Performance Overview

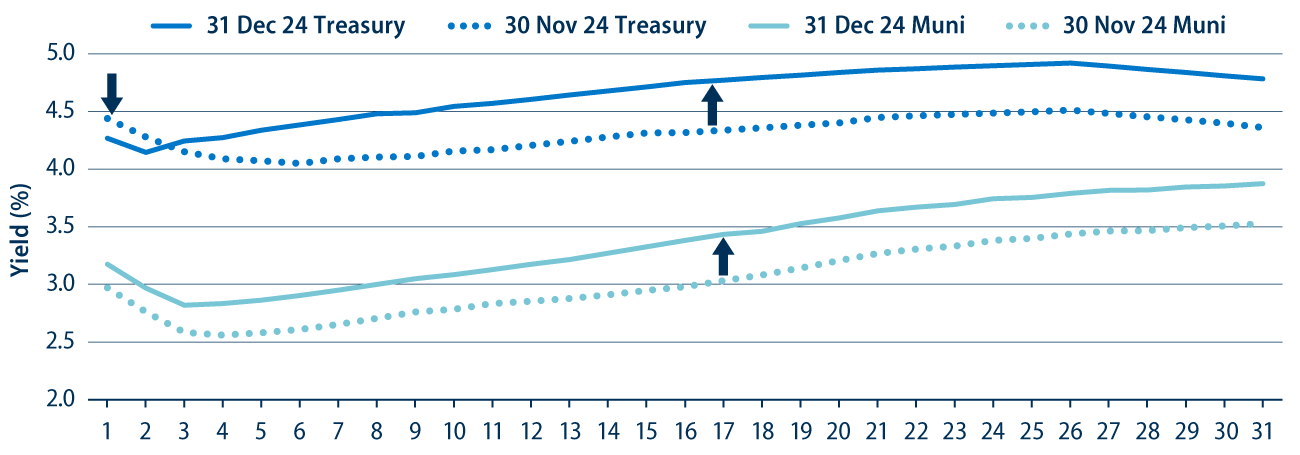

Muni yields moved higher as the Treasury curve steepened.

Fixed-income generally sold off in December as yields moved higher due to stronger-than-anticipated GDP data, which led market participants to question the path of inflation and interest rates in 2025. The Treasury yield curve steepened, with short maturities moving up to 17 basis points (bps) lower, while longer maturities moved up to 44 bps higher. Muni market yields moved higher across the curve, generally underperforming Treasuries amid the rate volatility and weakening supply and demand technicals.

The Bloomberg Municipal Bond Index returned -1.46% in December. Longer-duration municipals underperformed amid the rate volatility, as did lower investment-grade and high-yield municipals. All told, the Bloomberg Municipal Bond Index closed the year up 1.05%, outperforming Treasuries but underperforming investment-grade credit indices. High-yield municipals posted the strongest returns across the muni market, returning 6.32% during the year. The longer-duration Bloomberg Taxable Municipal Bond Index returned -2.46% in December, leading year-to-date returns to 1.57%, outperforming the Bloomberg US Treasury Index (0.58%) and the Global Aggregate (-1.69%).

Supply and Demand Technicals

Supply and demand technicals weakened during the month.

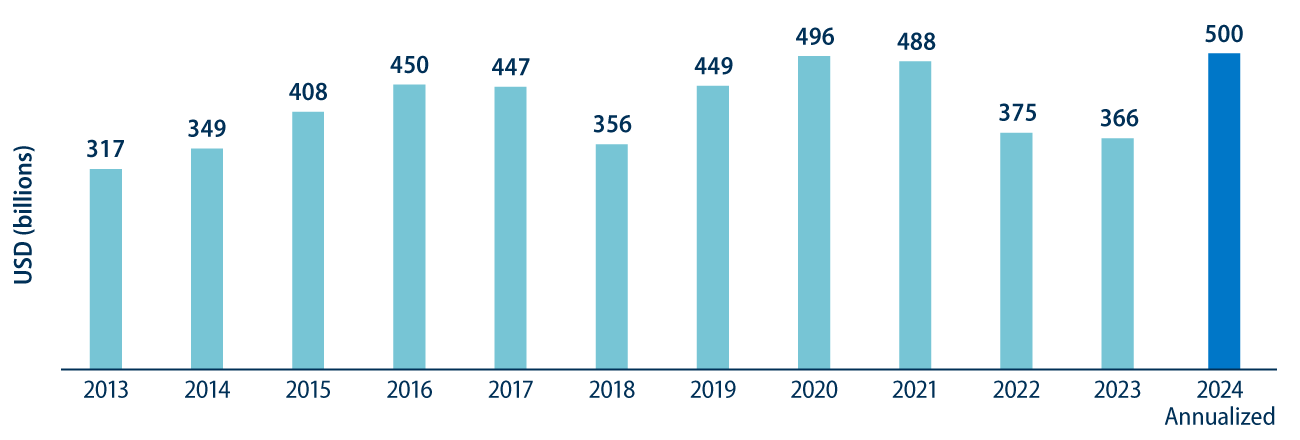

December new issuance reached $32 billion, up 26% from November’s level, closing out a record supply year of $500 billion. Tax-exempt supply of $460 billion comprised 92% of 2024 issuance and was 40% higher year-over-year (YoY), while taxable supply of $40 billion was just 6% higher than levels of prior years but still below recent averages as issuers sought better opportunities in tax-exempt markets in the higher rate environment.

Municipal demand softened in December as estimates from ICI and Lipper indicated modest net inflows of approximately $300 million during the month, driven partially by seasonal tax selling pressures. Despite the December demand slowdown, mutual funds recorded $46 billion of net inflows during the year according to ICI, partially reversing the greater than $120 billion of outflows recorded over the prior two years.

