Headline private-sector jobs rose by an apparently strong 465,000 in February, but there were so many undercurrents within the data that this is misleading. Allowing for the reopening of restaurants in many states and seasonal effects distorting construction and retailing sectors, the jobs gains elsewhere were smaller and served mostly to offset weak tallies in December and January.

When commenting on the January data a month ago, we stated that the apparent softness then would be offset by a better report in February. This was indeed the case, but no more. On net, job gains over the last three months have been modest to slight. We blame this not on any weakness in consumer or business fundamentals, but on the continuing shutdowns suppressing many service industries, and we would expect job gains to remain modest until a broad-based reopening occurs, hopefully not too far from now.

The details underlying this conclusion are as follows. Renewed shutdowns of restaurants drove sharp job losses there in December. With restaurants reopened in late-January, the sector recouped most of those losses in February, but not all. Thus, the restaurant sector saw a loss of -365,000 jobs in December, a gain of +17,000 in January, and a gain of +286,000 in February, leaving it still 52,000 short of November payroll counts. We should add that both December and January changes there were revised substantially.

Meanwhile, both construction and retailing saw typically sharp swings in payroll counts, in line with winter layoffs and rehirings, and with the government’s attempts to adjust for those seasonal swings. Construction now shows job swings of +47,000, +1,000 and -61,000 over December-February, respectively, which figures show little revision from month-ago estimates. Retailing shows swings of +30,000, +46,000 and +41,000, respectively—apparently steady, but revised sharply from month-ago estimates, which showed much stronger December gains and a substantial January decline.

For the rest of the private sector, month-ago job gain estimates for December and January were +21,000 and +66,000, respectively. Current data show net gains of +14,000, +26,000 and +199,000 over December-February, respectively. If all these disparate swings confound you, don’t shoot us, we’re only the piano player.

Beneath all this noise, it should be apparent that the pace of underlying job gains has been modest at best, with average gains of 80,000 per month over the last three months. So, today’s February report did indeed serve to offset the weakness reported in December and January, but no more than that.

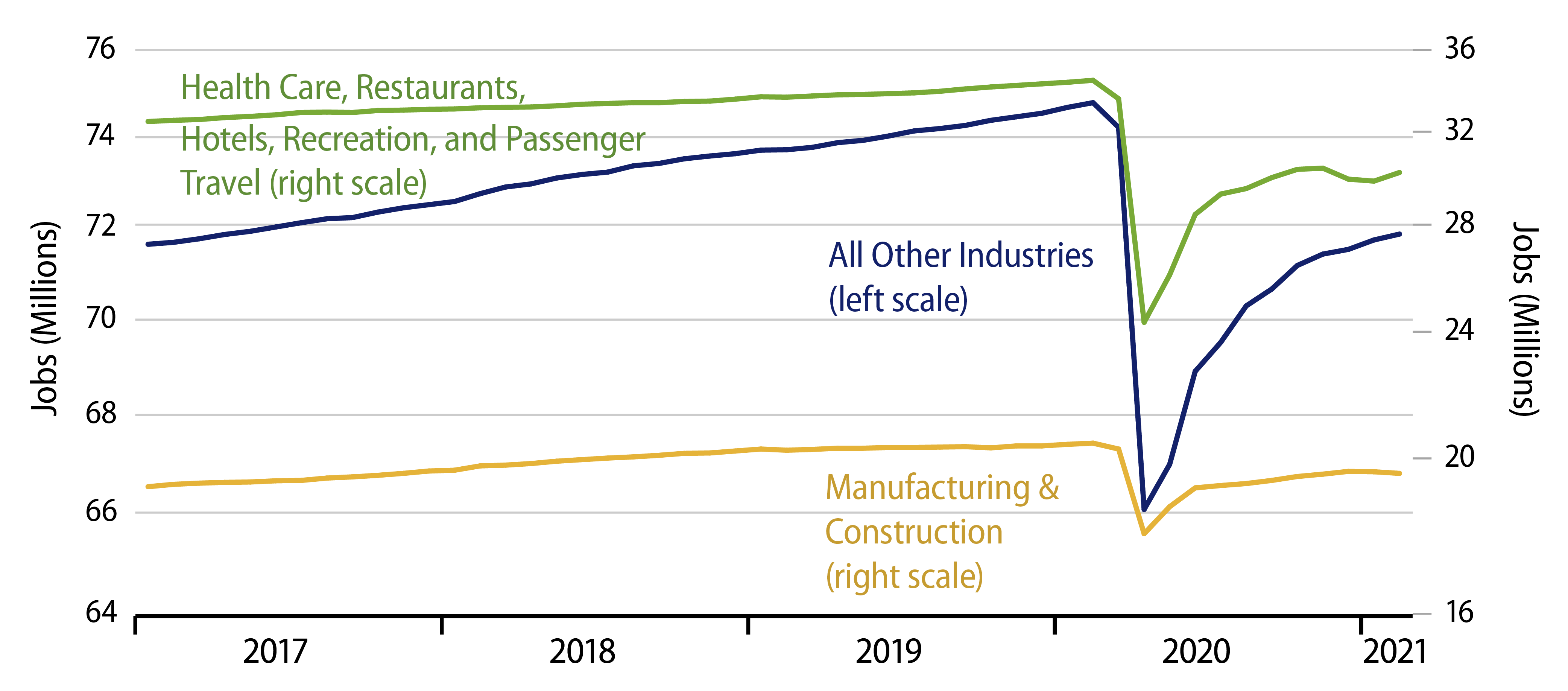

And we are inclined to think that this is as good as things will get until a broad-based reopening has occurred. Production levels in both manufacturing and construction have more than fully recovered from the shutdown-induced recession of last spring, even though job counts in these sectors are still well below pre-Covid levels. Maybe these sectors will further restore job counts without further strong growth in output, but this is debatable.

Meanwhile, all the “recession” remaining in the economy is in service sectors that are still largely shut. Stimulus money can’t put “butts in seats” of theaters that are closed, nor can it induce job growth in those venues. As you can see in Exhibit 1, job growth in such sectors has been steady but paltry in recent months. It will take a broad reopening to effect a change for the better in these trends.