Private-sector payroll employment rose by 223,000 in February, but there was a massive, -204,000 revision to January data. In other words, private-sector payrolls were little changed in February from what was initially reported for January a month ago. All in all, the jobs report was very much a mixed bag for bulls and bears on the economy.

First, job growth has not been weak recently, but with the revisions, it is a lot less buoyant than last month’s jobs data suggested. Furthermore, while reported jobs have risen, reported workweeks have declined sharply, enough so that total hours worked showed no change over the last two months. (Yes, hours worked rose in February, but that merely offset an equal-sized decline in January).

Similarly, wage growth looks to have slowed in February, with average hourly earnings for all workers rising just 0.14%, or at a 1.8% annualized rate. (Federal Reserve [Fed] Chair Powell has speculated that a 3.5% rate of wage growth is consistent with the Fed’s inflation target.) Finally, while we don’t devote a lot of coverage among these posts to household survey data—the survey that generates unemployment data—we’ll note in passing that total employment as per that household survey has declined on net by -308,000 over the last six months and shows a scant 124,000 cumulative increase over the last nine months (i.e., 14,000 per month on average).

So, we can’t assert that labor markets are weakening (unless we pay way more attention to the household data than is warranted). However, we do believe that the juggernaut about the “still strong” labor market has sprung some leaks. Labor market growth is clearly moderating and continually so.

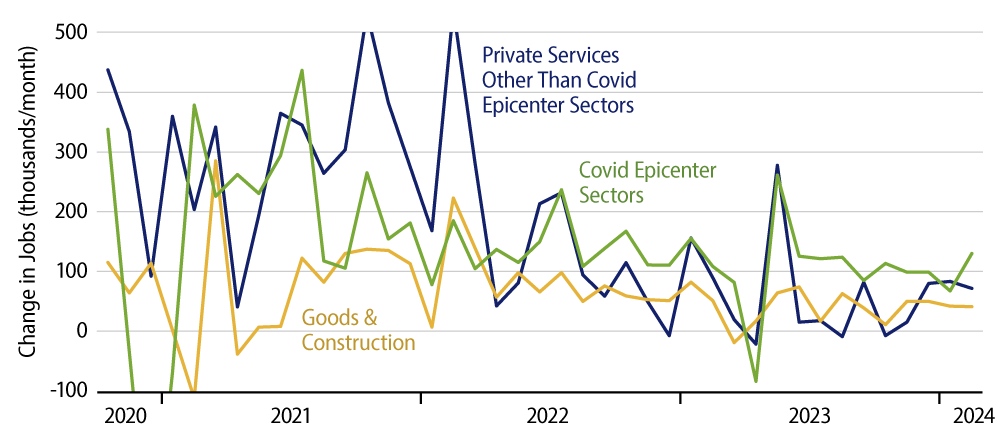

We focus on five sectors that were hit hard by the Covid shutdown: health care, restaurants, travel, hotels, and recreation (depicted in aggregate as “Covid epicenter” sectors in the chart here). These sectors are still under-staffed relative to pre-Covid conditions, so they are still generating relatively rapid job growth. However, in the rest of the economy, where recovery from Covid is complete, job growth has slowed markedly, and when workers are being added, workweeks for existing workers are being cut.

We believe this is reflective of the effects of Fed tightening. While it is true that the economy has withstood the Fed without falling into recession, growth has slowed markedly in those sectors not still recovering from the shutdown, and the labor market data reflect this clearly.

For the Fed, then, the issue is, whether it wants to sustain a restrictive policy when its inflation targets have been met and when further slowing in growth might be problematic. Granted, the Fed has not yet claimed victory over inflation, but should that goal be met in the next few months, as we think will be the case, the gradual but marked slowing in labor market growth would become the main focus for the Fed.