The Global Interest Rate Backdrop

Recent months have seen a meaningful rise in global bond yields amid stronger-than-expected US economic data and prospective policies under the Trump administration that could see fewer rate cuts by the Federal Reserve (Fed) than previously expected. Heavy bond supply from government and corporate issuers has further weighed on bond markets.

Though the rise in bond yields has been global, there has been a lot of focus on the potential for further economic divergence between the US and Europe, and the implications that this could have on monetary policy setting in each region.

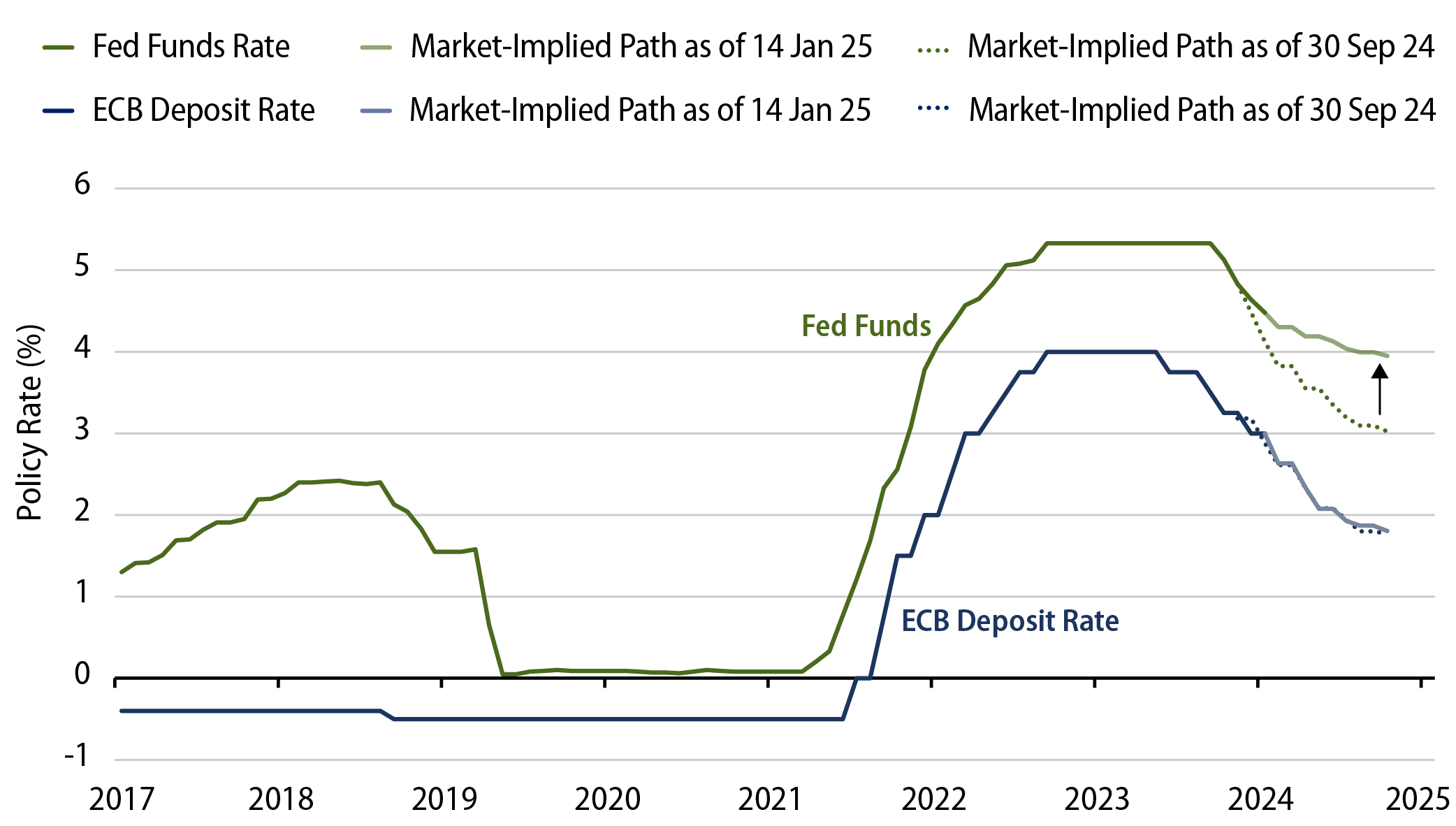

Prospective trade tariffs would weaken both growth and inflation in the eurozone given its trade surplus with the US, while the policy mix under the new administration is seen as putting upward pressure on US growth and inflation. Exhibit 1 illustrates how markets have shifted to discount far fewer rate cuts by the Fed in 2025 compared to at the end of September 2024 when the market began to discount a Trump win as more likely. Meanwhile, expectations for European Central Bank (ECB) rate cuts have held far steadier.

