Private-sector payroll jobs grew by 263,000 in September, with only a -12,000 revision to the August level. Government jobs grew by 73,000 and there was a gigantic +131,000 revision to the August level of government jobs, all of it coming from public school employment.

The September gains are a bounce from the much slower gains of the three previous months. Similarly, while the downward revision to August private-sector jobs is the ninth in a row this year, it is the smallest such revision of the year.

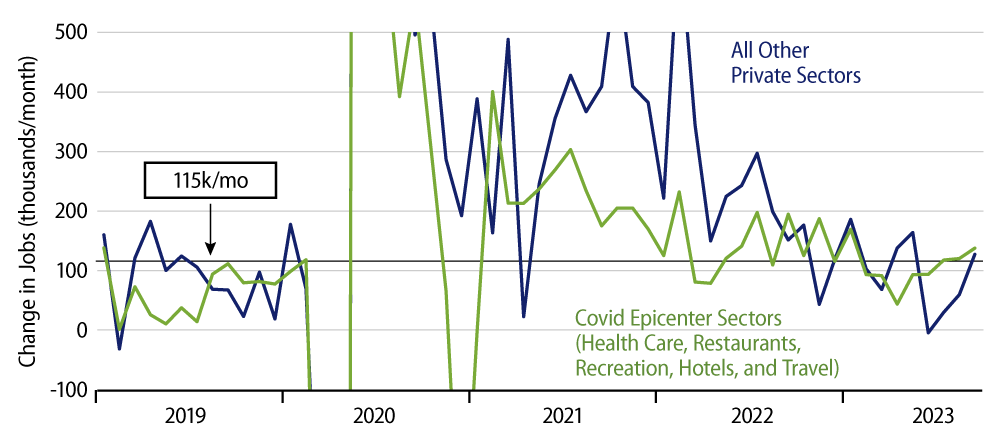

It remains the case that the bulk of the job gains occurred in those five sectors particularly ravaged by the Covid shutdown and still working to recover lost staffing. However, the remaining sectors of the economy gained 126,000 jobs, quite a bounce from the 26,000 average gain over June-August (See Exhibit 1).

The trend for job growth—outside the Covid-affected sectors, at least—still looks to be downward, with September experiencing a blip against that trend, but try telling that to the financial markets, which have sold off hard this morning in response to the news.

We focus on private-sector jobs, because these are indicative of market forces. However, today’s government jobs data were wild enough to require comment. The large September gains and huge upward revisions to August for public school jobs reverse declines over May-August that had previously been reported. This would seem to reflect late reporting of payroll data by various school districts and state colleges. Whatever the source, it provided some fireworks to the headline data.

Meanwhile, average hourly wages continued to moderate. Both aggregate measures of average hourly wages grew at an annualized rate of 2.5% in September, after posting similar gains in August. Fed pronouncements indicate Mr. Powell and company believe wage growth around 3.5% is consistent with their 2% target for inflation. Of course, wage growth had proceeded at annualized rates just below 5% in the four months through July, and the average rate of gain so far this year is right around 4.0%. So, the August-September rates of wage growth will have to be maintained a while longer before they can be regarded as a trend rather than an aberration.

This makes for an interesting decision by the Fed. Will it look at the trend of slowing job growth, or will it focus on the much stronger September job gains? Will it look at the apparent trend of wage growth around 4% so far this year, or will it focus on the more modest wage gains of August and September? Obviously, this is a mixed picture. The markets today appear to be betting that the Fed will look at the last year or so of wage gains, but the last month of job gains.