Municipals Posted Positive Returns

Munis posted positive returns last week and outperformed Treasuries, which moved lower on geopolitical tensions and more dovish Federal Reserve rhetoric. High-grade municipal yields moved lower across the curve, and technicals remained challenged amid fund outflows. Consumer Price Index (CPI) data came in higher than expected at 0.4% year-over-year (YoY) but core inflation was lower, at consensus levels of 0.3% month-over-month (MoM). The Bloomberg Municipal Index returned 1.22% during the week, the High Yield Muni Index returned 1.78% and the Taxable Muni Index returned 1.45%. This week we highlight a key driver of challenged municipal demand this year: competition from nominal cash yields.

Fund Outflows Continued Last Week

Fund Flows: During the week ending October 11, weekly reporting municipal mutual funds recorded $781 million of net outflows, according to Lipper. Long-term funds recorded $236 million of inflows, high-yield funds recorded $134 million of outflows and intermediate funds recorded $218 million of outflows. This week's outflows bring year-to-date (YTD) net outflows to an estimated $14.7 billion.

Supply: The muni market recorded $7 billion of new-issue volume last week, down 9% from the prior week. YTD issuance of $282 billion is down 6% YoY, with tax-exempt issuance marginally higher and taxable issuance down 41% YoY. This week's calendar is expected to jump to $13 billion. Large transactions include $1 billion New York City TFA and $875 million State of Connecticut transactions.

This Week in Munis: Cash Competition

Following last year's near-record negative returns that drove attractive nominal yields and relative value, demand has not returned to the muni market this year. Short-term cash yields above 5% have contributed to this dynamic as munis now face greater competition with money markets and Treasury bills to support a conservative portfolio allocation. iMoneyNet reported that money market fund inflows were nearly $1 trillion YTD, while municipal mutual fund outflows reached $15 billion YTD, according to Lipper. Although flows may suggest otherwise, we provide three key reasons why municipals could be more attractive for investors subject to tax rates.

