Real consumer spending was flat in May, as declining purchases of motor vehicles offset modest increases in services spending. Spending on goods other than motor vehicles was flat. Revisions to March and April data were all over the place, with total consumption for March revised upward by 0.1%, but April consumption revised down by -0.1%.

The March revisions drove some of the upward revisions announced for 1Q GDP yesterday. However, with the estimate for 1Q consumption higher and that for April lower, followed by no change in May, likely 2Q growth in consumption is looking soggier than was the case a few days ago.

Each of the revisions were a mixed bag. For March data, the +0.1% revision to total consumption was net of a -0.3% revision to goods spending and a +0.3% revision to services. The -0.1% revision to April was net of a -0.5% revision to April goods spending and a +0.1% revision to April services spending.

The markets reacted pretty strongly to the upward revisions to GDP yesterday. So, it is worth noting that the downward revisions to April released today more than offset yesterday’s revisions to 1Q.

Growth patterns within the data were similarly mixed. Initial April data released a month ago indicated a noticeable bounce in goods spending. Today’s data revised away that bounce and left “core” goods spending clearly on the same flat-to-declining trend it has followed for more than two years. On the other side of the fence, data through April had suggested a flattening in services spending other than on health care, but today’s data restore some ongoing growth to services spending.

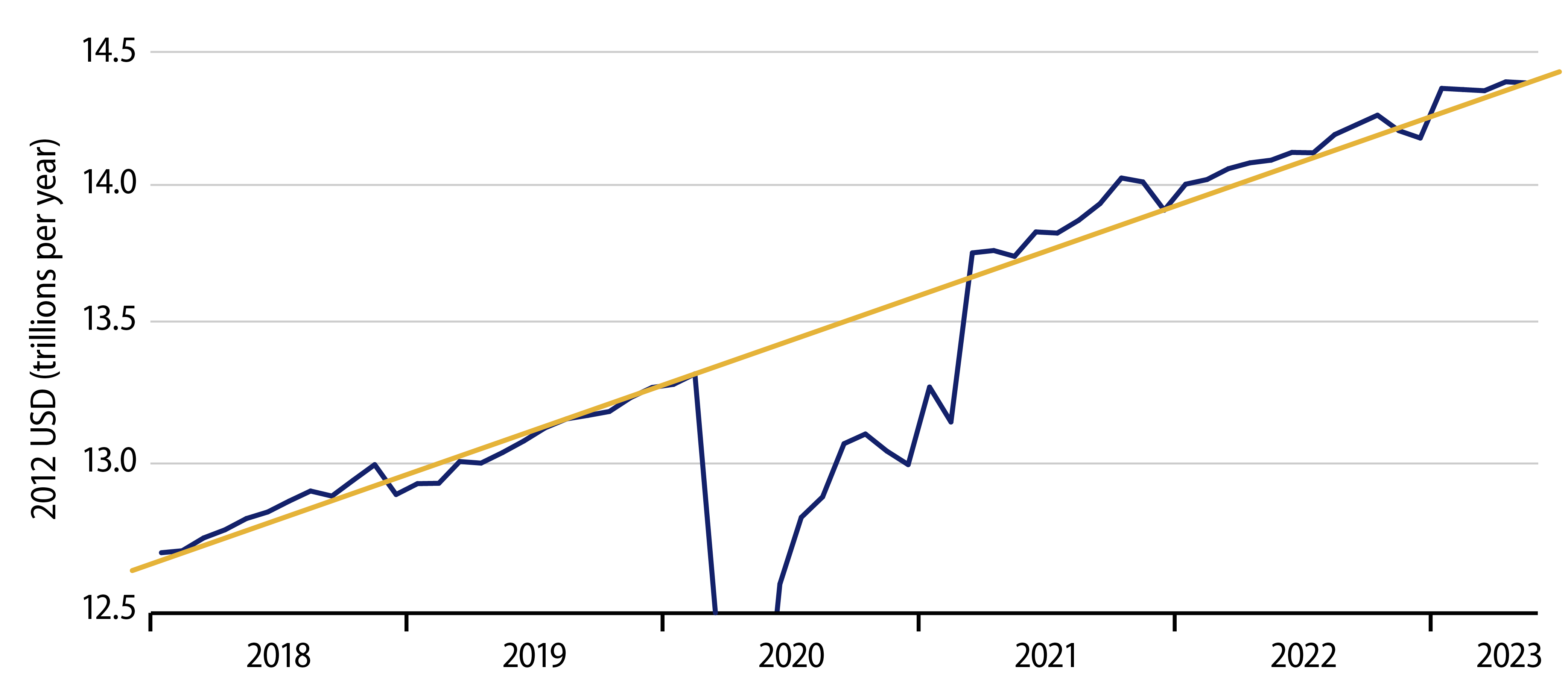

On net, consumer trends are as clear as mud, as you might judge from the chart. No, there is no sign of a consumer pick-up. In fact, we may have seen some slowing relative to pre-Covid growth trends (indicated by the yellow line in the chart). However, any such slowing is mild, and given the big data revisions seen lately, the flat overall spending in May should be “swallowed” only tentatively.

The motor vehicle spending data were interesting. Domestic vehicle production has virtually exploded in recent months, rising 9.8% in April and another 2.4% in May. A processing chip shortage hampered vehicle production for much of the past 18 months, and with that shortage now alleviated, carmakers are making up for lost time. However, consumer car buying has not responded commensurately, with April gains revised lower and May showing a 4.3% decline.

With production up and sales down, car inventories are obviously accumulating. The situation isn’t dire at present, but unless they can dramatically increase sales very soon, the model-year changeover will likely show even sharper output cuts than usual, a chip abundance notwithstanding. So, look for big price incentives in coming weeks.

We typically abstract from the vehicles sector when analyzing goods-sector and manufacturing trends, not because it doesn’t matter, but because the car industry follows inventory and sales patterns very different from those of the rest of the economy. Recent developments are a poster child for this point.

Finally, inflation as measured by the Personal Consumption Expenditures (PCE) price index moderated some in May. The headline PCE index rose at a 1.6% annualized pace in May, while the core PCE rose at a 3.8% annualized rate, and services prices within the PCE did show some moderation. This by itself won’t be enough to appease Fed Chair Powell and his colleagues, but it is a step in the right direction.