Municipals Posted Positive Returns Last Week

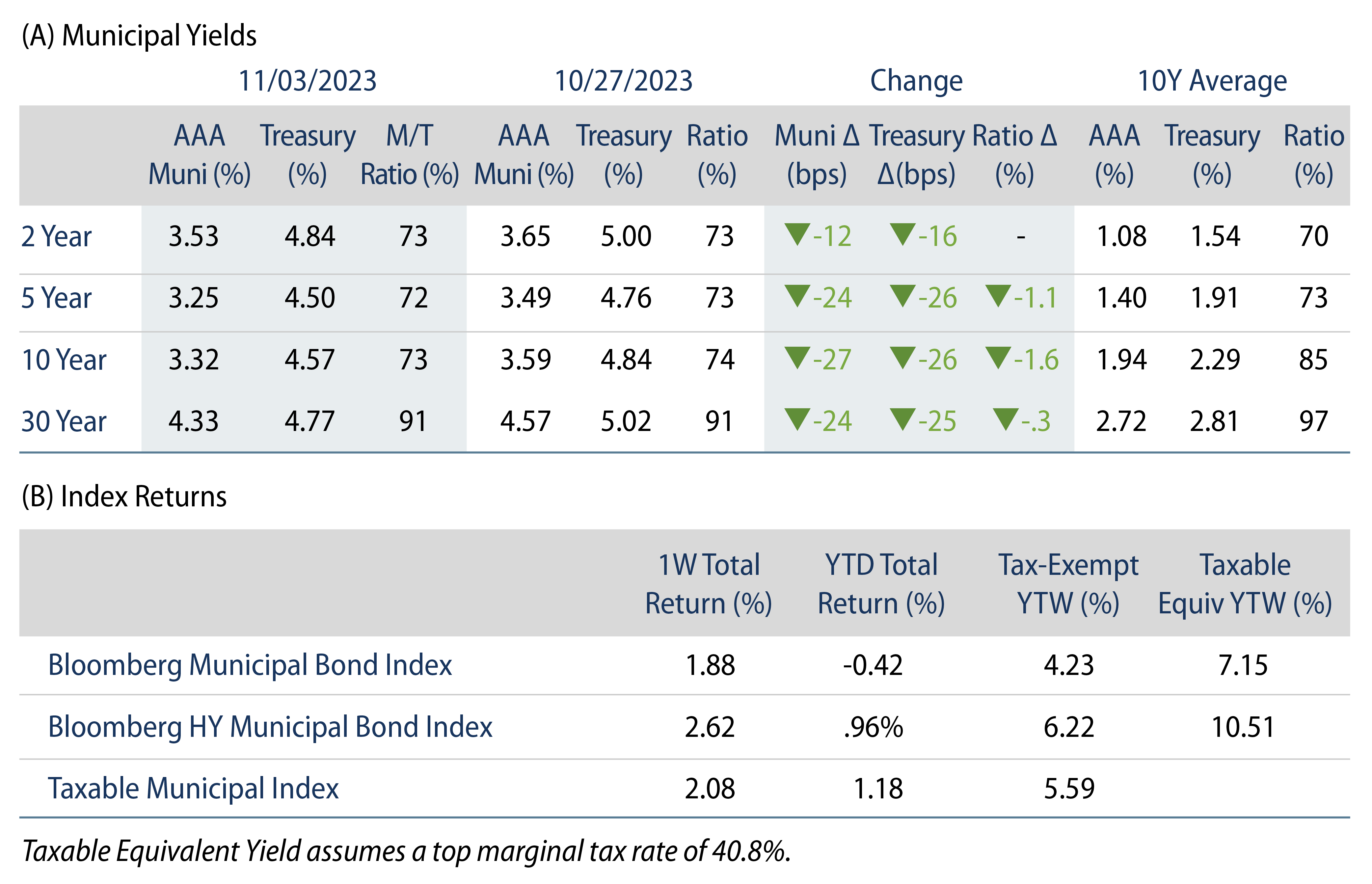

Munis rallied with Treasuries during the week amid the Treasury slowing debt issuance, the Federal Reserve keeping rates unchanged and lower-than-anticipated nonfarm payrolls data. Meanwhile, outflows continued while supply was light relative to recent weeks. The Bloomberg Municipal Index returned 1.88% during the week, the High Yield Muni Index returned 2.62% and the Taxable Muni Index returned 2.08%. This week we highlight election day implications for munis.

