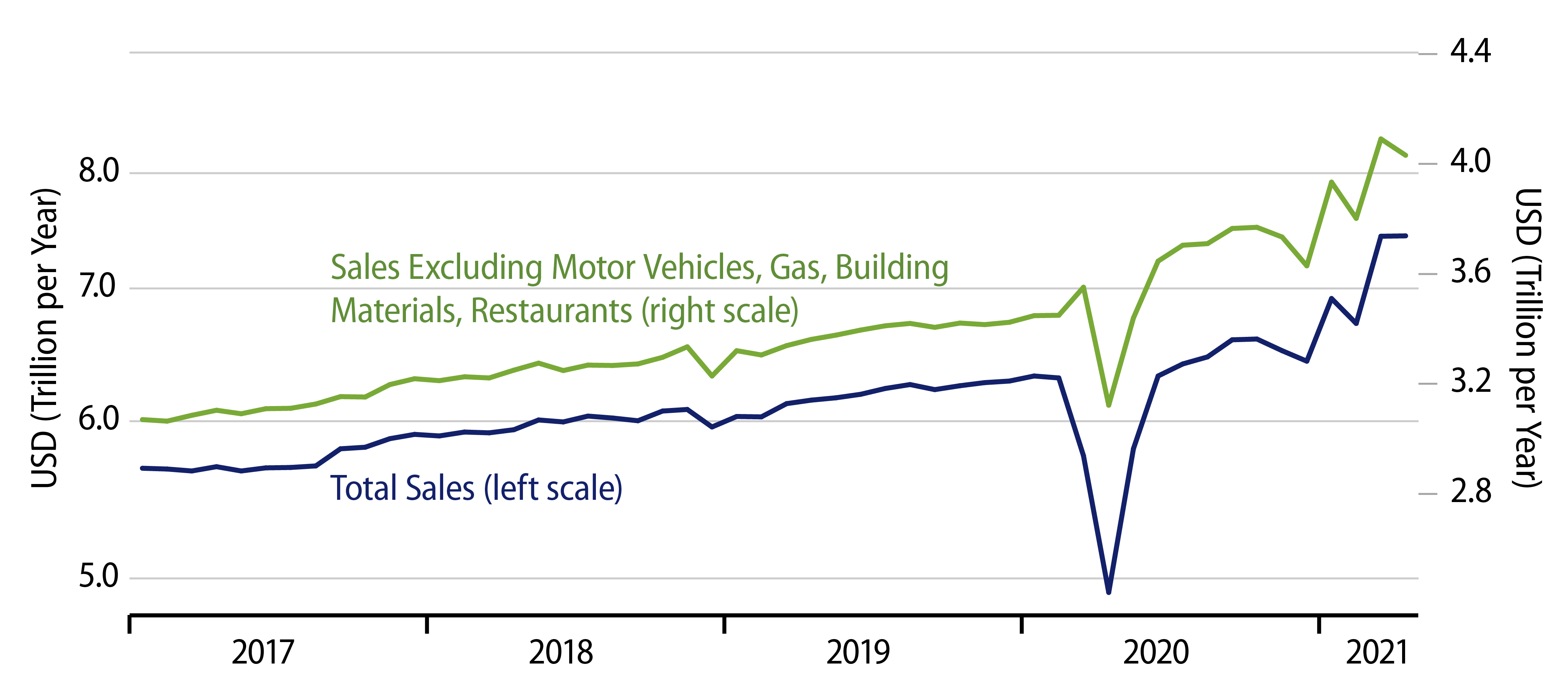

Headline retail sales were flat in April, with a slight +0.1% revision to the March estimate. For the more widely tracked “control” measure, which excludes vehicle dealers, building material stores, gas stations and restaurants, sales were down 1.5%, with a -0.2% revision to the March estimate.

In the title here, we describe that -1.5% April change in control sales as a “slight” decline because it comes off a +7.6% gain in March, not to mention a strong rebound in late-2020 from shutdown-induced declines a year ago. So, it would clearly be wrong to say April sales were weak. Nevertheless, they are clearly softer than the consensus expectations.

As described here a month ago, the consensus view was that February sales declines were due to blizzards in Texas, and that the combination of spring weather and federal stimulus checks would unleash a torrent of spending for a number of months. Our own view was that the ups and down of recent months were driven more by the vagaries of seasonal adjustment than by weather or ups and downs in the flow of federal benefits. We were also skeptical that households would spend much of the one-time windfalls doled out to them by the government.

The April sales news is consistent with our story, but is not a vindication of it. To fully confirm our story, the data in upcoming months would have to show a pullback to the trend path in place prior to the onset of the pandemic. Today’s news is a first step in that direction, but only that. Still, today’s data leaves us with less head-scratching to do than would have been the case had April sales surged again the way the consensus expected.

Underneath the headline data, most store types registered sales declines in April, following strong gains in March. Interestingly enough, sales at vehicle dealers registered an April increase, despite widespread reports of production snags on vehicle assembly lines. The 2.9% rise in car sales likely reflects higher used-car prices.

There was also a 1.0% rise in drug store sales and a 3.0% increase in restaurant sales that brought restaurants in aggregate back to within 2% of pre-Covid levels. The rebound in restaurant activity has been quite impressive, given both how many such establishments are still shuttered and also the constraints that operating restaurants have to deal with.

In sum, there is no question that consumer activity has rebounded nicely. Our question now is how much “gas is left in the tank” for further growth.