The Bank of Japan (BoJ) raised interest rates by 0.25% at its latest policy meeting in late January, bringing its key interest rate to about 0.50%. BoJ Governor Kazuo Ueda cited the increased likelihood of achieving the Bank’s price target in a sustainable and stable manner. He highlighted that the economy and inflation were on track, real interest rates remained significantly negative, high wage increases were expected and the outlook for the US economy was positive.

We expect the Bank to continue raising interest rates further due to the prospect of progress in the normalization of monetary policy. The adverse effects of this normalization have been limited since the appointment of Ueda. However, the more pronounced side effects of the delay in normalization, such as yen depreciation, inflation and sluggish real private consumption, may encourage additional interest rate hikes.

BoJ Statement and Outlook Report Overview

The Bank upwardly revised its inflation forecast in its latest Outlook Report. Core CPI for FY25 is expected to grow 2.4%, up by 0.5% from its October forecast, and core CPI is projected to grow 2.1%, up by 0.2%. The revision is primarily due to the rise in rice prices and the reaction to measures such as electricity bill subsidies. This is the first time that all three fiscal years of the forecast period are expected to exceed a 2% inflation rate.

The report pointed out that underlying inflation is expected to gradually increase as the output gap improves and the virtuous cycle between wages and prices continues to strengthen amid heightened labor shortages. Given that real interest rates are at extremely low levels, the BoJ suggested that it would raise interest rates further once its outlook for economic activity and prices was realized.

Side Effects of Delayed Normalization

It is evident that inflation is a factor in the slump in real private consumption due to the squeeze on real purchasing power. For example, real private consumption in the July-September quarter of 2024, as indicated by GDP statistics, was -1.4% compared to the 2018-2019 average, remaining below pre-pandemic levels. In contrast, nominal private consumption in GDP grew by 8.4% year-over-year (YoY).

The BoJ has noted that exchange rate fluctuations are more likely to affect prices than in the past due to the increased activity in wage- and price-setting behavior by firms. Consequently, the recent resurgence of the yen's depreciation is likely to increase upward pressure on cost-push prices, such as the depreciation of the yen and high commodity prices, which the Bank calls its “first force.”

On the other hand, the BoJ has maintained monetary easing to achieve its 2% price stability target in a sustainable and stable manner. It is uncertain whether underlying inflation and inflation expectations are anchored at that rate. However, as already mentioned, the side effects of the delay in normalization have become remarkable, and the Bank is likely to accelerate the pace of interest rate hikes in an effort to correct the yen’s depreciation and stabilize prices.

Effects of Monetary Policy Normalization

After more than 10 years of large-scale monetary easing, there is a strong possibility that expectations for economic activity are based on the assumption of ultra-low interest rates. Consequently, there is a risk that the negative effects of rising interest rates will be exposed, particularly for entities vulnerable to such increases. Therefore, in the current phase of monetary policy normalization, it will take a considerable amount of time to ascertain the negative impact of each stage. The BoJ must raise interest rates at a cautious pace while referring to the uncertain neutral interest rate.

