Macros, Markets and Munis

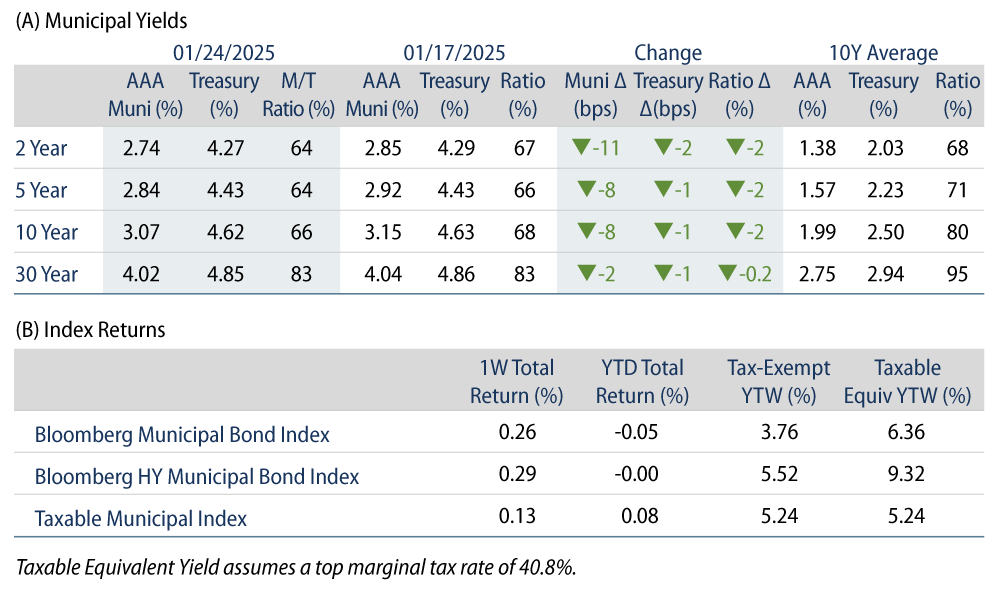

Munis posted positive returns last week as yields decreased. Fixed-income yields moved modestly lower amid weaker services Purchasing Managers’ Index (PMI) and consumer sentiment data. Muni yields outperformed Treasuries across the curve against a backdrop of improved demand from both SMAs and funds, which recorded an uptick in inflows last week. Meanwhile, technicals strengthened as fund flows turned positive. This week we highlight the Los Angeles regional wildfires and their potential implications on muni credit. Before delving into the details, we want to first acknowledge the human toll of these fires and the profound impact they have had on many of our team members, our loved ones and our broader community.

Technicals Strengthen as Fund Flows Turn Positive

Fund Flows (up $2.0 billion): During the week ending January 22, weekly reporting municipal mutual funds recorded $2 billion of net inflows according to Lipper. Long-term funds recorded $1.5 billion of inflows, intermediate funds recorded $215 million of inflows, and high yield funds recorded $556 million of inflows. Last week’s inflows led year-to-date inflows higher to $3 billion.

Supply (YTD supply of $11 billion): The muni market recorded $11 billion of new issue supply last week, modestly lower from the prior week but still relatively elevated versus longer-term averages. So far through January, the muni market has recorded $31 billion of new issuance, predominantly comprised of tax-exempt issuance. This week’s calendar is expected to decline to $10 billion. The largest deals include $1.1 billion Oklahoma Turnpike Authority and $836 million Columbus Regional Airport Authority transactions.

This Week in Munis: California Fires

The devastating wildfire damage in Los Angeles will likely represent one of the costliest disasters in the nation’s history, with some estimates surpassing $250 billion. Investor attention has understandably turned to affected municipalities’ ability to manage through the costs of recovery, revenue disruptions and potential liabilities. While headlines and near-term uncertainty could drive price volatility of impacted issuers, the municipal market has a favorable history of managing through significant natural disasters. We expect the Los Angeles regional economy and affected issuers to recover and support municipal debt.

Notable significant natural disasters since 2000 include Hurricane Katrina in 2005 ($201 billion in damages according to NCEI), Hurricane Harvey in 2017 ($160 billion), Hurricane Ian in 2022 ($120 billion) and the Butte County Camp Fire in 2018 ($100 billion). During these events, municipalities received a significant degree of federal and state aid to maintain budgetary flexibility and avoid any material payment default among traditional tax-supported and public utility debt. It is typical to see downgrades and negative ratings watches during these events. Notably, during the November 2018 Camp Fire, S&P identified 10 school districts as downgrade candidates, but only one school district was downgraded a single notch to A-/Negative despite losing its entire facilities.

Considering the size and diversity of the Los Angeles tax base, as well as the economic importance to the region, we expect affected municipal issuers to emerge from the disaster with limited implications to long-term municipal credit. At this juncture, we estimate less than 5% of affected issuer-assessed valuations or customer bases to be impacted. We also expect significant federal and state support to help uphold credit conditions through the recovery period. However, we recognize the potential for downgrade risks considering that the potential legal liability can surface around the fire ignition or response which have yet to be officially established. So far this month, S&P downgraded Los Angeles Department of Water and Power from AA- to A, citing litigation concerns. All three major agencies have placed the city of Los Angeles and Los Angeles Department of Water and Power on a negative watch or outlook.

