Headline sales rose by 0.3% in May, with most of that nominal gain offset by a downward revision to the April sales estimate. Most analysts focus on a “control sales” measure that excludes sales at car dealers, gas stations, building material stores and restaurants, because those sectors are frequented by businesses about as much as by consumers. That control measure showed a 0.2% gain in May, more than offset by a -0.4% revision to the April sales estimate.

In other words, the May sales estimate for headline sales was barely—0.07%—above the April estimate reported a month ago, while the May estimate for control sales was 0.2% below the April sales estimate reported a month ago. Meanwhile, the U.S. Department of Labor has reported a net increase in goods prices in May, so that in real terms, adjusting for inflation, both headline and control sales declined in May after holding about unchanged in April.

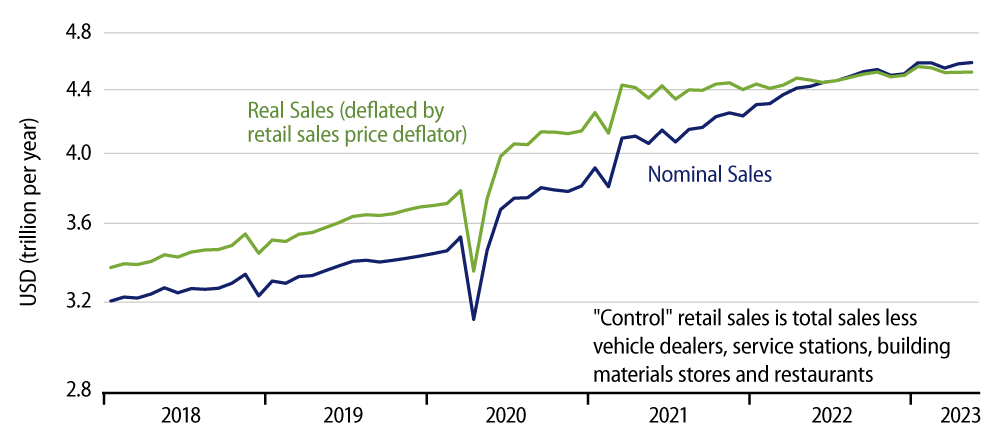

As you can see in the accompanying chart, the recent retail performance is on par with generally sluggish sales trends over the past two years plus. After a strong rebound coming out of the Covid shutdown, real retail activity has been essentially flat since March 2021 and the accompanying measure of real consumer spending on merchandise has shown a slight decline on net. Granted, the absolute level of both real retail sales and real consumer spending on goods compare well with pre-Covid trends, but again, there has been no further “progress” in these measures for over two years.

While merchandise prices rose in May, individual goods’ prices varied wildly, with most of the increases occurring for used cars and pharmaceuticals, and prices generally declining for other goods. The retail sales data share this pattern, with sales at vehicle dealers and drug stores rising somewhat in May, and sales declining elsewhere. And that is in nominal terms.

In real terms, we estimate that sales declined at least slightly for all store types except nonstore (online) vendors, vehicle dealers, building material stores and gas stations. For the last three of these, the estimated May real sales gain merely offset preceding declines, so that building material stores and gas stations look to be on declining trends, while vehicle dealer sales are extremely choppy but down from the levels of two years ago. Online vendors do continue to rack up real sales gains, but these are at the expense of “brick-and-mortar” retailers.

Real restaurant sales had shown a nice post-Covid uptrend through most of 2022 but that has stalled over the last six months. Real grocery store sales have been declining since mid-2021 and are well below pre-Covid trends.

To repeat, underneath month-to-month volatility in both directions, retail activity has been sluggish for over two years, and today’s news was right in line with that pattern.