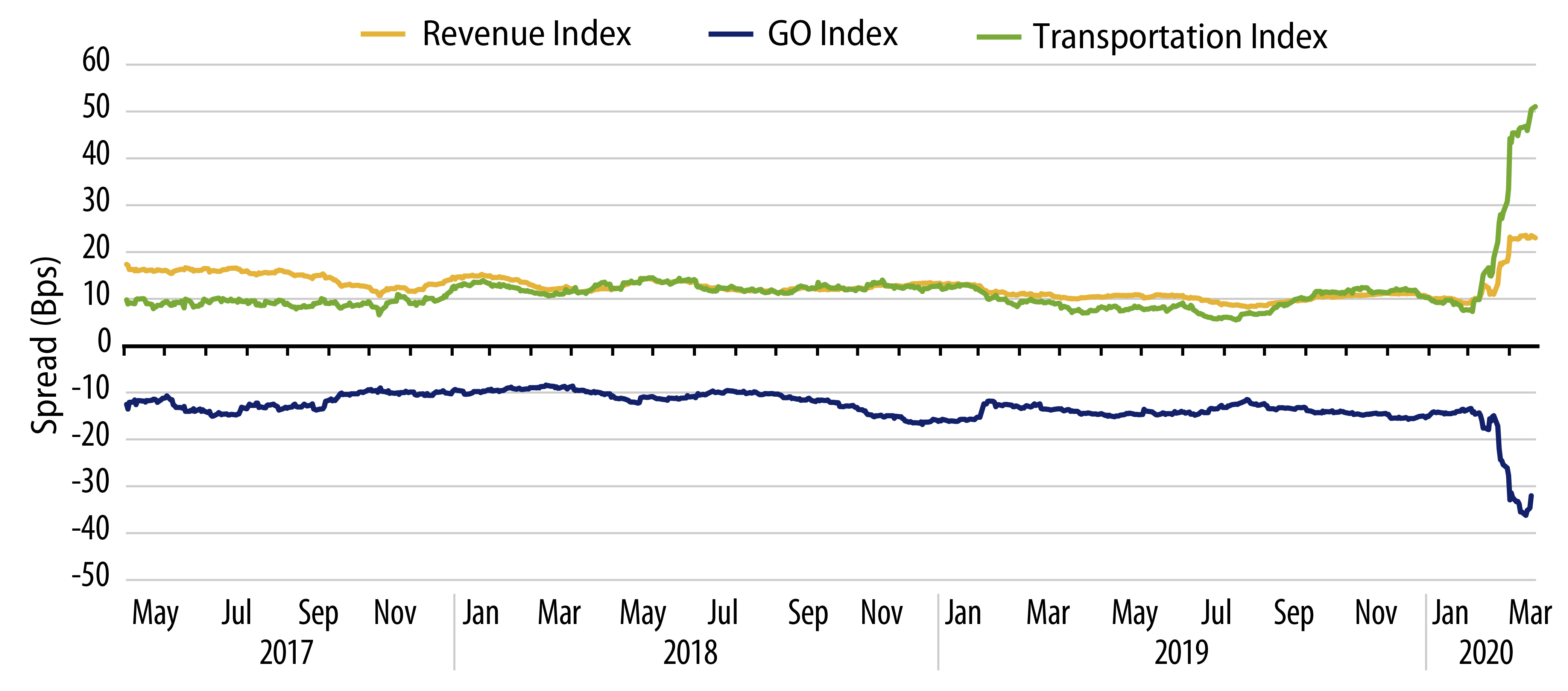

In the not too distant past, long lines at airport checkpoints, miles of roadway traffic jams and packed subway cars and buses were an all-too-common, if frustrating, part of American life. The ongoing coronavirus/COVID-19 pandemic has severely curtailed transportation activities of all types and in some cases has stopped activity altogether. This once unthinkable turn of events has led to a reality in which toll-road traffic and collections are down between 40% and 60%, airports are nearly empty, airplanes across the country are parked and mass transit and bus systems are virtually empty except for all but the most necessary of passengers. This is important data for municipal bond investors as transportation-related credits compose approximately 16.5% of the Bloomberg Barclays Municipal Bond Index and spreads have widened considerably.

The length of the ongoing disruption and the shape of the ultimate recovery are among the key questions that need to be evaluated to make sense of the current market for transportation-related municipal bonds. Also, thought must be given to the amount and form of potential state and federal aid that may be forthcoming to support municipals.

Western Asset has developed a few themes in our ongoing quest to identify and execute on value opportunities in the current muni market.

Mature toll-road assets with strong balance sheets that can withstand a long period of disruption: Western Asset has found that familiar names in the “A” rated category, which are critical to the nation’s transportation infrastructure, entered the crisis with strong debt service coverage ratios and large cash positions. Select well known and liquid credits offer attractive yields versus pre-crisis levels and are likely to bounce back relatively quickly when the economy reopens due to their essential nature. Based on Moody’s medians, as of September 24, 2019, “A” category toll roads had 769 days operating cash on hand and 2.0x debt service coverage—levels that are indicative of substantial financial wherewithal.

Looking to revenue diversity: Mass transit systems are reeling with stay-at-home orders nearly eliminating daily commuting demand and the need for regional mobility. It has been widely reported that high-profile subways and commuter rail systems have experienced ridership drops in excess of 90%. While these numbers are startling to say the least, we have been looking to systems with bonds that are supported by broader revenue streams such as sales taxes, which have provided a long history of strong debt service coverage. While still volatile, these revenue sources provide solid debt service coverage regardless of the headline-grabbing declines in ridership.

“Flying low in airports”: Airports are more difficult to assess in this environment. In our opinion, airports will be the hardest hit transportation assets and will require the most time and federal support to regain full financial independence. Not only are the airports' largest customers, the airlines, experiencing massive financial stress, their other customers, including retailers, auto rental companies and other land-side support operators, are simply not functioning. It is also likely that airline passengers will remain hesitant to return in large numbers until such time as their health and well-being are far more assured than is currently possible. That being said, Western Asset is currently favoring the largest hub airports and the strongest origination and destination airports. The largest hub airports are critical to national and international travel and the strong origination and destination airports are supported by strong economies with local industries and institutions that provide strong demand for air travel.

As valuations within the transportation sector have become more attractive, we are actively monitoring market conditions in search of opportunities in credits that were outperforming expectations before the pandemic, but which have also been hit particularly hard by the current uncertainty due to limited balance sheets and/or limited operating history. Examples of these assets include start-up toll roads in the Southern and Western states and certain managed-lane assets in major metropolitan areas that charge variable tolls based on traffic conditions. Favorable demographics and good planning demonstrated the viability of these assets pre-virus and we believe that demand and usage conditions will eventually return to levels that make some of these credits attractive long-term investments.

Western Asset believes that an active approach to managing the credit and market volatility associated with the COVID-19 pandemic is key to long-term portfolio performance. Transportation headlines will continue to be startling and unsettling for the immediate future, but careful analysis of credit fundamentals and mitigation tools on a credit-by-credit basis should lead to the uncovering of value opportunities going forward.