At its most recent meeting, the European Central Bank’s (ECB) Governing Council (GC) left all policy levers unchanged, according to its post-meeting statement. However, ECB President Christine Lagarde’s much more hawkish press conference following the meeting clearly caught the market by surprise. For example, she was not willing to repeat her December declaration that an increase of the policy rate was “highly unlikely” in 2022, noting that this was a statement conditional on the December projections. In (not) doing so, she invalidated the December projections, consistent with the significant upside surprises to inflation in both December and January.

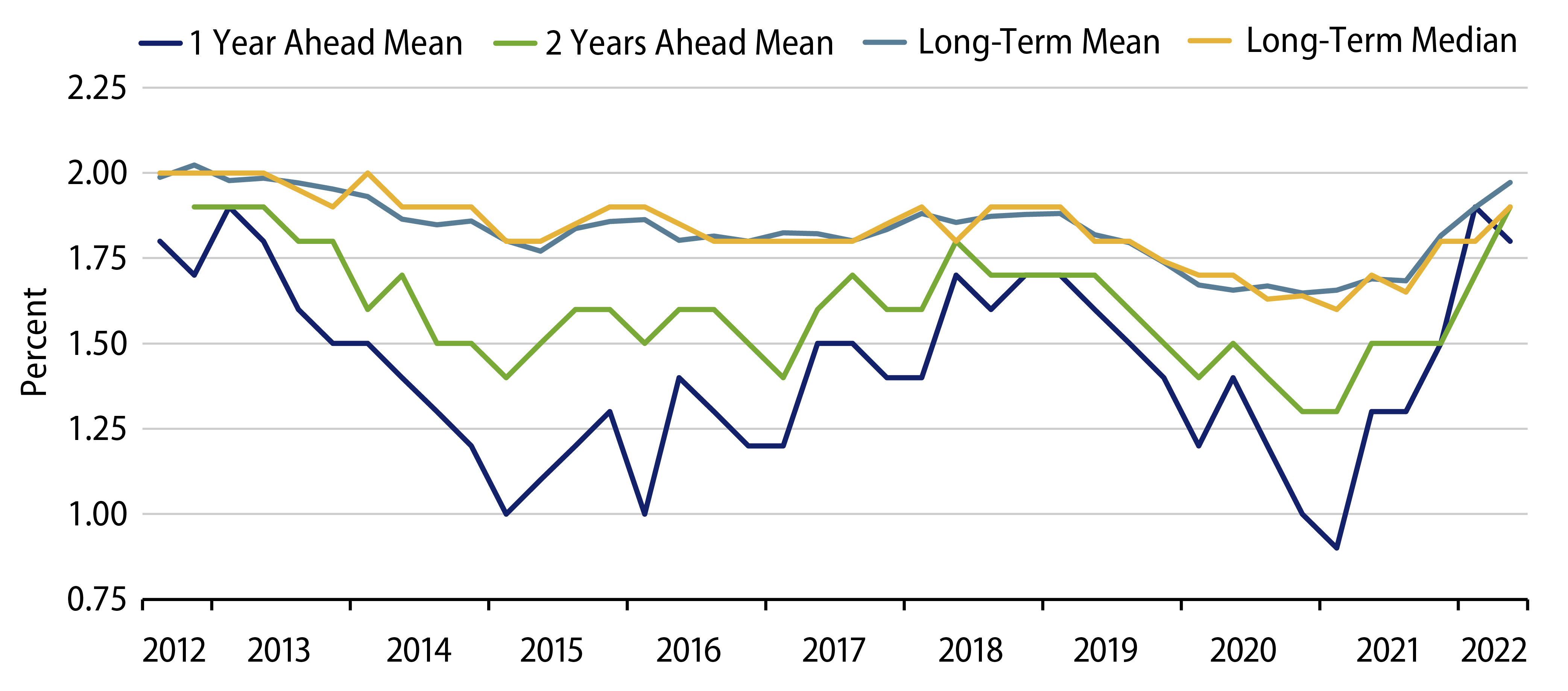

Indeed, Lagarde stressed explicitly the upside risk to the 2022 inflation forecast made in December, but she was more cautious regarding 2023 and 2024, and deferred to the next meeting in March when there will be a new round of macro projections. In this context, she noted three conditions for the forecast trajectory in the outer years to shift higher from the current 1.8% value and bring the ECB closer to a rate hike: (1) inflation driven by a broad increase in prices rather than just a few components; (2) survey-based inflation expectations closer to or at target; and (3) wage inflation picking up.

Our View

We believe that the first two conditions have now been met after today’s inflation survey print (Exhibit 1) and recent flash inflation data for January. While energy price increases are currently responsible for more than half of overall headline inflation, the increases have clearly started to seep into other parts of the consumer basket (e.g., food but also core inflation, which declined a lot less than expected in January).

Regarding the last condition for an upside revision (i.e., wage inflation), we believe that the ECB’s stance is changing: actual wage inflation is no longer a necessary condition for a higher inflation forecast down the line. ECB chief economist Philip Lane recently mentioned that the ECB is not seeing wage increases in the zone of 3%, which would be consistent with inflation sustainably at target (2%). To us, it seems that the ECB—as reflected by President Lagarde in the press conference—no longer needs to see wage inflation at 3% but is giving wage dynamics the benefit of the doubt: it is enough to fore-see these levels of wage growth based on circumstantial evidence. The circumstantial evidence is the shape of the labour market, of course, and the ECB seems to assume a faster transmission from wage inflation into price inflation. After all, we are broadly back to pre-pandemic rates of unemployment while employment and participation levels seem to indicate close to full employment conditions in a number of economies. Moreover, economic growth should be at least twice as high as steady state growth this year and next. This implies a closing output gap, and the delayed slowdown in headline inflation at the start of 2022 is indeed likely to play a role in wage negotiations later this year.

In December, the ECB laid out its plans for asset purchases this year and beyond. Assuming it sticks to the sequencing of finishing asset purchases first and hiking its policy rate second as Lagarde reassured yesterday, then the ECB needs to take two steps in terms of guidance change for a hike this year to become possible: (1) re-characterize the Asset Purchase Programme (APP) from “open-ended” to “finite” and (2) speed up the APP tapering to finish before year-end. We believe the GC will take the first step at the March meeting as the policy stance can remain accommodative even without asset purchases if needed. Assuming inflation remains uncomfortably high, the second step could be taken in June, with QE ending in Q3 and a potential hike in Q4. We still believe that the ECB does not want to rush into hikes—and Lagarde said as much at the press conference. After all, the inflation rate will very likely come down this year sooner or later due to large and ever-increasing base effects, especially in the second half of the year.

We believe the ECB is trying to create room for policy optionality, moving away from the firm guidance provided in its December meeting. Our base case is therefore that the ECB will hike once this year, but we acknowledge uncertainty around this call. We expect major policy changes and especially a potential first hike to take place at one of the policy meetings when the ECB also provides its forecasts. The Q4 forecasting round is quite late in the year (15 December) when market liquidity will have dried up. Therefore, a hike in September might be preferable, especially if it becomes clear early on in the year that a rate hike is indeed warranted. In that case, the GC could combine both steps mentioned earlier at the March meeting and bring the asset purchases to an end by June. We believe this to be a pretty aggressive but not impossible scenario that could also open the door to a second hike this year.

Following yesterday’s meeting, the market has repriced to (roughly) expect a 10-bp hike by June and another 40-bp hike in H2, taking the policy rate back to zero by the end of the year. We believe this is mildly too aggressive, but we expect European interest rates to move higher and curves to steepen from here as the ECB is taking the foot off the gas pedal more quickly than previously thought.