Municipals Posted Positive Returns Last Week

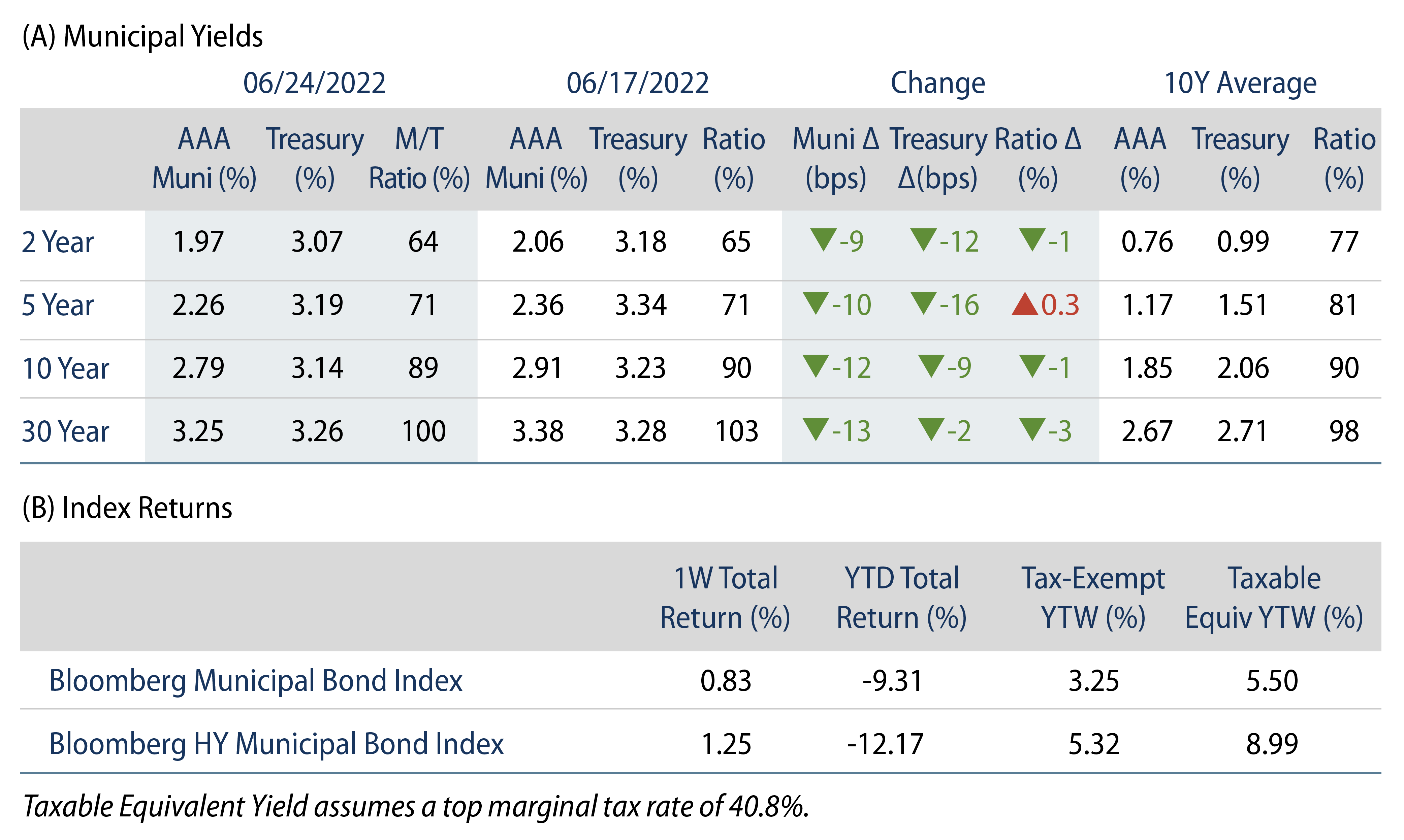

Munis posted positive returns last week and outperformed Treasuries in most maturities. High-grade municipal yields moved 9-13 bps lower across the curve while municipal mutual fund outflows continued. The Bloomberg Municipal Index returned 0.83% and the HY Muni Index returned 1.25%. This week we highlight details of first quarter tax receipts across states.

Market Technicals Remained Weak Amid Continued Mutual Fund Outflows

Fund Flows: During the week ending June 22, weekly reporting municipal mutual funds recorded $1.6 billion of net outflows, according to Lipper. Long-term funds recorded $1.1 billion of outflows, high-yield funds recorded $416 million of outflows and intermediate funds recorded $293 million of outflows. The week’s fund outflows extend the record outflow cycle to $76 billion.

