Investment-Grade Municipals Posted Positive Returns

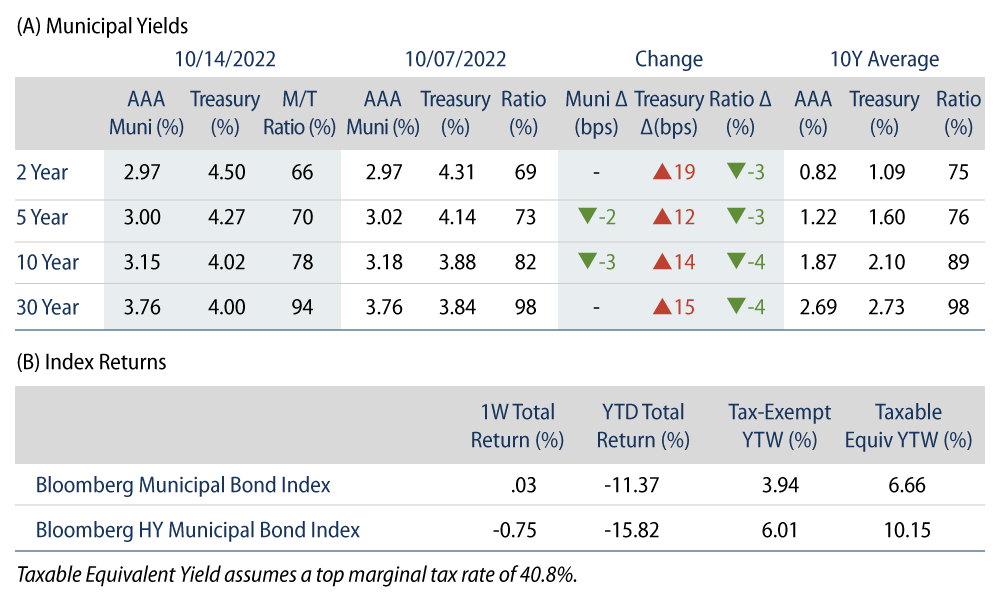

Investment-grade municipals posted positive returns last week amid continued rate volatility. High-grade municipal yields moved 2-3 bps lower in short and intermediate maturities. Municipals outperformed Treasuries, which reacted to higher than anticipated inflation data. Meanwhile, municipal outflows continued against a backdrop of light supply conditions. The Bloomberg Municipal Index returned 0.03% while the HY Muni Index returned -0.75%, as high-yield outflows were elevated during the week. This week we touch upon Chicago’s fiscal 2023 budget release, which highlights continued credit improvement.

Year-to-Date Municipal Fund Outflows Extend Past $100 Billion

Fund Flows: During the week ending October 12, weekly reporting municipal mutual funds recorded $2.3 billion of net outflows, according to Lipper. Long-term funds recorded $1.2 billion of outflows, high yield funds recorded $420 million of outflows, and intermediate funds recorded $518 million of outflows. The week’s outflows mark the tenth consecutive week of outflows and extend YTD outflows to $101 billion.

Supply: The muni market recorded $2.9 billion of new-issue volume last week, down 40% from the prior week. Total YTD issuance of $302 billion is 16% lower from last year’s levels, with tax-exempt issuance trending 5% lower year-over-year (YoY) and taxable issuance trending 49% lower YoY. This week’s new-issue calendar is expected to increase to $7.5 billion. Larger deals include $1.5 billion Commonspirit Health and $1.1 billion State of Connecticut Special Tax Revenue transactions.

This Week in Munis: Chicago Brings Budget

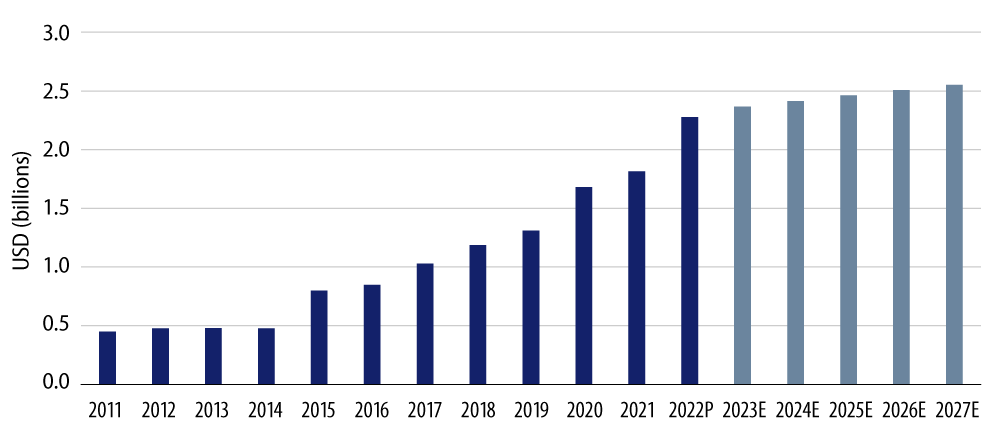

Earlier this month, Chicago Mayor Lori Lightfoot released a $5.1 billion fiscal 2023 budget. Consistent with the revenue trends observed across state and local governments this year, the budget release highlighted higher than anticipated revenues for the current fiscal year ending this December, tracking 1.7% higher than the prior amended budget and contributing to a projected $134 million surplus.

For the upcoming fiscal year 2023, the city projects revenues to climb an additional 2.0% to $5.0 billion, primarily driven by an increase in property tax revenue. The budget outlines 4.1% of increased spending, focused on additional funding for public safety, mental health and city modernization.

Additionally, Chicago continues its commitment to fund its challenged pension system, which has been and remains a credit detractor considering its 25% funded status. To address this issue, the fiscal 2023 budget increases pension contributions $334 million (or 13%) year-over-year to $2.6 billion across its four funds, double the level of five years prior (fiscal 2018). This will also include $242 million in advanced pension payments that is on top of scheduled increases, and the city comments that it plans to implement a policy for future advanced pension contributions going forward.

The budget will now go to the City Council for review. Western Asset remains optimistic on the credit trajectory of Chicago and we view the fiscal 2023 budget as another step in the right direction. Demonstrated fiscal discipline, including an ongoing commitment to fund actuarial pension contributions, a strategic utilization of federal funding and overall deleveraging have supported the city’s credit profile. However, we remain mindful of headwinds that remain, including higher crime, a sluggish return of tourism, outmigration trends, and significant pension underfunding that will continue to burden the city’s finances. Considering the recent spread widening amid this year’s broader market volatility, Western Asset believes investors are better compensated for these downside risks.