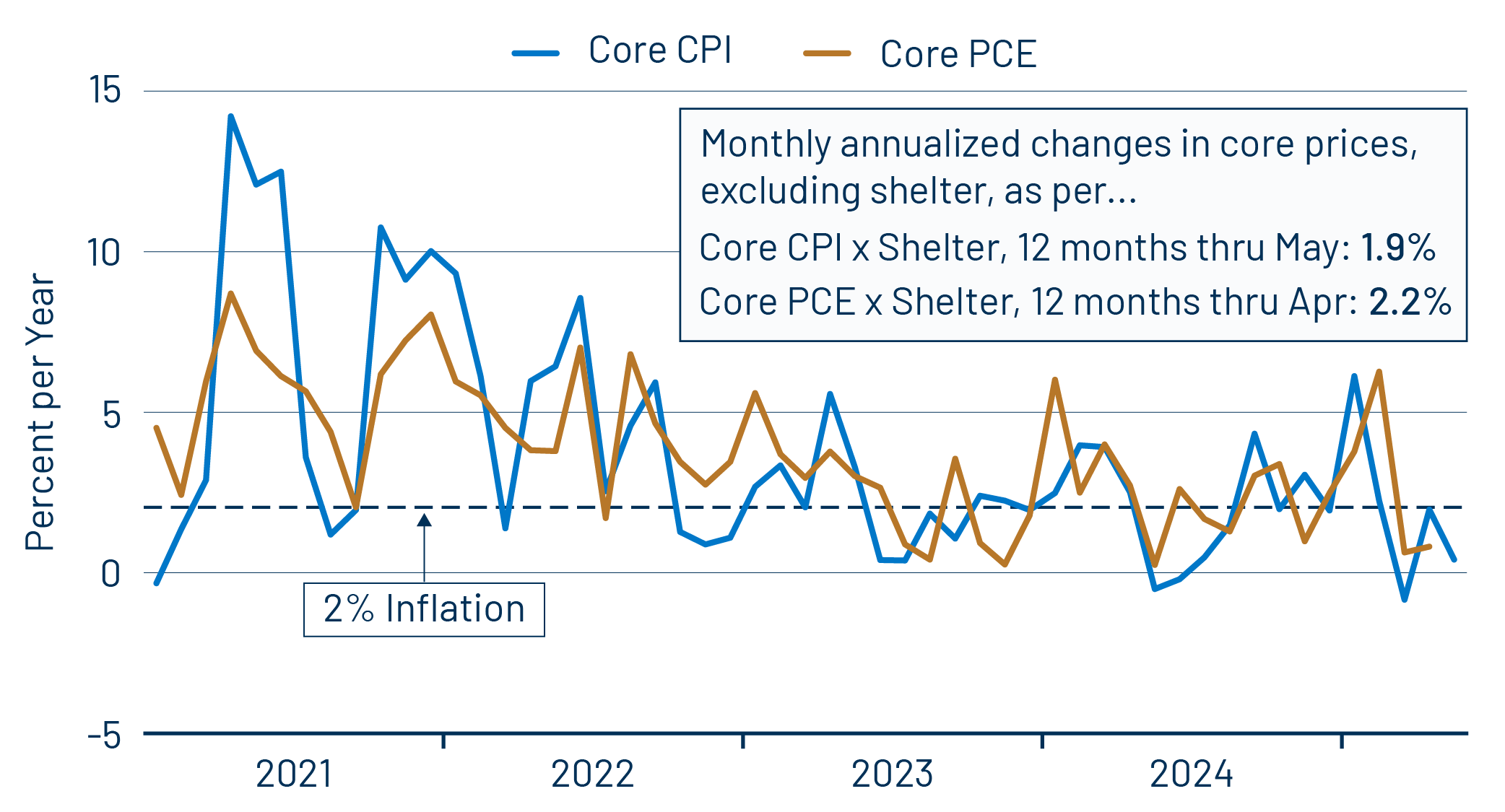

Today’s Consumer Price Index (CPI) report for May was as market friendly as it could get. Headline CPI inflation grew at a scant 0.08%, or at a 1.0% annualized rate. The more closely watched core CPI rose 0.13% or at a 1.6% annualized rate. (Core CPI excludes volatile food and energy prices.) Similarly, we have been tracking a core CPI that also excludes shelter costs due to apparent technical glitches in the Labor Department reporting methods for shelter costs. That measure rose 0.03% or at a 0.4% annualized rate.

All of these inflation paces were below the Federal Reserve’s (Fed) target of 2.0% annualized inflation. Indeed, the core-ex-shelter measure has been at the Fed’s target for the last two years, rising at a 1.9% annual rate over the last 12 months and at a 1.8% rate for the 12 months before that.

There are two technical factors to keep in mind. First, the Fed actually targets the core Personal Consumption Expenditures (PCE) index, and that measure ex-shelter has been a little hotter, rising at a 2.2% rate over the 12 months through April and at a 2.3% rate in the 12 months before that. Second, while it was Fed Chair Powell himself that pointed out the apparent glitches in reported shelter costs two years ago, the Fed has been silent on this issue recently.

It is the case that reported shelter costs have continued to decelerate much more decidedly than for the rest of core CPI. In late 2022, shelter costs as reported within the CPI were rising at a 9% annualized rate. By late 2023, that rate had declined to 6% and then dropped further to under 5% by late 2024. The May report had shelter costs rising around 3% (2.6% for tenants and 3.3% for homeowners).

Opposite these reported trends, new-home sales prices have been declining slightly ever since April 2022, while existing-home sales prices have risen at a scant 1.7% annual pace since then. So, the disparity between shelter costs within the inflation measures and pricing from the real estate markets is narrowing but has not yet quite disappeared. In line with this, the gap between overall core inflation and core-ex-shelter inflation has been narrowing and is likely to disappear by the end of this year.

Outside shelter, both goods and services prices were restrained in May. We mentioned last month that in the April report, there were possible signs of incipient effects of tariffs, as prices rose for home furnishings, appliances, sporting goods and electronics. May saw a reversal of those increases for home furnishings and electronics, and a slower rate of increase for sporting goods. Declining car prices also held down core goods prices, so that core goods prices declined slightly.

Energy prices also declined slightly, while food prices showed a slight gain. Meanwhile, core services other than shelter (aka “supercore” services) registered its fourth straight month of very low inflation readings. Inflation there has averaged a 0.7% annualized rate since January.

It is way too early to attribute the low inflation readings to the current administration’s policies. Rather, Fed actions over the last three years deserve the credit (and the blame for the previous inflation run). Then again, we are past the point when some pundits expected trade war woes to push inflation higher, and, as yet, this has not been the case. Instead, reported inflation continues to work toward the Fed’s targets.