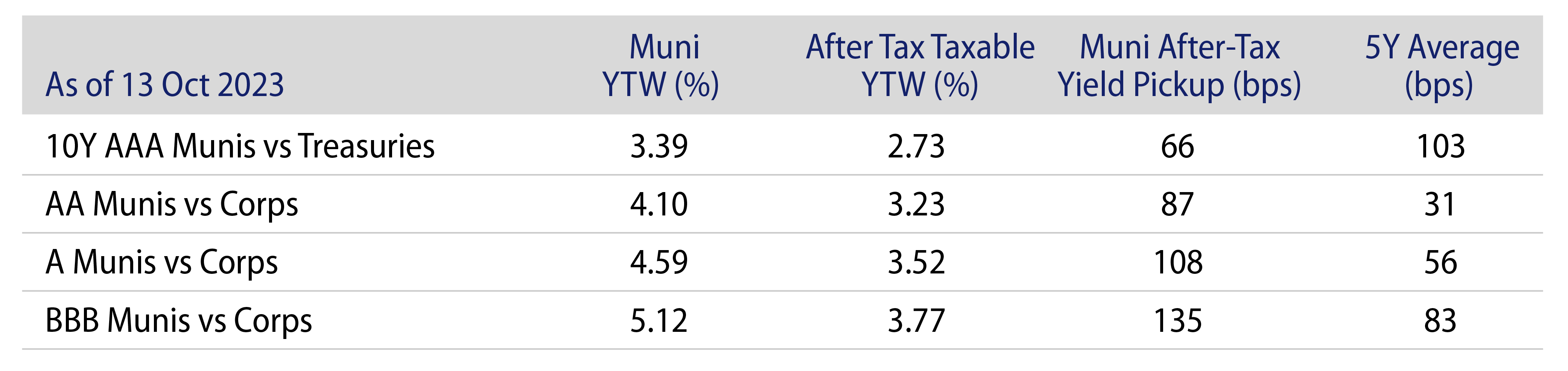

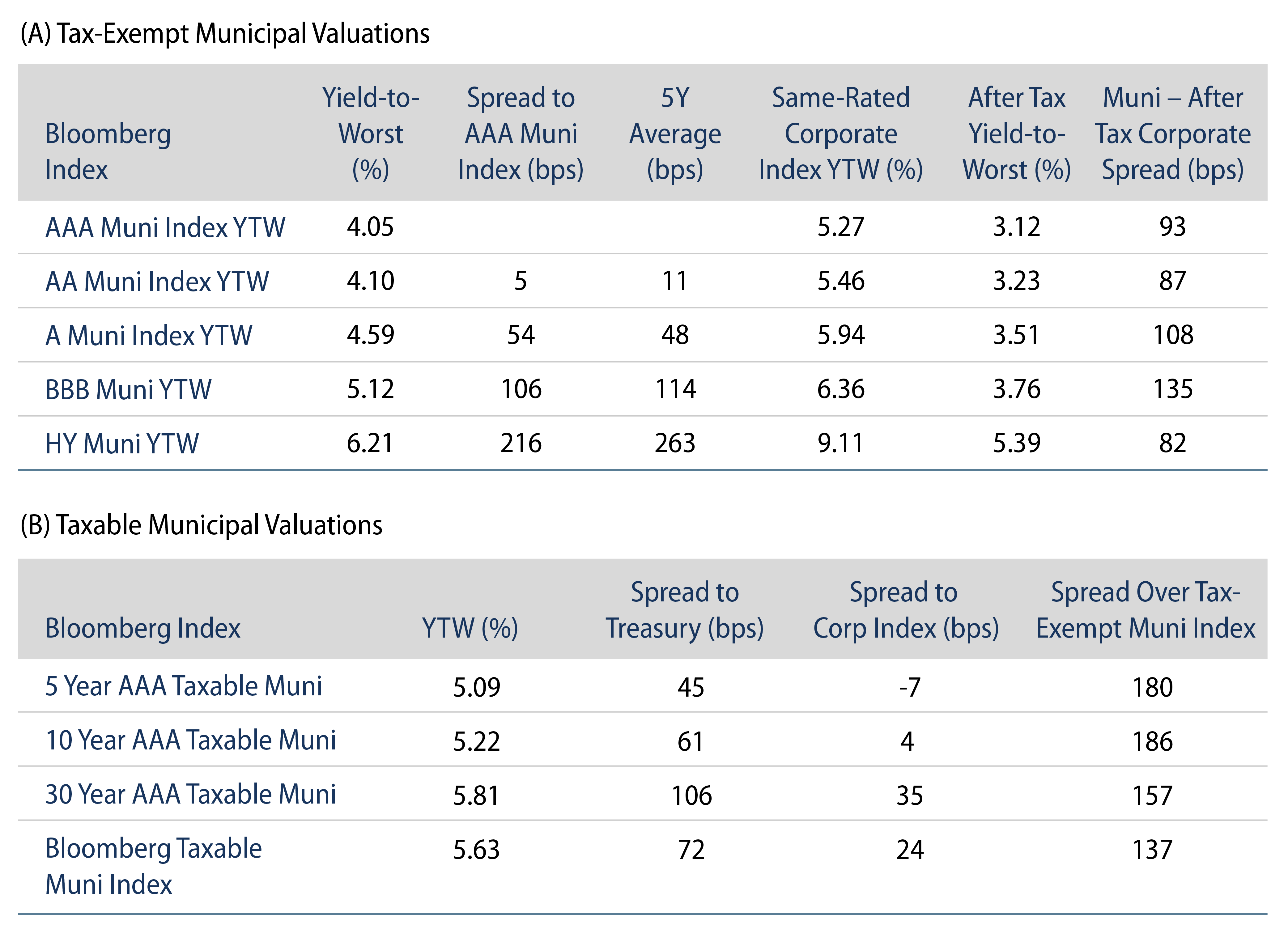

Reason #1: Munis Could Offer Better After-Tax Income Opportunities

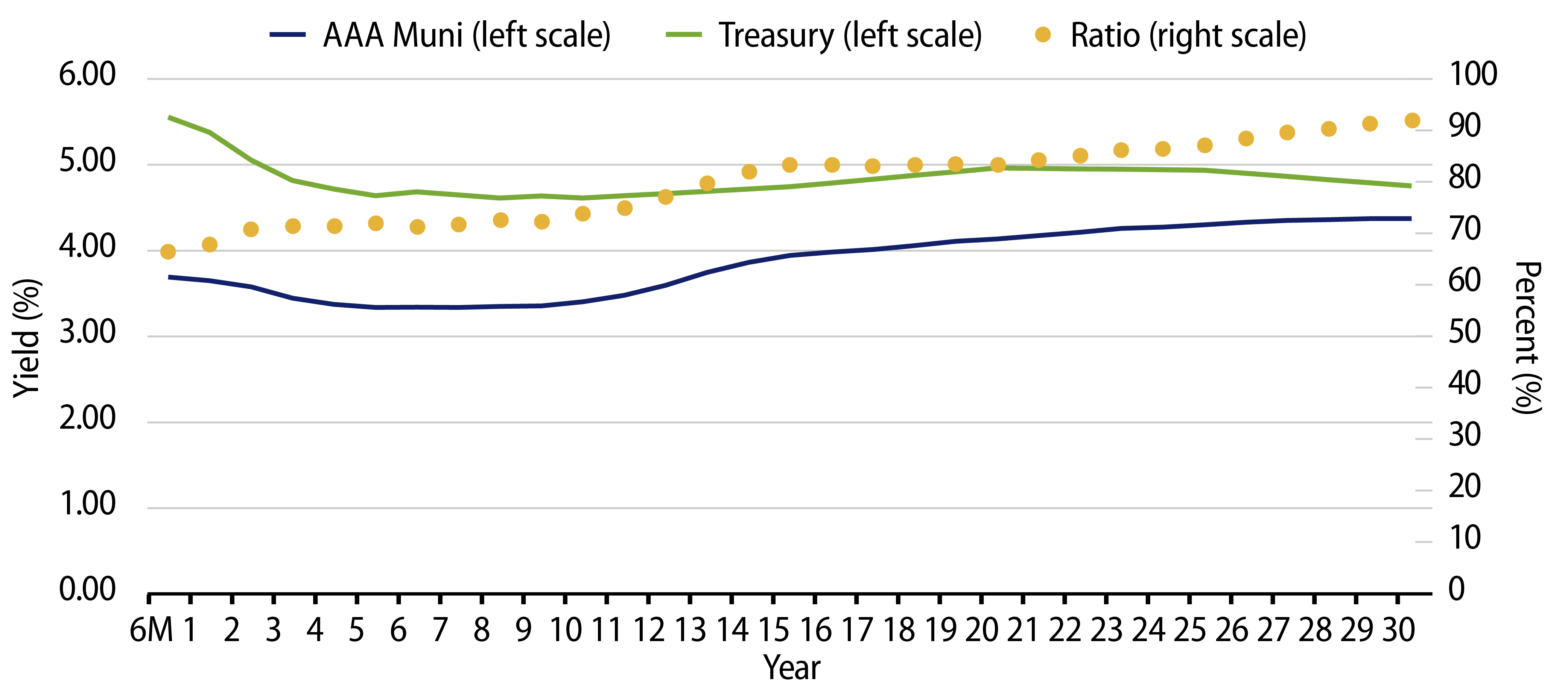

While nominal yields of greater than 5% have attracted cash to Treasuries and money markets, municipals often provide better after-tax return potential for high tax payers. Whether staying at the very short end of the curve or extending duration to lock in longer-term income levels, high-grade municipals offer better after-tax income opportunities and municipal after-tax yield pickup remains above recent averages.

Reason #2: Lower Reinvestment RiskWhile the inverted yield curve can offer attractive short-term income opportunities, investors focused on the very short part of the curve can miss longer-term income opportunities. Investors may enjoy above average income levels in three to 12 months; however, they could face challenged reinvestment opportunities if short-end rates do decline as current forward market pricing projects. Exhibit 2 highlights the 2-year taxable equivalent income difference between investing in the 12-month Treasury bill for two consecutive years (considering forward rates) and the 2-year AAA municipal yield.

Notably, in 2021 the Bloomberg Municipal Bond Index yield-to-worst (YTW) averaged 1.0%, and municipal investors allocated a record $105 billion to muni mutual funds. Given the potential for favorable market technicals, investors could be missing a longer-term income opportunity as the average index yield reached 4.3% last week (7.2% taxable equivalent).