Muni Outflows Continue to Weigh on Market Technicals

Fund Flows: During the week ending November 1, weekly reporting municipal mutual funds recorded $1.5 billion of net outflows, according to Lipper. Long-term funds recorded $933 million of outflows, high-yield funds recorded $190 million of outflows and intermediate funds recorded $171 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to an estimated $9 billion.

Supply: The muni market recorded $4 billion of new-issue volume last week, down 66% from the prior week’s level. YTD issuance of $306 billion is down 2% year-over-year (YoY), with tax-exempt issuance 4% higher and taxable issuance down 38% YoY. This week’s calendar is expected to drop to $3 billion. Large transactions include $1.2 billion District of Columbia Income Tax and $650 million Arizona Salt River Project Agricultural Improvement and Power District transactions.

This Week in Munis: Election Day Measures

Election day can lead to tax and bonding initiatives for state and local governments, which can inform municipal supply, demand and relative value dynamics. Given the odd election year absent major presidential or congressional races, this year’s headlines are relatively limited, but we find several initiatives still worth tracking.

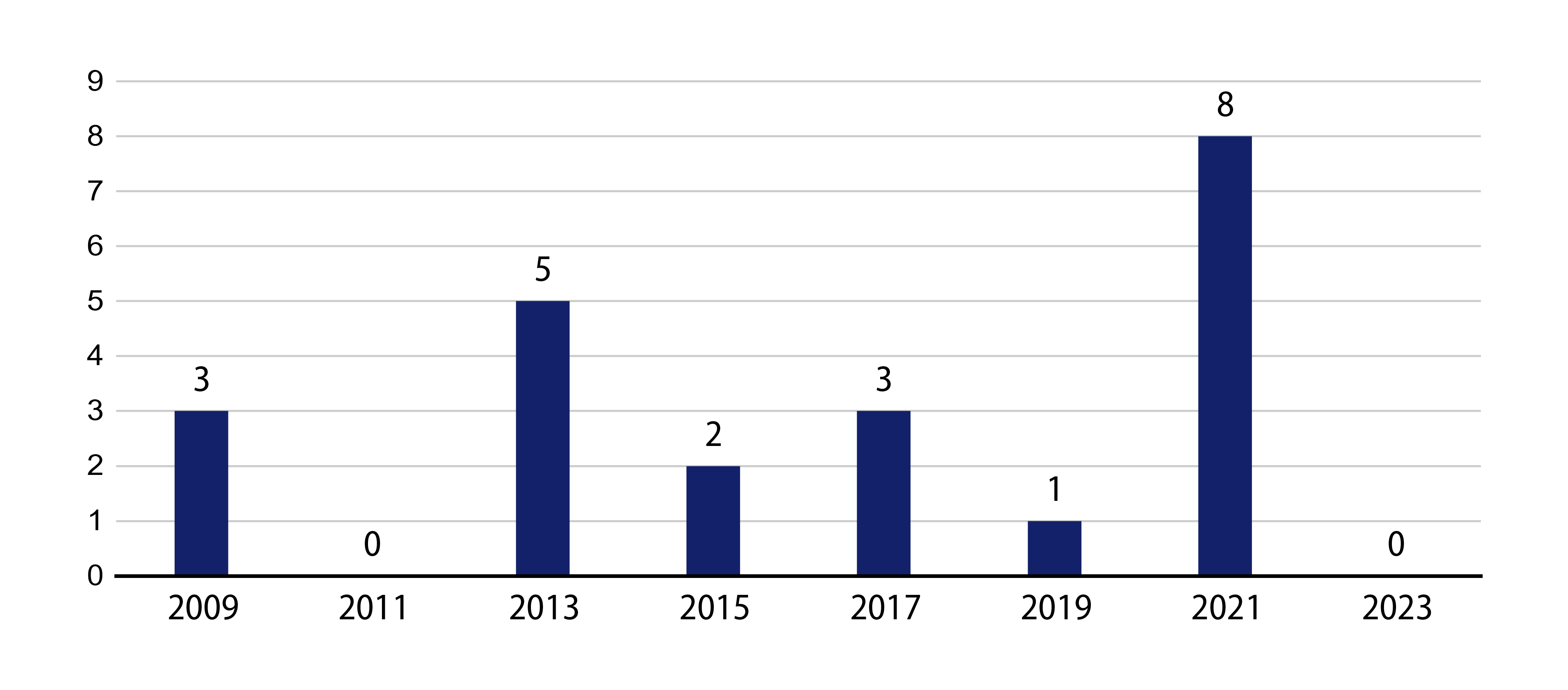

From a statewide bond initiative perspective, Ballotpedia.com reports zero statewide bonding initiatives, below the 10-year average during odd election years (three during 2011-2021) and down from the eight observed in 2021. The lack of statewide initiatives signals the potential that below-average new-issue supply could persist in the tax-exempt muni market.

At the local level, however, there are some notable bonding initiatives including record school district issuance on the ballot in Texas. According to Bloomberg, Texas school districts are asking for voter approval of $26 billion bonds, marking a record level in an odd-year election cycle. If the Texas school district bonds on this year’s ballot are an indicator of higher capital needs and issuance going forward, it would compound the record Texas school district issuance that emerged this year following the IRS expansion of the Permanent School Fund.

There are also tax rate measures on this year’s ballot that could impact municipal credit fundamentals. Notably in California, a constitutional amendment is on the ballot which would reduce the supermajority vote requirement from 66.7% of the vote to 55.0% for local jurisdictions to issue bonds or impose special taxes (e.g., sales tax, transaction tax or parcel tax) for affordable housing and public infrastructure projects. This would increase the taxing authority of California’s local governments to approve important housing and public safety projects, but could also contribute to outmigration concerns, considering California already bears the highest marginal tax rate (13.3%) among states. Given the vague definition of “public infrastructure” and lackluster support from the governor, we expect the likelihood is low that this will pass.

While headline initiatives may appear muted during this off-year election cycle, these measures highlight how ongoing public policy developments can continue to influence future supply dynamics and credit fundamentals within the municipal market.

