Municipals Posted Positive Returns Last Week

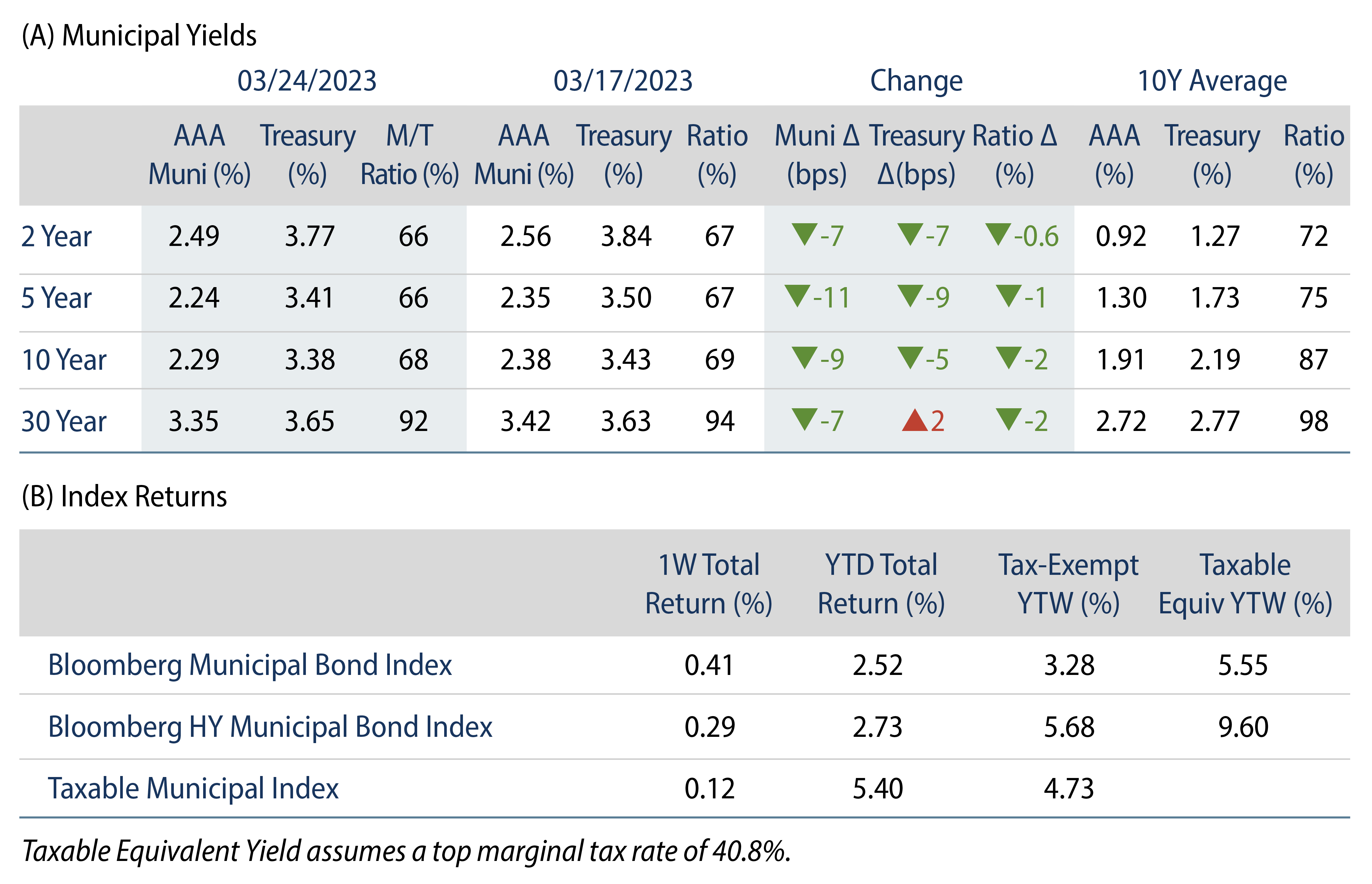

Municipals posted positive returns last week, with high-grade muni yields moving lower across the curve. Munis outperformed Treasuries amid light supply conditions. The Bloomberg Municipal Index returned 0.41% during the week, the High Yield Muni Index returned 0.29% and the Taxable Muni Index returned 0.12%. This week we highlight the potential impact that recent banking sector stress could have on the municipal market.

Muni Funds Recorded Outflows as New Issuance Declined

Fund Flows: During the week ending March 22, weekly reporting municipal mutual funds recorded $427 million of net outflows, according to Lipper. Long-term funds recorded $104 million of outflows, high-yield funds recorded $185 million of outflows and intermediate funds recorded $79 million of outflows. This week’s outflows extend year-to-date (YTD) net outflows to $1.5 billion.