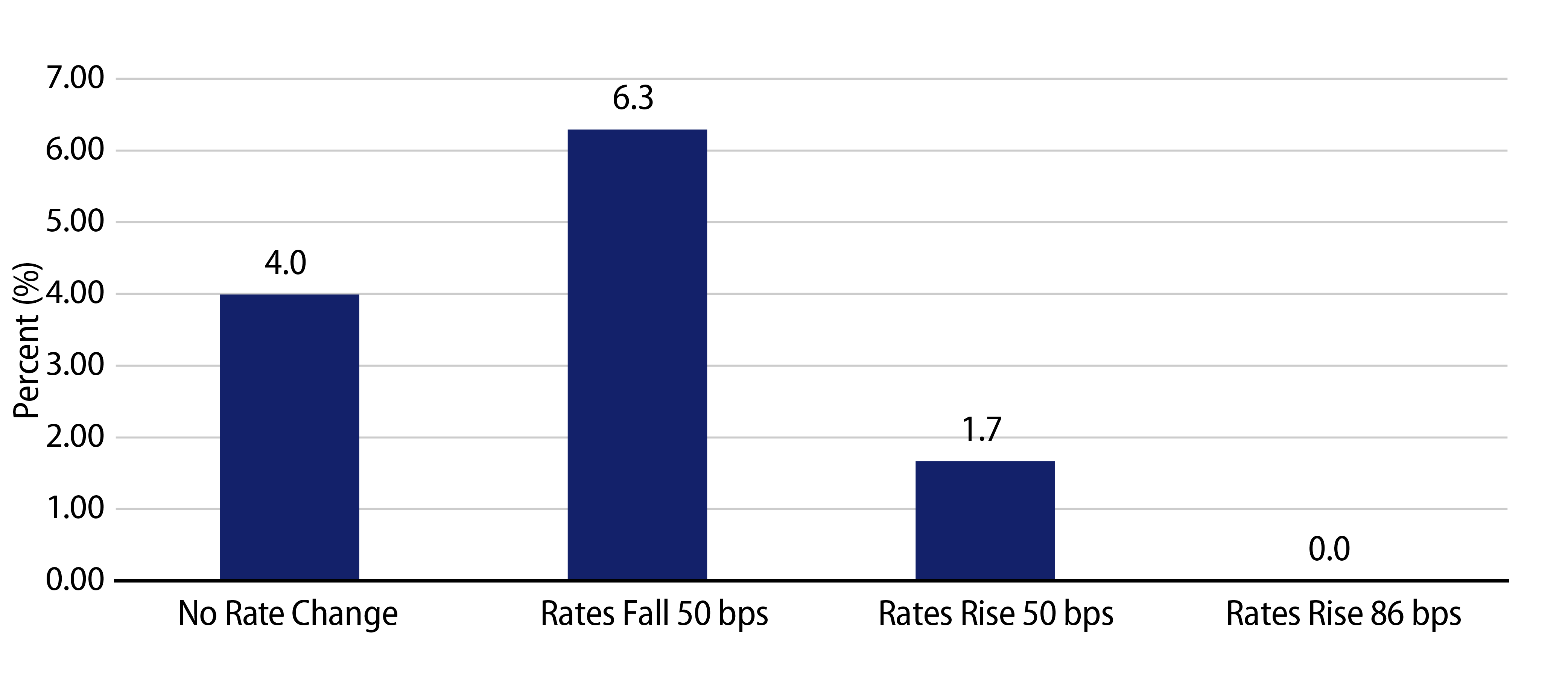

Reason #3: Higher Yields and Income Can Cushion Downside Risk and Contribute to Capital AppreciationWe expect a higher yield environment to contribute to a higher income component of total returns than what has been observed in recent years. This additional income advantage could provide support if rates move higher. Considering the 1-15 Year Bloomberg Municipal Index yield and duration of 4.0% and 4.6 years, respectively, rates would need to rise 86 bps across the curve just for the index to offer a breakeven, or return of 0.0%.

The market is pricing Treasury rates to move lower next year. Assuming both no change and 50-bp rate decline scenarios, all else equal, the 1-15 year muni index would return 4.0% and 6.4%, respectively (not considering the muni tax advantage).

In summary, Western Asset believes that for high tax payers, attractive after-tax income, lower reinvestment risk and downside protection offered by current income levels could provide for better opportunities than cash alternatives. Actively managed muni solutions can also tactically take advantage of value in the short end of the yield curve as it persists, while helping clients opportunistically move further out the curve as valuations shift.

Key Themes

Theme #1: Municipal Index Yields and Taxable Equivalent Yields Are Above Decade Highs

Theme #2: Inverted Curve Offers Barbell Opportunities for Active Strategies

Theme #3: Munis Offer Attractive After-Tax Yield Pickup vs. Corporate Credit