UK-Specific Trends

After framing that backdrop for the globally significant US and European interest rate markets, we will now focus on the behaviour of UK interest rates and their potential opportunity for investors.

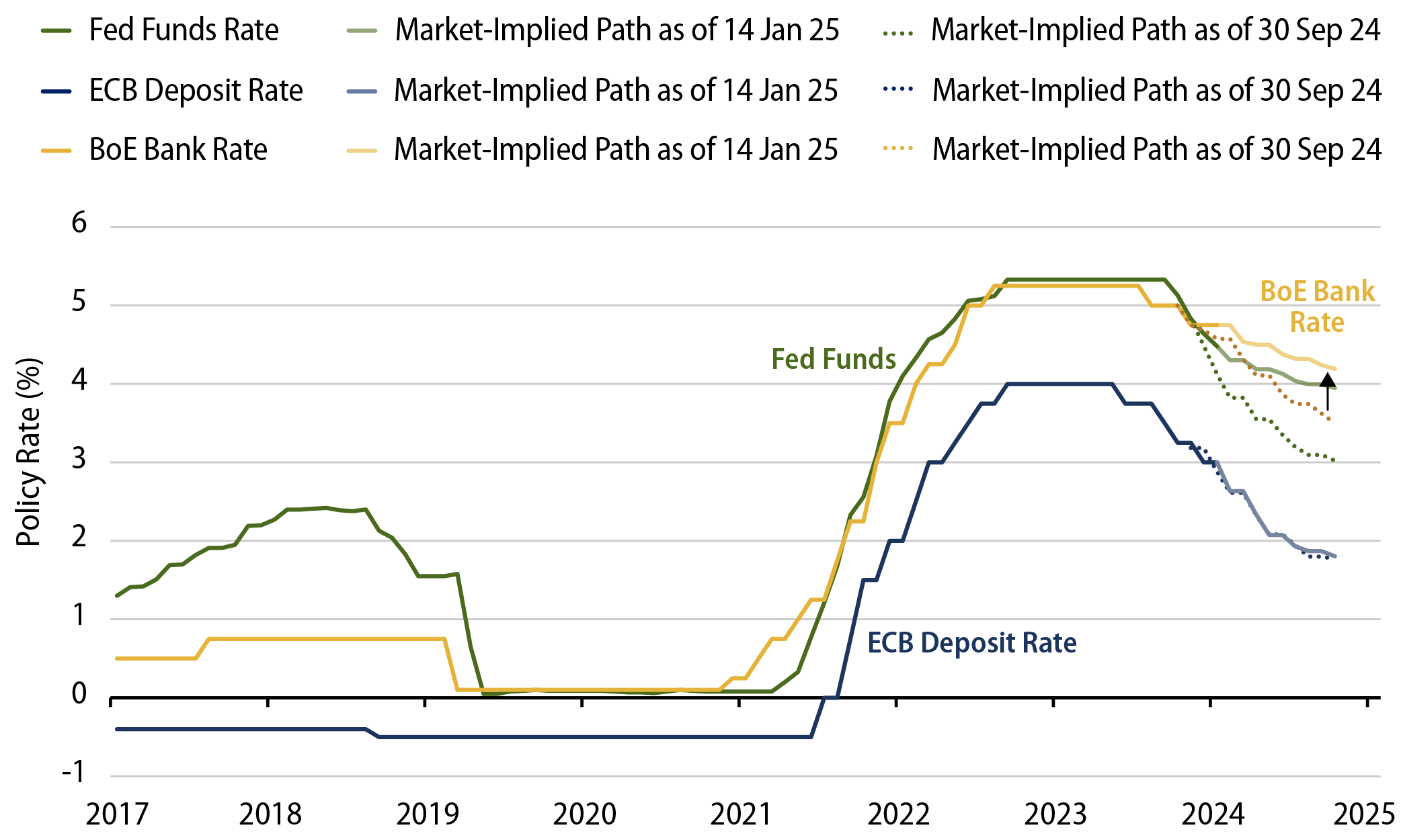

Exhibit 2 shows how markets are discounting a slower, shallower path for rate cuts in the UK compared to those seen at the end of September 2024. These have largely moved in sympathy with the repricing of rate expectations in the US, but there are UK-specific factors worth discussing.

