Municipals Posted Negative Returns in the First Week of The Year

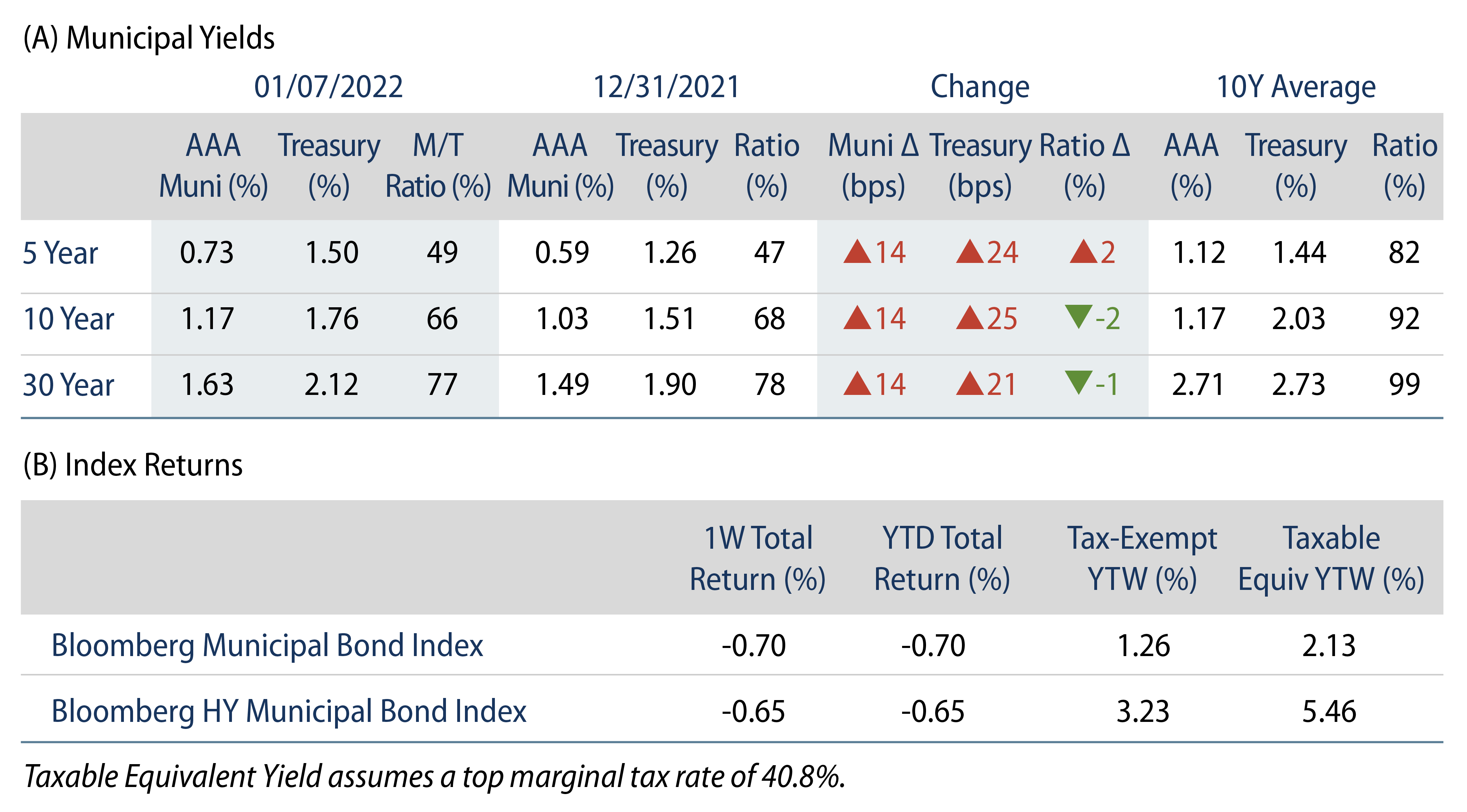

Municipals posted negative returns as high-grade yields trailed Treasuries higher. High-grade municipal yields moved 14 bps higher across the curve. While municipals trailed Treasuries higher, they continued to outperform amid favorable technical conditions. Municipal/Treasury ratios declined 1-2 bps in intermediate and long maturities. Municipal mutual fund flows continued their positive inflow streak. The Bloomberg Municipal Index returned -0.70%, while the HY Muni Index returned -0.65%. This week we highlight the implications around the Colorado wildfires.

Municipal Technicals Remained Favorable

Fund Flows: During the week ending January 5, municipal mutual funds recorded $841 million of net inflows. Long-term funds recorded $718 million of inflows, high-yield funds recorded $389 million of inflows and intermediate funds recorded $224 million of inflows. Municipal mutual funds have now recorded inflows 85 of the last 86 weeks, extending the record inflow cycle to $164 billion.

Supply: The muni market recorded approximately $3 billion of new-issue volume during the first week of the year, 29% of which was taxable. This week’s new-issue calendar is expected to increase to $5 billion, which remains below average. Largest transactions include $862 million Chicago Board of Education and $651 million State of Louisiana transactions.

This Week in Munis—Colorado Fires

At the end of December, wildfires in Boulder County, Colorado destroyed approximately 900 homes across 6,000 acres, causing thousands of evacuations and over 20,000 power outages. Winds exceeding over 100 miles per hour, coupled with record drought conditions, contributed to the intensity and rapid spread of the fires in the region that led to over $500 million in estimated damages.

The wildfires highlight evolving climate risks faced by state and local municipalities. While climate disasters can undoubtedly cause short-term economic disruptions, federal aid and insurance helps the recovery of traditional local government entities’ tax bases. However, an increased frequency of climate issues in Colorado could have a greater effect on development district (Met District) bonds, which are often smaller issuers that are highly reliant on assessed value growth to fully fund debt service. Because Met Districts are typically smaller and rely on concentrated revenue streams, the risk of assessed value loss is greater than traditional general obligation bonds that benefit from more diverse revenues and stronger reserves. We would expect development districts that are fully developed and established to remain relatively resilient through climate challenges such as December’s fire, given that homeowners would be likely to rebuild as soon as possible. However, early stage development districts would be vulnerable to extended delays as initial demand would be negatively impacted by the disaster. Disruption in contractors and supplies during recovery periods, particularly considering current supply-chain issues, could also be contributing factors to delays in recovery and payment of debt service.

To date, traditional municipal issuance has remained relatively resilient to climate challenges, largely due to federal aid and diverse revenue streams of municipalities. Because historical default instances associated with climate change have been limited, we have not observed bond prices reflect climate risks when these disasters arise. However, as climate disasters increase in frequency and cost, risk dynamics could evolve and have an outsized impact on select issuers or sectors. As such we believe it is prudent to monitor climate risks as part of an independent credit assessment and avoid material climate risks when not reflected in bond prices.