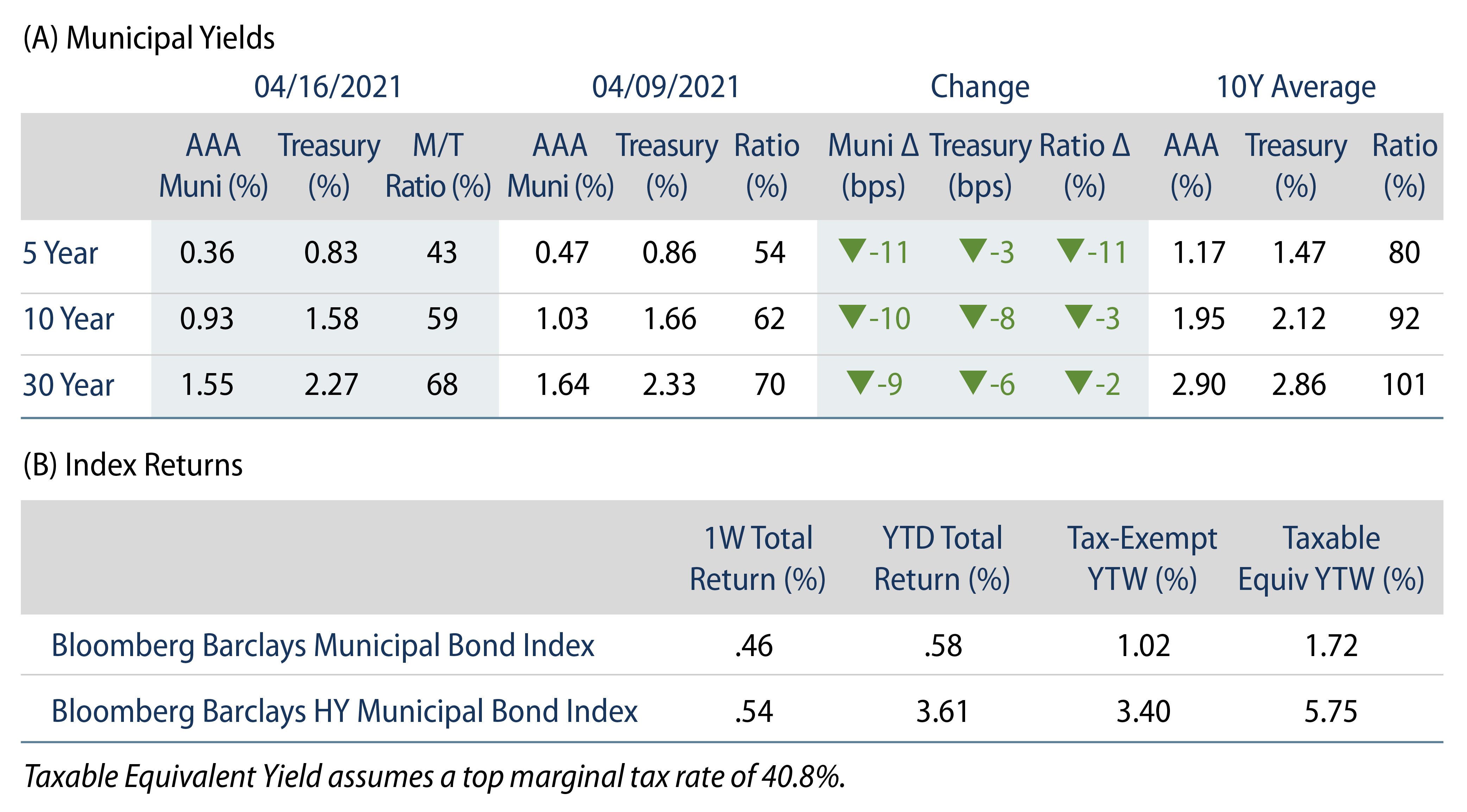

Municipal Yields Moved Lower Across the Curve with Treasuries

AAA Municipal yields moved 9-11 bps lower across the curve during the week. Municipals outpaced Treasuries on strong technicals, with short-end ratios touching record lows. The Bloomberg Barclays Municipal Index returned 0.46%, while the HY Muni Index returned 0.54%.

Technicals Strengthened with Fund Inflows Continuing Their Record Pace as Supply Declined Week-over-Week

Fund Flows: During the week ending April 14, municipal mutual funds recorded $2.3 billion of net inflows according to Lipper. Long-term funds recorded $2.1 billion of inflows, high-yield funds recorded $1.3 billion of inflows, and intermediate funds recorded $163 million of inflows. Year-to-date (YTD) net inflows reached $38 billion, maintaining a record YTD pace.

