Private-sector payrolls rose by 381,000 in June, with a slight -34,000 revision to the May jobs estimate. The private-sector gains were slightly better than the total nonfarm payroll gain of +372,000 and a -74,000 revision to May. In other words, government jobs showed slight declines on the month.

The June job gains should be read as something of a rebuke to those Chicken Littles who have been proclaiming recently that the US is already in recession, on the strength (weakness?) of the negative 1Q22 GDP print and the chances of a similarly negative 2Q22 showing. We have said repeatedly that the 1Q22 GDP result was an understatement of growth that offset a similarly overstated 4Q21 result. Meanwhile, our models still show some positive growth in 2Q22, contrary to others who are projecting negative 2Q22 growth.

More to the point, when the National Bureau of Economic Research deliberates on the issue of whether or not a recession is occurring, its primary indicators historically have been payroll employment, industrial production (IP), and retail sales, not GDP. Both payroll jobs and IP have continued to show more than enough growth in recent months to make a recession call out of the question at present.

Granted, the risks of a coming recession are relatively high and rising, as incomes fail to keep up with inflation and as the Federal Reserve (Fed) chugs merrily along on its path to higher short rates. However, our take is that it is silly to think that such an adverse outcome has already occurred.

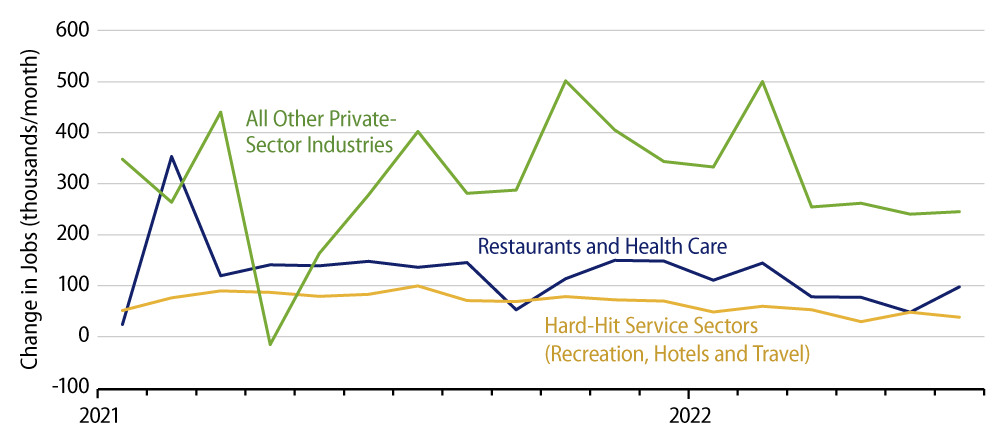

Getting back to today’s jobs report, payroll gains were decent in most sectors. There was especially good job growth in the five service sectors still recovering from Covid restrictions: health care, restaurants, recreation, hotels and travel. These sectors gained 136,000 jobs, 36% of the private-sector total, even though their share in current payroll employment is only 25%.

In commenting on today’s data, the Bureau of Labor Statistics emphasized that today’s data finally bring job total back to pre-Covid levels. In a zero-growth world, that would mean full recovery. However, in the real world of growing population and hopefully growing labor force, payroll jobs are still meaningfully short of re-attaining pre-Covid growth trends, about 6 million short by our estimates. Similarly, the share of the adult population that is employed is still 1.3 percentage points lower than its pre-Covid level.

The rock group The Who sang “I hope I die before I get old.” Our contrary hope is that the economy at least fully recovers before it falls again into recession, and on both jobs and GDP terms, such a full recovery is still quite a ways away.

As for possible signs of a weakening economy, the only two such possible indications in today’s report were a 5,000 decline in residential construction jobs and a 0.4% decline in total factory production hours worked. The reported residential construction job decline was small and may be statistical noise. The decline in factory production hours was more substantial, though we should point out that manufacturers continued to add workers even as they cut back sharply on workweeks.

Anyway, both indicators bear watching in the future. Otherwise, for now, the payroll data continue to indicate that some recovery in the US economy is still underway.