Western Asset Key Themes for Muni Investors

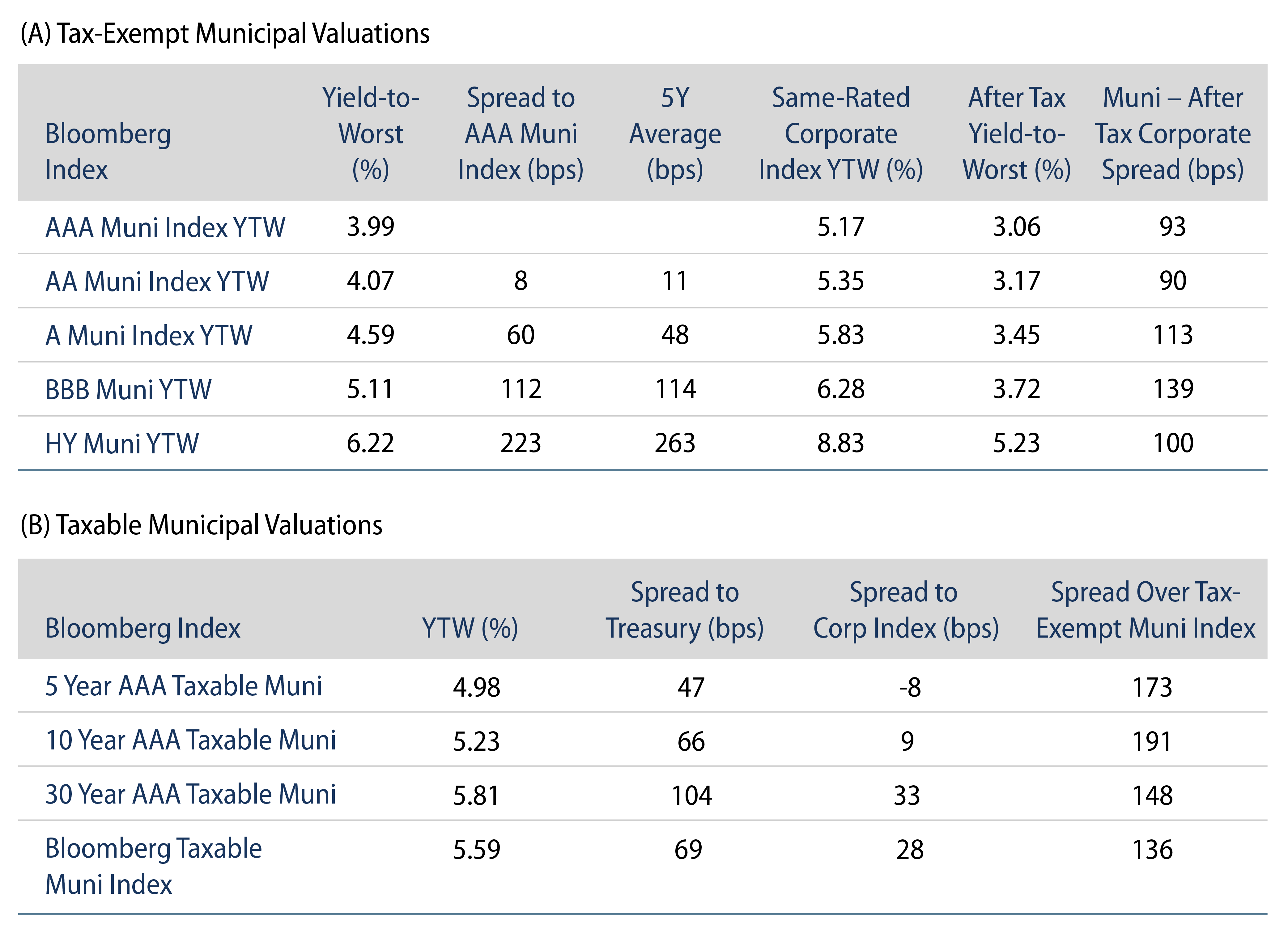

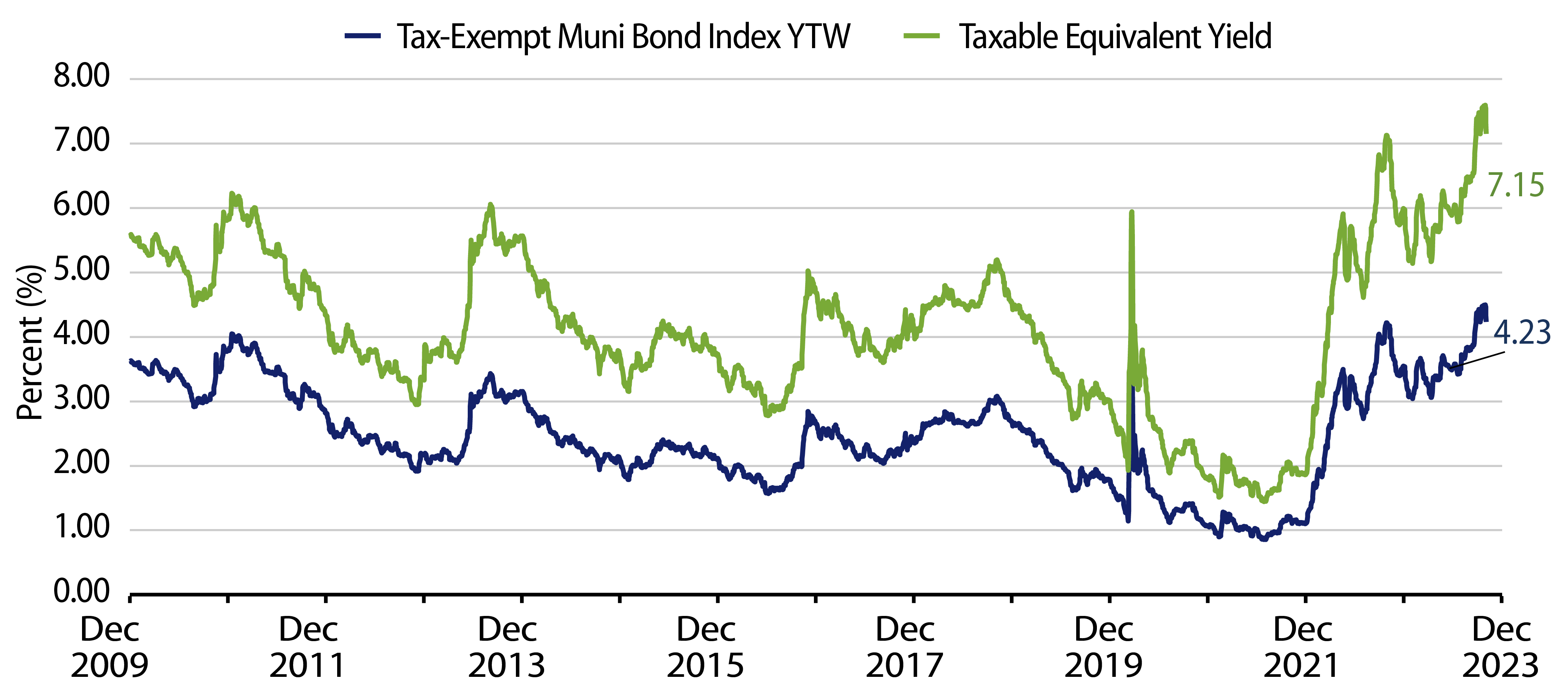

Theme #1: Municipal index yields and taxable equivalent yields are above decade highs.