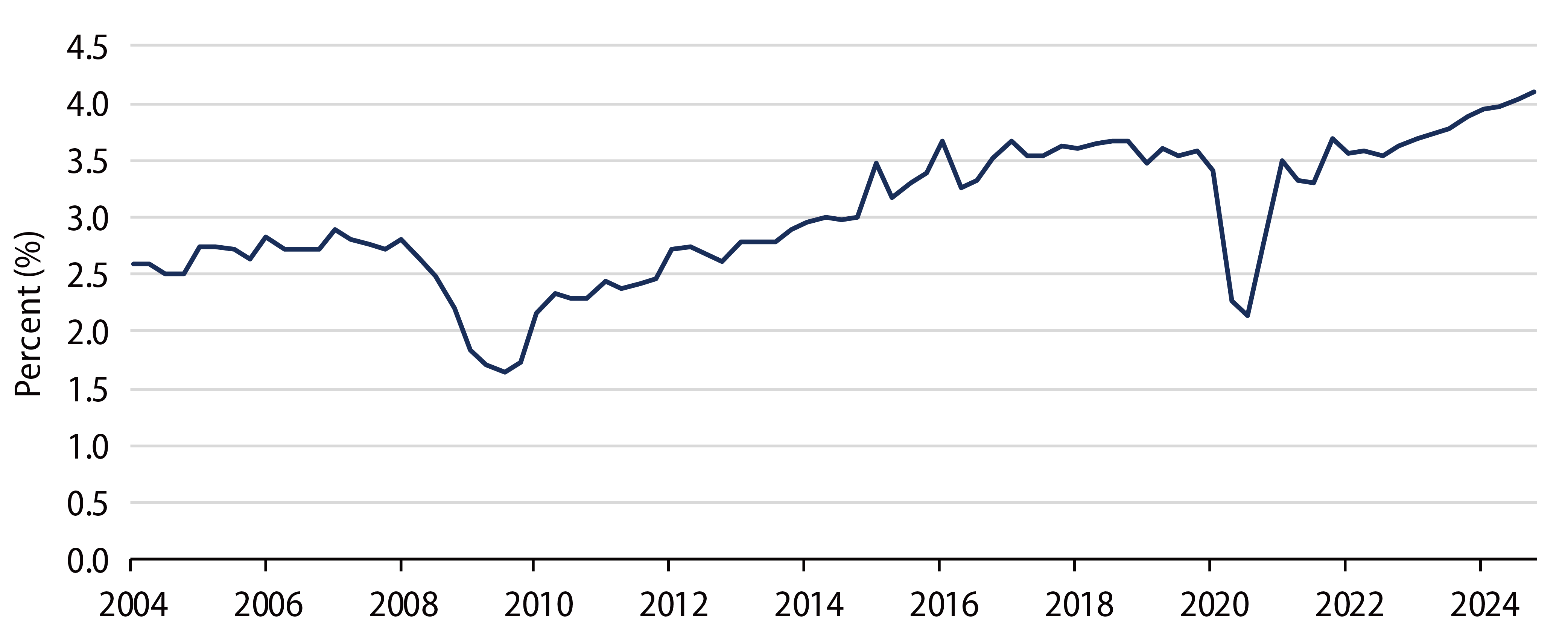

Small- and medium-sized enterprise (SME) profits are vulnerable to rising interest rates. However, the ordinary income of SMEs across all industries as reported in the Tankan Report remains high (Exhibit 1). Therefore, the impact of the interest rate hike on SMEs is minimal at this point.

The BoJ’s broad view of monetary policy highlighted the adverse effects of prolonged large-scale monetary easing, including a decline in the functioning of the Japanese government bond (JGB) market and the impact on financial institutions’ profits. However, considering the risk that prolonged monetary easing could distort economic and corporate behavior and expose potential imbalances, the BoJ should be cautious in hiking rates. Consequently, the more substantial side effect is that the pace of rate hikes during the normalization phase of monetary policy will be delayed, increasing the risk of “behind the curve” impacts.

Our View on BoJ Monetary Policy and Market Implications

We expect that the BoJ will continue to hike rates to at least 1.0%, which is the lower end of its neutral policy rate range of 1.0%-2.5%. We expect that the future pace of rate hikes will occur once every six months. However, as interest rate hikes progress and monetary policy further normalizes, the impact of rate hikes on the economy is likely to intensify, and it will take longer to see their side effects. As a result, there is a possibility that the pace of rate hikes will slow.

From an investment point of view, upward pressure on JGB yields is expected to continue for the time being. In the long run, however, the expected return on the JGB market seems to be increasing, especially due to carry and rolldown. This is due to the slow and cautious pace of policy rate hikes, the low terminal rate level, the steepened yield curve led by higher inflation expectations and the current JGB yield levels. These levels are 1.9% for 20-year JGBs and 2.3% for the 30-years. These appear valuable when compared to the liability of costs of typical private pension funds (2.0%-2.5%) and life insurance companies (1.8%).

In summary, the BoJ’s cautious approach to raising interest rates aims to balance the need for price stability with the risks of rapid hikes. While the normalization process may exert short-term pressure on JGB yields, we believe the long-term outlook remains positive due to the anticipated gradual pace of rate increases.