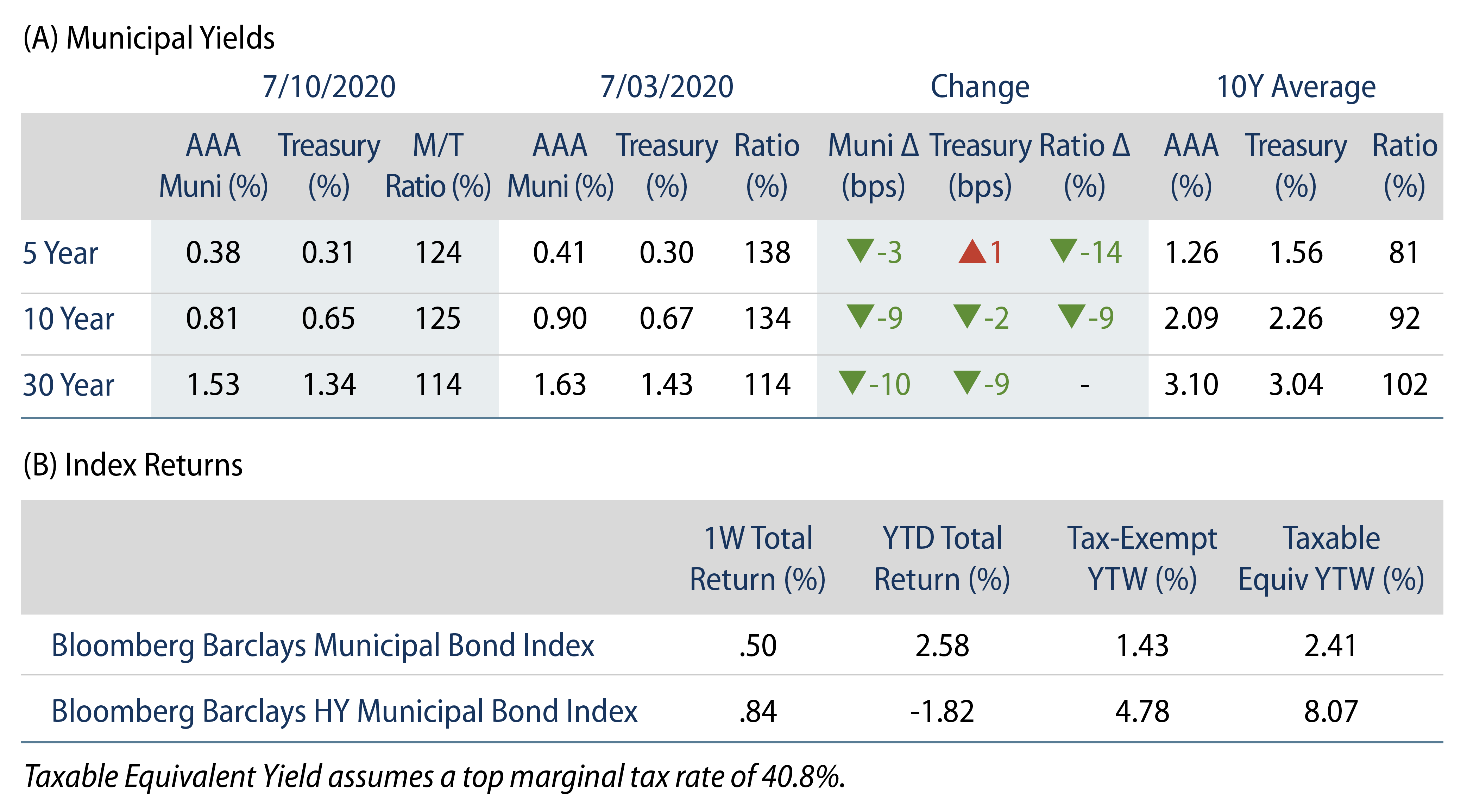

AAA municipal yields moved 3-10 bps lower during the week, outperforming Treasuries and driving municipal-to-Treasury ratios lower. The Bloomberg Barclays Municipal Index returned 0.50%, while the high-yield muni index returned 0.84%.

Technicals: Demand for Tax-Exempt Income Continues

Fund Flows: During the week ending July 8, municipal mutual funds reported a ninth consecutive week of inflows at $1.0 billion, according to Lipper. Long-term funds recorded $617 million of inflows, high-yield funds recorded $86 million of inflows and intermediate funds recorded $74 million of inflows. Year-to-date (YTD) municipal fund net outflows now total $4.8 billion.

Supply: The muni market recorded $10.8 billion of new-issue volume last week, up 81% from the prior holiday-shortened week. Issuance of $214 billion YTD is 29% above last year’s pace, primarily driven by taxable issuance which is 326% above last year’s levels. We anticipate approximately $13.1 billion in new issuance next week (+30% week-over-week), led by $2.3 billion New York State Urban Development Commission and $1.0 billion taxable Texas Transportation Commission transactions.

This Week in Munis: Biden’s Tax Plan Bodes Well for Muni Demand

In recent months, Joe Biden has been touting a plan to increase the corporate income tax rate to 28% from 21%. An increase in the corporate tax rate would have direct implications on the tax-exempt municipal market.