Supply: The muni market recorded $4 billion of new-issue volume last week, down 45% from the prior week. YTD issuance of $70 billion is down 15% year-over year (YoY), with tax-exempt issuance down 13% YoY and taxable issuance down 23% YoY. This week’s calendar is expected to remain steady at $5 billion. Large transactions include $1.0 billion Public Utilities Commission of the City and County of San Francisco, and $456 million Black Belt Energy District transactions.

This Week in Munis: Banking Sector Stress and the Muni Market

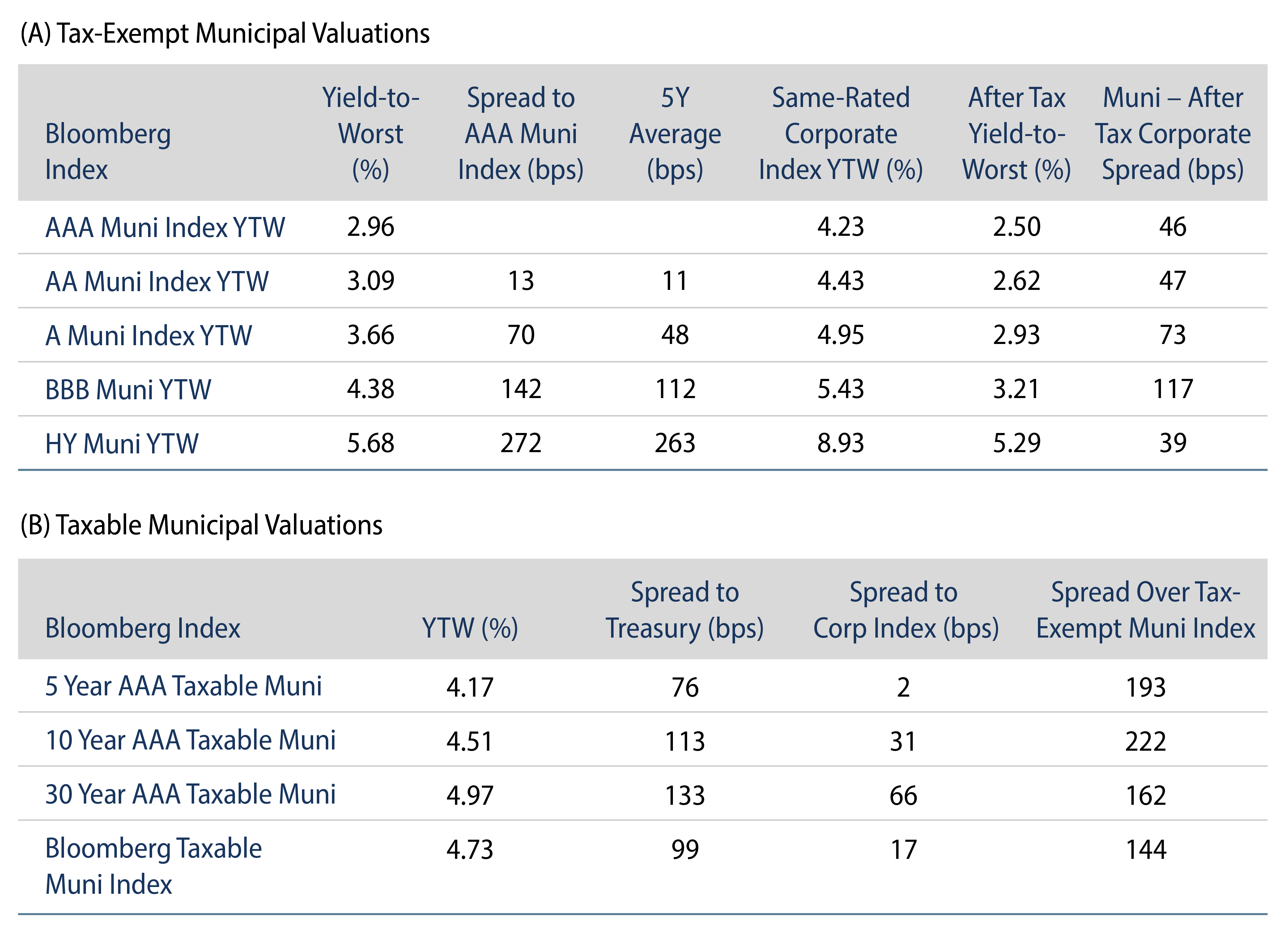

As markets have been focused on banking sector volatility, the connections between the muni market and the financial sector are multi-faceted. Primary concerns associated with the recent banking sector stress range from technical pressures that may arise due to bank selling of muni securities to the direct credit impact associated with municipal gas prepay securities and municipal variable rate demand notes (VRDNs).

