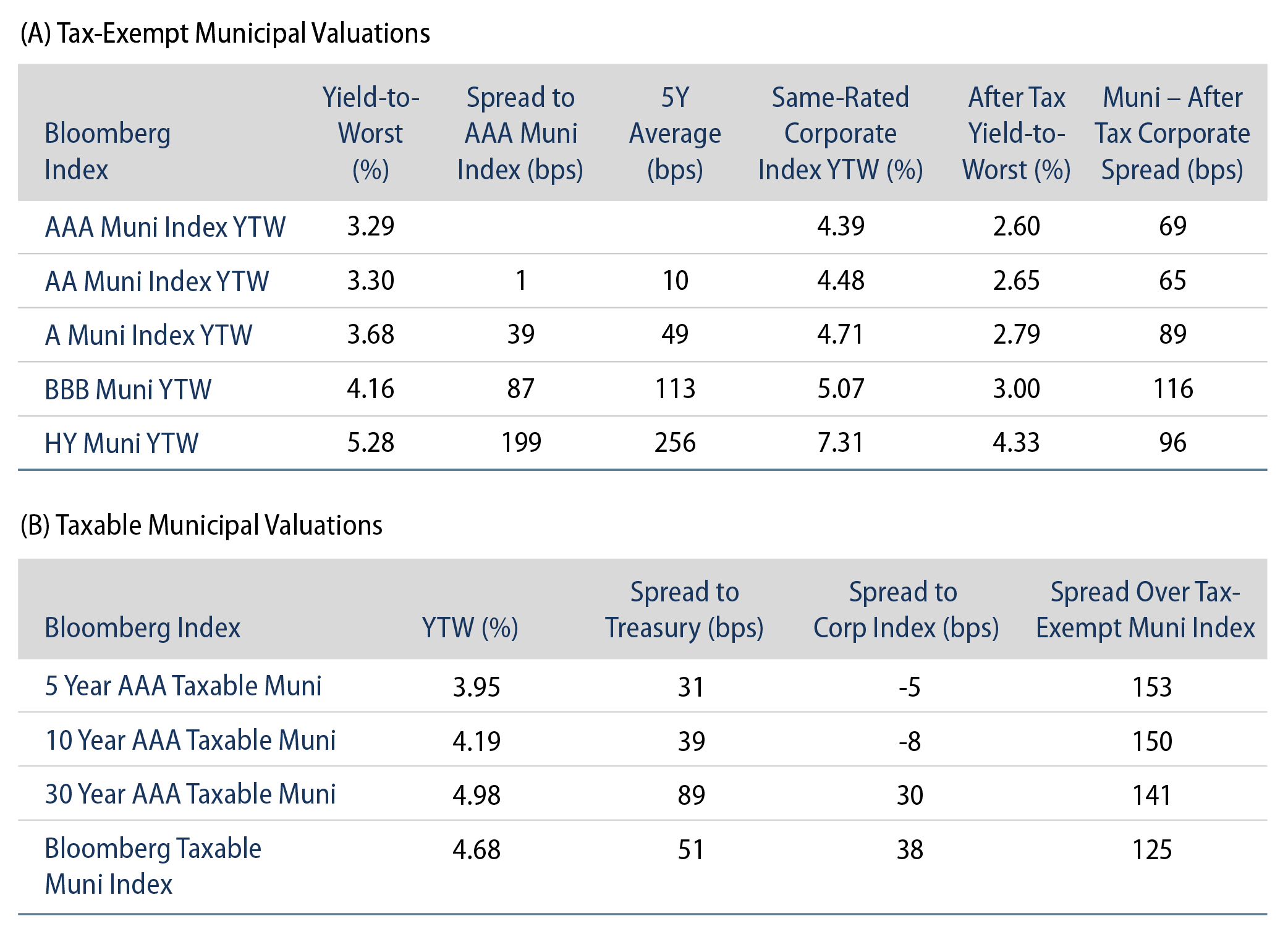

Theme #1: Municipal taxable-equivalent yields and income opportunities are above decade averages.