Growth

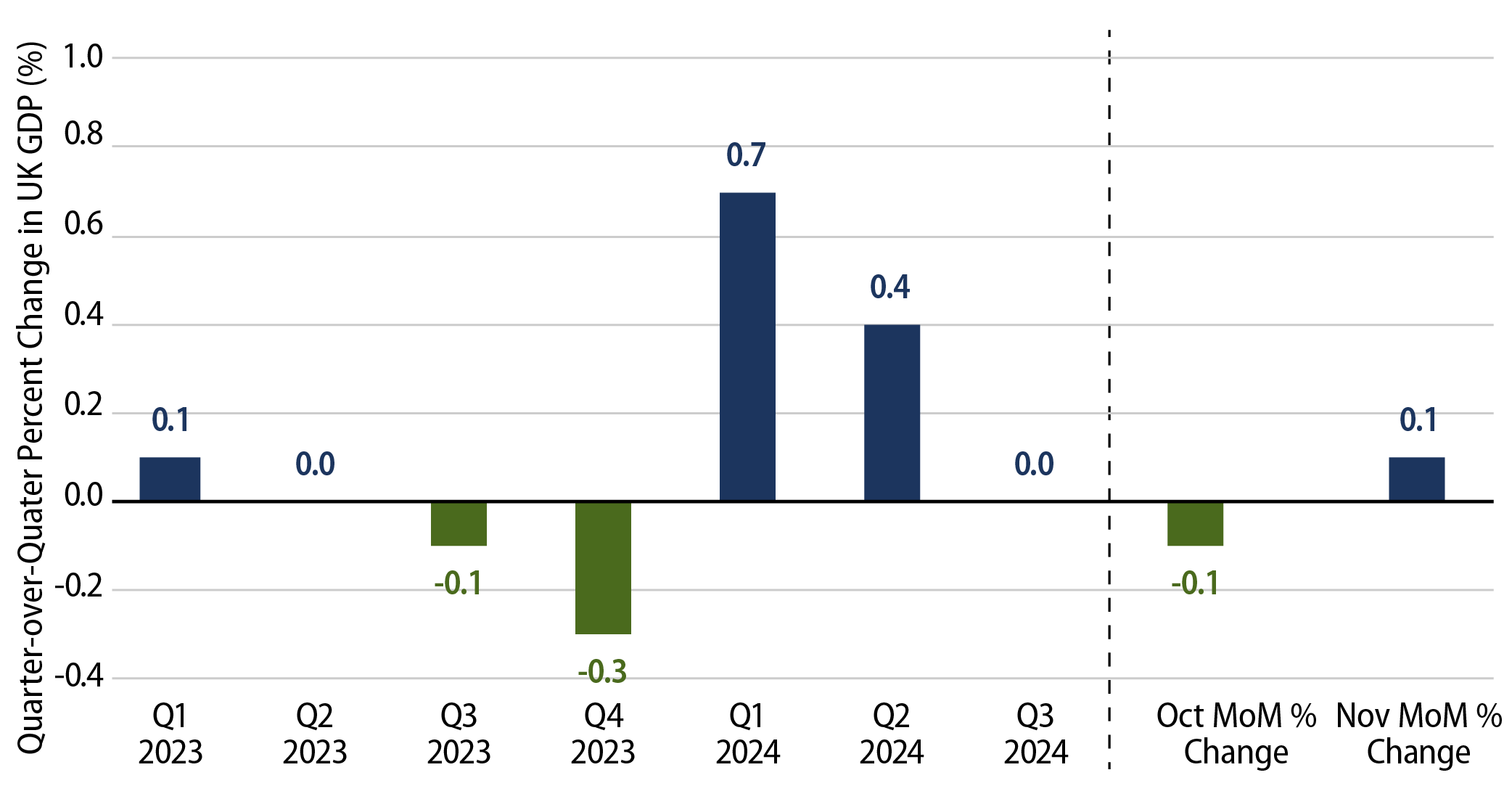

UK growth was good in the first half of 2024. Activity rebounded following a weak 2023 (including a technical recession in the second half of the year) helped by falling inflation, real income growth and lower interest rates in anticipation of central banks loosening restrictive monetary policy.

