Earlier this year, we shared our outlook for the UK and detailed why we viewed UK gilts as an attractive investment opportunity for fixed-income investors. This feels like another interesting juncture to provide an update and some of the reasons why we remain constructive on certain parts of the yield curve.

A Review of Recent Developments

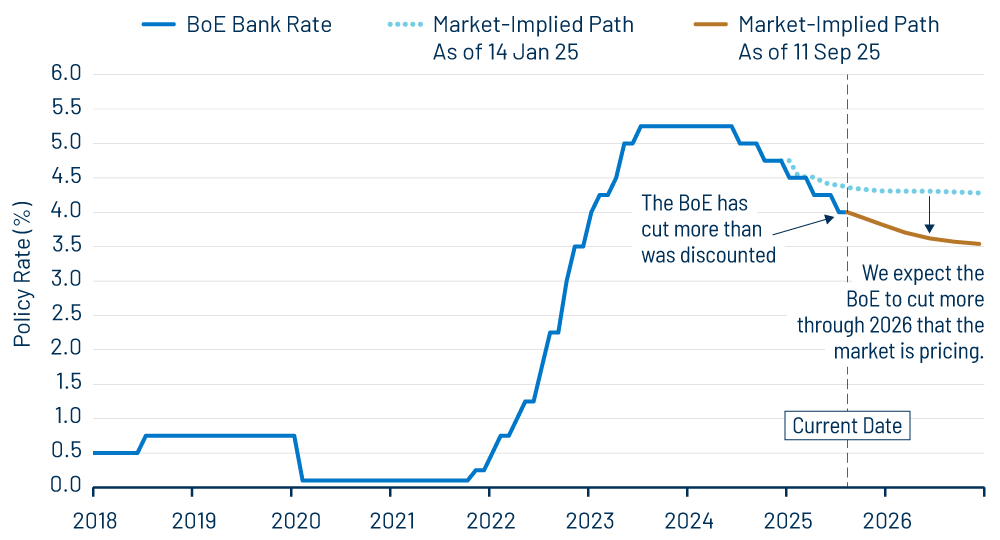

We previously noted how the market had significantly scaled back the amount of monetary policy easing expected from the Bank of England (BoE). With Bank Rate standing at 4.75%, the market was discounting only one cut through the end of 2025. Our outlook for growth, inflation and the labour market had led us to believe that the BoE would cut rates by more than this.

An important part of our thesis centred around how we thought businesses would respond to a rise in the UK minimum wage and an increase in employers’ national insurance contributions, which took effect in April. Many economists had expected a significant passthrough of these additional employment costs via selling prices, stoking inflationary pressures and limiting how much the BoE would cut. We gave greater weight to various survey-based indicators that suggested such pricing power could be limited, and that many firms were expecting to cut hiring and lower wages, dampening domestic inflation pressures instead.

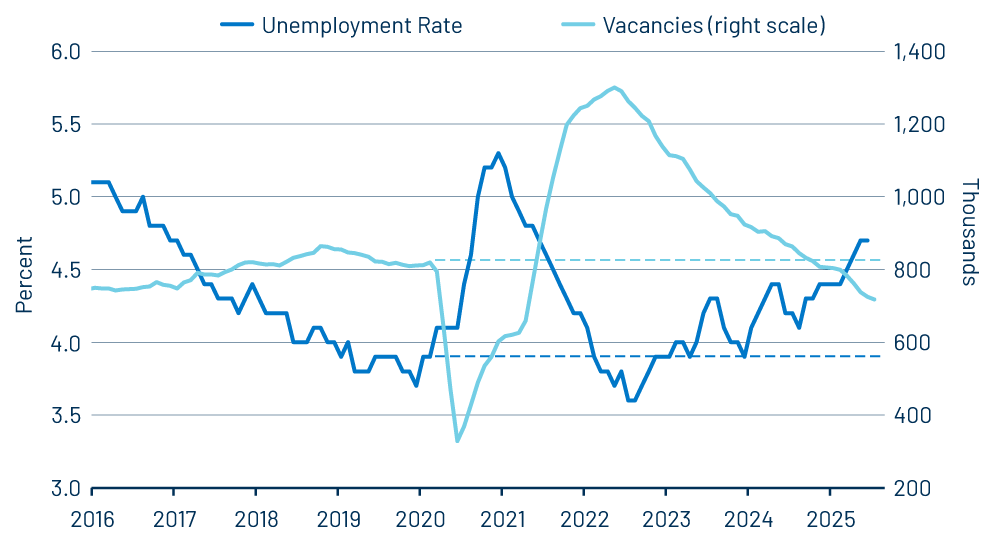

Data since April have confirmed that companies indeed have cut back on headcounts. The UK unemployment rate has risen to 4.7%, well above its pre-pandemic level, and the number of advertised vacancies continues to fall.

This return of slack in the labour market has enabled further wage growth normalisation and provided the BoE sufficient confidence to “carefully and gradually” proceed in removing monetary policy restrictiveness, with Bank Rate cut by 25 basis points three times already this year.