Supply: The muni market recorded $7.3 billion of new-issue volume during the week, down 27% from the prior week. Total issuance YTD of $125 billion was up 24% from last year’s levels, with tax-exempt issuance 21% higher and taxable issuance 34% higher. This week’s new-issue calendar is expected to pick up to $11 billion (-40% week-over-week). The largest deals include $1.1 billion California State General Obligation and $875 million State of Connecticut transactions.

This Week in Munis: New York’s Budget Proposal Extends Value for Municipals Within the State

Earlier this month, the New York Legislature passed an $82 billion fiscal 2022 general fund budget (+9.6% over the prior year), funded by a tax hike on top earners within the state as well as $5.5 billion of its $12.6 billion in American Rescue Plan Act stimulus funds. The budget is focused on increasing spending for K-12 education, higher education, renter protection, small businesses and art program recovery. The legislation increases the top tax rate to 10.9% (for filers earning over $25 million), which would imply a top combined state and local tax rate for city earners of 14.8%. The corporate franchise tax will also increase by 11.5% to 7.25%, to remain in place for three years.

- Like many other states, New York’s revenue picture has fared better than originally feared at the onset of the pandemic. Fiscal 2021 tax collections were down $513 million—approximately 1% year-over-year (YoY), but exceeded the state’s prior estimate by $3 billion. Stronger-than-expected revenues were primarily attributable to higher personal income tax collections, which reached $55 billion (+2.4% YoY), but were offset by sales tax and business tax receipts which declined YoY.

