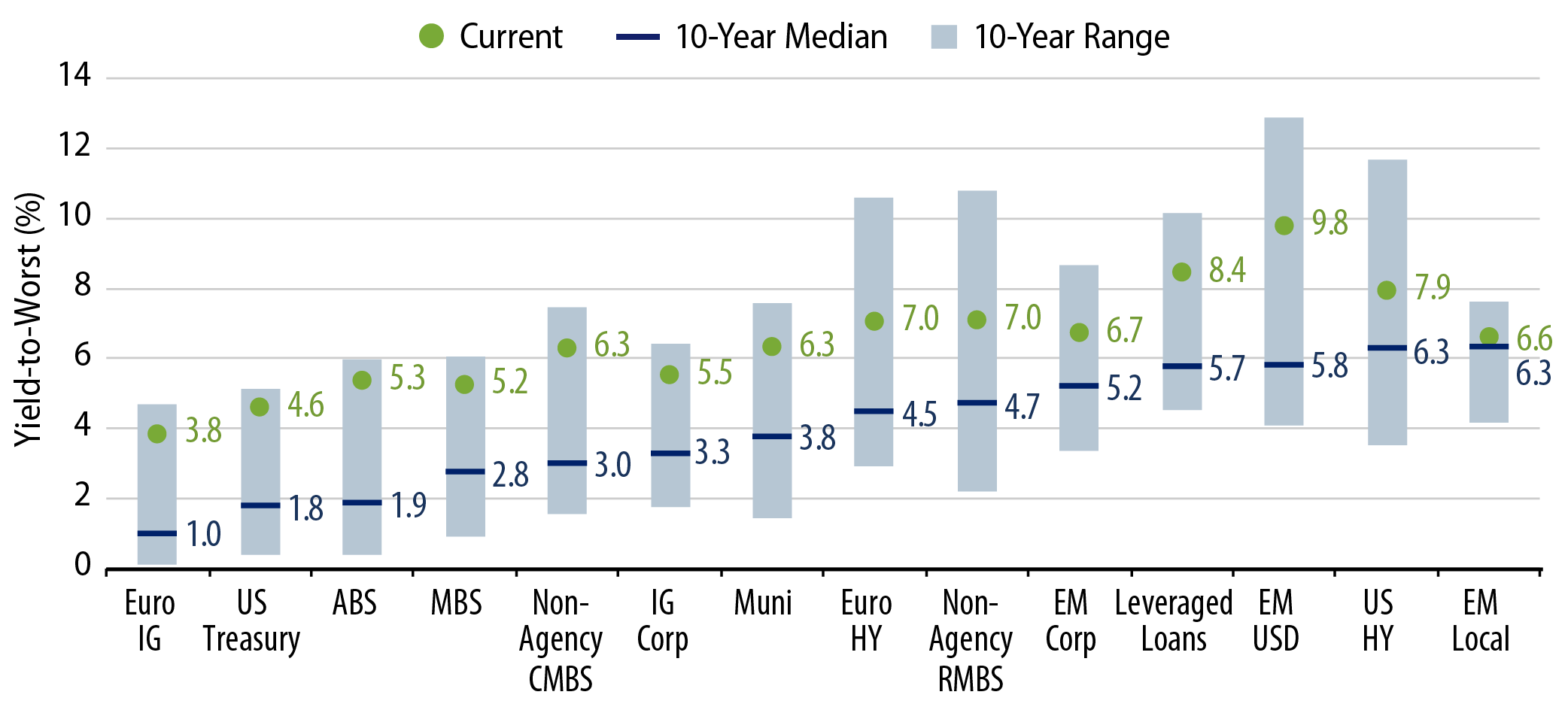

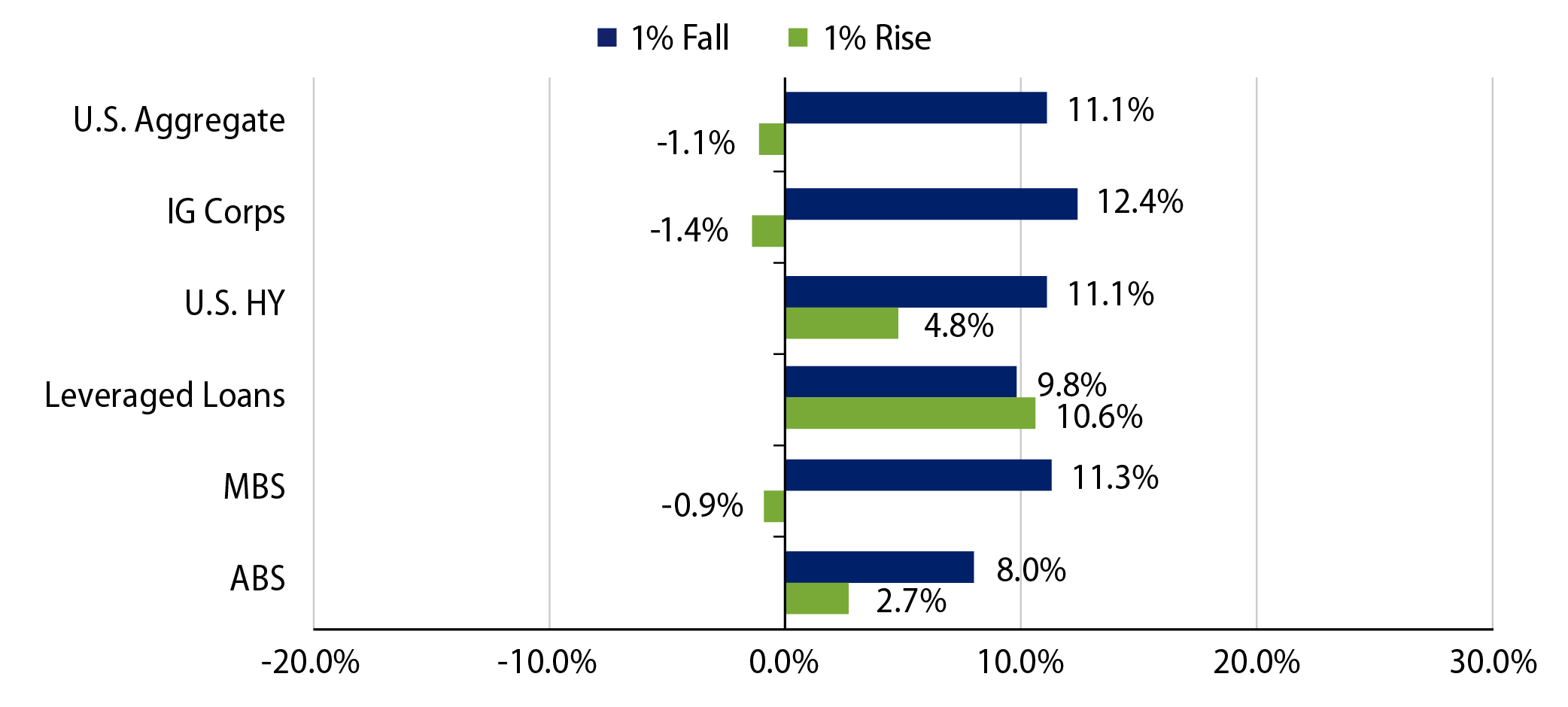

The global central bank rate-cutting cycle is in full swing, with the European Central Bank, Swiss National Bank, Sweden’s Riksbank and the Bank of Canada all reducing interest rates in recent weeks. The Bank of England is expected to join in later this fall. Meanwhile, US growth and inflation data are trending as we anticipated (i.e., moderate growth, abating inflation), which should enable the Federal Reserve (Fed) to cut rates at least once before year-end. Emerging market (EM) central banks, waiting for the Fed’s first move, will likely follow suit. Given this backdrop, we believe investors should revisit the global credit landscape, where the income and total return potential looks especially attractive in a lower interest rate environment. While opportunities may not be out in the open, a careful examination of global credit—in essence, shaking the trees—may be able to identify hidden pockets of value for investors.

Our MAC investment team currently holds a diversified mix of high-yielding, high-quality fixed-income credits in its portfolios, which is consistent with Western Asset’s outlook for a soft-landing scenario in the US. Here are the sectors we're focused on:

HY Corporate Credit

High-yield (HY) corporate fundamentals appear to remain sound midway through 2024. Leverage profiles and interest coverage ratios support the asset class, providing further runway for this credit cycle. Market technicals have created ongoing tailwinds with both retail and institutional inflows into high-yield credit and limited net new-issue supply via the primary calendar, keeping spreads tight (+313 bps) and yields around 8%. We remain confident in the income-generation narrative for this opportunity set, favoring cyclicals, financials, energy and potential rising stars. Our focus is on upcoming new issuance at appropriate concessions in the higher quality segment of high-yield credit.