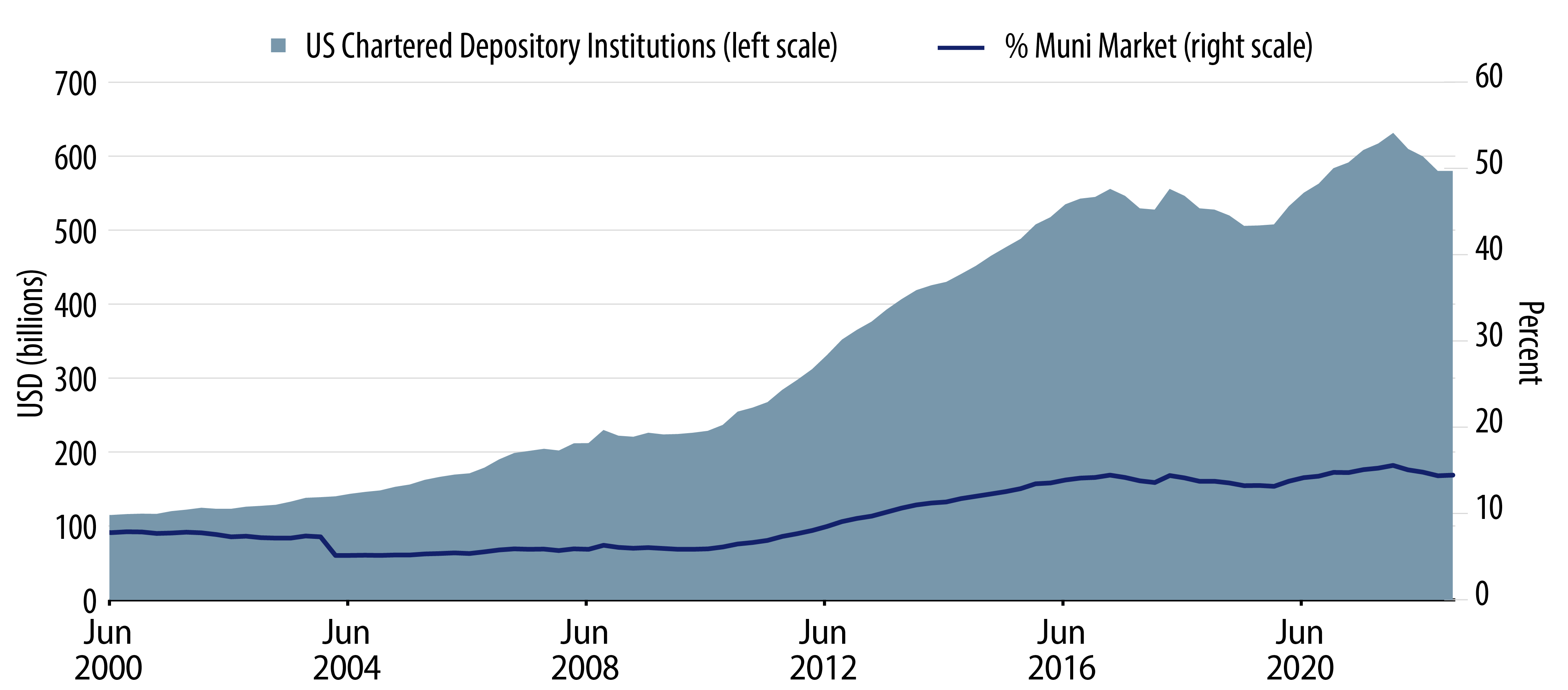

Bank Selling of Municipal Securities

Western Asset does not expect widespread selling of tax-exempt municipal securities from banking institutions. US depository institutions hold $580 billion of municipal debt, 14% of total municipal debt outstanding, according to Federal Reserve Flow of Funds data as of year-end 2022. Moreover, according to FDIC 4Q22 call report data, approximately 57% of bank muni holdings were available for sale. We are mindful of some elevated muni allocations within select regional bank entities which could lead to pockets of technical weakness if municipals were sold to improve their liquidity profile, but believe this risk is mitigated by access to the Federal Reserve liquidity window as well as the potential for mergers that could mitigate the need for forced liquidations.

Gas Prepay Municipal Securities

Gas prepay tax-exempt securities are typically secured by the credit from a financial institution, pledged via a derivatives contract that supports stable energy costs for a municipality. Notably, the credit support for gas prepay securities tends to be large high-quality US banking institutions, not regional banks or the foreign entities affected by recent banking turmoil. Large bank corporate credit spreads have gone relatively unscathed from recent banking volatility. For example, Citigroup’s liquid taxable corporate security traded 7 bps lower to 5.39% from March 10 to March 23. Meanwhile, a comparably structured, less liquid tax-exempt muni gas prepay security traded 30 bps higher over the same period. Such dislocations between municipal and corporate markets can offer value opportunities, as the after-tax yield pickup between the gas prepay muni and corporate security is now 168 bps, nearly twice the five-year average.