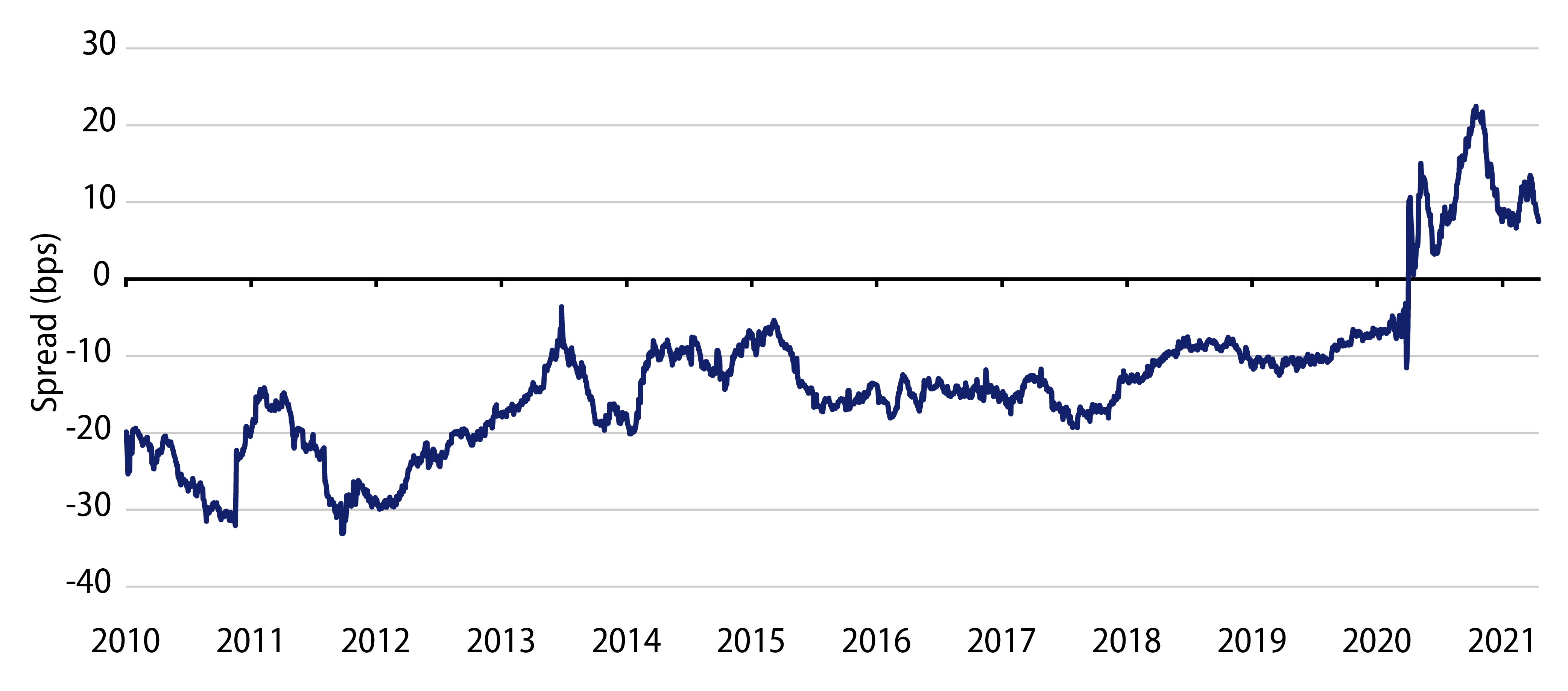

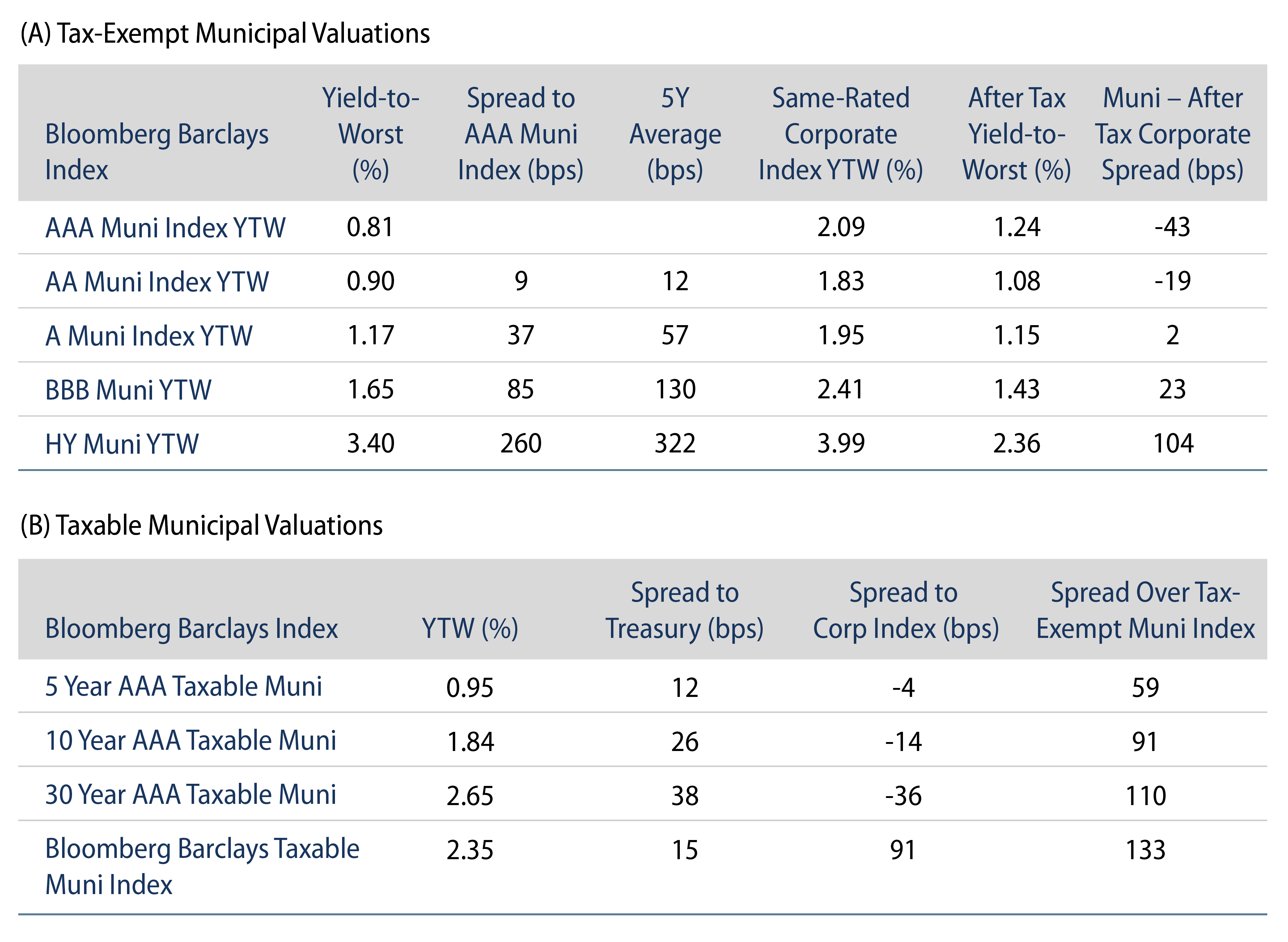

- The improving fundamental picture of the state, along with the proposed tax increase, extends the relative value observed among New York municipal securities. In the decade leading up to the pandemic (March 2020), the Bloomberg Barclays New York Municipal Bond Index yield-to-worst fell below the average yield of the broader municipal market indicated by Bloomberg Barclays Municipal Bond Index, attributable to the natural demand from high net worth individuals facing relatively higher effective tax rates within the state. Following March 2020, the average yield of New York securities traded up to 20 bps higher than the Bloomberg Barclays Municipal Bond Index, offering a yield pickup for even national municipal investors.

