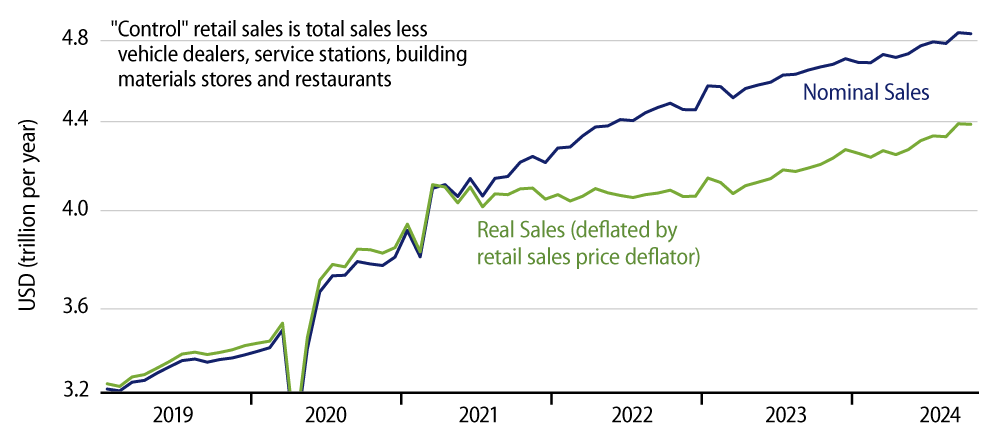

Headline retail sales rose +0.4% in October on top of a +0.2% revision to the September sales estimate. However, the more closely watched ''control'' sales measure declined -0.1%, with the September control sales estimate essentially unchanged (revised down by -0.03%). Note that control sales exclude sales at vehicle dealers, service stations, building material stores and restaurants—partly because these sectors experience elevated volatility and partly because they focus more on consumer-oriented retail sectors rather than those catering to businesses about as equally as to households.

The context behind the control sales decline is that we were coming off a very strong September sales gain, up +1.2%. With respect to the aforementioned revisions, the mostly unchanged September control sales estimate was net of a -0.5% revision to August sales growth (from +0.3% to -0.2%) and a +0.5% revision to September sales growth (from +0.7% to +1.2%). As you can see in Exhibit 1, very slight sales declines in August and October bracket the strong September gains.

As discussed in our last post regarding jobs data, we have been looking for evidence of hurricane effects in the various indicators. There have been hurricanes hitting the Southeast corner of the US in each of the last three months. The jobs data showed weak growth in August and October, but a rebound in September, similar to the pattern seen in the retail sales data.

The difference between the two indicators is that while the August/October job growth softness swamped the September gains, leaving weak net job growth over the three months together, the strength in sales in September fully offset the softer performance in August/October. This resulted in a decent net increase in control sales since July.

In other words, if hurricane effects were holding down retail activity in recent months, we should have seen more softness than was reported. So, after all the huffing and puffing, retail sales activity has held up well recently, especially given possible hurricane effects.

Payroll jobs likely saw some adverse effects of the hurricanes, and our guess is that the slightly elevated Consumer Price Index (CPI) inflation recently also reflects hurricane disruptions. However, there is no real sign of any weakness in retail sales activity over this same period.

Meanwhile, stronger October performance in headline sales versus control sales reflect good gains at vehicle dealers and restaurants. Both sectors had seen flat sales through the early months of 2024. However, vehicle dealers saw a bounce in sales over the last month, while restaurants saw a similar rise over the past two months. The vehicle dealer sales gain is likely a one-month blip, reflecting the introduction of 2025 models. The restaurant gains may reflect away-from-home dining by households displaced by the hurricanes.