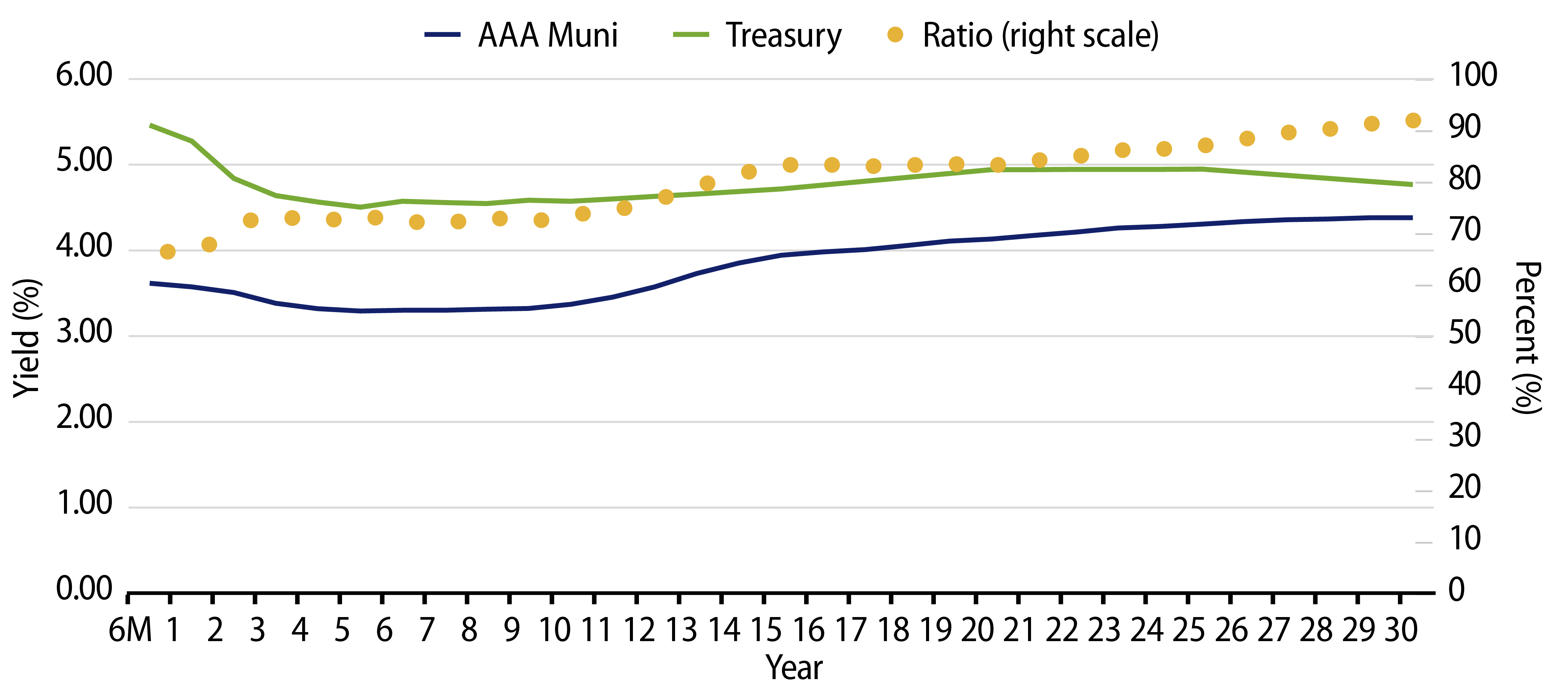

Theme #2: The inverted yield curve offers opportunities in short and long maturities.

