Municipal Yields Moved Higher in Sympathy with USTs

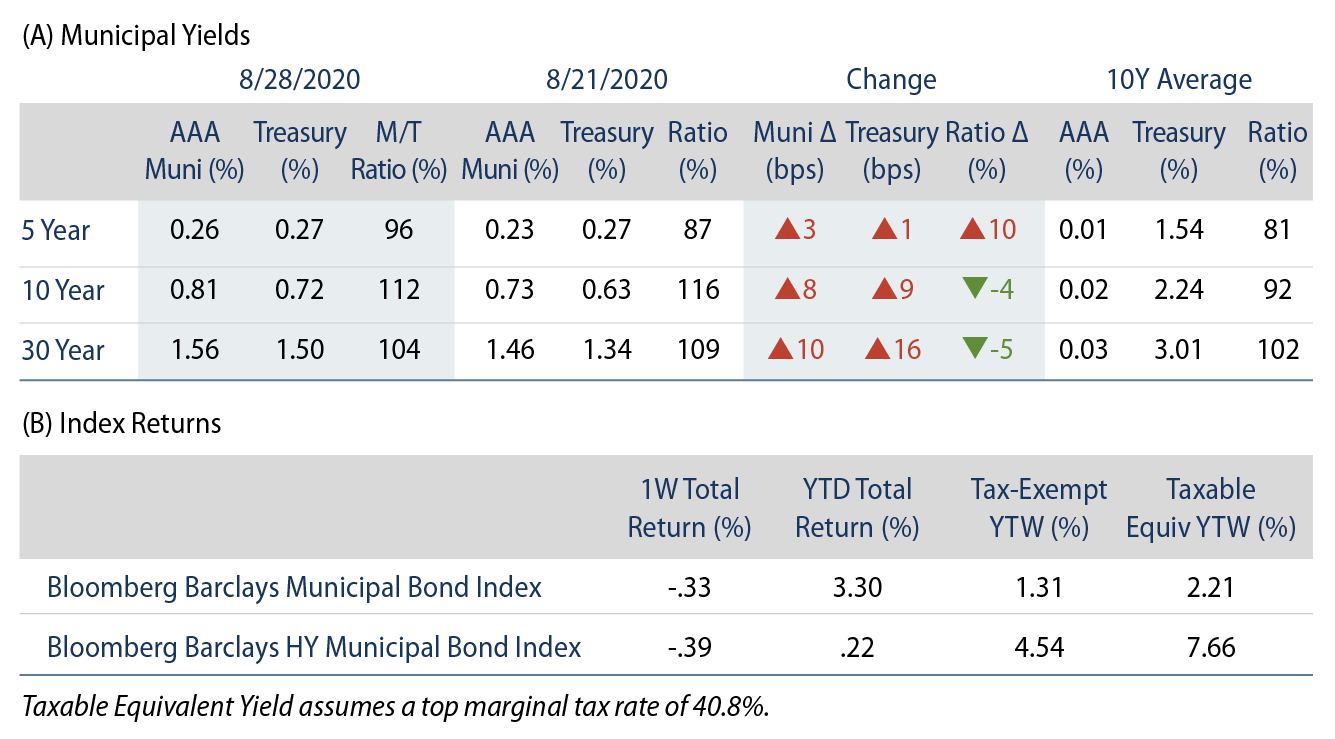

AAA Municipal yields moved 3-10 bps higher across the curve, trailing USTs. The Bloomberg Barclays Municipal Index returned -0.33%, while the HY Muni Index returned -0.39%.

Technicals Continue to Weaken Amid Heavy New Issuance

Fund Flows: During the week ending August 26, municipal mutual funds reported a 16th consecutive week of inflows at $1.0 billion, according to Lipper. Long-term funds recorded $66 million of inflows, high-yield funds recorded $15 million of outflows and intermediate funds recorded $205 million of inflows. Municipal mutual fund net inflows YTD total $14.2 billion.

Supply: The muni market recorded $12.5 billion of new-issue volume last week, down 3.5% from the prior week. Issuance of $291 billion YTD is 28% above last year’s pace, primarily driven by taxable issuance as tax-exempt issuance remains relatively unchanged year-over-year. We anticipate approximately $11 billion in new issuance this week (-12% week-over-week), led by $2.3 billion taxable State of Florida and $1.4 billion State of California transactions.

This Week in Munis: School’s Out?

As we approach autumn and the cloud of uncertainty around school reopenings, both at the K-12 and university levels, we anticipate fundamental implications across the municipal market.

Public school districts across the US are in crisis operationally and financially as a result of the pandemic. Fortunately for K-12 school districts, the primary funding source is property tax revenues which tend to be resilient. But, local school districts also receive approximately 21% of revenues from state and local funding which will be vulnerable if states and local municipalities do not receive meaningful federal assistance for COVID-related revenue losses. Many analysts expect that school districts will lose $200 billion in revenue over the next two years, which has the potential to drive approximately 300,000 teacher layoffs.

Colleges and universities—already reeling from pre-COVID online programs and tuition discounting—have lost funds from room and board, the cancellation of study abroad programs and athletic events. The cancellation of college football alone, the industry’s biggest moneymaker, could cost universities up to $4 billion. Federal funding for state and local governments is critical to higher education, as approximately 10% of university revenues are driven by state and local funding. Public colleges are budgeting for significantly less in-state appropriations while private colleges, which tend to be more expensive, could face larger enrollment declines.

The degree of austerity and budgetary pain felt by these downstream entities is still an unknown and will be on a case-by-case basis, but will ultimately be informed by the degree of aid that is provided by Congress. We continue to favor issuers in the education sector that maintain the market position, revenue diversity and budgetary flexibility to overcome the potential austerity faced by the municipal market under a scenario where reduced funding is provided to the sector.