Supply: The muni market recorded $7.1 billion of new-issue volume, up over 2x from the prior week. Total year-to-date issuance of $196 billion is 6% lower than last year’s levels, with tax-exempt issuance trending 3% higher year-over-year (YoY) and taxable issuance trending 35% lower YoY. This week’s new-issue calendar is expected to increase to $9 billion. Large deals include $950 million New York City Transitional Finance Authority and $700 million Triborough Bridge & Tunnel Authority transactions.

This Week in Munis: 1Q Tax Revenues Continue to Signal Strength

In recent weeks we highlighted the strong fundamental trends that have been underscored in municipal budgets and recent revenue releases. This week we peel back the top-level data to evaluate the composition of this growth by state, type of tax and what could be vulnerable to a potential economic downturn.

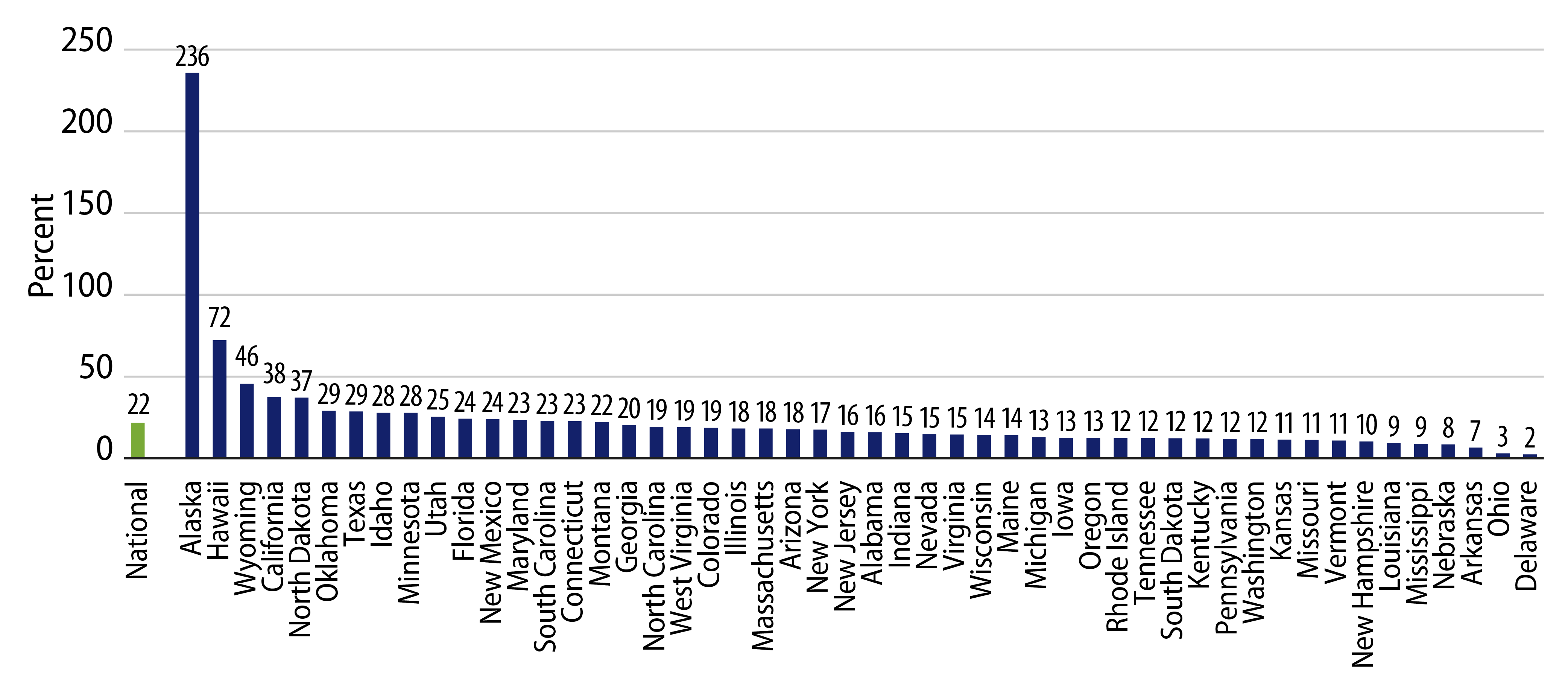

1Q22 state tax receipts were 22% higher over the 1Q21, favorably exceeding the 8.5% annual inflation rate recorded at the end of March. But revenue increases vary greatly across the states, led by outsized gains in Alaska (+236%), Hawaii (+72%) and Wyoming (+56%), while four states underperformed inflation: Nebraska (+8%), Arkansas (+7%), Ohio (+3%) and Delaware (+2%).

