Headline retail sales declined by -1.0% in March, with the February sales estimate seeing a slight, +0.1% revision. The more widely watched control sales measure declined by -0.3% in March, also with a +0.1% revision to February. Our estimate, based on details from Wednesday’s CPI release, is that in real terms, control sales declined by -0.5% in March.

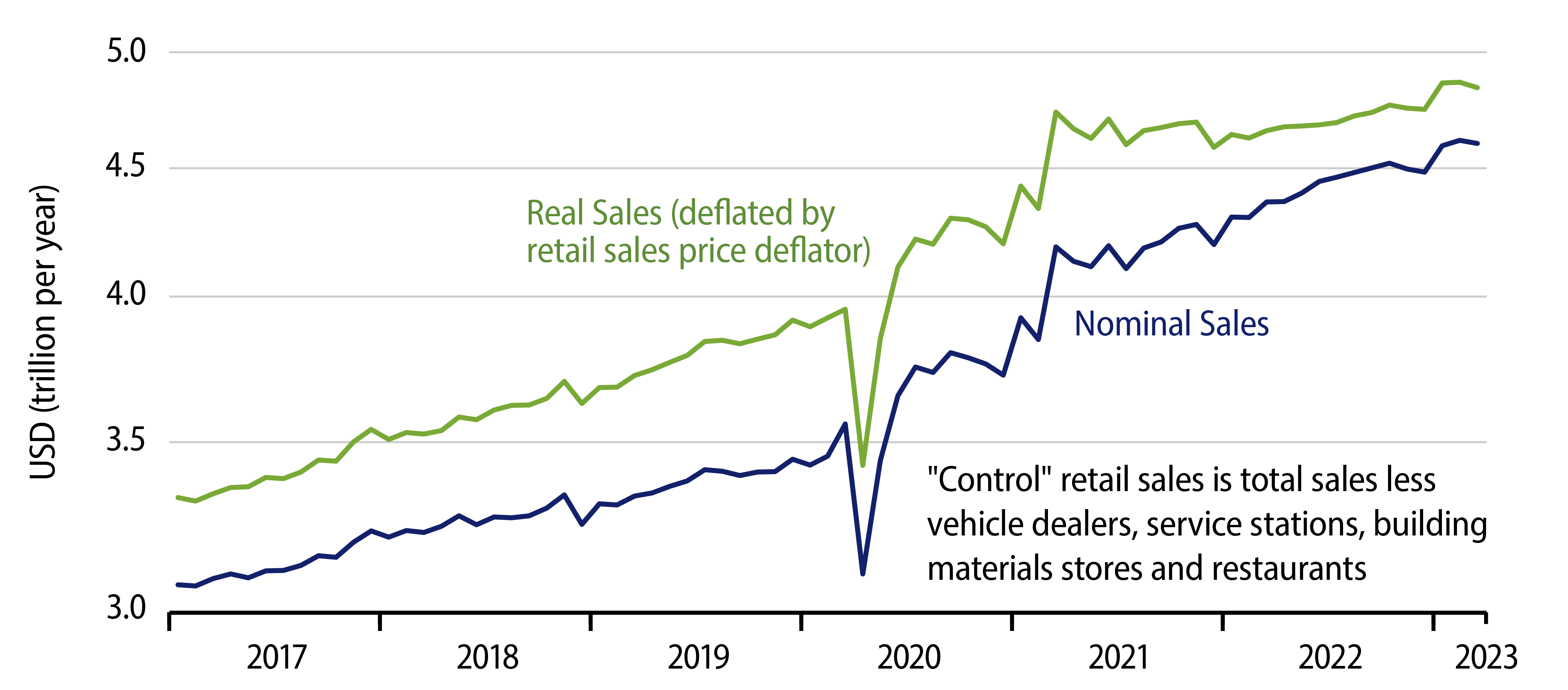

Control sales are plotted in nominal and real terms in the accompanying chart. As you can see there, the reported declines in real sales in February and March 2023 as well as in November and December 2022 just about offset the big reported increase for January 2023. As we argued at the time, it appears that this January increase—and the surrounding declines—are seasonal blips, reflecting a shift in consumers’ holiday spending patterns that is not yet fully captured by the government’s seasonal adjustment techniques.

All this technical dissection aside, the fact remains that even looking through the downs and ups of the last five months, there is a net uptrend in real sales going back to about July 2022. That is, while real sales were generally flat to down from March 2021 through July 2022, they have been rising modestly since then.

The growth pace of the last eight months looks slower/milder than what we were seeing prior to Covid. Then again, it has occurred alongside the Fed’s tightening maneuvers. The markets—and likely the Fed—were looking for a net softening in retail sales trends, and the data have not delivered that. This would seem to explain today’s declines in bond prices.

Where are sales gains occurring? The only components of control sales that are not flat or declining in real terms are sales at restaurants and nonstore (online) vendors. Real restaurant sales spiked in January (seasonal blip?) and have pulled back in the last two months, but still show fairly steady net gains over the past two years. Nonstore sales have shown steady growth throughout recent years, and they also show a net pick-up so far this year.

Meanwhile, real retail sales have declined considerably at grocery, furniture and apparel stores, with smaller declines occurring for electronics. Still, the net gains at restaurants and nonstore vendors are more than enough to offset these declines.

Real consumer spending on merchandise has not picked up as much as have real retail sales, but it does show some net improvement since last summer. Meanwhile, spending growth for services has been decelerating over that period.

All in all, we would assert that the consumer spending picture is mixed. However, that means it is not the clearly weakening picture that would reassure the markets or the Fed.