Municipals Relatively Unchanged During the Week

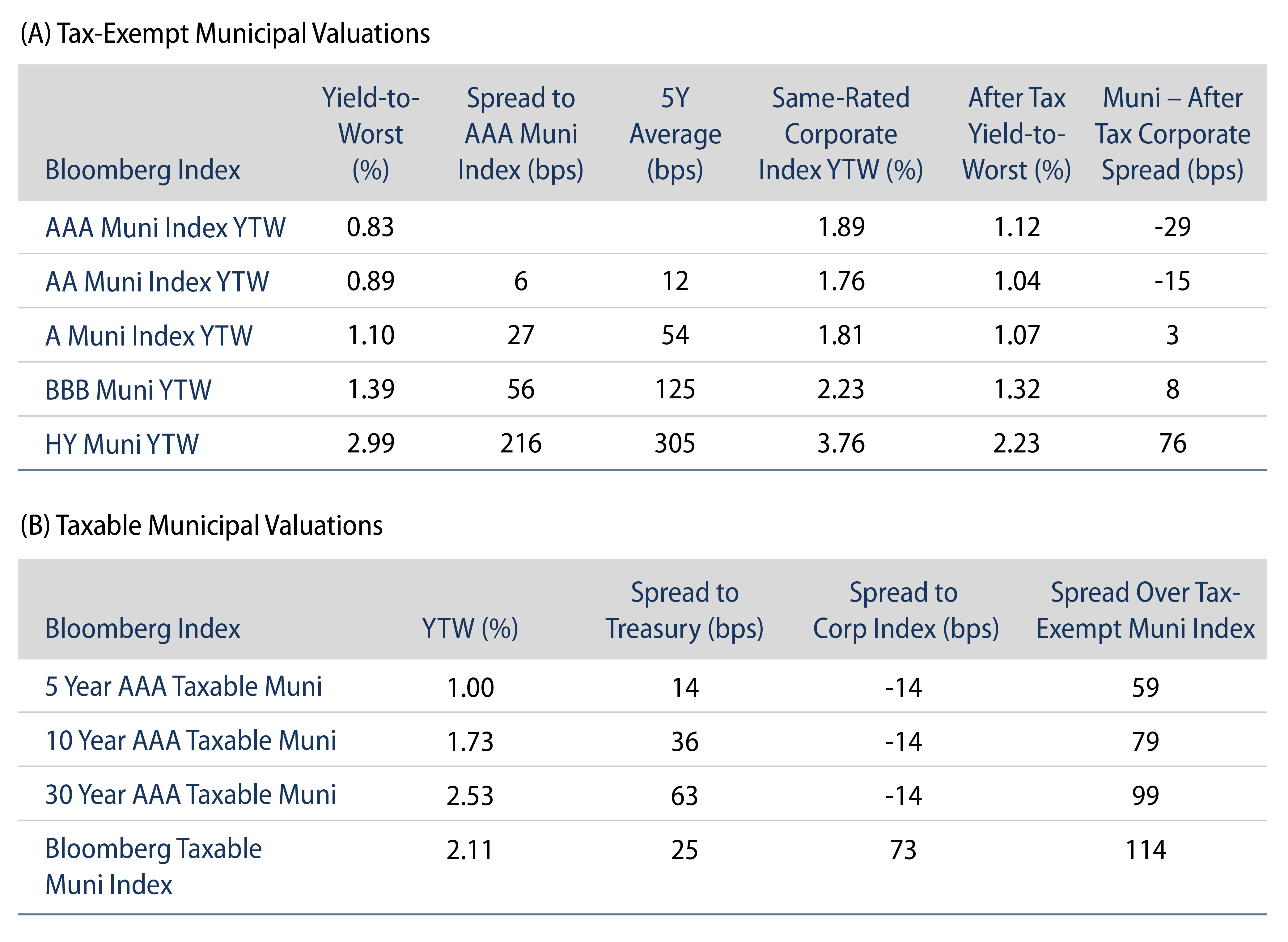

Municipals were relatively unchanged during the week and fund flows maintained a record pace. AAA muni yields moved 1 basis point (bp) higher in long maturities. Munis outperformed Treasuries in short and intermediate maturities. The Bloomberg Municipal Index returned 0.01%, while the HY Muni Index returned -0.06%. This week we evaluate the key municipal bond provisions included in the House Ways and Means Committee’s advancement of the Build Back Better Act.

Municipal Supply and Demand Technicals Remain Strong

Fund Flows: During the week ending September 15, municipal mutual funds recorded $1.3 billion of net inflows. Long-term funds recorded $968 million of inflows, high-yield funds recorded $338 million of inflows and intermediate funds recorded $178 million of inflows. Municipal mutual funds have now recorded inflows 69 of the last 70 weeks, extending the record inflow cycle to $148 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $86.5 billion.

Supply: The muni market recorded $13.8 billion of new-issue volume during the week, up 103% from the prior holiday-shortened week. Total issuance YTD of $326 billion is 5% higher from last year’s levels, with tax-exempt issuance trending 15% higher year-over-year (YoY) and taxable issuance trending 19% lower YoY. This week’s new-issue calendar is expected to decline to $9.1 billion of new issuance. The largest deals include $1.1 billion California Housing Finance Agency and $750 million Department of Airports of the City of Los Angeles transactions.

This Week in Munis: Building Back Better Municipal Market Supply

Last week the House Ways and Means Committee advanced legislation containing key tax and municipal bond provisions as part of the Build Back Better Act. The legislation, if enacted, could unlock hundreds of billions of dollars of new issuance across tax-exempt and taxable municipal markets. The legislation also includes significant tax increases for individuals and corporations that could bolster demand for municipal securities.