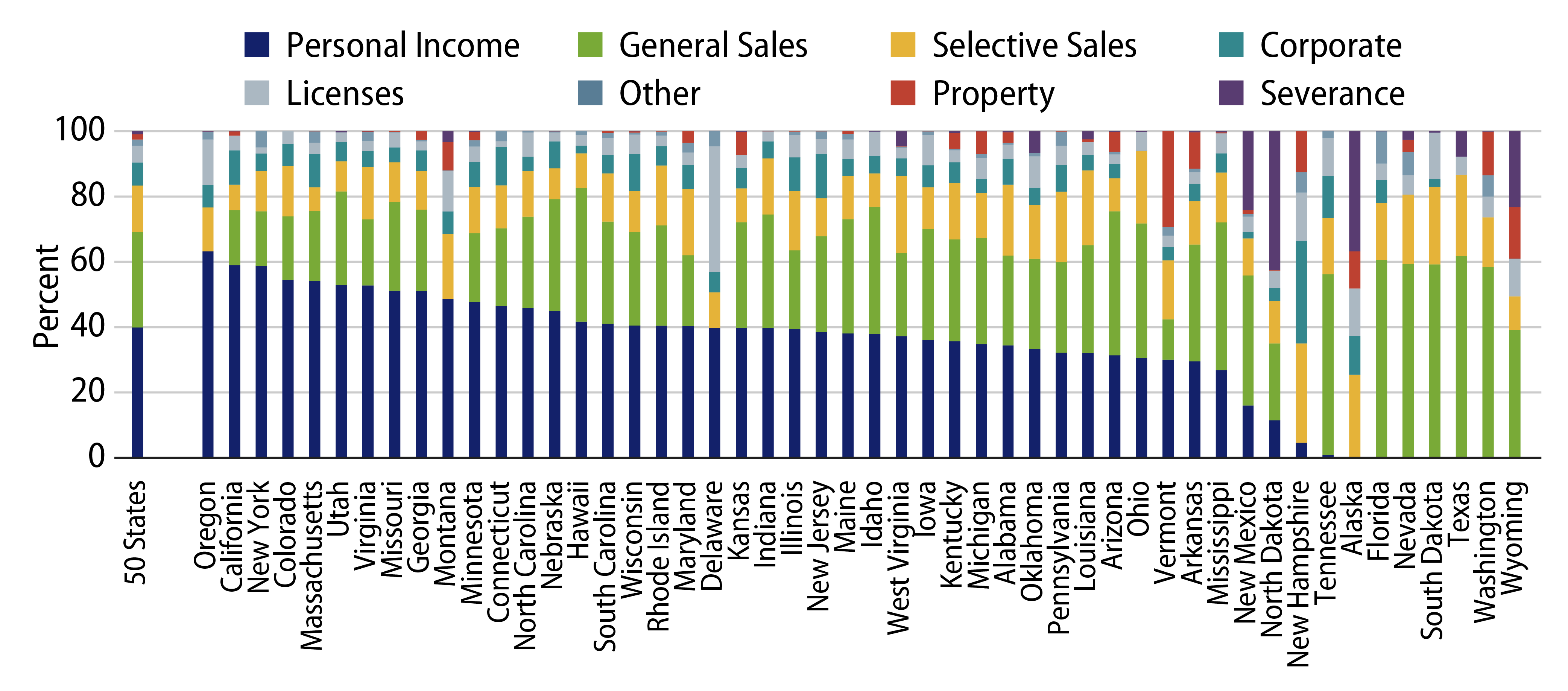

Robust tax revenue growth has been supported by a strong labor market and increasing wages. Tax revenues are higher across all categories, with personal income taxes (PIT) increasing 19%, corporate income taxes increasing by 128%, and sales taxes increasing by 19%. Notably, each state has varying exposures to these major revenue streams.

Personal income taxes (PIT) represent almost 40% of all taxes collected in the nation. Oregon is the most reliant on this source, followed by other high-tax states of California (59%) and New York (58.8%). Oregon’s PIT collections were up 15%, while California and New York PIT collections increased 21.8% and 19.4%, respectively.

Sales taxes represent the second-largest source of total tax collections at 29%. Select states such as Texas and Florida rely on sales taxes for over 60% of the tax collections (these states do not collect PIT). Continued population growth within these states and a strong consumer has led overall sales tax growth exceeding the US average.

Alaska, Wyoming and North Dakota are among the few states that derive a significant share of revenue from severance taxes (taxes on the extraction of oil and natural gas). Elevated energy prices observed this year contributed to the strong growth rates in these states, which are all in the top five of YoY total tax collection growth.

Considering the likelihood of slower economic growth as the Federal Reserve raises rates to combat inflation, Western Asset expects growth in these major revenue categories to stagnate or even decline. In addition, stock market declines we have seen could adversely impact states overly reliant on capital gains taxes, such as Oregon, California and New York. Up to this point, states have benefited from down streaming of federal capital. However, as pandemic support rolls off through 2026, we believe states will have to adjust to more typical revenue cycles. Western Asset believes revenue diversity, strong budgeting practices and prudent reserves will be key to sustaining credit strength in the next economic cycle.