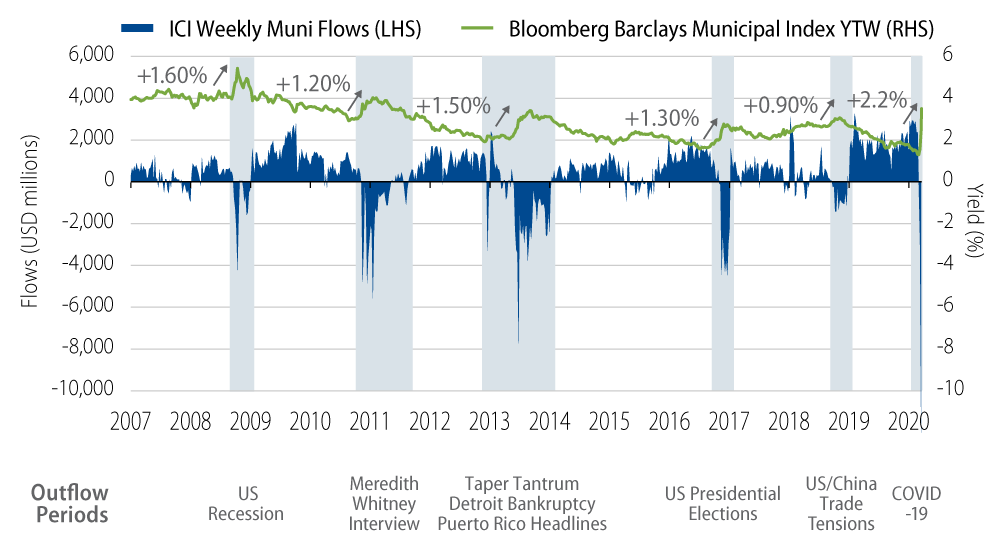

During this period of market volatility, investors should recall the quality, diversification and tax-exempt benefits of a municipal allocation. History has proven many times that when the market faces low liquidity, opportunities surface for investors with longer investment horizons, and we believe they should be liquidity providers to lock in above average tax-exempt value.

The substantial volatility in financial markets recently may lead some investors to question the purpose of municipal bonds in their portfolios. We think it may be helpful to keep in mind that:

- Market volatility can always lead to angst and uncertainty but more importantly it often brings with it opportunities in sound credits at discounted prices should investors choose to maintain their municipal allocation through the volatile market cycle.

- Municipals historically offer diversification benefits through negative correlations to equities and low correlations to high-quality credit alternatives.

- During the last 14 S&P drawdowns of 10% or greater, municipals have outperformed equities on average by +23%, and investment-grade corporates (after consideration of the top marginal income tax rate) by +1.4%.

Looking ahead, as we highlighted in a blog on March 10, we believe COVID-19 will create many challenges for the public finance sector. However, in our view municipal fundamentals are mostly in a better place now versus where they stood prior to the great recession because several states and localities enjoyed steady revenue growth during the recent prolonged recovery. But, not all munis have benefited equally from the recovery. This highlights why we believe investors should consider working with an active manager that has an experienced credit research team to help avoid potential pitfalls within the 50,000+ obligor market.

We believe municipals offer very attractive after-tax relative value following the most recent increase in yields. Importantly, as municipal yields move higher, the value of the municipal tax exemption increases at a higher rate. For example, investment-grade municipal yields spiked 200 bps higher over the first three weeks of March. This equates to approximately a 340 bp taxable-equivalent yield increase for a taxable bond that would have to move higher to meet the same benefit for those investors in high tax brackets. In addition to low default rates versus comparably rated corporate fixed-income, municipal securities offer significant after-tax value over comparably rated taxable securities. Considering the highest tax rate, AA and A municipal index yields are well above respective after-tax corporate index yields. This benefit is more pronounced considering municipals historically have defaulted less than 10% as frequently as like-rated corporate bonds in those rating categories.

We believe current value is offered due to the fact that municipals are not the best source of liquidity. We believe current market volatility exposes the municipal market’s inefficiencies, considering its composition of about one million securities across various sectors, a limited buyer base and declining broker/dealer inventories. During the entire financial market’s recent scramble for liquidity and given the relative illiquidity of municipals, we recommend investors look to investment-grade quality tax-exempt municipal allocation as recent large selling pressures are causing valuations to fall well below relative fundamentals.

Below are some areas in which we believe liquidity-related selling has caused valuations to undershoot fundamentals, which could serve as opportunities for municipal investors reassessing relative value:

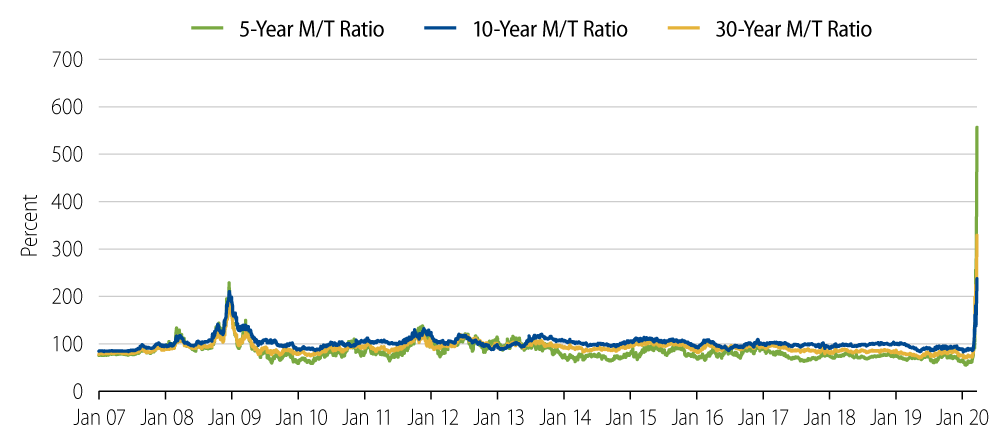

- Municipal/Treasury ratios exceed 200%—levels not observed since 2008. It may not happen during the next month but we believe valuations will eventually normalize. We expect yield ratios will decline below 100% over time and with the support of institutional investors (banks/insurance companies) if retail does not meaningfully step back into the market.

- Pre-refunded municipals trading at 4-5x taxable Treasury value. Pre-refunded municipals are securities that have principal and interest escrowed to call dates or maturities dates with cash or government securities. As such, the underlying credit risk is equivalent to Treasury securities. Because pre-refunded municipals are tax-exempt, the securities typically trade at a yield less than the comparable duration Treasury yield. Given the herd behavior to “sell what can be sold” in the market, we have observed pre-refunded securities trading at 4-5x fundamental Treasury yields.

- Municipal variable-rate demand notes (VRDNs), high-quality zero duration notes, are trading at 7%-9% tax-exempt yields as broker inventories have built amid a scramble for liquidity. VRDNs are floating-rate coupon securities that are typically priced to SIFMA (municipal equivalent of LIBOR) and in addition to the municipal credit, are supported by bank lines of credit and Standby Bond Purchase Agreements. As funds were required to raise cash for large scale redemptions, SIFMA reset at 5.2% last week (as of March 18), equivalent to 693% LIBOR and 963% SOFR.

We believe an active manager’s ability to navigate credit and liquidity dynamics is key. History has shown many times that the limited liquidity of the market often serves as an opportunity for investors with longer investment horizons to lock in favorable levels of risk-adjusted tax-exempt income. While COVID-19 will prove challenging for many municipal issuers, we believe overall municipal fundamentals remain intact and attractive relative valuations will increase demand as volatility eventually subsides.