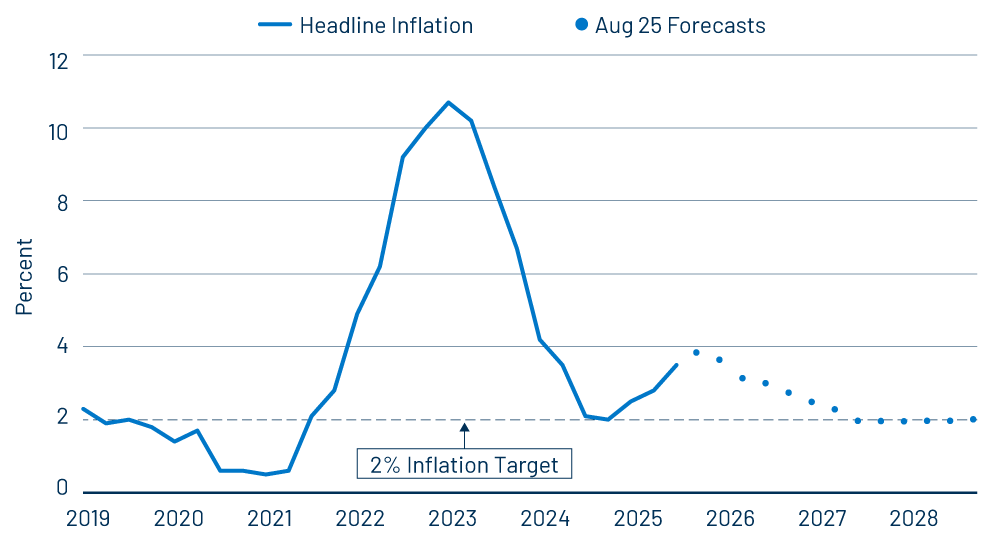

Notably, those cuts have been delivered despite food prices and energy-related base effects contributing to lift inflation. Exhibit 2 shows how the BoE forecasts inflation to peak later this year and gradually return to target thereafter.

The Impact on Gilt Yields and Returns

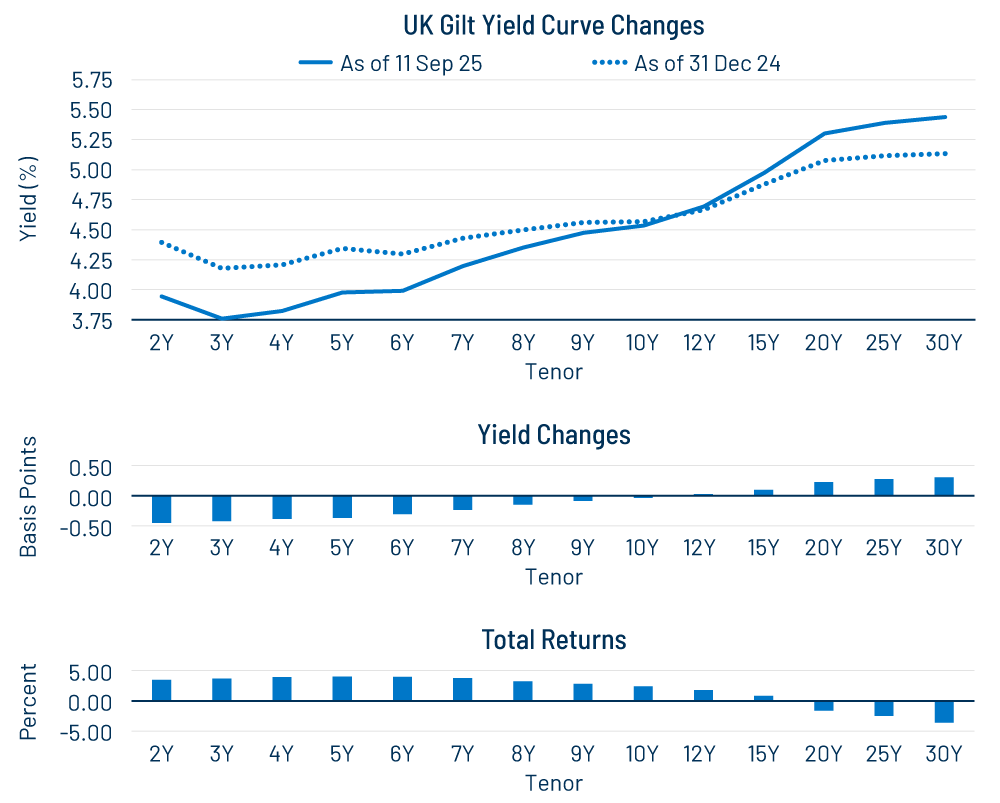

Yields at the front end of the yield curve have been pushed lower as the BoE has cut rates by more than had been discounted, while yields on longer-dated maturities have risen, along with global peers as yield curves have steepened. The 7- to10-year part of the curve, where we had concentrated our overweight in global portfolios, has seen positive total returns as yield declines have been boosted by the income component.

The Current Outlook and Positioning in Global Portfolios

At its August policy meeting, the Monetary Policy Committee (MPC) noted that “the path of disinflation in underlying domestic price inflation and wage pressures has generally continued” and that pay growth “is still expected to slow significantly over the rest of the year”. Against this, the MPC judged “that upside risks around medium-term inflationary pressures have moved slightly higher”. As a result, the market is expecting the BoE to slow the pace of easing from the quarterly pace that has been seen so far.

We expect the economy to continue to grow at a sub-trend rate over the coming quarters and see risks that the labour market will loosen further. Slowing wage growth and the current elevated inflation should squeeze household finances and continue to dampen domestic inflationary pressures. With the Chancellor expected to announce tax increases at the Budget on 26 November to restore headroom against her fiscal rules, this tightening will act as another disinflationary force.

While the pace and timing of further rate cuts is difficult to predict with confidence, we believe that the market is again discounting too little when we look through to 2026. Exhibit 4 shows how the market expects the BoE to cut roughly twice by the end of 2026. We believe that this is too little. To express this view, global portfolios have an overweight duration position via front-end rates, and gilts at the 5- and 10-year points of the curve.