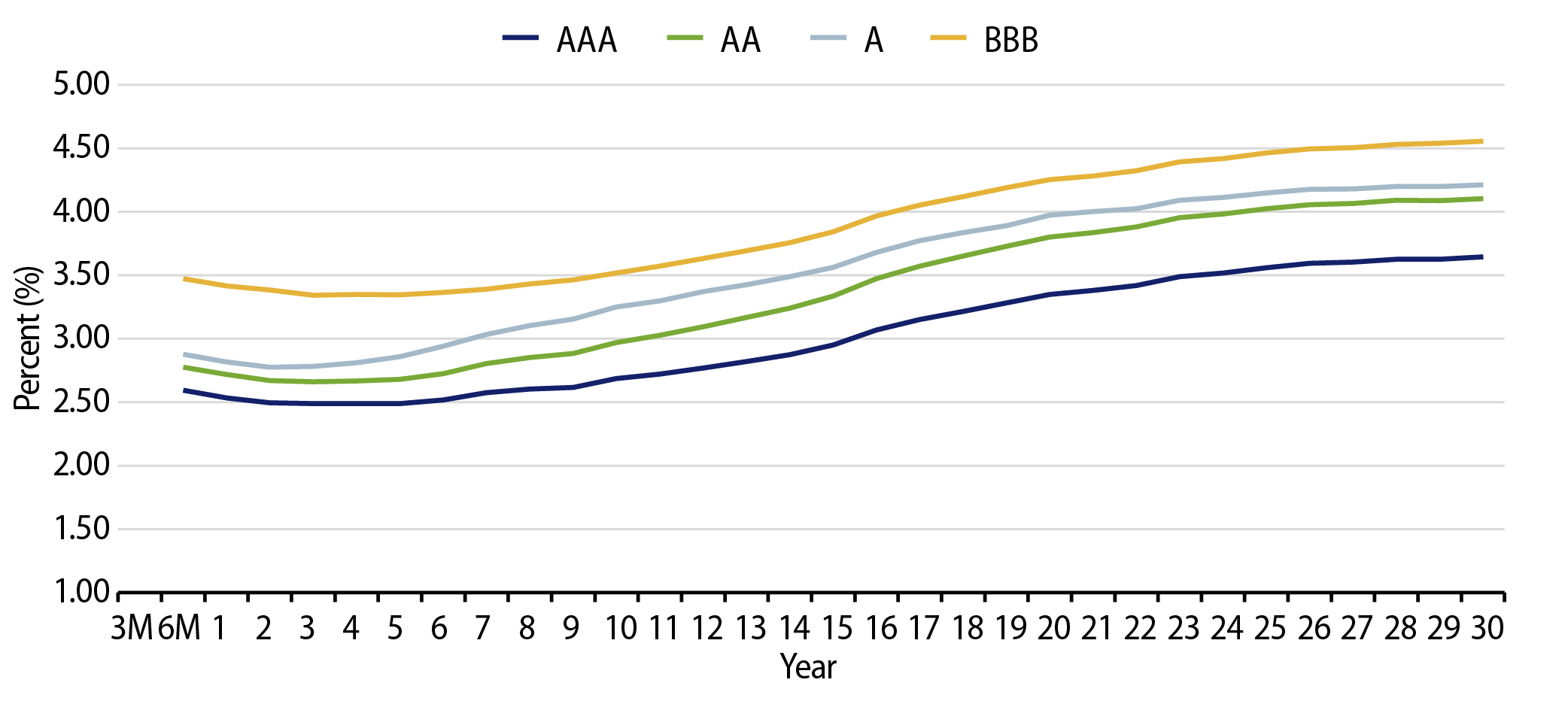

Theme #2: The muni yield curve has largely disinverted, offering potential value in extending maturities.

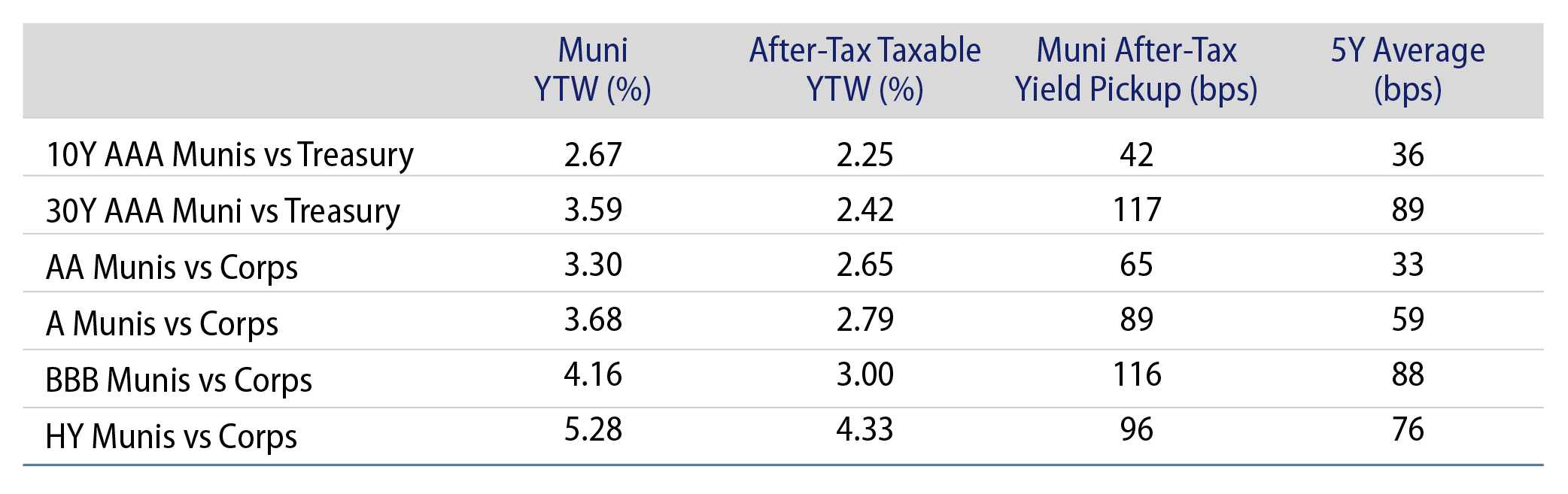

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.