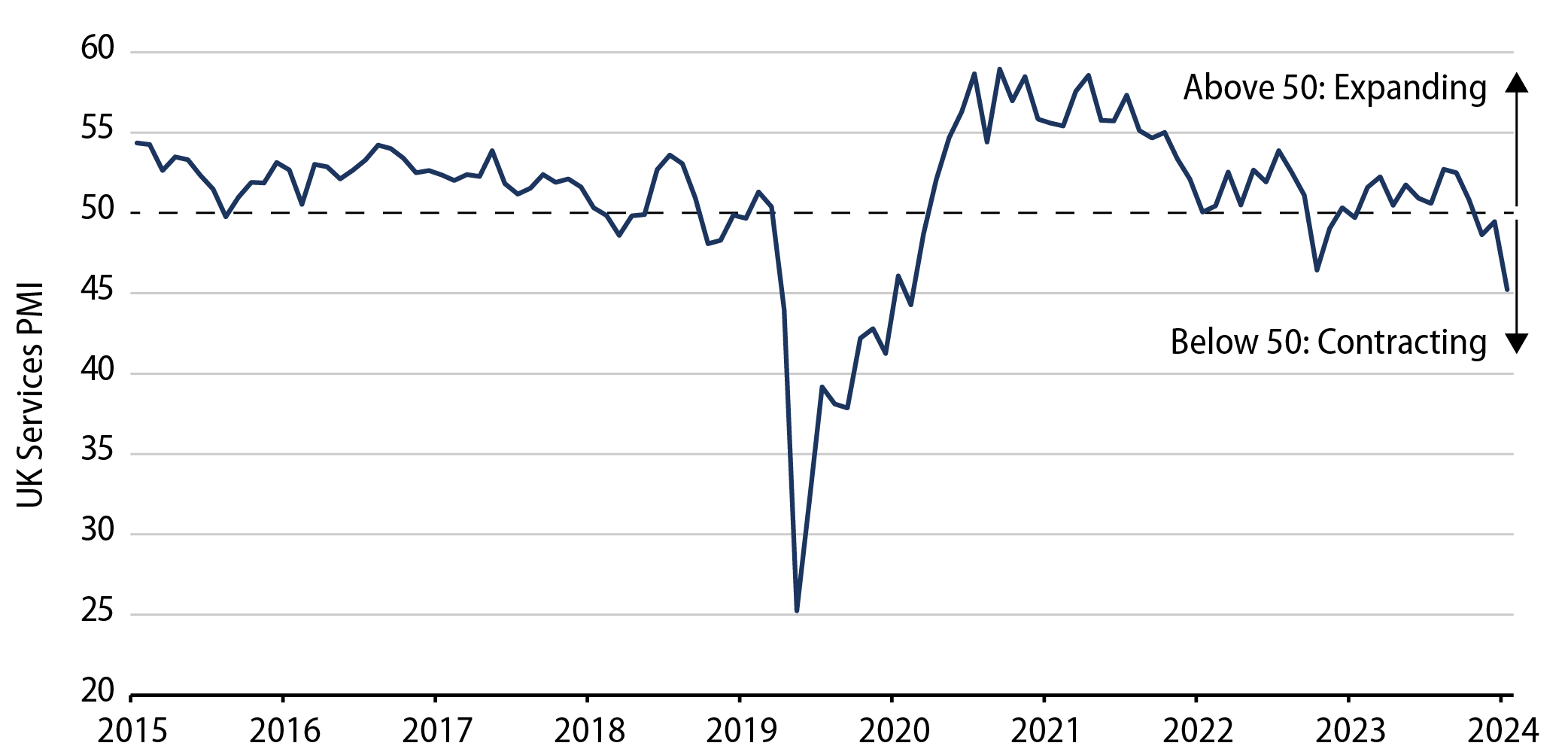

However, more recent data shows that momentum was not sustained. Q3 quarter-over-quarter (QoQ) growth was revised down to zero from an initial estimate of +0.1%, and monthly data has showed similarly flat growth. Purchasing Managers’ Index (PMI) and retail sales data have painted a similarly subdued picture.