While the wildfire damage in Los Angeles is significant, the historical resilience of municipal issuers and anticipated federal and state support provides a basis for cautious optimism and potential opportunities for California investors. Western Asset has always considered issuer vulnerabilities to natural disasters in its credit research process. While we anticipate headlines to drive a potential for widening spread and price volatility among select issuers over the near-term, the potential for price overreactions could lead to longer-term opportunities within the California municipal debt complex.

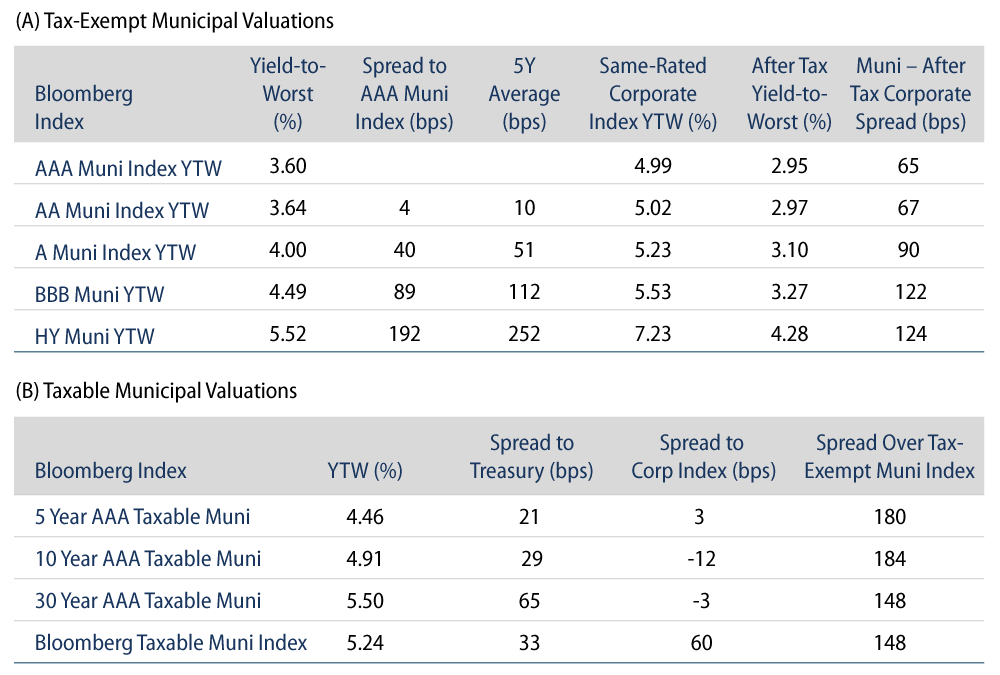

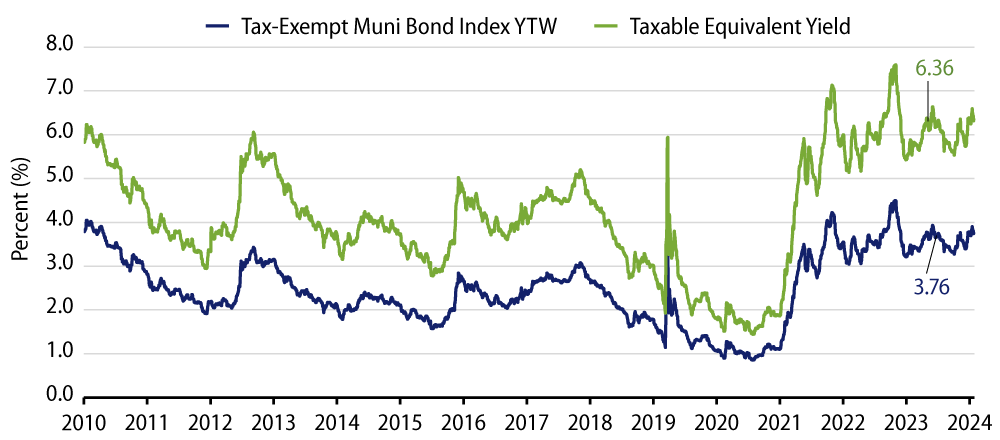

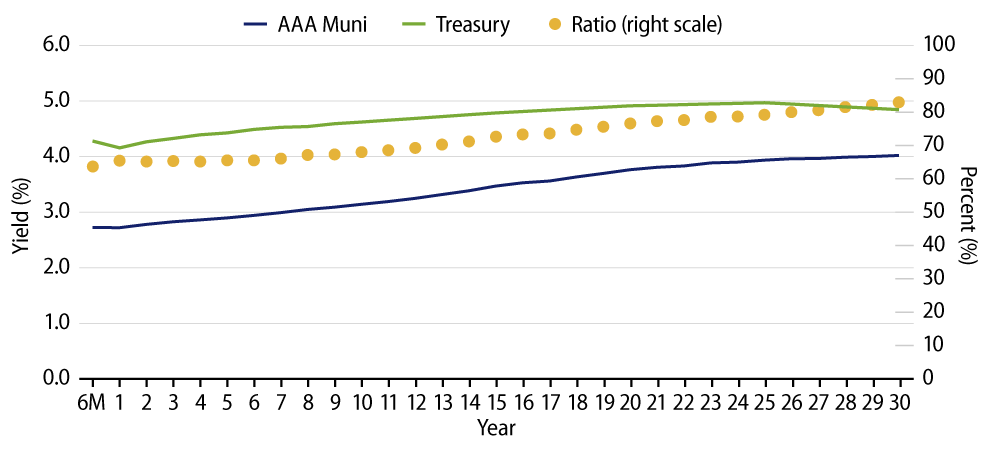

Municipal Credit Curves and Relative Value

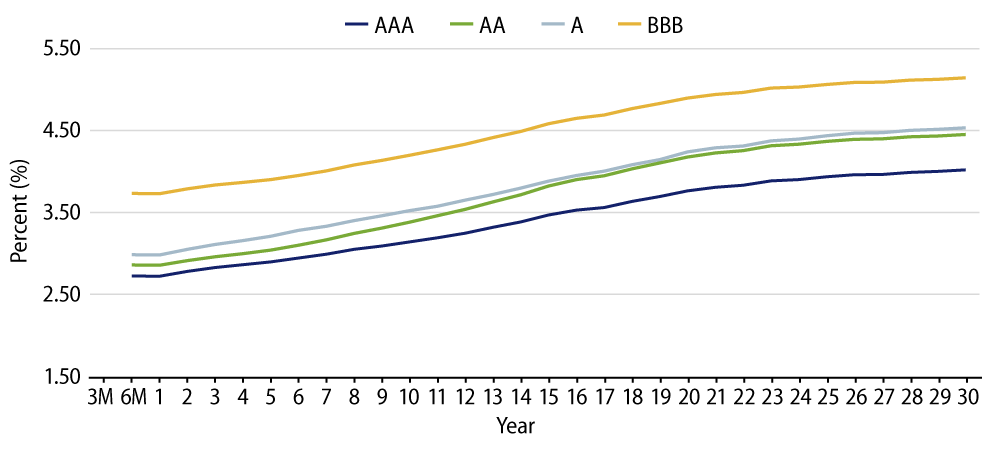

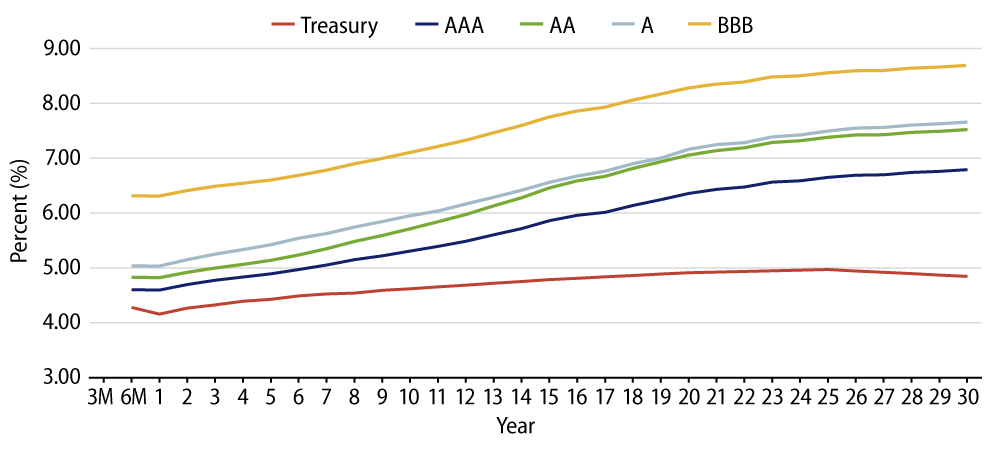

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

Theme #2: The muni curve has steepened, offering better roll-down value further out the curve.

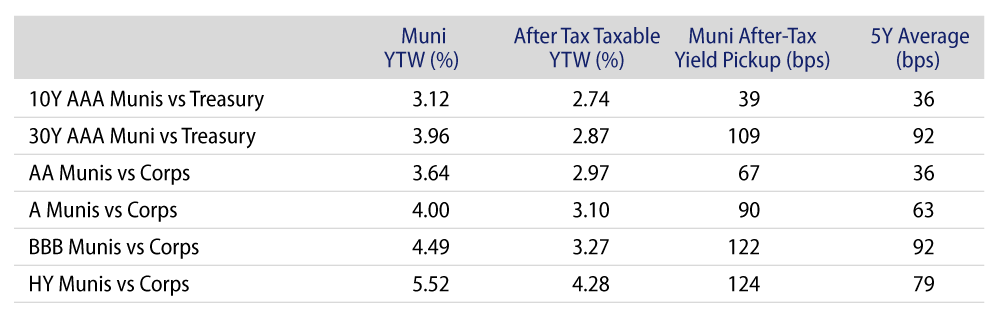

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.