As we approach the end of the first quarter of 2024, we think it is worthwhile to reflect on the elevated volatility of global fixed-income markets. The reason is twofold: first, to provide an update on how we are navigating portfolios through this environment, and second, to restate our conviction that our investment philosophy and process are well-suited to the current environment.

Volatility Has Been Elevated

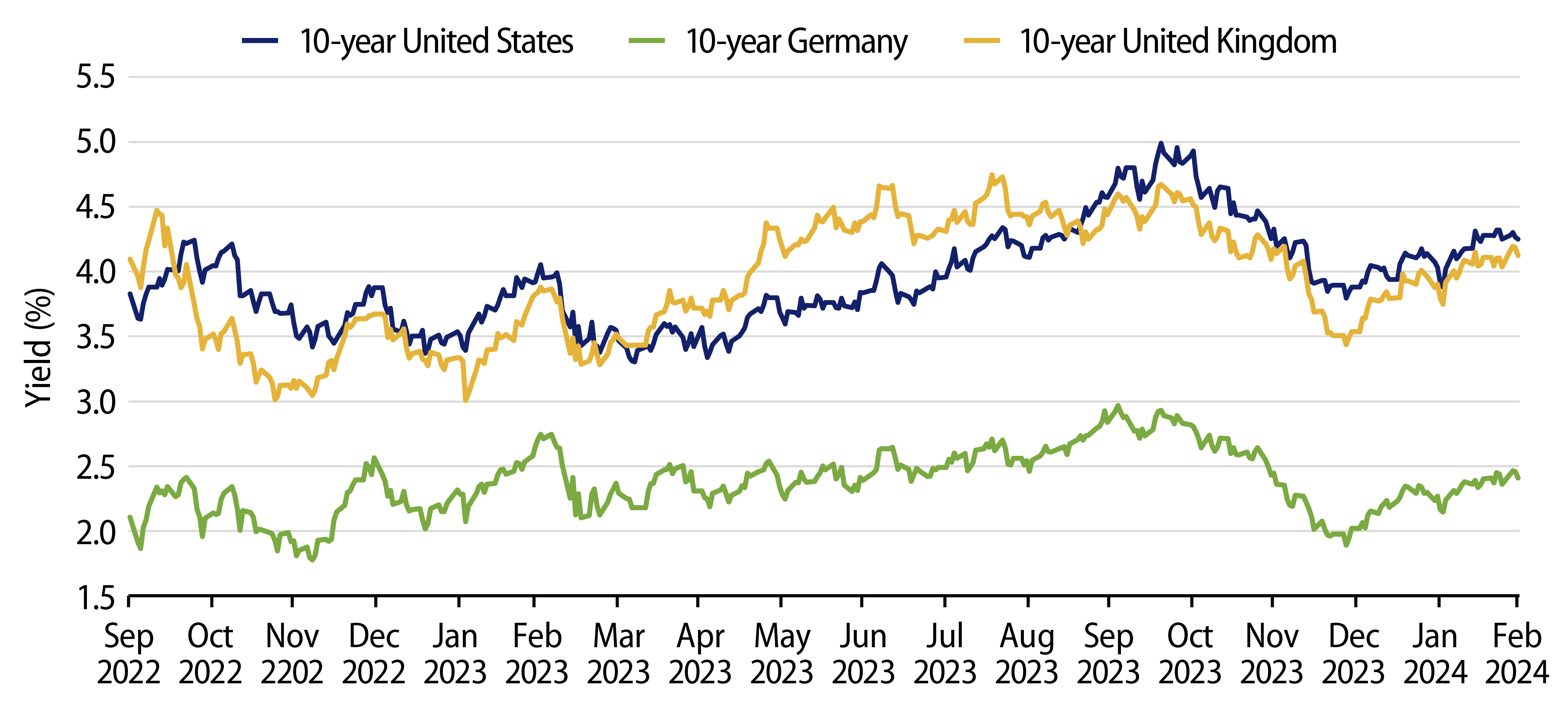

Exhibit 1 illustrates the long-term history of volatility for the Bloomberg Global Aggregate Bond Index. Volatility more than doubled over the past two years to unprecedented levels and, while it has eased, it remains very elevated.

A number of factors and interactions between them have combined to generate this volatility. A couple of our blog posts last year that discussed the US Treasury yield curve bear-steepening and the surge in US Treasury yields noted these factors, but from the perspective of the direction of bond yields, including:

- The rapid, harmonized monetary policy-tightening by central banks globally, and the more recent pivot toward monetary policy normalization.

- Inflation persistence, followed by a faster-than-anticipated slowing, and ongoing uncertainty over the future path.

- Economic resilience, most notably in the US.

- Heavy government bond issuance alongside central banks’ quantitative tightening.

- Shifts to the Bank of Japan’s monetary policy stance and what it may mean for Japanese investors’ foreign bond purchases.

- Sporadic fears stemming from US regional banks and commercial real estate exposures.

- Possible AI-related boosts to productivity and whether neutral policy rates have risen.

- Elevated geopolitical risks.

