Performance Overview

Municipals posted positive returns along with other fixed-income asset classes as the Fed reduced the fed funds rate by 50 bps.

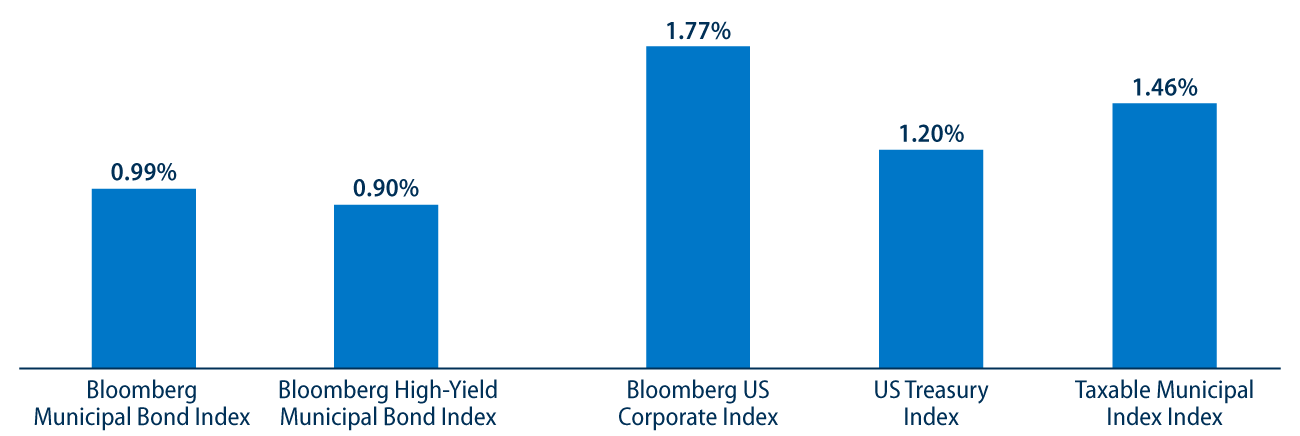

The investment-grade municipal market posted positive returns in September, as the Bloomberg Municipal Bond Index returned 0.99%. This marks the fourth consecutive month of positive returns, leading year-to-date (YTD) returns higher to 2.30%. Long-maturity municipals outperformed during the month, as sentiment around a lower rate environment improved following the Federal Reserve’s (Fed) 50-basis-point (bp) rate cut. Quality returns were mixed across the board, and high-yield municipal debt underperformed following the significant outperformance recorded earlier this year. The Bloomberg High Yield Municipal Index returned 0.90% in September, leading YTD returns higher to 7.48%. Municipals continued to underperform other high-quality fixed-income asset classes, in part due to elevated supply conditions.

Supply and Demand Technicals

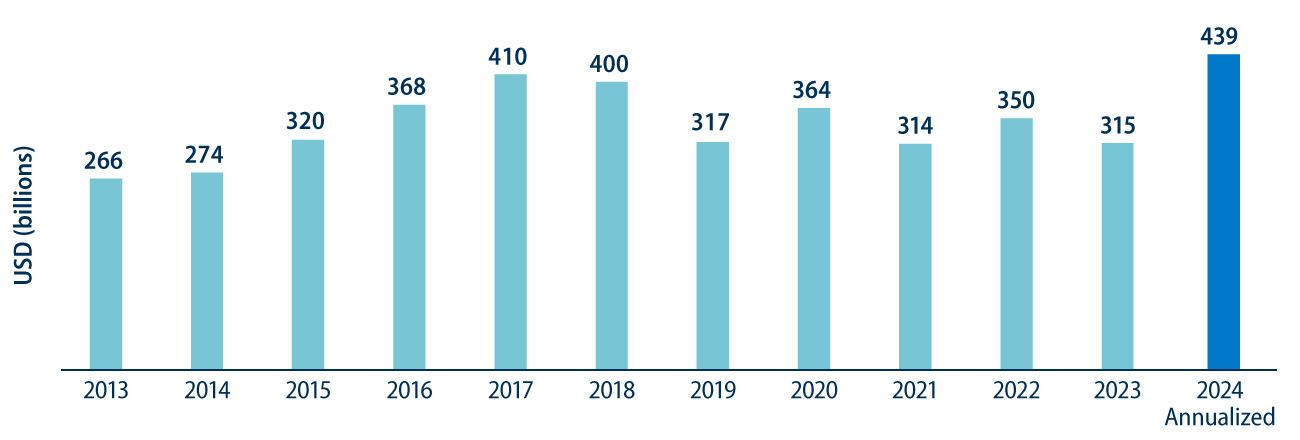

Tax-exempt muni supply is on pace for a record year.