Fundamentals

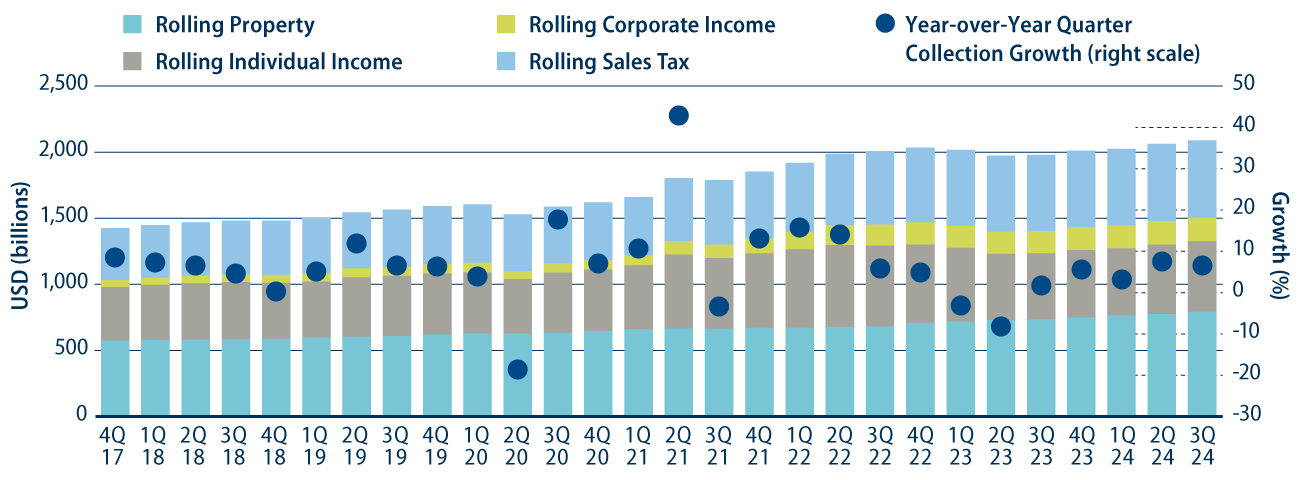

State and local revenue collections remain near record levels.

Municipal fundamentals remained resilient in December. The Census released state and local revenue collection estimates which signaled that municipal credit conditions remained well supported by elevated tax collections. Through the third quarter of 2024, 12-month trailing tax collections increased 6.4% YoY to $2.1 trillion, marking a record high level according to the Census data. On a 12-month trailing basis, individual income tax collections increased 6.6% YoY, corporate income tax collections increased 6.7% YoY, and sales tax collections increased 1.5% YoY. 12-month rolling property tax collections also recorded a strong trend higher, growing 7.7% YoY.

Valuations

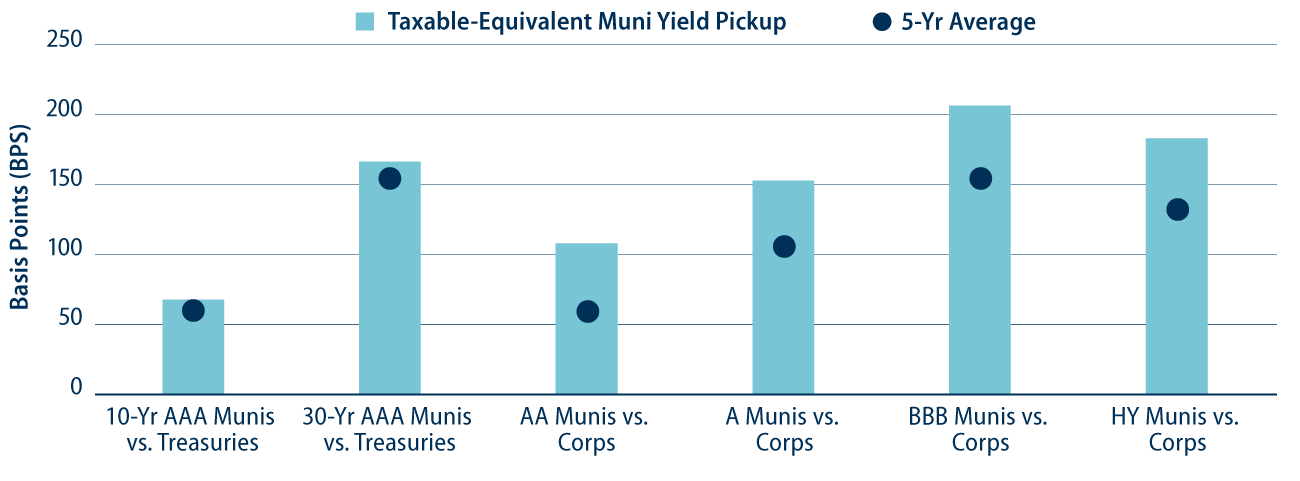

Municipals currently offer above-average after-tax yield pickup versus taxable counterparts.

December’s weakness has contributed to higher income opportunities and improved relative valuations in the municipal market. The Bloomberg Municipal Bond Index average yield-to-worst (YTW) ended the year at 3.74%, up over 50 bps from the start of the year and equivalent to 6.32% on a taxable-equivalent basis. The taxable-equivalent income opportunity, across the curve and credit cohorts, exceeds what is available in taxable fixed-income markets. As the Federal Reserve is expected to continue its rate-cutting cycle into 2025, we expect investors to pursue the relative income opportunities offered by the muni asset class.