Headline retail sales declined by 0.6% in November, and there was a 0.1% revision to the estimated October level. Because of volatile movements in sales at motor vehicle dealers, service stations, building material stores and restaurants, it is more common to track “control” sales, which exclude these volatile sectors. Control sales declined by a more modest 0.2%, but there was a larger downward revision there, of 0.4%. The declines in both headline and retail sales follow big gains in October, where these indicators were up 1.3% and 0.5%, respectively, even after revisions.

Keep in mind also that retail prices have been declining recently. The price index for control sales declined by 0.2% in October, and Tuesday’s CPI data indicate a decline of about 0.5% in November. So, in real terms, both headline and control sales look a bit better over the last two months than the reported (nominal) data might suggest.

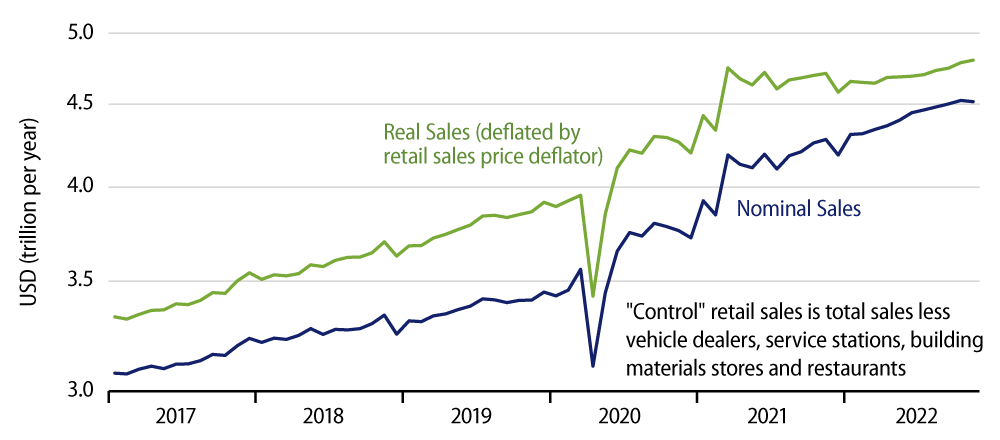

When retail prices were rising in late-2021 and early-2022, nominal sales data substantially overstated the gains in retail activity. The opposite is true now that retail prices are declining again.

The accompanying chart shows control sales in both nominal and (estimated) real terms. As you can see, real retail sales had been flat from March 2021 through July 2022, before showing a bit of an uptrend over the last four months. This is consistent with a modest upturn in real consumer spending on merchandise since July. Not shown in the chart is the fact that consumer spending on services has shown slower growth over the last four months.

So, all in all, consumer spending is not rocketing forward, but neither is it dropping sharply. Rather, we are seeing pretty modest growth very recently in spending on both goods and services. Perhaps surprising is that such modest growth fails to evince any sign of weakness in response to the Fed’s tightening moves this year.

Other analysts have suggested that consumer spending will hold up until job growth falters. We can’t quibble with this assessment, but we will repeat that consumer spending growth, while positive, remains modest.

This is echoed in the real sales data for various store types. The Census Bureau’s retail sales report shows sales for 12 major retail components. Of these 12, the only ones showing any upward momentum in real terms are non-store (mostly online) vendors and restaurants. Online vendors flourished in the height of the Covid era and in the seasons since, and continue to pull market share away from brick-and-mortar retailers. Restaurants continue to move back toward pre-Covid norms for sales activity after taking a beating during the Covid shutdown and its aftermath.