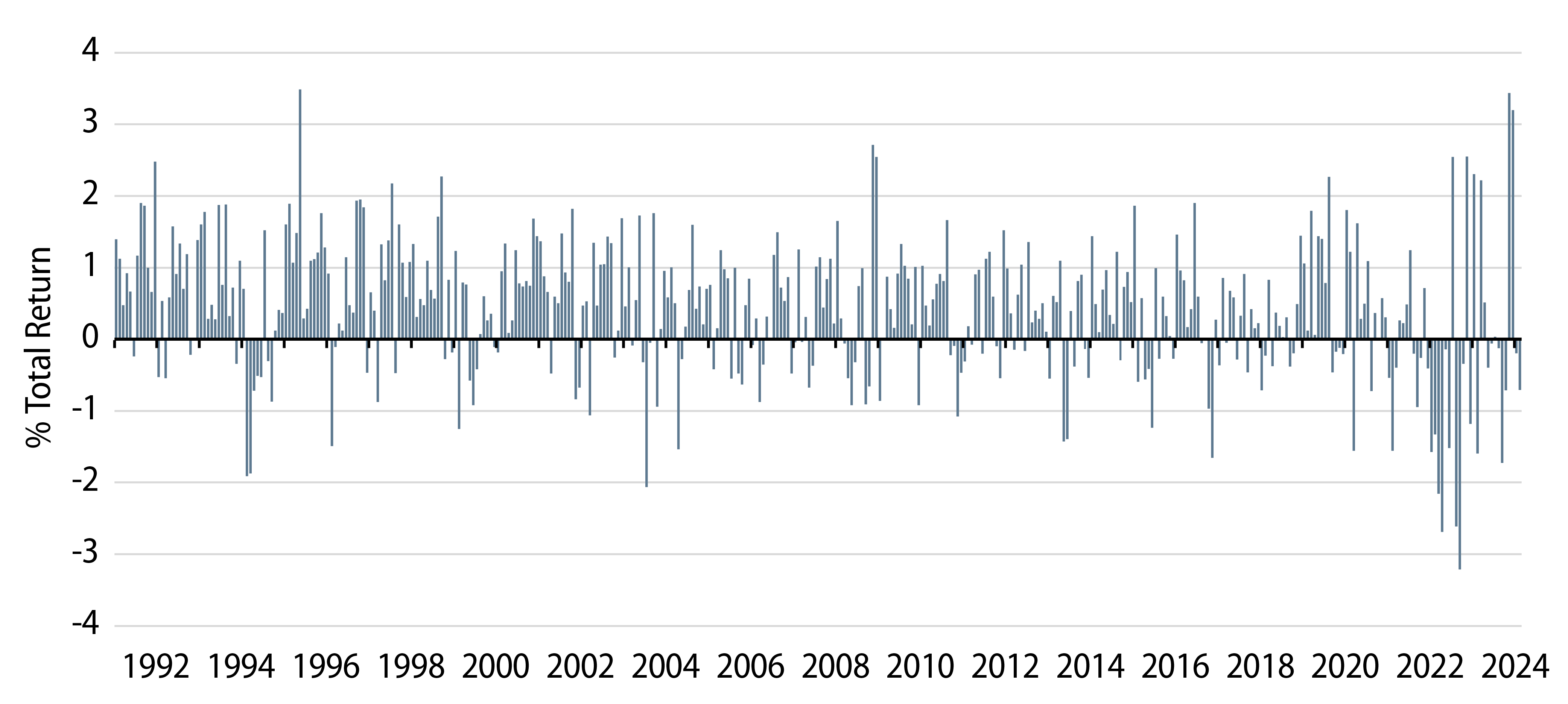

Exhibit 2 shows the history of monthly returns for the Bloomberg Global Aggregate Bond Index, illustrating how the volatility mentioned earlier has manifested in price swings well in excess of 1%, with a frequency over the past two years that has not been seen before.

Considerations for Managing Global Bond Portfolios

Recognizing that uncertainty from the factors described previously remains very much with us (and the chance that new ones emerge is always present), it is important to remain thoughtful about the extent to which volatility is likely to remain high and what that could mean for the deployment of risk in portfolios.

Western Asset’s investment philosophy has, for more than 50 years, focused on long-term fundamental value alongside multiple diversified strategies. This time-tested approach has often enabled the Firm to generate strong positive excess returns over the medium and long terms. This is complemented by the integration of risk management into our investment process, aiding the investment management team in its effort to ensure that risk allocations are appropriate given: 1) the level of market volatility and 2) the degree of mispricing between our view of fundamental fair value and that of the market.

While of course no investment manager will always be correct, the following example highlights Western Asset’s long term fundamental value based approach to active management. In October 2023, our constructive view of fixed-income required a great deal of defending in conversations with clients as US Treasury yields reached 5%. However, November and December saw an extraordinary rally as inflation decelerated rapidly and focus shifted toward interest rate cuts, as discussed in our December 7, 2023 blog post. Our investment outlook (though very little changed) had become very much aligned with the market consensus and market pricing was much more aligned with our view of fair value. As a result, global portfolios meaningfully scaled back duration exposure (Exhibit 3). As economic data released at the start of this year, particularly US employment and inflation data, has surprised to the upside, fixed-income markets have given back some of the very strong gains from the final months of last year. This has provided an opportunity to redeploy some interest-rate risk in portfolios and duration has been increased following the rise in yields.

Using our disciplined approach described earlier, we believe that our investment style is very well-suited to the current environment of elevated near-term volatility—specifically, as we focus our outlook on the six- to nine-month horizon, which allows us to recalibrate portfolio positioning in an attempt to take advantage of the opportunities in a risk-aware manner.