Municipal underperformance versus other fixed-income asset classes continued to be driven by elevated supply conditions. Total municipal supply of $47 billion was 63% higher than last year’s September issuance level, leading total YTD issuance to $376 billion. Through three quarters of the year, tax-exempt issuance increased $100 billion (+44%) from the prior year to $347 billion, and taxable issuance increased 9% year-over-year (YoY) to $30 billion.

Municipal demand improved during the month, as weekly data from Lipper and ICI indicate over $6 billion of municipal fund inflows during the month, leading YTD inflows higher to $30 billion. Long- term category flows recorded the largest proportion of fund flows during the month, consistent with market returns.

Fundamentals

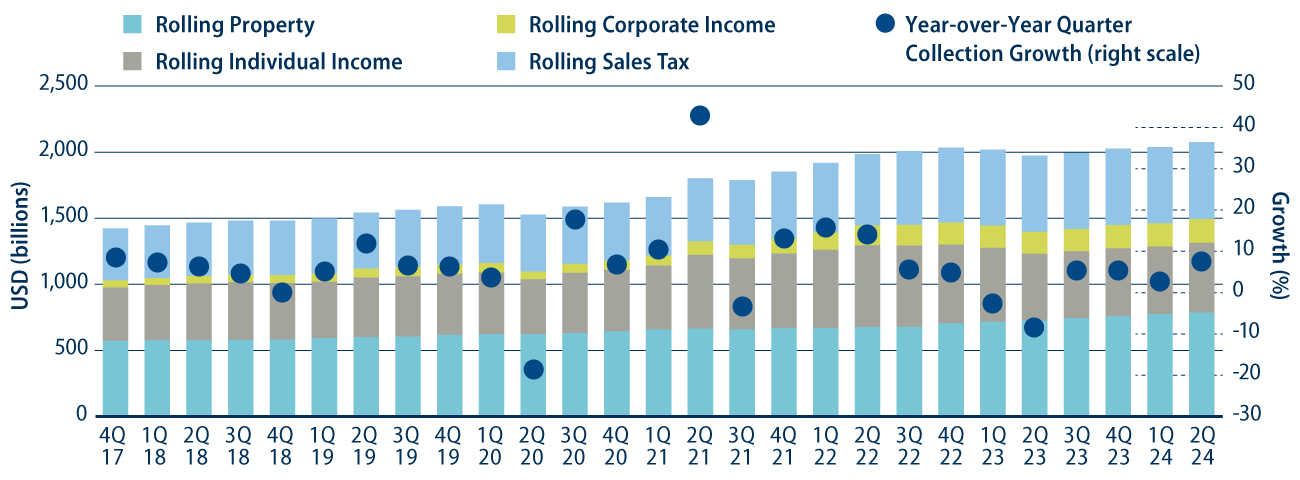

State and local revenue collections remain near record levels.

In September, the Census released 2Q24 state and local tax collection estimates, which coincide with the fiscal year-end for many municipalities. Second quarter major state and local government tax col- lections grew 7.4% from 2Q23 levels. Among the major state revenue sources, individual income taxes increased 11.9%, corporate income tax collections increased 7.2% and sales tax collections increased 2.6% YoY. Property tax collections, the primary source of revenues for local governments, increased 8.1% YoY to $146 billion. The continued growth of tax collections highlights the strength of municipal credit, and we expect a strong labor market and consumer to support tax collections and municipal credit conditions over the medium term.

Valuations

Municipals offer above-average after-tax yield pickup versus most taxable counterparts.

Despite the fourth consecutive month of positive municipal returns, elevated supply and relative underperformance versus other investment-grade fixed-income assets have contributed to an attractive relative value proposition for municipal debt. The 3.32% average yield-to-worst of the Bloomberg Muni Bond Index remains 10 bps higher than at the start of the year, and equivalent to 5.61% on a taxable-equivalent yield basis for an investor in the highest marginal tax bracket. Comparing municipals to like-rated taxable fixed-income, longer and lower intermediate-grade after-tax spreads remain above five-year averages across most of the curve and credit spectrum.