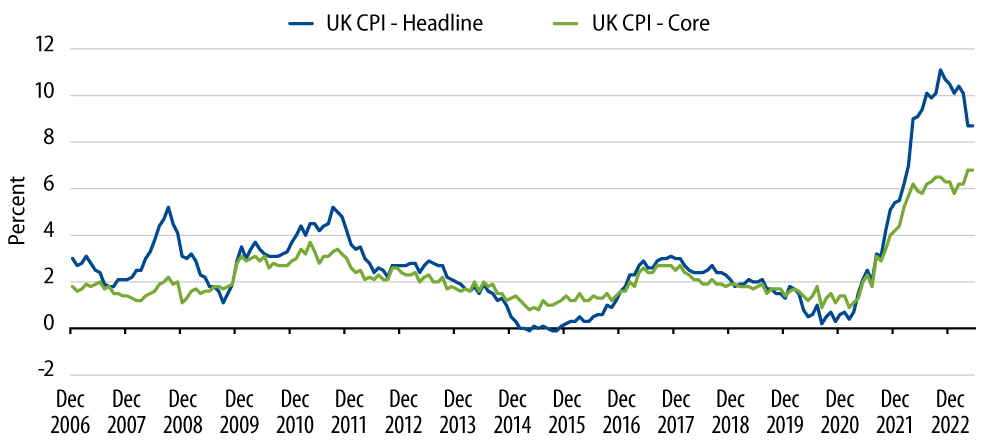

UK inflation data for the month of April was published on 24 May and showed CPI falling from 10.1% to 8.7% year-over year (YoY). This is a decent deceleration, but failed to live up to the market’s expectations of 8.2% or the Bank of England’s (BoE) 8.4% projection. The stronger catalyst for the robust market reaction, however, was the core CPI reading rising from 6.2% to 6.8% YoY.

Goods inflation slowed from 12.8% to 10.0% YoY. This was partly offset by services inflation increasing slightly from 6.6% to 6.9% YoY.

Here are some dynamics that we would like to highlight from the data:

- Energy was clearly the biggest driver behind the slowing inflation.

- Base effects here have been very well anticipated, but reassuring to see nonetheless.

- The fall should continue in the coming months given the recent reduction in the maximum price that energy providers can charge under new regulations, imposed by the UK’s energy regulator, OFGEM.

- Food inflation remains high at 19.3% YoY, but this was a slight decline from 19.6% reported for March.

- The BoE recently offered a detailed observation regarding food prices not having fallen (so far) as much as the Bank had reflected in its forecast, which was based on declines in agricultural commodity and energy prices.

- This sticky food inflation appears to be due to a combination of retailers increasing margins back towards longer-term averages and hedging strategies that result in input prices taking a little longer to reflect in shop prices.

- Confidence remains, however, that food prices eventually will fall.

- Communications inflation jumped from 3.7% to 7.9% YoY due to a large 8.0% month-over-month (MoM) jump.

- This is due to many mobile phone contracts stipulating that monthly charges will increase annually in line with inflation. Such price increases take effect in April, which is the start of the new fiscal year.

- With inflation having been so high this year, the impact was material.

- While not unexpected, we feel this effect has been underappreciated.

- Alcohol and tobacco became subject to higher taxes in April, following the Chancellor’s March budget.

- This saw alcohol and tobacco inflation rise from 5.3% to 9.1% YoY (+3.7% MoM).

- Again, this was not unexpected, but neither will it repeat in coming months.

Market Reaction to the CPI Data

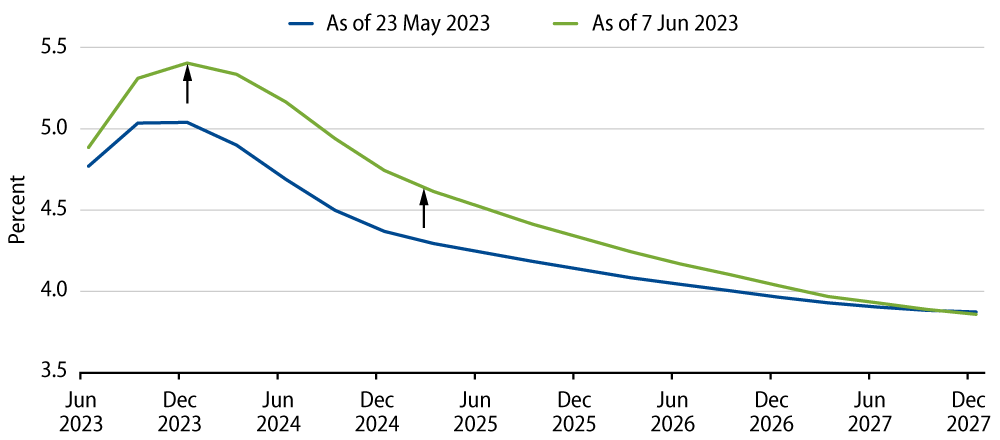

Exhibit 2 shows the policy rate path implied by futures as of 23 May (the day prior to the April CPI release) alongside the current rate path. The expected peak policy rate was lifted from 5.0% to 5.5%, 1.0% above the current 4.5% Bank Rate.

Our Assessment

Estimating with precision exactly when lower input prices for food will pass through to lower shop prices for consumers has been challenging, but we are confident that they will eventually do so. May’s CPI reading will be released on 21 June, the day before the next BoE rate decision.

The other key data that will factor into the Bank’s assessment will be on the labour market, and will be released next week on 13 June.

There have been several signs of labour market conditions loosening:

- The unemployment rate has been rising, while job vacancies and hiring intentions have been falling.

- Inactivity has fallen.

- The majority of jobs added in recent months have been part-time roles, often as workers take second jobs amid higher living costs.

- Last month’s data included a negative 136,000 monthly payrolls number.

- Nominal wage growth has stabilised a little above 6% YoY, which is still high, but real wages remain deeply negative.

With respect to concern over second-round effects, such as a wage-price spiral whereby employees demand higher wages in order to preserve their living standards and firms in turn pass these higher costs on via further price rises, the latest retail sales data provides some reassurance. While spending on food is high, rising 9.6% YoY, non-food spending is almost flat, increasing just 0.7% YoY. This shows that consumers are cutting back on non-essential spending due to the higher cost of essentials, with volumes lower across all items. This certainly doesn’t suggest an environment where firms have strong pricing power, which will limit both their ability and willingness to offer higher wages. Instead, we expect hiring intentions to continue to contract.

If incoming data validates our view, then the market has significant scope for another repricing—this time for less additional monetary-policy tightening, which should benefit an overweight to UK duration as the yield curve shifts downwards.