Tax-Exempt Market Impact

The legislation reverses the repeal on tax-exempt advanced refundings, which we believe could be the most impactful for municipal market supply. Annual tax-exempt issuance declined nearly 20%, or $74 billion, since the 2017 Tax Cuts and Jobs Act revoked tax-exempt advanced refundings. We estimate that such a reversal could bring up to $100 billion in additional tax-exempt issuance in 2022 (+30% of calendar year 2020 levels). In addition to the reinstatement of tax-exempt advance refundings, the legislation also includes an expansion of the small issuer exception and expansion of Private Activity Bonds (PABS), both of which would be positive for new issuance.

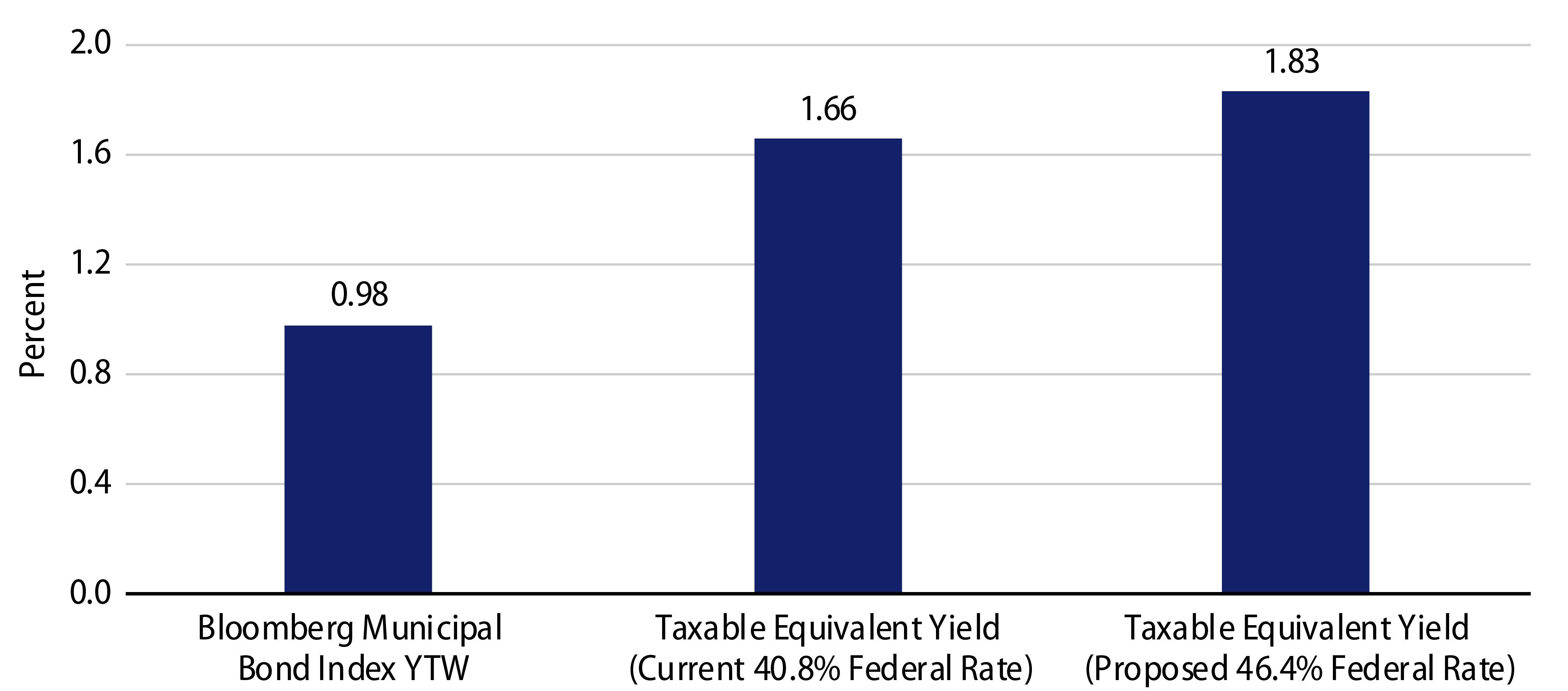

We believe that higher tax-exempt issuance should be well received, especially considering the “pay-fors” within the legislation, which increase the top marginal federal tax rate to the Obama-era 39.6% level, and also institutes a 3.0% surtax on individuals earning above $5 million. For top earners in New York, top marginal tax rates could rise to 61.2%, increasing the value of the tax exemption from municipal debt.

Taxable Municipal Supply Impact

The legislation includes a new taxable muni direct pay program that will offer a federal subsidy payment of 35% of the interest costs from 2022 to 2024, which will decrease to 28% by 2027 and thereafter. Under the similar Build America Bonds (BABs) program under the American Recovery and Investment Act of 2009 (also a 35% subsidy), issuers sold $187 billion of BABs in 2009 and 2010, and we would anticipate a similar adoption rate from municipal issuers.

An environment of low global interest rates, paired with attractive hedging costs, continues to support global demand for taxable municipal assets. A BABs-like taxable bond incentive program would certainly be welcome, particularly if tax-exempt advanced refunding returns, given the potential for a large portion of taxable supply to shift to tax-exempt markets.

While we believe these initiatives should be constructive for both municipal supply and demand, we expect these tax reform and spending initiatives could prove challenging, considering the ongoing national pandemic recovery and the razor thin margins in the Senate.