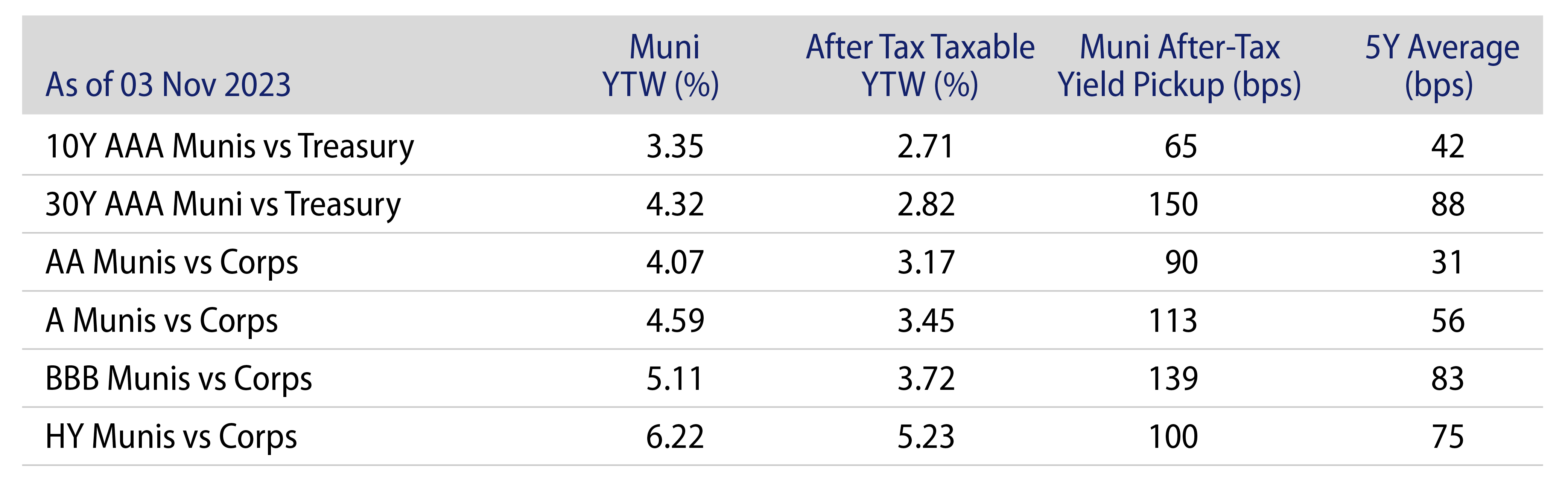

Theme #3: Munis offer attractive after-tax yield pickup vs. corporate credit.