Inflation

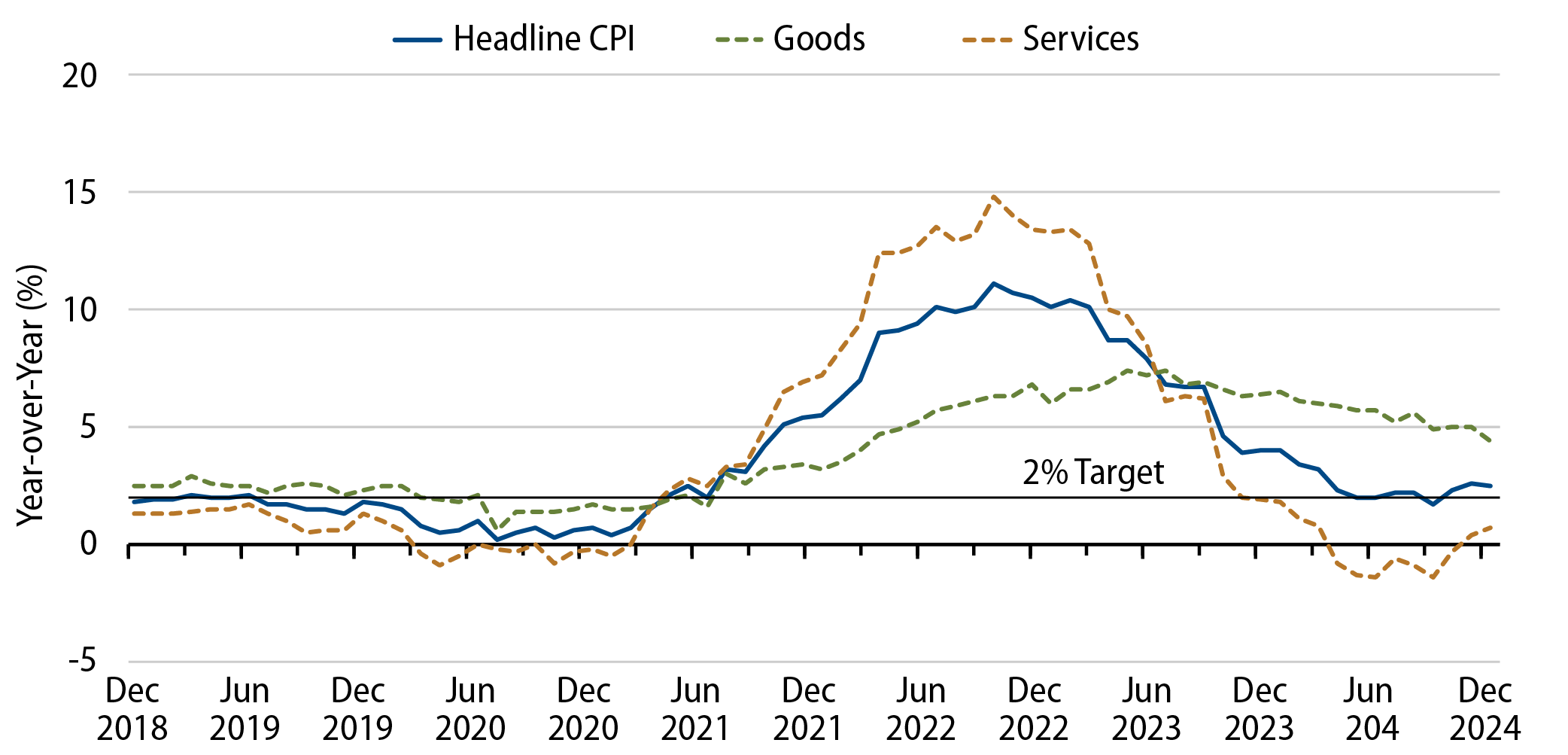

While energy-related base effects have seen headline inflation rise slightly back above 2%, this has been very well anticipated. Meanwhile, price inflation in the services sector has continued to moderate. Though there has been some concern that disinflation progress may have stalled globally, we believe that UK labour market and growth dynamics will see domestic inflationary pressures continue to subside.

Impact of October’s Autumn Statement (UK Budget)

Based on what we have written so far, one might reasonably have expected UK interest rate expectations to have followed those in Europe more closely rather than those in the US.

While it is true that the UK does not have a similar trade surplus with the US and its economy is tilted more towards the services sector rather than manufacturing or trade, making it less directly exposed to potential tariffs, a larger factor holding back rate cut expectations has been uncertainty stemming from October’s controversial Autumn Statement. Specifically, an increase in national insurance contributions from UK employers raised concern that they will aim to pass on higher payroll costs via higher prices, thereby stoking inflationary pressures.

While the Bank of England (BoE) has made clear that it will have to monitor how businesses respond, multiple surveys have shown that firms expect some combination of lower hiring (Exhibit 5), lower wages and profit margin compression, with only a modest passthrough to higher selling prices. This should enable the BoE to continue its gradual approach to removing restrictive policy.

Implications for UK gilts

Western Asset expects UK growth to be somewhat subdued in 2025 as the labour market should continue to soften. The tailwind from real income growth is also likely to fade somewhat as nominal wage growth slows and inflation has fallen back to around target. If we are right, the BoE will deliver more than the roughly two cuts priced in for this year, and the terminal rate is likely to be well below what is currently discounted. At current yields, UK gilts appear to be a very attractive opportunity for global fixed-income investors.