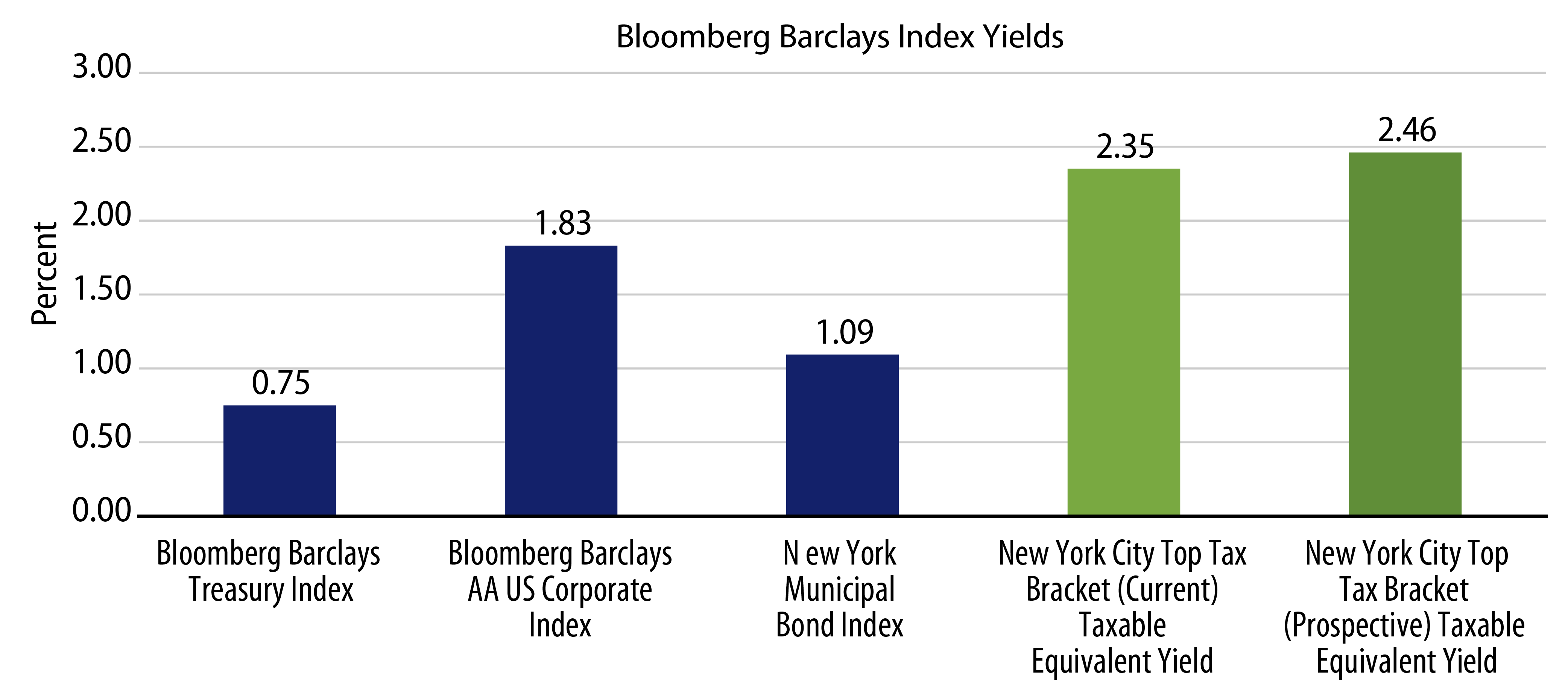

- While New York was arguably more affected by the pandemic than the nation, we anticipate its credit profile to stabilize due to the unprecedented federal support and vaccine rollouts. Headlines often point to a great exodus from higher tax states, but net migration tends to be slower than headlines suggest and we anticipate high earners to remain near top employment centers such as New York City. As effective tax rates move higher, so will the demand for in-state municipal debt, as we estimate top tax bracket in-state municipal investors will receive an incremental 10 bps of taxable equivalent yield associated with the tax increase.