VRDN Liquidity

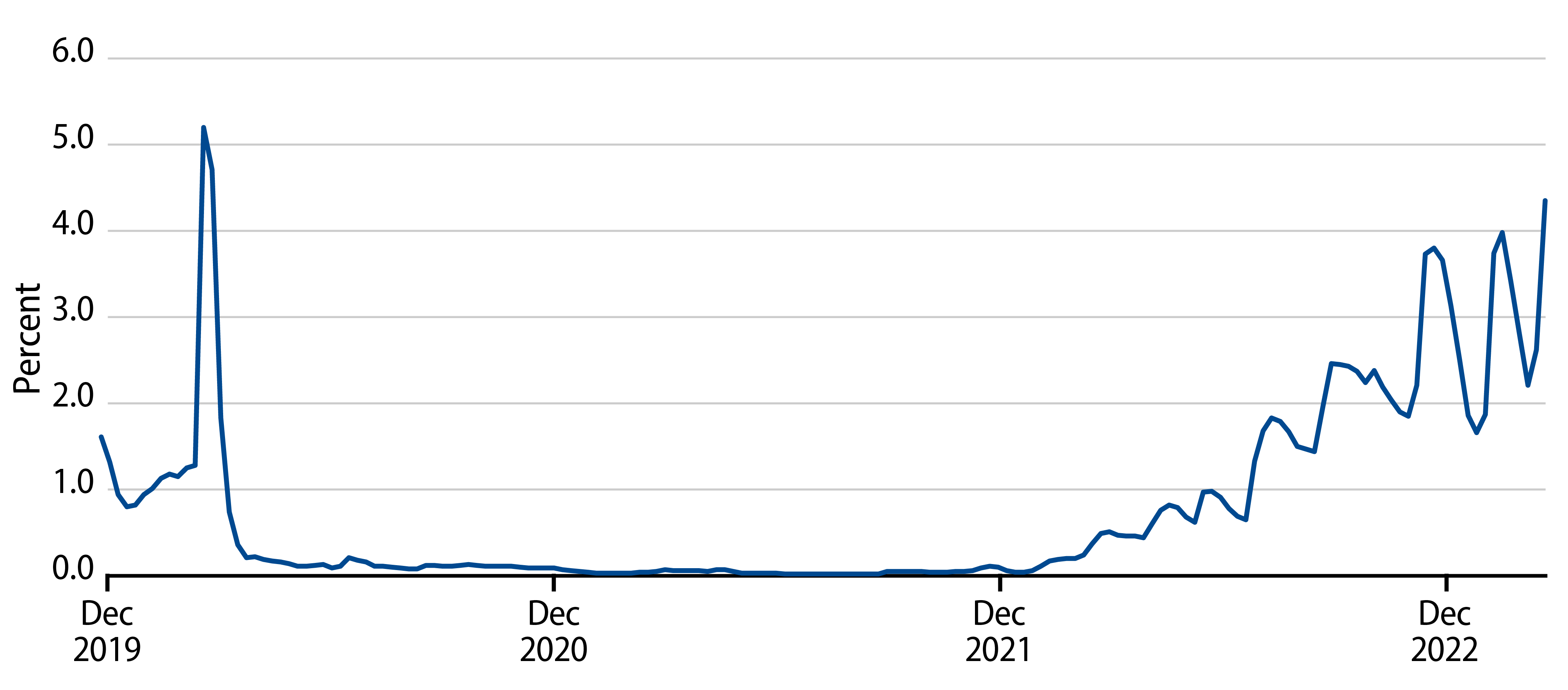

Short-term municipal VRDNs are often supported by liquidity from a letter of credit (LOC) provided by financial institutions. Banks that typically provide liquidity support to these securities also tend to be larger, healthier financial institutions, and not regional banks. We expect these entities that offer liquidity to the ultrashort muni market could potentially benefit at the expense of regional banking stress, and we do not anticipate VRDN liquidity support to deteriorate. Recent money market fund flow volatility has contributed to VRDN yield volatility, as the 7-day SIFMA index jumped to 4.35% last week, up from 1.65% observed at the end of January and equivalent to 91% of SOFR.

Muni Market Reaction

Despite the market concerns associated with the banking sector, so far the overall municipal market has reacted with a flight-to-quality sentiment, returning 1.96% for the month to date (MTD) and shunning the negative muni returns typically observed in the month of March. While we continue to monitor the potential vulnerabilities to these certain segments of the market as recent banking sector challenges evolve, up to this point the impact on the muni market appears contained.