As a reminder, the corporate income tax rate was reduced from 35% to 21% following the passage of the Tax Cuts and Jobs Act in 2017. As a result of the change, bank and insurance company municipal holdings declined over $104 billion (or 12%), from December 2017 to March 2019.

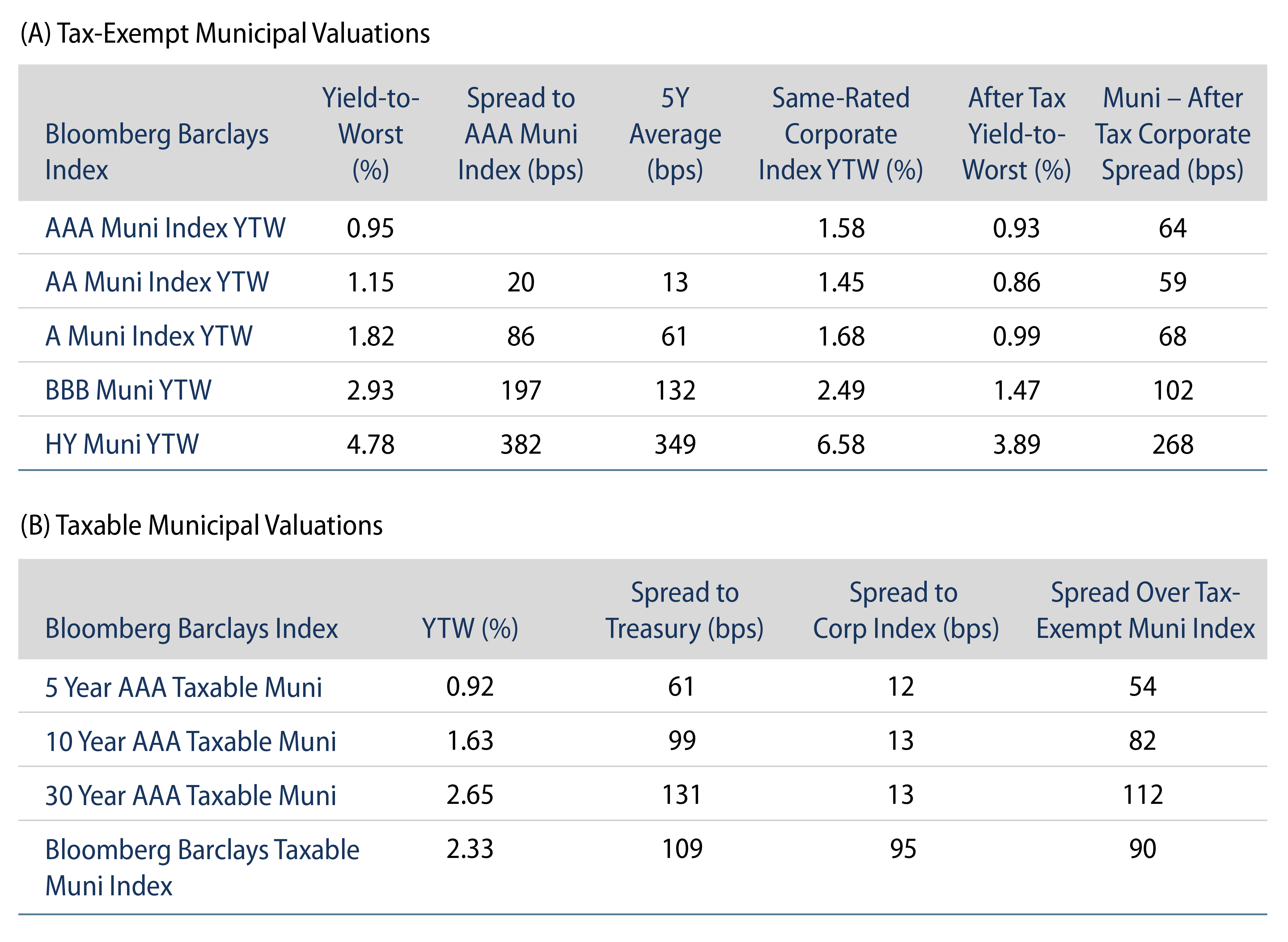

A 7% increase in the corporate tax rate could make the relative value of tax-exempt municipals more compelling for banks and insurance companies. Considering the average 30-year Bloomberg A-Revenue Muni Yield of 2.26%, these corporate entities would only have to find a taxable yield of 2.86% in the broader fixed-income market. Under Biden’s proposal, the taxable-equivalent municipal yield proposition would increase to 3.14%, higher than the current 30-year Bloomberg A rated US Corporate Yield of 2.62%.

We believe the prospect of higher tax rates is one of several positive supply and demand factors municipal investors should consider. Over the long term, we believe that retirees will be converting higher risk allocations to high quality income producing assets, including municipals. Meanwhile, the net supply of tax-exempt debt is declining. With Treasury rates remaining low, municipalities are issuing taxable municipal debt more frequently in lieu of tax-exempt issuance. In addition, as mentioned in our infrastructure blog post on June 23, any potential bipartisan agreement on infrastructure would more likely incentivize additional taxable debt rather than tax-exempt issuance, further curb tax-exempt supply and serve as a tailwind for tax-exempt valuations.