Bank Loans and CLO Tranches

The loan market continues to grind tighter due to record demand imbalances, with significant collateralized loan obligation (CLO) issuance against a limited new-issue loan calendar. Bank loan yields above 9% remain attractive, offering limited duration and potential outperformance during periods of rate volatility. We continue to favor high-quality loan borrowers and more defensive sectors at this stage of the cycle. CLO debt has experienced significant tightening and outperformance this year, thanks to its floating-rate nature and attractive yields. We expect this performance trend is likely to persist through the rest of the year. For broad market investment portfolios, we prefer higher-quality CLO AAA tranches, while for more total return-focused investors, we favor BBB and select BB opportunities.

Structured Credit

This sector offers high-quality yields across most asset classes, and spreads are likely to continue tightening without a hard-landing scenario. Excess returns across structured product sectors range from 1% to 12% year-to-date (YTD), yet still appear cheap on a relative value basis compared to most credit sectors.

In the residential mortgage-backed securities (RMBS) space, housing affordability remains strained, but home prices are rising due to limited supply meeting pent-up demand. While sales and starts activity will be tied to interest rates, credit performance currently shows no signs of strain. Mortgage lenders are seeking tools to improve affordability. Subordinated tranches of credit risk transfer (CRT) securities have been among the best performers in the credit market over the past 12 months, as investors benefited from the following market low.

The commercial MBS (CMBS) market has reopened with YTD issuance volume on pace with the 2013-2020 annual average. While some AAA bonds now merely appear to be priced at fair value, spreads remain wide across mezzanine and subordinate tranches, and secondary markets offer a variety of total return opportunities. CMBS is one of the few active commercial real estate (CRE) financing markets, with capital being deployed to take advantage of the cyclical opportunity to lend at the best terms seen in more than a decade.

In the asset-backed securities (ABS) space, consumer fundamentals remain strong and stress has been manageable. We are still cautious of credit deterioration and favor higher-quality consumer sectors, established sponsors and sectors with positive tailwinds. Off-the-run sectors and issuers can provide attractive risk/reward opportunities, while bank selling may result in opportunities in the form of risk transfer or outright portfolio sales in the auto sector.

IG Corporate Credit

US investment-grade (IG) credit spreads hit new multi-year lows of +80 bps in May, driven by a continued influx of capital into IG. Persistent all-in yield buyers have bolstered technical strength, effortlessly absorbing the record new-issue calendar. Q1 earnings revealed that IG fundamentals are still robust, with corporate management teams maintaining balance sheet discipline and defensive strategies. While valuations are stretched compared to historical averages and warrant caution, we are focusing on moving up in quality as spread compression persists.

EM Debt

We see value in specific segments of EM debt, reflecting strong YTD returns but acknowledging the potential for increased volatility stemming from the upcoming US elections and shifts toward protectionist trade policies. Looking ahead, we anticipate the remainder of 2024 to be a carry-type environment for EM credit given strong absolute yields but comparatively tight spreads. Our focus remains on frontier market sovereigns and primary issuances from HY companies, which both offer attractive valuations and potential returns relative to the broader market. We’re also constructive on select EM local markets, such as Mexico, which offer high nominal yields. EM corporates, which continue to benefit from lower interest-rate sensitivity and strong balance sheets, can be an attractive allocation for ratings-sensitive investors given the spread pickup to US IG credit.

In Closing

In recent months, global credit markets have shown impressive resilience despite challenges like volatility with US Treasuries, surprising economic data and global political uncertainties. Looking ahead to the second half of the year, the upcoming US presidential election could add more uncertainty to the mix. However, developed market central banks have finally started cutting rates after much anticipation, a trend likely to continue amid the ongoing global economic slowdown and subdued inflation. While some investors remain cautious about potential spread widening and are prepared to pivot toward riskier assets in a market selloff, we believe it’s time to “shake the trees” in an effort to capitalize on compelling opportunities in today’s market.